Document 13321569

advertisement

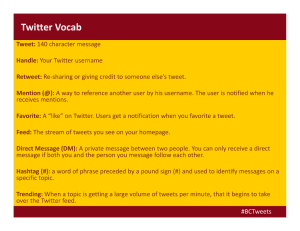

Proceedings of 11th International Business and Social Science Research Conference 8 - 9 January, 2015, Crowne Plaza Hotel, Dubai, UAE. ISBN: 978-1-922069-70-2 Can Twitter Sentiment Predict Earnings Surprises? Analysis of TickerTweets.com data Thomas O. Miller* This work-in-progress research is based on the financial information that may be present in Twitter data streams. While this area of research contains many possibilities, the focus of this paper is the potential information in tweets leading up to firms’ quarterly earnings announcements. Quarterly earnings announcements can have a major impact on stock prices especially if the earnings are a “surprise.” Earnings surprises will be the main dependent variable of this study, and are defined as the percentage difference between a firm’s reported earnings and analyst expectations prior to the announcement. Data on stock related tweets has recently been compiled and published onto “TickerTweets.com.” Using Twitter’s “$” tag the website screens for tweets referencing stock tickers. A summary of total tweets for any stock ticker is available on a trailing daily, weekly, or monthly basis. Additionally, the tweets are grouped into three moods based on sentiment analysis. This analysis is conducted by assigning values to key words within the tweets which are then totaled resulting in a designation for each tweet of positive, negative, or neutral. TicketTweets.com experienced a data interruption in late April, which has led to a reduction in sample size to 41 firms that reported earnings during the week of May 19, 2014 and had at least 400 recorded Tweet references in the trailing month. This represents a pilot study sample with plans for future expansion. The results of several OLS regressions indicate that the percentage of positive tweets in the trailing week is positively and significantly (5% level) related to earnings surprises, while the percent of total negative tweets in the trailing month is negatively and significantly related (5% level). When including controls for stock market performance over the prior month, percentage of positive tweets in the trailing week remains positive and significant at 5%. JEL Codes: G14 _________________________________________________________________________ *Thomas O. Miller, PhD, Assistant Professor of Finance, Department of Economics and Finance, West Chester University, 700 South High St, West Chester, PA 19383. Email: tmiller@wcupa.edu Office: (610) 436-3460, Cell: (610) 416-5389