Proceedings of 9th Annual London Business Research Conference

advertisement

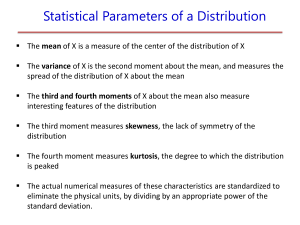

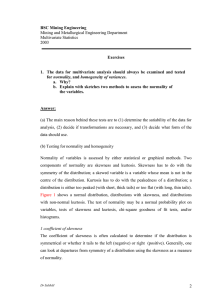

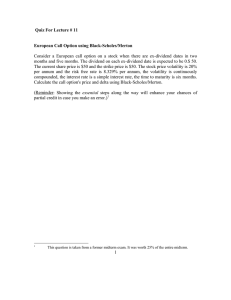

Proceedings of 9th Annual London Business Research Conference 4 - 5 August 2014, Imperial College, London, UK, ISBN: 978-1-922069-56-6 Parity Analysis of Non-log Normality of Black-Scholes & Its Inter-competence Vipul Kumar Singh Enforced by the empirical deficiencies of the Black-Scholes and its wrong distributional assumption, researchers provoked to pursuit the development of more realistic option pricing models encompassing the level of skewness and kurtosis. Therefore, the objective of this paper is multi-fold. The first and foremost objective is to investigate the Black-Scholes assumption of log-normality of the underlying asset return density with constant volatility. The second relative objective is to testify the comparative competitiveness of impeccable models capable of incorporating log non-normality explaining smile phenomenon of option pricing. Though the option pricing models is a combination of numerous models but to provide a focused approach we banked upon the three most dominant models of this species named as Jarrow-Rudd, Carrado-Su, and Gram-Charlier. To testify the price effectiveness of models we inter-passed these across meticulously collected data of the most unsteady period of Indian financial frame. Besides that, the paper also investigates the information content of three crucial parameters namely volatility smile, skewness and kurtosis. Keyword: Black-Scholes, Call, Carrado-Su, Gram-Charlier, Implied, Jarrow-Rudd, Kurtosis, Nifty, Options, Skewness, Volatility. JEL Classification: C2, C14, C53, G13, G17 ________________________________________________________________________ Dr. Vipul Kumar Singh, Assistant Professor, Institute of Management Technology, 35 Km Milestone, Katol Road, Nagpur - 441502, INDIA, E-mail: vksingh@imtnag.ac.in

![[From: http://en.wikipedia.org/wiki/Skewness ] If Y is the sum of n](http://s2.studylib.net/store/data/018423120_1-ab53997b8d304a8b110fe1b216e8955d-300x300.png)