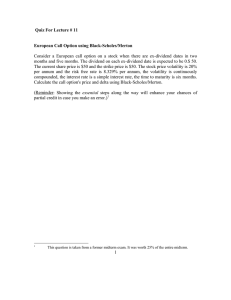

Quiz For Lecture # 11 European Call Option using Black-Scholes/Merton

advertisement

Quiz For Lecture # 11 European Call Option using Black-Scholes/Merton Consider a European call option on a stock when there are ex-dividend dates in two months and five months. The dividend on each ex-dividend date is expected to be $ 0.50. The current share price is $50 and the strike price is $50. The stock price volatility is 20% per annum and the risk free rate is 8.329% per annum, the volatility is continuously compounded, the interest rate is a simple interest rate, the time to maturity is six months. Calculate the call option's price and delta using Black-Scholes/Merton. (Reminder: Showing the essential steps along the way will enhance your chances of partial credit in case you make an error.)1 r r = n ⋅ ln 1 + 1 n d y = 0.5 ⋅ e 2 −0.08 ⋅ 12 0.08=1 · ln (1+0.08329/1) + 0.5 ⋅ e 5 −0.08 ⋅ 12 c0 = (S0 -d y ) ⋅ N (d1 ) − Ke − rf T = 0.9770 N (d 2 ) where S0 − d y σ2 ln + rf + T K 2 and d1 = σ T d 2 = d1 − σ T S0 = 50, K = 50, rf= 0.08, σ = 0.2, T = 0.5. We can use the discounted dividend of 0.977 and deduct it from the spot price of the stock. Using the B-S/M formula on a dividend-paying stock, d1 = 0.2 2 6 50 − 0.977 ⋅ ln 0.08 + + 50 2 12 6 0.2 ⋅ 12 = 0.2140 and d2 = d1 - 0.2√0.5 = 0.0.0726 1 This question is taken from a former midterm exam. It was worth 25% of the entire midterm. 1 This implies that: N(d1) = 0.58, N(d2) = 0.53 so that the call price c0 from the B-S/M formula is: c0 = (50-0.977) · 0.58 - 50 · 0.53 · e-0.08 x 0.5 = 3.26. 2