“Value” as a Measure of Rightful Position – General Principles

advertisement

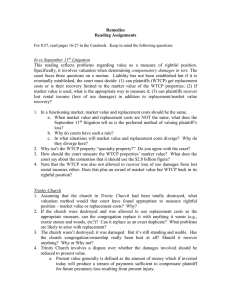

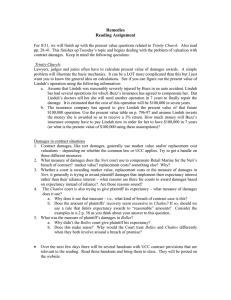

“Value” as a Measure of Rightful Position – General Principles o Overarching principle of all compensatory damage awards is to restore injured party to their rightful position o How do we implement “rightful position?” o Value = the method by which courts measure injury/loss to plaintiffs o 3 most common ways to measure value: o Market value – what a willing B will pay a willing S for property to change hands o Replacement costs – cost of replacing a lost/destroyed/stolen item o Income/capitalization of earning – the sum of money that must be invested to produce the same income stream from the property before it was destroyed or damaged Measuring Value in Tort Cases – Background on Sept. 11th Litigation o Port Authority (“PA”) entered K to lease Twin Towers and related buildings to WTCP ◦ PA conveyed 99 year leaseholds re the towers to WTCP ◦ As consideration, WTCP gave (1) a flat payment at closing and (2) a 99 year stream of future rental payments. Present value of the leaseholds is roughly $2.8 billion o After 9/11, WTCP sued Aviation D’s claiming WTCP property wouldn’t have been destroyed but for their negligence. Lawsuit seeks at least $16.8 billion. ◦ Liability is NOT yet established. Decision comes after D’s motion on whether P’s damages are limited to market value of destroyed property IF liability is established. ◦ Major question: Can P recover replacement costs or is P limited to market value? In Re Sept. 11th - Market Value v. Replacement Costs o In a well-functioning market, market value and replacement costs are generally equivalent. But sometimes replacement costs are significantly higher than the market value of a damaged or destroyed item (and occasionally vice versa). o In what situations does this “nonequivalence” occur? o What is the In re Sept. 11th court’s rule on whether to award market value or replacement costs when they are not equivalent? o Why would the court have such a rule? In re September 11th – Exception to Awarding Lesser Market Value o Special Purpose Property (aka “specialty property”) o Property for which there is no discernable market value – i.e., property which isn’t readily traded in a market o Ps can get replacement costs for specialty property o Why aren’t the WTCP properties special purpose property? o Weren’t the Twin Towers iconic symbols of NYC? Doesn’t that make them special? o What if the Washington Monument had been hit? Wouldn’t such an iconic property be a specialty property? o How are the Towers different from the Washington Monument? In re September 11th – Loss of Use Damages (some additional questions on rightful position) o P also asked for $3.9 billion in lost rents from tenants due to loss of buildings. (These would be loss of use damages ). o Court says P not entitled to such damages because the FMV award includes the present value of tenants’ rental income streams. To give loss of rents is double recovery. o Is the court right that P’s will be in their rightful position without them? ◦ Is this consistent with Hatahley? ◦ Would P’s argument be more persuasive if P sought only the 10 years of rents lost during the time it took to rebuild the WTCP properties? Trinity Church - Boston Trinity Church v. John Hancock o Assume the church had been totally destroyed, what measure of damages would have been appropriate – market value or replacement costs? o Why? o Could Trinity Church build any replacement it wanted? • E.g., Eight times bigger than the original and of Carrera marble? BUT Trinity Church wasn’t totally destroyed: o After the damage, Trinity Church was simply closer to “takedown” (i.e., the end of its useful life) than before. o “Angles of distortion” method used to calculate how much of the church’s useful life was lost. The unusual increase in the church’s foundational settling was used to calculate damages and the assumption was that the church will have a lesser useful life than if it were not damaged. o Has P really been damaged if it is using the church and isn’t planning to repair the damage until the church is fully at “takedown”? Trinity Church – the damage The Concept of “Present Value” o Trinity Church majority rejected argument that P’s damages should be reduced to their present value – What is that? • Present Value = the amount of money which if invested today would produce a future stream of payments sufficient to compensate plaintiff for future pecuniary loss resulting from a present injury. o Why did the Court reject the present value argument? Present Value Problem o Assume Linduh was injured by Buzz in an auto accident. Linduh had several operations for which Buzz’s insurance compensated her. But Linduh will need another operation in 7 years to finally repair the damage. It is estimated that the cost of this operation will be $100,000 in seven years. o The insurance company has agreed to give Linduh the present value of that future $100,000 operation. Use the present value table on p. 795-97 and assume Linduh invests the money she is given so that she receives a 3% return. o How much money must Buzz’s insurance company give Linduh now in order for her to have $100,000 in 7 years (or what is the present value of $100,000 using these assumptions)? Present Value Problem – broken down o Linduh must invest sum PV for 7 years at 3 percent interest in order to get $100,000 in 7 years. o The present value table tells you how to get sum PV with that information – use the appropriate column & row to get the multiplier to use to find the present value of $100,000. o Here present value (PV) of $100,000 = $81,309.15 o Note multiple assumptions made here: • 1) What the appropriate investment return will be (i.e., interest) • 2) What the cost of the operation in the future is likely to be (based on inflation) • 3) What the timing of the operation is likely to be • This is a mathematic calculation but it is still based on some tenuous assumptions that might not get P full recovery or might overcompensate P.