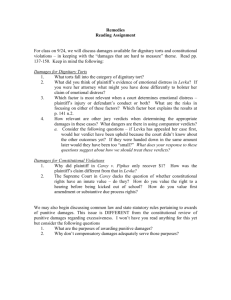

Remedies Reading Assignment

advertisement

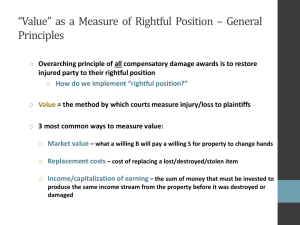

Remedies Reading Assignment For 8/31, we will finish up with the present value questions related to Trinity Church. Also read pp. 28-41. This finishes up Tuesday’s topic and begins dealing with the problem of valuation with contract damages. Keep in mind the following questions: Trinity Church: Lawyers, judges and juries often have to calculate present value of damages awards. A simple problem will illustrate the basic mechanics. It can be a LOT more complicated than this but I just want you to know the general idea on calculations. See if you can figure out the present value of Linduh’s operation using the following information: a. Assume that Linduh was reasonably severely injured by Buzz in an auto accident. Linduh has had several operations for which Buzz’s insurance has agreed to compensate her. But Linduh’s doctors tell her she will need another operation in 7 years to finally repair the damage. It is estimated that the cost of this operation will be $100,000 in seven years. b. The insurance company has agreed to give Linduh the present value of that future $100,000 operation. Use the present value table on p. 796-97 and assume Linduh invests the money she is awarded so as to receive a 3% return. How much money will Buzz’s insurance company have to pay Linduh now in order for her to have $100,000 in 7 years (or what is the present value of $100,000 using these assumptions)? Damages in contract situations 1. Contract damages, like tort damages, generally use market value and/or replacement cost valuations – depending on whether the common law or UCC applies. Try to get a handle on those different measures. 2. What measure of damages does the Neri court use to compensate Retail Marine for the Neri’s breach of contract? market value? replacement costs? something else? Why? 3. Whether a court is awarding market value, replacement costs or the measure of damages in Neri, it generally is trying to award plaintiff damages that implement their expectancy interest rather than their reliance interest – what reasons are there for courts to award damages based on expectancy instead of reliance? Are those reasons sound? 4. The Chatlos court is also trying to give plaintiff its expectancy – what measure of damages does it use? a. Why does it use that measure – i.e., what kind of breach of contract case is this? b. Does the amount of plaintiffs’ recovery seem excessive in Chatlos? If so, should we use a rule that limits expectancy awards to “reasonable” amounts? Consider the examples in n.2 p. 38 as you think about your answer to this question. 5. What was the measure of plaintiff’s damages in Bolles? a. Why didn’t the Bolles court give plaintiff his expectancy? b. Does this make sense? Why would the Court treat Bolles and Chatlos differently when they both revolve around a breach of promise? Over the next few days there will be several handouts with UCC contract provisions that are relevant to the reading. Read these handouts and bring them to class. They will be posted on the website.