Remedies Reading Assignments

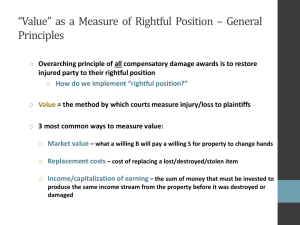

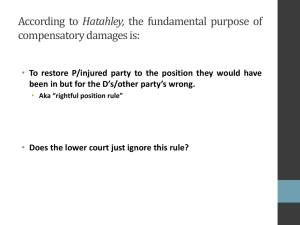

advertisement

Remedies Reading Assignments For 8/27, read pages 16-27 in the Casebook. Keep in mind the following questions: In re September 11th Litigation This reading reflects problems regarding value as a measure of rightful position. Specifically, it involves valuation when determining compensatory damages in tort. The court faces three questions on a motion. Liability has not been established but if it is eventually established, the court must decide: (1) can plaintiffs (WTCP) get replacement costs or is their recovery limited to the market value of the WTCP properties; (2) If market value is used, what is the appropriate way to measure it; (3) can plaintiffs recover lost rental income (loss of use damages) in addition to replacement/market value recovery? 1. In a functioning market, market value and replacement costs should be the same. a. When market value and replacement costs are NOT the same, what does the September 11th litigation tell us is the preferred method of valuing plaintiff’s loss? b. Why do courts have such a rule? c. In what situations will market value and replacement costs diverge? Why do they diverge here? 2. Why isn’t the WTCP property “specialty property?” Do you agree with the court? 3. How should the court measure the WTCP properties’ market value? What does the court say about the contention that it should use the $2.8 billion figure? 4. Note that the WTCP was also not allowed to recover loss of use damages from lost rental incomes either. Does this plus an award of market value but WTCP back in its rightful position? Trinity Church 1. Assuming that the church in Trinity Church had been totally destroyed, what valuation method would that court have found appropriate to measure rightful position – market value or replacement costs? Why? 2. If the church were destroyed and was allowed to use replacement costs as the appropriate measure, can the congregation replace it with anything it wants (e.g., exotic stones and woods, etc?)? Can it replace as an exact duplicate? What problems are likely to arise with replacement? 3. The church wasn’t destroyed; it was damaged. But it’s still standing and usable. Has the church congregation/ownership really been hurt at all? Should it recover anything? Why or Why not? 4. Trinity Church involves a dispute over whether the damages involved should be reduced to present value. a. Present value generally is defined as the amount of money which if invested today will produce a stream of payments sufficient to compensate plaintiff for future pecuniary loss resulting from present injury. b. Why did the court refuse to use it here? 5. Lawyers, judges and juries often have to calculate present value of damages awards. A simple problem will illustrate the basic mechanics. It can be a LOT more complicated than this but I just want you to know the general idea on calculations. See if you can figure out the present value of Linduh’s operation using the following information: a. Assume that Linduh was reasonably severely injured by Buzz in an auto accident. Linduh has had several operations for which Buzz’s insurance has agreed to compensate her. But Linduh’s doctors tell her she will need another operation in 7 years to finally repair the damage. It is estimated that the cost of this operation will be $100,000 in seven years. b. The insurance company has agreed to give Linduh the present value of that future $100,000 operation. Use the present value table on p. 795-97 and assume Linduh invests the money she is awarded so as to receive a 3% return. How much money must Buzz’s insurance company pay Linduh now in order for her to have $100,000 in 7 years (or what is the present value of $100,000 using these assumptions)?