1Q 14 4Q 13 1Q 13 Feb. 1,

advertisement

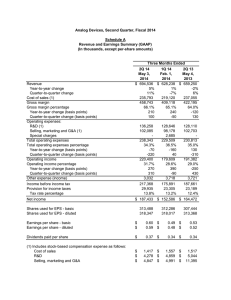

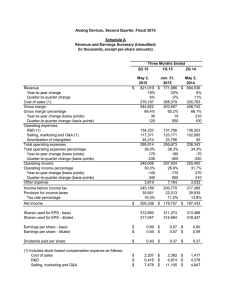

Analog Devices, First Quarter, Fiscal 2014 Schedule A Revenue and Earnings Summary (GAAP) (In thousands, except per-share amounts) Three Months Ended Revenue Year-to-year change Quarter-to-quarter change Cost of sales (1) Gross margin Gross margin percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating expenses: R&D (1) Selling, marketing and G&A (1) Special charges Total operating expenses Total operating expenses percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating income Operating income percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Other expense (income) 1Q 14 4Q 13 1Q 13 Feb. 1, Nov. 2, Feb. 2, 2014 2013 2013 $ 628,238 $ 678,133 $ 622,134 1% -2% -4% -7% 1% -10% 219,120 233,263 231,850 409,118 444,870 390,284 65.1% 65.6% 62.7% 240 180 -50 -50 110 -110 Income before income tax Provision for income taxes Tax rate percentage Net income 128,646 98,178 2,685 229,509 36.5% -160 40 179,609 28.6% 390 -90 3,718 131,034 98,197 15,777 245,008 36.1% 330 250 199,862 29.5% -150 -140 (82,650) 125,164 97,560 14,071 236,795 38.1% 320 530 153,489 24.7% -360 -630 3,380 175,891 23,305 13.2% 282,512 80,958 28.7% 150,109 18,887 12.6% $ 152,586 $ 201,554 $ 131,222 312,286 318,017 311,009 317,216 303,484 310,275 Shares used for EPS - basic Shares used for EPS - diluted Earnings per share - basic Earnings per share - diluted $ $ 0.49 0.48 $ $ 0.65 0.64 $ $ 0.43 0.42 Dividends paid per share $ 0.34 $ 0.34 $ 0.30 (1) Includes stock-based compensation expense as follows: Cost of sales R&D Selling, marketing and G&A $ $ $ 1,557 4,859 4,991 $ $ $ 1,737 5,721 5,664 $ $ $ 1,667 5,600 5,794 Analog Devices, First Quarter, Fiscal 2014 Schedule B Selected Balance Sheet Information (GAAP) (In thousands) Cash & short-term investments Accounts receivable, net Inventories (1) Other current assets Total current assets PP&E, net Investments Goodwill and intangible assets Other Total assets 1Q 14 Feb. 1, 2014 $ 4,701,109 328,787 289,935 151,128 5,470,959 529,010 23,363 311,664 64,472 $ 6,399,468 4Q 13 Nov. 2, 2013 $ 4,682,912 325,144 283,337 181,032 5,472,425 508,171 21,180 312,664 67,310 $ 6,381,750 1Q 13 Feb. 2, 2013 $ 3,986,979 329,578 307,263 190,115 4,813,935 491,431 32,720 313,084 65,638 $ 5,716,808 Deferred income on shipments to distributors, net Other current liabilities Long-term debt, non-current Non-current liabilities Shareholders' equity Total liabilities & equity $ 245,236 274,258 872,378 211,961 4,795,635 $ 6,399,468 $ 247,428 323,084 872,241 199,421 4,739,576 $ 6,381,750 $ 243,396 265,139 759,672 124,804 4,323,797 $ 5,716,808 (1) Includes $2,196, $2,273, and $2,381 related to stock-based compensation in 1Q14, 4Q13, and 1Q13, respectively. Analog Devices, First Quarter, Fiscal 2014 Schedule C Cash Flow Statement (GAAP) (In thousands) Three Months Ended 1Q 14 4Q 13 1Q 13 Feb. 1, Nov. 2, Feb. 2, 2014 2013 2013 Cash flows from operating activities: Net Income Adjustments to reconcile net income to net cash provided by operations: Depreciation Amortization of intangibles Stock-based compensation expense Gain on sale of product line Other non-cash activity Excess tax benefit - stock options Deferred income taxes Changes in operating assets and liabilities Total adjustments Net cash provided by operating activities Percent of total revenue Cash flows from investing activities: Purchases of short-term available-for-sale investments Maturities of short-term available-for-sale investments Sales of short-term available-for-sale investments Additions to property, plant and equipment Proceeds from sale of product line Increase in other assets Net cash (used for) provided by investing activities Cash flows from financing activities: Term loan repayments Dividend payments to shareholders Repurchase of common stock Proceeds from employee stock plans Excess tax benefit - stock options Contingent consideration payment Increase (decrease) in other financing activities Net cash used for financing activities Effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $ 152,586 27,335 55 11,407 1,417 (7,604) (2,993) (24,730) 4,887 157,473 25.1% $ 201,554 27,515 55 13,122 (85,444) 887 (1,098) (6,558) 132,132 80,611 282,165 41.6% $ 131,222 27,755 55 13,061 (1,362) (5,975) (9,635) 2,848 26,747 157,969 25.4% (2,234,996) (2,559,600) (1,653,593) 2,029,319 2,199,444 1,551,147 212,819 59,903 283,164 (48,123) (48,558) (18,269) 100,000 (3,342) (1,591) (2,048) (44,323) (250,402) 160,401 (106,024) (88,963) 79,600 7,604 (1,773) 22,248 (87,308) (704) 25,138 392,089 $ 417,227 (105,938) (42,809) 44,399 1,098 (1,913) 4,696 (100,467) 725 (60,108) (90,679) (17,001) 113,770 5,975 (3,752) (1,027) (52,822) 1,416 (67,979) 266,964 460,068 528,833 $ 392,089 $ 795,797 Analog Devices, First Quarter, Fiscal 2014 Schedule D Revenue Trends by End Market The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the "ship to" customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data evolve and improve, the categorization of products by end market can vary over time. When this occurs we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. Three Months Ended Industrial Automotive Consumer Communications Total Revenue Revenue 290,365 124,157 74,119 139,597 $ 628,238 $ Feb. 1, 2014 % Q/Q % 46% -7% 20% -5% 12% -22% 22% 0% 100% -7% Y/Y % 3% 15% -31% 11% 1% Nov. 2, 2013 Revenue $ 312,451 131,105 94,545 140,032 $ 678,133 Feb. 2, 2013 Revenue $ 281,209 107,760 107,356 125,809 $ 622,134 Analog Devices, First Quarter, Fiscal 2014 Schedule E Revenue Trends by Product Type The categorization of our products into broad categories is based on the characteristics of the individual products, the specification of the products and in some cases the specific uses that certain products have within applications. The categorization of products into categories is therefore subject to judgment in some cases and can vary over time. In instances where products move between product categories we reclassify the amounts in the product categories for all prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each product category. Three Months Ended Feb. 1, 2014 Converters Amplifiers / Radio Frequency Other analog Subtotal Analog Signal Processing Power management & reference Total Analog Products Digital Signal Processing Total Revenue Revenue 290,551 164,714 79,419 534,684 38,710 $ 573,394 54,844 $ 628,238 $ % 46% 26% 13% 85% 6% 91% 9% 100% Q/Q % -5% -7% -14% -7% -12% -7% -7% -7% Y/Y % 5% 4% -17% 1% -2% 1% 6% 1% Nov. 2, 2013 Revenue $ 306,187 176,538 92,405 575,130 44,226 $ 619,356 58,777 $ 678,133 Feb. 2, 2013 Revenue $ 277,940 157,978 95,158 531,076 39,382 $ 570,458 51,676 $ 622,134 Analog Devices, First Quarter, Fiscal 2014 Schedule F Reconciliation from Non-GAAP to GAAP Data (In thousands, except per-share amounts) See "Non-GAAP Financial Information" in this press release for a description of the items excluded from our non-GAAP measures. GAAP Operating Expenses 1Q 14 Three Months Ended 4Q 13 1Q 13 Feb. 1, 2014 Nov. 2, 2013 Feb. 2, 2013 $ 229,509 $ 245,008 $ 236,795 36.5% 36.1% 38.1% (2,685) $ 226,824 (15,777) $ 229,231 (14,071) $ 222,724 36.1% 33.8% 35.8% $ 179,609 $ 199,862 $ 153,489 Percent of Revenue Restructuring-Related Expense Non-GAAP Operating Expenses Percent of Revenue GAAP Operating Income/Margin Percent of Revenue Restructuring-Related Expense Non-GAAP Operating Income/Margin 28.6% 29.5% 24.7% 2,685 $ 182,294 15,777 $ 215,639 14,071 $ 167,560 29.0% 31.8% 26.9% 3,718 $ (82,650) Percent of Revenue GAAP Other (Income) Expense $ Percent of Revenue Gain on Sale of Product Line Non-GAAP Other (Income) Expense $ Percent of Revenue GAAP Diluted EPS 0.6% -12.2% 3,718 85,444 2,794 $ 0.6% $ 0.48 $ 0.64 - Restructuring-Related Expense 0.01 Impact of the Reversal of Prior Period Tax Liabilities Impact of Tax Reserve - (0.01) - 0.13 $ 0.49 $ $ 0.42 - 0.05 $ 3,380 0.5% (0.19) 0.62 3,380 0.5% 0.4% Impact of Gain on Sale of Product Line Impact of the Reinstatement of the R&D Tax Credit Non-GAAP Diluted EPS $ 0.04 $ (0.02) 0.44