4Q 15 3Q 15 4Q 14 FY 15

advertisement

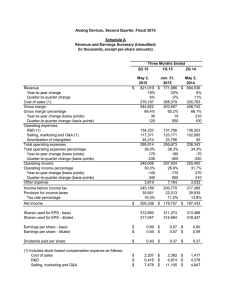

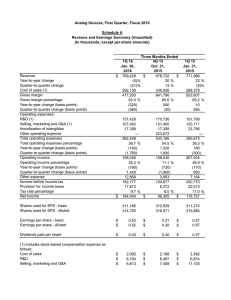

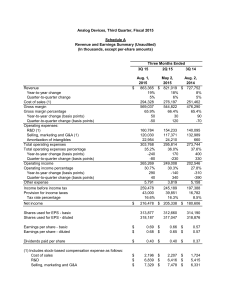

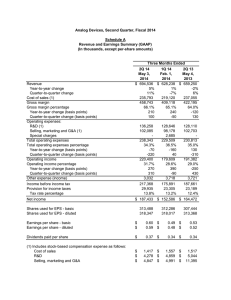

Analog Devices, Fourth Quarter, Fiscal 2015 Schedule A Revenue and Earnings Summary (Unaudited) (In thousands, except per-share amounts) Three Months Ended 4Q 15 Revenue Year-to-year change Quarter-to-quarter change Cost of sales (1) Gross margin Gross margin percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating expenses: R&D (1) Selling, marketing and G&A (1) Amortization of intangibles Special charges Other operating expense Total operating expenses Total operating expenses percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Operating income Operating income percentage Year-to-year change (basis points) Quarter-to-quarter change (basis points) Other expense $ Income before income tax Provision for income taxes Tax rate percentage Net income $ Shares used for EPS - basic Shares used for EPS - diluted 3Q 15 Oct. 31, 2015 978,722 $ 20% 13% 336,926 641,796 65.6% 590 -30 Aug. 1, 2015 863,365 $ 19% 5% 294,328 569,037 65.9% 50 -50 170,736 121,400 17,358 223,672 533,166 54.5% 1320 1930 108,630 11.1% -730 -1960 3,953 160,784 120,030 22,954 303,768 35.2% -240 -80 265,269 30.7% 290 40 5,791 104,677 8,372 8.0% 259,478 43,000 16.6% 96,305 $ 312,829 316,571 Twelve Months Ended 4Q 14 216,478 $ 313,877 318,187 FY 15 Nov.1, 2014 814,247 20% 12% 328,210 486,037 59.7% -590 -570 $ FY 14 Oct. 31, 2015 3,435,092 $ 20% Nov. 1, 2014 2,864,773 9% 1,175,830 2,259,262 65.8% 190 1,034,585 1,830,188 63.9% -40 154,797 121,424 25,250 34,637 336,108 41.3% 520 370 149,929 18.4% -1,110 -940 11,231 637,459 478,972 88,318 223,672 1,428,421 41.6% 400 559,686 454,676 26,020 37,322 1,077,704 37.6% 190 830,841 24.2% -210 752,484 26.3% -230 20,727 23,139 138,698 30,003 21.6% 810,114 113,236 14.0% 729,345 100,025 13.7% 108,695 $ 312,815 316,868 696,878 $ 312,660 316,872 629,320 313,195 318,027 Earnings per share - basic Earnings per share - diluted $ $ 0.31 0.30 $ $ 0.69 0.68 $ $ 0.35 0.34 $ $ 2.23 2.20 $ $ 2.01 1.98 Dividends paid per share $ 0.40 $ 0.40 $ 0.37 $ 1.57 $ 1.45 (1) Includes stock-based compensation expense as follows: Cost of sales R&D Selling, marketing and G&A $ $ $ 2,188 6,487 7,408 $ $ $ 2,196 6,839 7,329 $ $ $ 2,371 6,155 6,867 $ $ $ 8,983 26,617 33,319 $ $ $ 7,069 20,707 23,036 Analog Devices, Fourth Quarter, Fiscal 2015 Schedule B Selected Balance Sheet Information (Unaudited) (In thousands) Cash & short-term investments Accounts receivable, net Inventories (1) Other current assets Total current assets PP&E, net Investments Goodwill Intangible assets, net Other Total assets Deferred income on shipments to distributors, net Other current liabilities Debt, current Long-term debt Non-current liabilities Shareholders' equity Total liabilities & equity 4Q 15 Oct. 31, 2015 $ 3,028,928 466,527 412,314 171,779 4,079,548 644,110 41,235 1,636,526 583,517 77,242 $ 7,062,178 3Q 15 Aug. 1, 2015 $ 3,099,961 451,511 424,475 173,945 4,149,892 631,269 40,324 1,640,381 601,882 70,953 $ 7,134,701 4Q 14 Nov. 1, 2014 $ 2,866,468 396,605 367,927 180,886 3,811,886 622,422 34,507 1,642,438 671,402 77,035 $ 6,859,690 $ $ $ 300,087 438,904 374,839 498,497 376,892 5,072,959 $ 7,062,178 307,265 375,753 374,752 498,448 513,322 5,065,161 $ 7,134,701 (1) Includes $2,923, $2,935, and $3,291 related to stock-based compensation in 4Q15, 3Q15, and 4Q14, respectively. 278,435 430,621 872,789 519,948 4,757,897 $ 6,859,690 Analog Devices, Fourth Quarter, Fiscal 2015 Schedule C Cash Flow Statement (Unaudited) (In thousands) 4Q 15 Oct. 31, 2015 Cash flows from operating activities: Net Income Adjustments to reconcile net income to net cash provided by operations: Depreciation Amortization of intangibles Stock-based compensation expense Other non-cash activity Excess tax benefit - stock options Deferred income taxes Changes in operating assets and liabilities Total adjustments Net cash provided by operating activities Percent of revenue $ Cash flows from investing activities: Purchases of short-term available-for-sale investments Maturities of short-term available-for-sale investments Sales of short-term available-for-sale investments Additions to property, plant and equipment Payments for acquisitions, net of cash acquired Change in other assets Net cash provided by (used for) investing activities Cash flows from financing activities: Proceeds from debt Term loan repayments Dividend payments to shareholders Repurchase of common stock Proceeds from employee stock plans Excess tax benefit - stock options Contingent consideration payment Change in other financing activities Net cash used for financing activities Effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period $ Three Months Ended 3Q 15 4Q 14 Aug. 1, Nov. 1, 2015 2014 96,305 $ 216,478 $ 108,695 Twelve Months Ended FY 15 FY 14 Oct. 31, Nov. 1, 2015 2014 $ 696,878 $ 629,320 32,688 18,302 16,083 (2,428) (2,895) (25,650) 65,570 101,670 197,975 20.2% 33,650 23,898 16,364 3,827 (6,373) (17,168) (73,537) (19,339) 197,139 22.8% 30,917 26,186 15,393 600 (882) (69,406) 150,760 153,568 262,263 32.2% 130,147 92,093 68,919 6,974 (25,045) (52,214) (9,954) 210,920 907,798 26.4% 114,064 27,906 50,812 4,423 (22,231) (77,711) 145,019 242,282 871,602 30.4% (1,808,202) 2,045,945 159,546 (45,807) 1,102 352,584 (1,403,600) 1,083,474 215,998 (35,164) (6,947) (1,180) (147,419) (1,946,144) 1,507,940 487,259 (43,417) (2,183) (2,633) 822 (6,083,999) 4,984,980 1,251,194 (153,960) (7,065) (8,275) (17,125) (7,485,162) 7,318,877 2,187,389 (177,913) (1,945,887) (12,055) (114,751) (125,582) (111,702) 7,760 2,895 3,724 (222,905) (798) (125,511) (31,340) 19,988 6,373 (1,767) 4,327 (127,930) (509) (1,995,398) (116,308) (187,375) 21,533 882 (1,178) (2,277,844) (1,449) (491,059) (226,953) 122,631 25,045 (1,767) 500 (571,603) (3,950) 1,995,398 (1,995,398) (454,225) (356,346) 200,114 22,231 (3,576) 15,192 (576,610) (3,097) 326,856 557,497 884,353 $ (78,719) (2,016,208) 636,216 2,585,441 557,497 $ 569,233 $ 315,120 569,233 884,353 177,144 392,089 $ 569,233 Analog Devices, Fourth Quarter, Fiscal 2015 Schedule D Revenue Trends by End Market (Unaudited) (In thousands) The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the "ship to" customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data evolve and improve, the categorization of products by end market can vary over time. When this occurs we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. The results below are inclusive of the Hittite acquisition from the acquisition date, July 22, 2014. Three Months Ended Industrial Automotive Consumer Communications Total Revenue Revenue $ 369,387 132,188 317,376 159,771 $ 978,722 Oct. 31, 2015 %* 38% 14% 32% 16% 100% Q/Q % -4% 1% 53% 12% 13% Y/Y % -2% -2% 234% -23% 20% Aug. 1, 2015 Revenue $ 383,946 130,258 206,818 142,343 $ 863,365 Nov. 1, 2014 Revenue $ 375,704 134,947 94,904 208,692 $ 814,247 Twelve Months Ended Industrial Automotive Consumer Communications Total Revenue Revenue $ 1,496,198 526,124 729,965 682,805 $ 3,435,092 Oct. 31, 2015 % 44% 15% 21% 20% 100% Y/Y % 11% 0% 123% 2% 20% Nov. 1, 2014 Revenue $ 1,343,255 525,712 327,223 668,583 $ 2,864,773 Analog Devices, Fourth Quarter, Fiscal 2015 Schedule E Reconciliation from GAAP to Non-GAAP Revenue and Earnings Measures (In thousands, except per-share amounts) (Unaudited) See "Non-GAAP Financial Information" in this press release for a description of the items excluded from our non-GAAP measures. GAAP Revenue 4Q 15 Three Months Ended 3Q 15 4Q 14 Oct. 31, 2015 Aug. 1, 2015 Nov. 1, 2014 Oct. 31, 2015 $863,365 $814,247 $3,435,092 $2,864,773 20% 9% $978,722 Twelve Months Ended FY 15 FY 14 Y/Y Revenue growth % Q/Q Revenue growth % Hittite Operations Non-GAAP Revenue 13% 5% - 12% - $ 978,722 - $ 863,365 $ 814,247 $ 3,435,092 GAAP Gross Margin Gross Margin Percentage Hittite Operations Acquisition-Related Expenses 9% $486,037 $2,259,262 $1,830,188 59.7% 65.8% 13% 5% 13% $641,796 $569,037 65.6% 65.9% - - - 1,307 54,388 1,399 Stock-Based Compensation Expense Non-GAAP Gross Margin - - (5,392) $ 2,859,381 20% Y/Y Revenue growth % Q/Q Revenue growth % Nov. 1, 2014 63.9% (3,015) 7,199 (113) 61,225 113 (113) $ 643,195 $ 570,344 $ 540,312 $ 2,266,574 $ 1,888,285 Gross Margin Percentage 65.7% 66.1% 66.4% 66.0% 66.0% GAAP Operating Expenses $ 533,166 $ 303,768 $ 336,108 $ 1,428,421 $ 1,077,704 54.5% 35.2% 41.3% 41.6% 37.6% - - - - - - (2,033) Percent of Revenue Other Operating Expense (223,672) Hittite Operations Acquisition-Related Expenses (223,672) - (17,682) (23,490) (27,166) (89,738) (32,450) Acquisition-Related Transaction Costs - (5,139) (5,987) (10,016) (27,110) Restructuring-Related Expense - - (34,637) - (37,322) Stock-Based Compensation Expense - - 1,302 (4,164) Non-GAAP Operating Expenses $ 291,812 $ 275,139 $ 269,620 $ 1,100,831 29.8% 31.9% 33.1% 32.0% $ 108,630 $ 265,269 $ 149,929 11.1% 30.7% 18.4% - - - - - - Percent of Revenue GAAP Operating Income/Margin Percent of Revenue Other Operating Expense 223,672 Hittite Operations Acquisition-Related Expenses $ 830,841 1,302 $ 980,091 34.3% $ 24.2% 752,484 26.3% 223,672 (982) 19,081 24,797 81,554 96,937 93,675 Acquisition-Related Transaction Costs - 5,139 5,987 10,016 27,110 Restructuring-Related Expense - - 34,637 - 37,322 Stock-Based Compensation Expense - - (1,415) 4,277 Non-GAAP Operating Income/Margin $ 351,383 $ 295,205 $ 270,692 $ 1,165,743 35.9% 34.2% 33.2% 33.9% Percent of Revenue GAAP Other Expense (Income) $ Percent of Revenue Acquisition-Related Debt Costs Non-GAAP Other Expense $ 0.4% $ 3,953 $ 0.30 $ $ 0.71 Hittite Operations - Acquisition-Related Expenses 5,791 0.06 0.68 11,231 $ 1.4% $ 6,408 $ 0.34 - - - - - $ $ 20,727 (6,336) $ 0.6% $ 2.20 23,139 0.8% - 0.8% - 20,727 908,194 31.8% 0.6% (4,823) 0.7% - Other Operating Expense $ - 0.4% Impact of Loss on Extinguishment of Debt 5,791 0.7% - Percent of Revenue GAAP Diluted EPS 3,953 (1,415) $ 16,803 0.6% $ 1.98 - 0.71 - - - 0.08 0.25 0.30 0.27 0.02 0.01 0.03 0.05 Acquisition-Related Transaction Costs Acquisition-Related Debt Costs - Acquisition-Related Tax Impact - Restructuring-Related Expense - - Stock-Based Compensation Expense - - - 0.01 - - - (0.04) - - - (0.02) - Impact of Reversal of Prior Period Tax Liabilities Impact of the Reinstatement of the R&D Tax Credit Non-GAAP Diluted EPS (1) (0.00) (0.04) $ 1.03 (1) The sum of the individual per share amounts may not equal the total due to rounding 0.01 $ 0.77 - (0.02) 0.09 $ 0.69 0.01 (0.01) (0.02) - $ 3.17 0.10 $ 2.39 Analog Devices, Fourth Quarter, Fiscal 2015 Schedule F SUPPLEMENTAL CASH FLOW MEASURES (Unaudited) See "Non-GAAP Financial Information" in this press release for a description of the items excluded from our supplemental cash flow measures. (In thousands) Net cash provided by operating activities Non-GAAP adjustments: Pension conversion payments Adjusted cash flows from operations Capital expenditures Adjusted free cash flow % of revenue Three Months Ended 4Q 15 3Q 15 4Q 14 Oct. 31, Aug. 1, Nov. 1, 2015 2015 2014 $ 197,975 $ 197,139 $ 262,263 $ $ 223,672 421,647 $ (45,807) 375,840 $ 197,139 $ (35,164) 161,975 $ 38.4% 18.8% 262,263 (43,417) 218,846 26.9% Twelve Months Ended FY 15 FY 14 Oct. 31, Nov. 1, 2015 2014 $ 907,798 $ 871,602 223,672 $ 1,131,470 $ (153,960) $ 977,510 $ 28.5% 871,602 (177,913) 693,689 24.2%