Portfolio Media. Inc. | 860 Broadway, 6th Floor | New... Phone: +1 646 783 7100 | Fax: +1 646 783...

advertisement

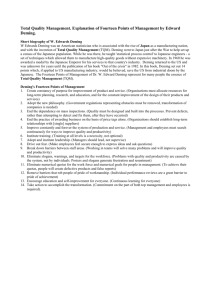

Portfolio Media. Inc. | 860 Broadway, 6th Floor | New York, NY 10003 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | customerservice@law360.com Merrill Lynch Ducks Mortgage Fee Class Action In 9th Circ. By Sindhu Sundar Law360, New York (May 01, 2013, 10:15 PM ET) -- Merrill Lynch & Co. Inc. on Wednesday shook off a proposed class action by a home buyer accusing its unit First Franklin Financial Corp. of unlawful residential mortgage lending practices when the Ninth Circuit ruled federal laws over a bank's real estate lending ability preempt state laws that impede it. A three-judge panel affirmed a lower court’s November 2011 decision granting summary judgment to the defendants and said that Roger Deming’s claims were preempted by the National Banking Act, according to the order. Deming had filed his complaint in July 2009 in federal court in Washington state, claiming that First Franklin — which was acquired by Merrill Lynch, a company itself acquired by Bank of America Corp. in 2008 — violated the Washington Consumer Protection Act and other state laws by charging fees it did not earn. Administrative fees that it charged were already covered by the loan origination fees that he paid, Deming claimed. “Applying the Washington Consumer Protection Act or the Washington Consumer Loan Act to the administrative and compliance review fees charged by Franklin would obstruct Franklin’s ability to exercise its ‘federally authorized real estate lending powers,’” the panel said Wednesday. “Accordingly, all of Deming’s claims based on Washington state laws are preempted.” An attorney for Deming could not immediately be reached for comment late Wednesday. Deming had incurred the fees when he applied for financing in 2006 to buy a house in Washington state, obtaining two loans for the purpose. He was charged a $795 administrative fee on one of them and a $350 fee on another. Such fees are meant to cover costs including underwriting the loans, according to court documents. Deming had claimed First Franklin collected the fees in violation of Washington consumer laws, and lobbed negligence and other claims against defendants including Merrill Lynch and Bank of America, whom he accused as successors-in-interest, according to the lower court's 2011 order. The Ninth Circuit panel on Wednesday also affirmed the dismissal of all of Deming's common law claims, saying he had not shown that his agreements with First Franklin indicated clearly how the administrative and compliance fees would be calculated, according to the order. The panel also noted that Deming had obtained the loans through another broker and had not shown enough evidence about what duty First Franklin had toward him. "As Deming procured the underlying loans through an independent broker and did not have any conversations with anyone from Franklin, he has not shown that Franklin had a duty toward him necessary to give rise to a claim of negligence," the panel said Wednesday. Circuit Judges Dorothy W. Nelson and Consuelo M. Callahan and U.S. District Judge Raner C. Collins sat on the panel for the Ninth Circuit. Deming is represented by Debra Brewer Hayes and Charles Hunter of The Hayes Law Firm PC. First Franklin is represented by John S. Devlin III of Lane Powell PC and John S. Siamas of Reed Smith LLP. The case is Roger Deming v. Merrill Lynch & Co Inc., et al., case number 11-35957, in the U.S. Court of Appeals for the Ninth Circuit. --Editing by Jeremy Barker. All Content © 2003-2013, Portfolio Media, Inc.