Pricing Credit Risk of Asset-Backed Securitization Bonds in Singapore

advertisement

Pricing Credit Risk of Asset-Backed Securitization Bonds in Singapore

TIEN FOO SING*, SEOW ENG ONG, GANG-ZHI FAN

Department of Real Estate, School of Design & Environment,

National University of Singapore,

4 Architecture Drive, Singapore 117566

*rststf@nus.edu.sg

and

KIAN GUAN LIM

School of Business, Singapore Management University, Singapore

Revised: June 17, 2004

Abstract

Asset-backed securitization (ABS) is a creative arrangement to raise funds through the

issuance of marketable securities backed by predictable future cash flows from revenueproducing assets. This paper proposes two pricing models: structural model and intensity

model, to value credit spreads on Singapore ABS bonds. Sensitivity analyses were

conducted on the ABS credit spreads by varying the values of the key input variables

within a plausible range. The property price volatility and its correlations with risk-less

interest rates have been shown to have positive effects on the ABS credit spreads.

However, when the market volatility is extremely high, the credit spreads decrease with

an increase in the time to maturity. The positive effects of the property price volatility

were significantly reduced when credit enhancements were added to the ABS bonds, and

the credit risks associated with the correlation variable were fully eliminated in the credit

enhanced ABS bonds. The rate of loss recovery in the event of default also has significant

impact on the credit risks of the ABS bonds. ABS bonds backed by physical property will

likely to have high recovery rates thus reducing the credit risks vis-à-vis noncollateralized bonds.

Keywords: Asset Backed Securitization; credit risk; structural model; intensity model

*

We would like to thank National University of Singapore for funding the research project. We

also wish to thank Brent Ambrose, CF Sirmans, anonymous referees and others for their

constructive comments and suggestions on the earlier version of the paper. Errors, if any,

remain the responsibility of the authors.

1

Pricing Credit Risk of Asset-Backed Securitization Bonds in Singapore

1.

Introduction

Asset-backed securitization (ABS) is a creative arrangement to raise funds by issuing

marketable securities backed by future cash flows from revenue-producing assets. In the

Singapore context, the assets consist of real estate assets with regular cash flows. A

special-purpose vehicle (SPV) is set up in the ABS structure, which issues debt securities

to finance the purchase of the real estate assets. After the Asian financial crisis in 1997,

ABS transactions became popular in Singapore. The first securitization deal involved the

sale of Neptune Orient Lines (NOL)1 headquarter office building in 1999. 10-year fixedrate bonds were issued through a special purpose vehicle (SPV) Chenab Investments

Limited, to fund the purchase of the 26-storey building valued at S$185 million. Six other

asset securitization transactions were subsequently concluded in 1999. The total bonds

issued from the seven ABS transactions amounted to S$1.84 billion. Securitization of

S$2billion worth of non-real estate assets was also initiated by the Development Bank of

Singapore (DBS)2, with the first tranche of S$200 million short-term interest bearing

notes launched in June 2000.3 The asset pool comprises loans granted to statutory boards

of Singapore and bonds issued by government-linked companies. The short-term notes

were the first asset backed securitization instrument that was assigned an “A-1” rating by

the Standard and Poor’s, which marks an important milestone in the development of ABS

market in Singapore.

ABS is a relatively new financial innovation in Singapore. As yet, there has been no

academic study on credit risk evaluation on Singapore ABS transactions due largely to

shortage of empirical data given the short history of Singapore ABS. Traditional

valuation methods estimate credit spreads by analyzing ex-post default data using

1

2

3

Founded in 1968, Neptune Orient Lines (NOL) is the largest shipping company listed on the Singapore

Exchange. NOL operates a network of container transportation and logistic services on major

international trade routes.

The Development Bank of Singapore (DBS) listed on the Singapore Exchange is one of the largest

banks in Singapore, in term of market capitalization.

Siow, L.S., “DBS offers retail investors short-term interest notes,” Business Times Singapore, June 1,

2000.

2

empirical credit risk models. The modern derivative theory offers a theoretical approach

to pricing credit risk of defaultable bonds, which include the ABS bonds in this paper.

There are two approaches commonly used to evaluate credit risk of defaultable bonds: a

structural-based (firm value) model and an intensity-based model. In the structural or

firm value approach, default and recovery rates are determined based on the evolution of

the firm value relative to its liability. While in the intensity model, an exogenous default

process is directly modeled as a Poisson process. This study attempts to employ the two

models to separately analyze and value credit risk in the ABS transactions.

The organization of the paper is as follows: Section 2 reviews the relevant literature on

pricing defaultable debt instruments. Section 3 discusses the key security features relating

to the selection and applicability of credit risk quantitative valuation techniques. Section

4 specifies the two comparable approaches proposed to price the credit spreads of ABS

bonds. Sections 5 and 6 evaluate the numerical properties of the credit spreads based on

the proposed models. Section 7 summarizes the results of the investigation and draws

some conclusions.

2.

Valuation of Defaultable Debts

Based on the classical option pricing theory first developed by Black and Scholes (1973)

and Merton (1973), Merton (1974) prices the default risk of defaultable bond as a

European put option on the total value of firm assets. The firm value is assumed to evolve

following a stochastic diffusion process. The defaultable zero-coupon bond is then

modeled as an arbitrage-free portfolio consisting of a long position in an equivalent

Treasury bond and a short position in a put option on the firm value with an exercise

price equal to the bond’s face value. Default occurs when the firm value drops below the

face value of its bond at maturity. Merton’s (1974) model suffers several drawbacks.

Firstly, default risk is independent of interest rate risk and different seniority levels.

Secondly, the possibility of default before debt maturity was excluded. Jones et al (1984)

and Franks and Torous (1989) showed that the empirical credit spreads on corporate

3

bonds were too high to be consistent with those generated from the Merton’s model with

non-stochastic interest rates.

Shimko et al. (1993) make a significant extension to Merton’s model by allowing

stochastic interest rates in the model. The interest rates are assumed to follow the Vasicek

(1977) process, which fits many observed term structures of interest rates. In the Vasicek

process, it is possible to generate negative interest rates. They derived closed-form

solutions for defaultable zero-coupon bonds, and showed that the correlation between the

returns of underlying asset and the interest rate movements plays an important role in

determining the credit spread on bonds. However, their model does not allow default

before debt maturity.

Kim et al. (1993) developed their corporate bond pricing model by defining default as the

time when the firm value first reaches a pre-specified constant default threshold. They

incorporated stochastic interest rates in the model, which are assumed to evolve

following a square-root CIR process (Cox, Ingersoll, and Ross, 1985). When the default

threshold is crossed, default occurs and the firm is assumed to go bankrupt immediately.

Bondholders will then exogenously receive a given amount of riskless bonds upon

default. They showed that the proposed model is able to generate corporate spreads that

match with those observed in practice (also see Nielsen et al., 1993; Longstaff and

Schwartz, 1995; and Briys and de Varenne, 1997). This structural valuation framework of

Kim et al. (1993) will be adopted as the first credit risk model for ABS bonds.

Structural models have, however, some practical limitations. Firstly, it is difficult to

estimate the required input parameters related to the value of the firm. The firm’s assets

are generally not frequently traded in financial markets. The firm value is, therefore, not

directly observed. In our case, the assets are commercial properties. If transactions of

comparable properties are not available in the market, the price movements of these

properties can still be indirectly inferred through relevant property indices published by

relevant authorities. Secondly, structural models do not explicitly account for credit

rating information that reflects the credit quality changes of defaultable corporate bonds.

4

It is important, however, in practice, to incorporate the relevant credit-rating information

into the proposed valuation models.

The intensity model offers an alternative approach, in which rating agencies’ data or

other relevant financial markets series can be incorporated into the valuation process. In

the intensity model, default or bankruptcy is directly treated as an unpredictable event

(i.e. a Poisson process). The probability of a jump from no-default to default in a given

time interval is measured by a hazard rate, which is also called an intensity rate. This

group of credit risk models have been examined in financial literature, which includes

Ramaswamy and Sundaresan (1986), Madan and Unal (1994, 1999), Jarrow and Turnbull

(1995), Duffie and Huang (1996), Schönbucher (1997), Duffie and Singleton (1999) and

others.

In Ramaswamy and Sundaresan (1986) intensity model, they assumed that the

instantaneous default risk premium evolves according to a stochastic CIR process (Cox et

al. 1985). In a risk-adjusted valuation procedure, Duffie and Singleton (1999) show that

risky corporate bonds can be directly priced by discounting promised payments using

risk-adjusted interest rates. In Jarrow and Turnbull (1995) intensity model, default is

governed by a constant-parameter Poisson process that is independent of default-free

interest rates. The payoff is known before default. More recently, Madan and Unal (1999)

proposed a two-factor hazard-rate model. The stochastic hazard rate is specified as a

function of the firm’s asset value and the default-free interest rate, which are driven by

two independent stochastic processes. They showed that the proposed hazard-rate model

generates a rich array of credit-spread shapes that are consistent with those observed in

practice.

3.

Problem Specifications

In a typical ABS deal, an owner of an income-generating property asset sells the asset to

a special purpose vehicle (SPV), which is created specifically to hold the asset in the

securitization process. This process distinguishes a securitization arrangement from the

traditional mortgage-backed or collateralized bond issues (Sing, Ong and Sirmans, 2003).

5

The SPV is usually a shell company with no assets. It will raise funds through the

issuance of debt securities to finance the purchase of the securitized assets from the

originator. The debt securities contain the feature of an interest-only balloon-payment

loan that requires no amortization of principal during the bond periods. The debt

securities will be fully redeemed at maturity. The bonds are usually fixed-rate bonds with

a term to maturity ranging from 7 to 10 years.

The ABS bond issuer relies only on the cash flows produced from the securitized incomegenerating property for the periodic coupon payments. The securitized property also

serves as collateral for the ABS bonds. The credit quality of the bonds depends to large

extent upon the fluctuation of the underlying property value. When default occurs, the

model assumes that the securitized property will be foreclosed and sold immediately. The

sale proceeds will then be used to make outstanding coupon payments and also redeem

the bonds at par value. With the non-recourse structure of the bonds, the ABS

bondholders will bear the risks associated with the shortfalls between property values and

ABS issuance bond values.

We employ the analytic framework of defaultable bonds to price credit risks of ABS

bonds. The model assumes that the ABS bondholders possess a risk-free debt security

and simultaneously write to the borrower (SPV) a put option on the underlying property

asset. The bondholders receive a coupon spread over and above the Treasury-bill rate as

the premium for the put option. If default occurs, the SPV could put the securitized

property asset to the bondholders at a strike price that is not more than the present value

of the remaining coupon obligations plus the face value of bonds at maturity.

For corporate bonds, one of the main problems faced in pricing credit risks using the

option pricing techniques is the difficulty in determining the value of miscellaneous

assets owned by firms that issues the bonds (Corcoran and Kao, 1997). Like non-recourse

loans, the ABS bondholders can only have recourse to the commercial property of the

SPV in the event of default. This simplifies the problem in the valuation of ABS credit

risk. Compared with other corporate bonds, the structure of ABS consisting of only one

6

real estate asset is more straightforward. Therefore, the ABS is a good case for the

application of option pricing approach to value credit risk.

In addition to the securitized claims on cash flows generated from the underlying assets,

ABS bonds are credit enhanced through both external and internal means like guarantee

of minimum rental cash flows by the head-lessee, a senior/subordinated structure, and

embedded sale-backed options (Sing, Ong and Sirmans, 2003). The credit enhancements

reduce uncertainty in the ABS transactions, and at the same time, increase the credit

rating of the bond tranches. The ABS bonds have also a higher credit rating than the

corporate rating of the originator because of the bankruptcy-remote feature built-in to the

ABS deals.

In the structural model, the default risk of ABS bonds can be priced based on the relative

value of SPV property to its issued bond/debt value. The model will not be flexible

enough to incorporate various credit enhancements for the bonds, such as corporate

guarantees included to assure ABS investors of timely payments of bond interests and

principals. The corporate guarantees will enhance the credit rating of ABS bonds, but

they are independent of whether the underlying property assets are able to produce

sufficient incomes to meet the bond payment obligations. The credit enhancements may

be an exogenous factor that will shift the optimal triggering boundary of the default

options. In other words, the property value may have to fall substantially below its

outstanding loan value before a default option will be exercised. This may imply that the

structural model may underestimate the credit risks of ABS bonds, when credit

enhancements of various forms are incorporated to the bonds.

In many credit risk pricing models, prices of underlying assets are assumed to evolve

following an exogenous stochastic diffusion process. The prices will only move

incrementally subject to predefined parametric constraints, when new information flows

in continuously. The price process precludes any sudden falls in prices, and therefore,

default never occurs unexpectedly. In the real world, however, shocks and bad news may

occur and cause abrupt downward adjustments of property price, which may in turn

7

trigger a sudden default by the bond originator. Therefore, when default event is

unpredictable, the reduced form approach may be more appropriate for valuing ABS

credit risk. In the model, the probability of default will be treated as an exogenous

variable linked to the rating-based information.

4.

Valuation Frameworks

Two credit risk pricing models are proposed to evaluate the default risks of the ABS

bonds in this paper: structural model and intensity model.

a)

Structural Model

In the structural model, credit risk of ABS bonds is driven by two state variables: the

underlying property value and the instantaneous risk-less interest rate. Credit

enhancements are not considered in this model. The default is triggered by the joint and

simultaneous occurrence of two events: when the underlying property value falls below

the market value of outstanding principal and interest payments of the bonds, and when

the net operating income from the property is less than the scheduled coupon payments at

any payment dates.

We extend the credit risk pricing framework of Shimko et al. (1993) and Kim et al.

(1993), which is used to price zero-coupon bonds, by incorporating discrete coupon

payments in the ABS bonds. Like the earlier models, we assume that the evolution of the

value of underlying property (V) follows a lognormal diffusion process, which is defined

in a specific form as follows,

dV = (a − b )Vdt + σ V VdZV ,

(1)

where a is the instantaneous expected rate of return of the underlying property, b is the

continuous payout rate for the property, σ V is the instantaneous standard deviation of

property return, and Z V is the standardized Wiener process. bV (t ) , in this model, defines

the net operating income from the securitized property.

We also assume that the instantaneous risk-less interest rate(r) evolves in a meanreverting diffusion process (see Cox, Ingersoll, and Ross, 1985).

8

dr = κ (µ − r )dt + σ r r dZ r

(2)

where κ is the speed at which the interest rate r reverts to the long-term mean rate, µ is

the long-term mean value of r, σ r is the interest rate volatility, and Z r is the

standardized Wiener process.

A risk-free portfolio consisting of a short position in the ABS bonds and a long position

in the underlying asset is constructed under the arbitrage-free conditions. The risk-free

portfolio yields an instantaneous risk-free rate of return on the portfolio over a short time

interval, dt, in a market where arbitrage is strictly eliminated. Using Itô’s Lemma on the

two stochastic variables, the ABS bond pricing equation can be defined by the following

partial differential equation (PDE),

1 2 2 ∂2S

∂2S 1 2 ∂2S

∂S

∂S

σVV

σ

σ

ρ

+

+ σ r r 2 + (r − b )V

+ (κ (µ − r ) − λr )

r

V

V r

2

2

∂V

∂r

∂V∂r 2

∂V

∂r

∂S

+

− rS = 0

∂t

(3)

where λ denotes the market price of interest rate risk, and ρ is the instantaneous

correlation coefficient between dZ V and dZ r .

On the assumption that the ABS bonds consist only of one single fixed-rate tranche with

coupons payments due semi-annually, Equation (3) is expanded to include the discrete

fixed-rate coupon payments as follows,

∂S

∂S

1 2 2 ∂2S

∂2S 1 2 ∂2S

+ (κ (µ − r ) − λr )

σVV

+ σ V σ r rVρ

+ σ r r 2 + (r − b )V

2

∂V

∂r

2

∂V∂r 2

∂r

∂V

∂S

+

− rS + ∑ C i δ (t − t i ) = 0

∂t

i

(4)

9

where C i is ith constant coupon payment during the bond periods4, δ (⋅) is the Dirac delta

function and t i is the time of the ith coupon payment (see, e.g., Cossin and Pirotte, 2001).

If ruthless default is not restricted, the bond originator can still choose not to fulfill the

redemption obligations at maturity (i.e., t=T), if and only if the following default

condition holds,

V (T ) < F + C

(5)

where F represents the outstanding bond values at maturity, C is the constant coupon

payment, and V(T) is the value of the underlying property at maturity.

Therefore, the value of ABS bonds, S(V, r, T) at maturity is a corner solution, which can

be defined as,

S(V,r,T) = Min {F + C , V (T )} .

(6)

At time t prior to bond maturity, the general solution for the ABS bond value with default

options can be derived by solving PDE (4) subject to two default conditions5: (a) the net

operating income, bV (t ) , is less than or equal to the scheduled coupon payment, C; and

(b) the value of the underlying property, V(t), falls to or below the value of ABS bonds,

S(V, r, t):

bV (t ) ≤ C

(7)

V (t ) ≤ S (V , r , t )

(8)

The two default conditions are jointly binding, which means that default will occur at a

coupon payment date only if both conditions are satisfied.6 Therefore, at time t prior to

bond maturity, [t < T], the equations can be written simply as follows,

4

5

6

As there are no earlier redemptions of the bonds in the ABS, the fixed-rate coupon payment, C i , is

assumed to be constant throughout the bond periods.

Leland (1994) suggests that default triggered by the condition that asset value falls to or below the debt

value will be irrelevant when the asset value becomes large. He includes an endogenous triggering

mechanism that is dependent on firm ability to raise capital to meet the debt obligations, which is

consistent with the condition in our equation (7), [ C ≤ bV (t ) ].

A similar default definition can be found in Westhoff et al. (2000), who developed a simulation-based

approach of estimating CMBS defaults.

10

V (t ) = Min [ S (V , r , t ), C / b]

(9)

Like in Titman and Torous (1989) and Childs et. al. (1996), the default may occur in the

absence of default cost, at a critical property value, which is way before the lower

triggering value is reached,

V * (r , t ) = S (V * , r , t )

(10)

where V * (r , t ) is determined endogenously.7

If either one of the conditions were not met, default will not occur. In other words, even if

the ABS originator was not able to meet the scheduled coupon payments with the net

operating income from the property, the default will still not be triggered as long as the

property value is still higher than the bond redemption value. Similarly, even if the

underlying property value falls below the value of ABS bonds, the originator will still

continue to keep the bond alive as long as the net operating income is higher than the

scheduled coupon payments.

After determining the value of defaultable ABS bonds, we could back-up the yield-tomaturity from the following pricing equation,

T

S t = ∑ C t e − yt + Fe − y (T −t )

(11)

t =1

where S t is the value of ABS bonds at time t, and F is the face value of ABS bond.8

The credit spread, which reflects the default premium over the remaining life of the

security, τ where [τ= T – t], can then be determined as the difference between the yieldto-maturity of ABS bond, y (τ ) , and the comparable yield on a Treasury bond with the

same maturity, r (τ ) ,

cs = y (τ ) − r (τ )

7

8

(12)

The critical V (r , t ) is determined endogenously using a spline methodology as in Childs et al.

(1996).

In order to calculate the yield-to-maturity from equation (10), we have developed a bisection algorithm

to approach the real solution of this equation.

*

11

b)

Intensity Model

The intensity-based model is an alternative approach to pricing the credit risk of ABS

bonds, where default is modeled as an exogenous Poisson process. The underlying

property value and the instantaneous risk-less interest rate are the two state variables in

the model, which are assumed to follow the same stochastic processes defined in the

previous structural model.

Following Wilmott’s (1998) approach in pricing the ABS bonds, S, a perfectly hedged

portfolio of a long position in underlying asset and a short position in risk-less zerocoupon bond with price Z (r , t ) is constructed, which is represented as follows,

Π = S (V , r , t ) − ∆Z (r , t ) .

(13)

where ∆ is the hedge ratio for the risk-less bonds.

Let the instantaneous default risk be p at time t, the default will be triggered at the first

jump of a Poisson process. For a simple case with only binary outcomes, the risky bonds

will either be or not be defaulted by the originator. The probability of default in a short

time interval from times t to t+dt can be represented as [pdt]. Conversely, [1-pdt]

indicates the probability of non-default of the ABS bonds. The value of the risk-less

hedge portfolio after the short time interval of dt, if default does not occur, can then be

derived as follows,

1

∂2S

∂2S 1 2 ∂2S

∂S

∂S

dΠ = σ V2V 2

r

V

dV +

dr

+

+ σ r r 2 + C dt +

σ

σ

ρ

V r

2

∂V∂r 2

∂V

∂r

∂V

∂r

2

∂Z 1 2 ∂ 2 Z

∂Z

dr ⋅

− ∆

+ σ r r 2 dt +

∂r

∂r

∂t 2

(14)

On the other hand, if default occurs with a probability of pdt, the change in value of the

portfolio can then be given as,

dΠ = − S + Q + O(dt1 2 )

(15)

12

(

where Q is the recovery amount of the ABS bond in default, and O dt1 / 2

)

is an

infinitesimal value relative to the loss of the ABS bond.

To solve the PDE (12), an optimal ∆ is selected such that the dr term in the equation can

be eliminated. By taking the expectation of the change in portfolio value, the basic

pricing equation for the ABS bonds with no interim coupon payments can be derived as,

∂2S 1 2 ∂2S

∂S

∂S

1 2 2 ∂2S

+

+ σ r r 2 + (r − b )V

+ (κ (µ − r ) − λr )

r

V

σ VV

σ

σ

ρ

V r

2

∂V∂r 2

∂V

∂r

2

∂V

∂r

∂S

+

− (r + p )S + pQ = 0

∂t

(16)

When the discrete coupon payments are taken into account, Equation (14) can be further

expanded as follows,

1 2 2 ∂2S

∂2S 1 2 ∂2S

∂S

∂S

σ VV

σ

σ

ρ

+

+ σ r r 2 + (r − b )V

+ (κ (µ − r ) − λr )

r

V

V r

2

2

∂V∂r 2

∂V

∂r

∂V

∂r

∂S

+

− (r + p )S + pQ + ∑ C i δ (t − t i ) = 0

∂t

i

(17)

which is subject to the following boundary condition,

S (V , r , T ) = F + C

(18)

For simplicity reasons, we assume that the instantaneous risk of default and the recovery

rate are constant. In other words, the instantaneous default risk and the recovery rate are

not correlated with the two specified stochastic variables.9 The credit spreads in a

continuous time intensity-based framework are also estimated by taking the difference

between the yield-to-maturity of ABS bond and the comparable yield of the Treasury

bond with the same maturity period.

9

The assumptions can be relaxed for more generalized cases. However, this study does not intend to

elaborate on the generalized cases, instead it focuses on the analysis of the effects on of these variables

on credit spreads.

13

5.

Estimation of ABS Credit Spread

In this section, we numerically analyze the credit spreads of ABS bonds using the two

proposed models. We consider a 10-year, 6% fixed rate coupon ABS bond backed by the

rental incomes from a securitized office property. The risk-less rate of return is

represented by the coupon rate of 3% for a Treasury bond proxy with a comparable

maturity term. In the ABS structure, the securitized property asset is transferred off-thebalance sheet of the original owner of the real estate asset. It insulates the bond investors,

on one hand, against any bankruptcy liability of the original owner. On the other hands,

bondholders will also have no recourse to the original firm’s asset in the case of default

on the bond obligations by the SPV. In other words, the ABS bondholders will only have

direct recourse on the income and sale proceeds from the securitized property, if it is

foreclosed.

The credit spreads of the ABS bonds can be estimated by solving equations (4) (structural

model) and (17) (intensity model). There are no analytical solutions to the two equations,

explicit finite-difference methods will be used to numerically compute the bond prices

and credit spreads from the two equations. For the numerical analyses, we make

necessary assumptions for the input parameters in the two stochastic processes, which

include: σ V , σ r , ρ , κ , µ , λ and b in equation (4), and σ V , σ r , ρ , κ , µ , λ , b, p and Q in

equation (17). We use the secondary data sources10: the Urban Redevelopment Authority

(URA)11 of Singapore data on commercial property prices, and the Monetary Authority

of Singapore (MAS) data on Treasury bonds over the past fifteen years to provide a close

approximation to the input parameters. In this paper, 5-year Treasury bond yield data

were used, because longer time series data were available compared to the 7-year and 10year Treasury bonds, which have only a relatively short history from the late 1990s.12

10

11

12

The secondary sources of information may include the Urban Redevelopment Authority (URA) of

Singapore published office property price and rental indexes and also the Treasury bond yields

published by the Monetary Authority of Singapore (MAS), the de-facto central bank of Singapore.

URA is the national planning authority of Singapore entrusted with the role to plan the long-term land

use and physical development of the country.

The 5-year Treasury bond yields offer a closer available proxy for the risk-less interest rate for the

ABS bond valuation, but we recognize that the Treasury bond yields with comparable maturity term of

10 years, if available, should be a better substitute (Titman and Torous, 1989).

14

6.

Results of Numerical Analyses

This section evaluates the sensitivity of the credit spread estimates to the changes of key

input parameters. The objective of these sensitivity analyses is to identify the important

factors and how these factors will have significant influences, in terms of both direction

and magnitude, on the credit spreads of the ABS bonds. The bond value is normalized to

one unit dollar, and the property value is set in a range from 0 to 2.5*F. The effects of the

changes in selected key variables, which include property value volatility, ( σ V ), the

correlation coefficient parameter, (ρ), and the recovery rate, (Q), on he ABS credit

spreads can then be illustrated.

For a base case scenario, we specify the parameter values for the relevant parameters

based on the historical data of Singapore office property market and the 5-year

government Treasury bond yields. The property payout rate, (b), is assumed to be 7%

based on the rental data, and the volatility of the office price is estimated at σ V =13%

based on the quarterly office rental return of the URA. The correlation coefficient of

[ ρ = 0.1 ] is assumed to reflect the historical correlations of the risk-less interest rate

changes and property returns over the last fifteen years, which was less than 10 percent.

The market price of interest rate risk is set to be [ λ = 0 ]. For the stochastic risk-less

interest rates, we use the quarterly yield data for the 5-year Treasury bonds to estimate

the reversion speed, [ κ =0.5], the long-term mean of risk-less interest rates, [ µ =0.037],

and the volatility of riskless interest rates, [ σ r =0.05]. For the intensity model, two more

parameters were assumed for the risk intensity, [p=0.01], and the recovery rate, Q=0.9].

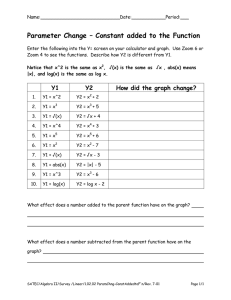

a)

Effects of Property Price Volatility

By varying the property value volatility parameter from 0% to 45%, we evaluate how the

value surfaces of the ABS credit spreads will be affected in both the structural model

(Figure 1) and the intensity model (Figure 2). The maturity periods of the ABS bonds are

also added to show the time dimension of the volatility-credit spread relationships.

15

In the structural model, where no credit enhancement is included, the ABS credit spreads

increase with increases in volatility of the property value over time (Figure 1). However,

the rate of changes in the credit spread decrease as the volatility increases. In fact, the

positive relationships are no longer observed when the property value volatility exceeds

approximately 40%. When the property price volatility is above this level, the reverse

effects set in when the maturity of the ABS bonds is shortened. For example, at

σ V =45%, the credit spread premiums decrease from 4.62% for a 2-year ABS bonds to

4.41% and 3.56% for a 3-year and a 10-year ABS bonds respectively. We expect the

bond originator to keep the “default option” alive when the potential upside associated

with the high property price is valuable when the market is highly uncertain. The risk

premium for the ABS originator to default will also be higher when the bond maturity is

shortened.

[Insert Figure 1]

The positive credit spread-property price volatility relationships as shown in Figure 2 are

more discernible in the intensity model. However, in the relative scale, the credit spread

premiums of ABS bonds and also the rate of change of the premium over the volatility

changes estimated in the intensity model are much lower than those obtained in the

structural model. The effects are, however, independent of the maturity term of the ABS

bonds.

[Insert Figure 2]

The above results imply that ABS bonds without credit enhancement as represented by

the structural model are more sensitive to the shocks in the securitized property prices.

The rates of credit spread change are also dependent on the maturity term of ABS bonds,

if they are not provided with adequate credit enhancements. Clearly, ABS bonds with no

credit enhancements are riskier than those with credit enhancements. Therefore, credit

enhancements should be used as an effective mean to reduce default risks in the ABS,

especially in a high property price volatility environment.

16

b)

Effects of Correlation Coefficient between property values and risk-less rates

The effects of changing correlations between the risk-less interest rates and the

securitized ABS property return are analyzed by varying the coefficient, (ρ), from a

negative range of -0.4 to a positive range of +0.5. In the structural model (Figure 3), the

credit spread curves shifts in an upward direction along the correlation coefficient axis,

but the rate of change is marginal. For a case of 10-year ABS bond, the credit spread

premium increases from 0.0303 to 0.0322 when the correlation coefficient changes from

–0.4 to 0.4. The effects created by the correlations between the two stochastic processes

in the model were eliminated when credit enhancements were included in the intensity

model (Figure 4). The credit spread curves were the same over the entire range of

maturity periods, despite the changes in the coefficients of correlation.

[Insert Figures 3 and 4]

The difference in the estimates of the credit spread premium between Figure 3 and Figure

4 show the effects of having credit enhancement in ABS bonds on the credit spreads. This

suggests the importance of the credit enhancements in mitigating the default risks

associated with the correlations between property returns and risk-less interest rate

changes in ABS bonds.

c)

Intensity-based Factors Effects

In the intensity model, default is a Poisson process that is dependent on the instantaneous

risk of default, p, and the recovery rate in the event of default, Q. The probability of [1-

pdt] indirectly measures the level of credit enhancements within which default of ABS

will not occur. The credit enhancement effects will be evaluated by changing the

recovery rate in a range from 50% to 90% (Figure 5).

[Insert Figure 5]

The results show that the ABS credit spread is negatively related to the changes in the

recovery rates. The rate of decrease of the ABS credit spread as shown by the slope along

17

the recovery rate axis increases when the term to maturity increases. For a 2-year ABS

bonds, every 10% increase in the recovery rate, the credit spread premium decreases by

0.1%, whereas the rate of changes was approximately -0.14% for a 10-year fixed rate

coupon payment ABS bonds.

The results are not unexpected, which imply that ABS credit risk is lower when ABS

bondholders are assured that they can recover a substantial portion of the bond values

through foreclosure and disposal of the securitized property in the event of default, i.e. a

higher recovery rate. Compared to other paper-based non-recourse bonds, the probability

and the rate at which the bondholders can recover their investments from the securitized

assets are likely to be higher, since property price is less prone to inflationary risks. The

underlying property assets securitized indirectly credit enhance ABS bonds.

In summary, our results show that in the absence of credit enhancement, the ABS credit

spread is more sensitive to the positive shocks in the securitized property prices over

time. However, when credit enhancements are included, the effect of volatility on the

credit spread is significantly reduced. It is also shown that the credit spread is an

increasing function of the maturity term of ABS bonds. The effects of an increasing ABS

bond term are less critical when the price volatility level is high, [ σ V =45%], and when

credit enhancements are not available. Another significant and positive determinant of

ABS credit spread is the correlation between the risk-less interest rates and the property

return. The effect of the correlation can be eliminated by including appropriate credit

enhancements to the ABS structure. We also find that the credit spread is a decreasing

function of the recovery rates.

7.

Conclusion

This paper extended and applied two pricing models: structural model and intensity

model, to value credit spreads for ABS bonds. Numerical analyses were conducted with a

set of input assumptions that represent a base case scenario. Unlike the zero-coupon bond

models (Shimko et. al., 1993), the model is extended to allow for discrete coupon

payments during the life of the ABS bonds. However, the structural model does not

18

explicitly account for credit enhancements in the ABS bonds. In the intensity process, a

Poisson default process is included to represent the exogenous effects of credit

enhancements on the ABS credit risks. We could model different level of credit

enhancements by varying the intensity of default risks, p, and also the recovery rate, Q, in

the event of default.

We examine the sensitivities of the ABS credit spreads with respects to changes of key

parameters such as property price volatility, correlations between property price and riskless interest rate and also the intensity-based recovery factor. By varying the values of the

controlled variable within a plausible range, value surfaces of credit spreads estimated in

the two different models could be analyzed and compared. Credit spreads are highly

sensitive to the property price volatility, and the risk premiums are higher in the absolute

scale when credit enhancements are not included in the ABS structure. In the absence of

credit enhancement, credit spreads in a highly volatile environment, ( σ V =40%), decrease

with the length of the bond maturity term.

The credit spread analysis shows that the effects of an increase in the correlations

between property price return and risk-less interest rate on the ABS credit spreads were

positive, but at a marginal rate of change. These positive effects were eliminated in the

intensity model when credit enhancements are included. Based on the above sensitivity

analyses, credit enhancements are important features in ABS that will improve the credit

quality and mitigate possible losses of ABS investors in the event of default. The

effectiveness of the credit enhancements is, however, dependent on the loss recovery rate

when default occurs. ABS bonds backed by physical property are likely to have lower

credit risk than non-collateralized ABS bonds, because bondholders is assured that they

can recover a substantial portion of the bond values through foreclosure and disposal of

the securitized property in the event of default, i.e. a higher recovery rate.

19

References

Black, F. and M. Scholes, The Pricing of Options and Corporate Liabilities, Journal of

Political Economy, 1973, 81, pp.637-654.

Briys, E. and F. de Varenne, Valuing Risky Fixed Rate Debt: An Extension, Journal of

Financial and Quantitative Analysis, 1997, 32(2), June, pp. 239-249.

Childs, P. D., S. H. Ott and T. J. Riddiough, The Pricing of Multiclass Commercial

Mortgage-Backed Securities, Journal of Financial and Quantitative Analysis, 1996,

31(4), pp.581-603.

Corcoran, P. and D. L. Kao, Assessing Credit Risk of CMBS, in The Handbook of

Commercial Mortgage-Backed Securities, Eds. Frank J. Fabozzi and David P. Jacob,

1997, pp. 251-268, Frank J. Fabozzi Associates and Nomura Securities International,

Inc., USA.

Cossin, D. and H. Pirotte, Advanced Credit Risk Analysis: Financial Approaches and

Mathematical Models to Assess, Price, and Manage Credit Risk, 2000, New York: John

Wiley & Sons.

Cox, J.C., J. Ingersoll and S. Ross, A Theory of the Term Structure of Interest Rates,

Econometrica, 1985, 53, pp.385-407.

Duffie, D. and M. Huang, Swap Rates and Credit Quality, Journal of Finance,1996,

51(3), July, pp.921-949.

Duffie, D. and K. Singleton, Modeling Term Structures of Defaultable Bonds, Review of

Financial Studies, Special 1999, 12(4), pp. 687-720.

Fama, E. F., Term Premiums and Default Premiums in Money Markets, Journal of

Financial Economics, 1986, September, pp.175-196.

Franks, J. R. and W. Torous, An Empirical Investigation of US Firms in Reorganization,

the Journal of Finance, 1989, 44, pp.747-769.

Jarrow, R. and S. Turnbull, Pricing Derivatives on Financial Securities Subject to Credit

Risk, Journal of Finance, 1995, 50(1). March, pp.53-85.

Jones, E. Philip, S. P. Mason and E. Rosenfeld, Contingent Claims Analysis of Corporate

Capital Structures: An Empirical Investigation, Journal of Finance, 1984, 39(3), pp.611627.

Kim, I. J., K. Ramaswamy, and S. Sundaresan, Does Default Risk in Coupons Affect the

Valuation of Corporate Bonds?: A Contingent Claims Model, Financial Management,

Autumn1993, 22(3), pp.117-131.

20

Leland, H.E., Corporate Debt Value, Bond Covenants, and Optimal Capital Structure,

Journal of Finance, 1994, 49(4), pp. 1213-1252.

Longstaff, F. and E. Schwartz, A Simple Approach to Valuing Risky Fixed and Floating

Rate Debt, Journal of Finance, 1995, 50(3), pp.789-819.

Madan, D. and H. Unal, Pricing the Risks of Default, Working Paper, College of

Business, University of Maryland, September, 1995.

Madan, D. and H. Unal, A Two-Factor Hazard-Rate Model for Pricing Risky Debt and

the Term Structure of Credit Spreads, Working Paper, College of Business, University of

Maryland, November, 1999.

Merton, R. C., Theory of Rational Option Pricing, Bell Journal of Economics and

Management Science, 1973, 4, pp.141-183.

Merton, R. C., On the Pricing of Corporate Debt: The Risk Structure of Interest Rates,

Journal of Finance, 1974, 29, pp.449-470.

Nielsen, L. T., J. Saá-Requejo, and P. Santa-Clara, Default Risk and Interest Rate Risk:

The Term Structure of Default Spreads, Working Paper, INSEAD, France, 1993.

Ramaswamy, K., and S. Sundaresan, The Valuation of Floating-Rate Instruments,

Journal of Finance, 1986, 17, February, pp.251-272.

Saá-Requejo, J. and P. S. Santa-Clara, Bond Pricing with Default Risk, Working Paper,

John E. Anderson Graduate School of Management, UCLA, Los Angeles, 1997, 23.

Schönbucher, P., The Term Structure of Defaultable Bond Prices, Working Paper,

University of Bonn, 1997.

Shimko, D., N. Tejima and D. V. Deventer, The Pricing of Risky Debt When Interest

Rates are Stochastic, The Journal of Fixed Income,1993, September, pp.58-65.

Sing, T. F., S. E. Ong and C. F. Sirmans, Asset-Backed Securitization in Singapore:

Value of Embedded Buy-Back Options, Journal of Real Estate Finance and Economics,

2003, 27:2, pp.173-189.

Titman, S. and W. Torous, Valuing Commercial Mortgages: An Empirical Investigation

of the Contingent-Claims Approach to Pricing Risky Debt, Journal of Finance, 1989,

44:2, pp.345-373.

Vasicek, O., An Equilibrium Characterization of the Term Structure, Journal of

Financial Economics, 1977, 5, pp.177-188.

Westhoff, D., V. S. Srinivasan and M. Feldman, An Empirical Framework for Estimating

CMBS Defaults, in The Handbook of Nonagency Mortgage-Backed Securities, Eds. F. J.

21

Fabozzi, C. Ramsey and M. Marz, 2nd, 2000, pp.435-441, Pennsylvania: Frank J. Fabozzi

Associates.

Wilmott, P., Derivatives: the theory and practice of financial engineering, Chichester:

John Wiley, 1998

22

Figure 1 Sensitivity Measures of Credit Spreads vs. Varying Property Value

Volatility (Structural Approach)

23

Figure 2 Sensitivity Measures of Credit Spreads vs. Varying Property Value

Volatility (Intensity Approach)

24

Figure 3 Sensitivity Measures of Credit Spreads vs. Varying Correlation

(Structural Approach)

25

Figure 4 Sensitivity Measures of credit Spreads vs. Varying Correlation

(Intensity Approach)

26

Figure 5 Sensitivity Measures of Credit Spreads vs. Varying Recovery Rate

(Intensity Approach)

27