Managerial Aspects of Enterprise Risk Management David L. Olson Desheng Wu

advertisement

Managerial Aspects of

Enterprise Risk Management

David L. Olson

University of Nebraska-Lincoln

Desheng Wu

University of Toronto; University of Reykjavik

Risk & Business

• Taking risk is fundamental to doing business

– Insurance

• Lloyd’s of London

– Hedging

• Risk exchange swaps

• Derivatives/options

• Catastrophe equity puts (cat-e-puts)

– ERM seeks to rationally manage these risks

• Be a Risk Shaper

Risk Reduction Strategies

C.S. Tang

Journal of Logistics: Research and Applications 9:1 [2006] 33-45

1.

2.

3.

4.

Identify different types of risk

Estimate likelihood of each event

Assess potential loss from major disruption

Identify strategies to reduce risk

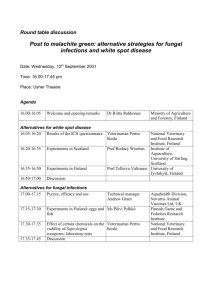

Finland 2010

Another view

Slywotzky & Drzik, HBR [2005]

• Financial

– Currency fluctuation

• DEFENSE: Hedging

• Hazard

– Chemical spill

• DEFENSE: Insurance

• Operational

– Computer system failure

• DEFENSE: Backup (dispersion, firewalls)

• New technology overtaking your product

– ACE inhibitors, calcium channel blockers ate into hypertension drug

market of beta-blockers & diuretics

• Demand shifts

– Gradual – Oldsmobile; Rapid - Station wagons to Minivans

Finland May 2010

5

Technology Shift

• Loss of patent protection

• Outdated manufacturing process

– DEFENSE: Double bet

•

•

•

•

Invest in multiple versions of technology

Microsoft: OS/2 & Windows

Intel: RISC & CISC

Motorola didn’t – Nokia, Samsung entered

Finland May 2010

6

Brand Erosion

• Perrier – contamination

• Firestone – Ford Explorer

• GM Saturn – not enough new models

– DEFENSE: Redefine scope

• Emphasize service, quality

– DEFENSE: Reallocate brand investment

• AMEX – responded to VISA campaign, reduced

transaction fees, sped up payments, more ads

Finland May 2010

7

One-of-a-kind Competitor

• Competitor redefines market

• Wal-Mart

– DEFENSE: Create new, non-overlapping business

design

• Target – unique product selection

Finland May 2010

8

Customer Priority Shift

– DEFENSE: Analyze proprietary information

• Identify next customer shift

– Coach leather goods – competes with Gucci

– Went trendy, aggressive in-market testing

» Customer interviews, in-store product tests

– DEFENSE: Market experiments

• Capital One – 65,000 experiments annually

– Identify ever-smaller customer segments for credit cards

Finland May 2010

9

New Project Failure

• Edsel

– DEFENSE: Initial analysis

• Best defense

– DEFENSE: Smart sequencing

• Do better-controllable projects first

– Applied Materials – chip-making

– DEFENSE: Develop excess options

• Improve odds of eventual success

– Toyota – hybrid: proliferation of Prius options

– DEFENSE: Stepping-stone method

• Create series of projects

– Toyota – rolling out Prius

Finland May 2010

10

DEALING WITH RISK

• Management responsible for ALL risks facing

an organization

• CANNOT POSSIBLY EXPECT TO ANTICIPATE ALL

• AVOID SEEKING OPTIMAL PROFIT THROUGH

ARBITRAGE

• FOCUS ON CONTINGENCY PLANNING

– CONSIDER MULTIPLE CRITERIA

– MISTRUST MODELS

Financial Risk Management

• Evaluate chance of loss

– PLAN

• Hubbard [2009]: identification, assessment,

prioritization of risks followed by coordinated

and economical application of resources to

minimize, monitor, and control the probability

and/or impact of unfortunate events

– WATCH, DO SOMETHING

Value-at-Risk

• One of most widely used models in financial

risk management (Gordon [2009])

• Maximum expected loss over given time

horizon at given confidence level

– Typically how much would you expect to lose 99%

of the time over the next day (typical trading

horizon)

• Implication – will do worse (1-0.99) proportion of the

time

VaR = 0.64

expect to exceed 99% of time in 1 year

Here loss = 10 – 0.64 = 9.36

Finland 2010

Use

• Basel Capital Accord

– Banks encouraged to use internal models to measure

VaR

– Use to ensure capital adequacy (liquidity)

– Compute daily at 99th percentile

• Can use others

– Minimum price shock equivalent to 10 trading days

(holding period)

– Historical observation period ≥1 year

– Capital charge ≥ 3 x average daily VaR of last 60

business days

Finland 2010

Limits

• At 99% level, will exceed 3-4 times per year

• Distributions have fat tails

• Only considers probability of loss – not

magnitude

• Conditional Value-At-Risk

– Weighted average between VaR & losses

exceeding VaR

– Aim to reduce probability a portfolio will incur

large losses

Finland 2010

Correlation Makes a Difference

Daily Models t-distribution

0.80

0.70

0.60

0.50

Return(correlated)

0.40

Return(uncorrelated)

0.30

0.20

0.10

0.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

Correlation impact on Variance

Daily Models t-distribution

3 outliers – China mixed with others

1600.00

1400.00

1200.00

1000.00

Return(correlated)

800.00

Variance(correlated)

Variance(uncorrelated)

600.00

400.00

200.00

0.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

Correlation impact on Value-at-Risk

Daily Models t-distribution

Directly proportional to Variance

120.00

100.00

80.00

Return(correlated)

60.00

VaR(correlated)

VaR(uncorrelated)

40.00

20.00

0.00

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

Conclusions

• Can use a variety of models to plan portfolio

• Expect results to be jittery

– Near-optimal may turn out better

– Sensitive to distribution assumed

• Trade-off – risk & return

COSO

Committee of Sponsoring Organizations

Treadway Committee – 1990s

Smiechewicz [2001]

• Assign responsibility

– Board of directors

• Establish organization’s risk appetite

• establish audit & risk management policies

– Executives assume ownership

• Policies express position on integrity, ethics

• Responsibilities for insurance, auditing, loan review, credit, legal

compliance, quality, security

• Common language

– Risk definitions specific to organization

• Value-adding framework

Finland May 2010

21

COSO Integrated Framework 2004

Levinsohn [2004]; Bowling & Rieger [2005]

• Internal environment – describe domain

• Objective setting – objectives consistent with

mission, risk appetite

• Event identification – risks/opportunities

• Risk assessment - analysis

• Risk response – based on risk tolerance & appetite

• Control activities

• Information & communication – to responsible

people

• Monitoring

Finland May 2010

22

Supply Chain Risk Categories

6 sources

CATEGORY

RISK

NATURE

External

Natural disaster, plant fire, disease & epidemics

POLITICAL SYSTEM

“

War, terrorism, labor disputes, regulations

COMPETITOR & MARKET “

Price, recession, exchange rate

Demand, customer payment

New technology, obsolescence substitutes

AVAILABLE CAPACITY

Internal

Capacity cost, supplier bankruptcy

INTERNAL OPERATION

“

Forecast inaccuracy, safety

Bullwhip, agility, on-time delivery

Tradeoff: inventory/fill rate

Quality

INFORMATION SYSTEM

“

System breakdown

Distorted information

Integration

Viruses/bugs/hackers

Finland 2010

Supply Chain risk management process

P. Chapman, M. Cristopher, U. Juttner, H. Peck, R. Wilding,

Logistics and Transportation Focus 4:4 [2002] 59-64

• Risk Identification

– Uncertainties: demand, supply, cost {quantitative}

– Disruption: disasters, economic crises {qualitative}

• Risk Assessment

–

–

–

–

–

Political

Product availability

Capacity, demand fluctuation

Technology, labor

Financial instability, management turnover

• Risk Avoidance

– Insurance

– Inventory buffers

– Supply chain alliances, e-procurement

• Risk Mitigation

– Product pricing, other demand control

– Product variety

– VMI, CPFR

Finland 2010

Empirical

• BUBBLES

– Dutch tulip mania – early 17th Century

– South Sea Company – 1711-1720

– Mississippi Company – 1719-1720

• Isaac Newton got burned: “I can calculate the motion

of heavenly bodies but not the madness of people.”

Modern Bubbles

• London Market Exchange (LMX) spiral

– 1983 excess-of-loss reinsurance popular

– Syndicates ended up paying themselves to insure

themselves against ruin

– Viewed risks as independent

• WEREN’T: hedging cycle among same pool of insurers

– Hurricane Alicia in 1983 stretched the system

Long Term Capital Management

• Black-Scholes – model pricing derivatives

• LTCM formed to take advantage

– Heavy cost to participate

– Did fabulously well

• 1998 invested in Russian banks

– Russian banks collapsed

– LTCM bailed out by US Fed

• LTCM too big to allow to collapse

Information Technology

• 1990s very hot profession

• Venture capital threw money at Internet ideas

– Stock prices skyrocketed

– IPOs made many very rich nerds

– Most failed

• 2002 bubble burst

– IT industry still in trouble

• ERP, outsourcing

Real Estate

• Considered safest investment around

– 1981 deregulation

• In some places (California) consistent high rates of

price inflation

– Banks eager to invest in mortgages – created tranches of

mortgage portfolios

• 2008 – interest rates fell

– Soon many risky mortgages cost more than houses worth

– SUBPRIME MORTGAGE COLLAPSE

– Risk avoidance system so interconnected that most banks

at risk

APPROACHES TO THE PROBLEM

• MAKE THE MODELS BETTER

– The economic theoretical way

– But human systems too complex to completely

capture

– Black-Scholes a good example

• PRACTICAL ALTERNATIVES

– Buffett

– Soros

Better Models

Cooper [2008]

• Efficient market hypothesis

– Inaccurate description of real markets

– disregards bubbles

• FAT TAILS

• Hyman Minsky [2008]

– Financial instability hypothesis

• Markets can generate waves of credit expansion, asset inflation,

reverse

• Positive feedback leads to wild swings

• Need central banking control

• Mandelbrot & Hudson [2004]

– Fractal models

• Better description of real market swings

Fat Tails

• Investors tend to assume normal distribution

– Real investment data bell shaped

– Normal distribution well-developed, widely understood

• TALEB [2007]

– BLACK SWANS

– Humans tend to assume if they haven’t seen it, it’s impossible

• BUT REAL INVESTMENT DATA OFF AT EXTREMES

– Rare events have higher probability of occurring than normal

distribution would imply

•

•

•

•

Power-Log distribution

Student-t

Logistic

Normal

Human Cognitive Psychology

• Kahneman & Tversky [many – c. 1980]

– Human decision making fraught with biases

• Often lead to irrational choices

• FRAMING – biased by recent observations

– Risk-averse if winning

– Risk-seeking if losing

• RARE EVENTS – we overestimate probability of rare

events

– We fear the next asteroid

– Airline security processing

Animal Spirits

• Akerlof & Shiller [2009]

– Standard economic theory makes too many

assumptions

• Decision makers consider all available options

• Evaluate outcomes of each option

– Advantages, probabilities

• Optimize expected results

– Akerlof & Shiller propose

• Consideration of objectives in addition to profit

• Altruism - fairness

Warren Buffett

• Conservative investment view

– There is an underlying worth (value) to each firm

– Stock market prices vary from that worth

– BUY UNDERPRICED FIRMS

– HOLD

• At least until your confidence is shaken

– ONLY INVEST IN THINGS YOU UNDERSTAND

• NOT INCOMPATIBLE WITH EMT

George Soros

• Humans fallable

• Bubbles examples reflexivity

– Human decisions affect data they analyze for future

decisions

– Human nature to join the band-wagon

– Causes bubble

– Some shock brings down prices

• JUMP ON INITIAL BUBBLE-FORMING

INVESTMENT OPPORTUNITIES

– Help the bubble along

– WHEN NEAR BURSTING, BAIL OUT

Nassim Taleb

• Black Swans

– Human fallability in cognitive understanding

– Investors considered successful in bubble-forming

period are headed for disaster

• BLOW-Ups

• There is no profit in joining the band-wagon

– Seek investments where everyone else is wrong

• Seek High-payoff on these long shots

– Lottery-investment approach

• Except the odds in your favor

Taleb Statistical View

• Mathematics

– Fair coin flips have a 50/50 probability of heads or

tails

– If you observe 99 heads in succession, probability of

heads on next toss = 0.5

• CASINO VIEW

– If you observe 99 heads in succession, probably the

flipper is crooked

• MAKE SURE STATISTICS ARE APPROPRIATE TO

DECISION

CASINO RISK

• Have game outcomes down to a science

• ACTUAL DISASTERS

1. A tiger bit Siegfried or Roy – loss about $100 million

2. A contractor suffered in constructing a hotel annex,

sued, lost – tried to dynamite casino

3. Casinos required to file with Internal Revenue

Service – an employee failed to do that for years –

Casino had to pay huge fine (risked license)

4. Casino owner’s daughter kidnapped – he violated

gambling laws to use casino money to raise ransom

Risk Management Tools

• Simulation (Beneda [2005])

– Monte Carlo – Crystal Ball

• Multiple criteria analysis

– Tradeoffs between risk & return

• Balanced Scorecard

– Organizational performance measurement

Finland May 2010

40