Views of Risk

advertisement

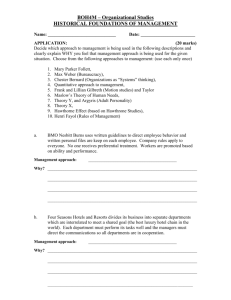

Views of Risk Traditional Economic View • Thűnen [1826] – Profit is in part payment for assuming risk • Hawley [1907] – Risk-taking essential for an entrepreneur • Knight [1921] – Uncertainty non-quantitative – Risk: measurable uncertainty (subjective) – Profit is due to assuming risk (objective) Contemporary Economics • Harry Markowitz [1952] – RISK IS VARIANCE – Efficient frontier – tradeoff of risk, return – Correlations – diversify • William Sharpe [1970] – Capital asset pricing model • Evaluate investments in terms of risk & return relative to the market as a whole • The riskier a stock, the greater profit potential • Thus RISK IS OPPORTUNITY • Eugene Fama [1965] – Efficient market theory • market price incorporates perfect information • Random walks in price around equilibrium value Empirical • BUBBLES – Dutch tulip mania – early 17th Century – South Sea Company – 1711-1720 – Mississippi Company – 1719-1720 • Isaac Newton got burned: “I can calculate the motion of heavenly bodies but not the madness of people.” Modern Bubbles • London Market Exchange (LMX) spiral – 1983 excess-of-loss reinsurance popular – Syndicates ended up paying themselves to insure themselves against ruin – Viewed risks as independent • WEREN’T: hedging cycle among same pool of insurers – Hurricane Alicia in 1983 stretched the system Black Monday • October 19, 1987 • Stock Exchange – triple witching hour • Some blamed portfolio insurance – Based on efficient-market theory, computer trading models sought temporary diversions from fundamental value Long Term Capital Management • Black-Scholes – model pricing derivatives • LTCM formed to take advantage – Heavy cost to participate – Did fabulously well • 1998 invested in Russian banks – Russian banks collapsed – LTCM bailed out by US Fed • LTCM too big to allow to collapse Information Technology • 1990s very hot profession • Venture capital threw money at Internet ideas – Stock prices skyrocketed – IPOs made many very rich nerds – Most failed • 2002 bubble burst – IT industry still in trouble • ERP, outsourcing Real Estate • Considered safest investment around – 1981 deregulation • In some places (California) consistent high rates of price inflation – Banks eager to invest in mortgages – created tranches of mortgage portfolios • 2008 – interest rates fell – Soon many risky mortgages cost more than houses worth – SUBPRIME MORTGAGE COLLAPSE – Risk avoidance system so interconnected that most banks at risk APPROACHES TO THE PROBLEM • MAKE THE MODELS BETTER – The economic theoretical way – But human systems too complex to completely capture – Black-Scholes a good example • PRACTICAL ALTERNATIVES – Buffett – Soros Better Models Cooper [2008] • Efficient market hypothesis – Inaccurate description of real markets – disregards bubbles • FAT TAILS • Hyman Minsky [2008] – Financial instability hypothesis • Markets can generate waves of credit expansion, asset inflation, reverse • Positive feedback leads to wild swings • Need central banking control • Mandelbrot & Hudson [2004] – Fractal models • Better description of real market swings Fat Tails • Investors tend to assume normal distribution – Real investment data bell shaped – Normal distribution well-developed, widely understood • TALEB [2007] – BLACK SWANS – Humans tend to assume if they haven’t seen it, it’s impossible • BUT REAL INVESTMENT DATA OFF AT EXTREMES – Rare events have higher probability of occurring than normal distribution would imply • • • • Power-Log distribution Student-t Logistic Normal Correlated Investments • EMT assumes independence across investments – DIVERSIFY – invest in countercyclical products – LMX spiral blamed on assuming independence of risk probabilities – LTCM blamed on misunderstanding of investment independence Human Cognitive Psychology • Kahneman & Tversky [many – c. 1980] – Human decision making fraught with biases • Often lead to irrational choices • FRAMING – biased by recent observations – Risk-averse if winning – Risk-seeking if losing • RARE EVENTS – we overestimate probability of rare events – We fear the next asteroid – Airline security processing Animal Spirits • Akerlof & Shiller [2009] – Standard economic theory makes too many assumptions • Decision makers consider all available options • Evaluate outcomes of each option – Advantages, probabilities • Optimize expected results – Akerlof & Shiller propose • Consideration of objectives in addition to profit • Altruism - fairness Warren Buffett • Conservative investment view – There is an underlying worth (value) to each firm – Stock market prices vary from that worth – BUY UNDERPRICED FIRMS – HOLD • At least until your confidence is shaken – ONLY INVEST IN THINGS YOU UNDERSTAND • NOT INCOMPATIBLE WITH EMT George Soros • Humans fallable • Bubbles examples reflexivity – Human decisions affect data they analyze for future decisions – Human nature to join the band-wagon – Causes bubble – Some shock brings down prices • JUMP ON INITIAL BUBBLE-FORMING INVESTMENT OPPORTUNITIES – Help the bubble along – WHEN NEAR BURSTING, BAIL OUT Nassim Taleb • Black Swans – Human fallability in cognitive understanding – Investors considered successful in bubble-forming period are headed for disaster • BLOW-Ups • There is no profit in joining the band-wagon – Seek investments where everyone else is wrong • Seek High-payoff on these long shots – Lottery-investment approach • Except the odds in your favor Taleb Statistical View • Mathematics – Fair coin flips have a 50/50 probability of heads or tails – If you observe 99 heads in succession, probability of heads on next toss = 0.5 • CASINO VIEW – If you observe 99 heads in succession, probably the flipper is crooked • MAKE SURE STATISTICS ARE APPROPRIATE TO DECISION CASINO RISK • Have game outcomes down to a science • ACTUAL DISASTERS 1. A tiger bit Siegfried or Roy – loss about $100 million 2. A contractor suffered in constructing a hotel annex, sued, lost – tried to dynamite casino 3. Casinos required to file with Internal Revenue Service – an employee failed to do that for years – Casino had to pay huge fine (risked license) 4. Casino owner’s daughter kidnapped – he violated gambling laws to use casino money to raise ransom DEALING WITH RISK • Management responsible for ALL risks facing an organization • CANNOT POSSIBLY EXPECT TO ANTICIPATE ALL • AVOID SEEKING OPTIMAL PROFIT THROUGH ARBITRAGE • FOCUS ON CONTINGENCY PLANNING – CONSIDER MULTIPLE CRITERIA – MISTRUST MODELS