Concentrating on Governance

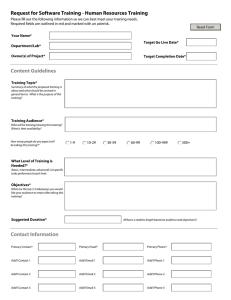

advertisement