STATE OF NEW JERSEY ASSEMBLY, No. 1645 208th LEGISLATURE [First Reprint]

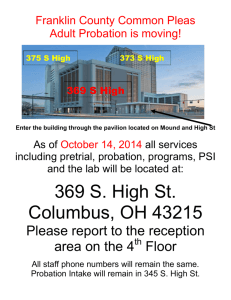

advertisement

![STATE OF NEW JERSEY ASSEMBLY, No. 1645 208th LEGISLATURE [First Reprint]](http://s2.studylib.net/store/data/013116454_1-049c83fbab0726e6babe9982a1b76b46-768x994.png)