P Planning ahead The Financially Capable Child Choosing financial products

advertisement

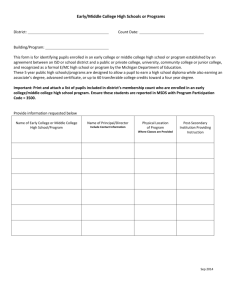

The Financially Capable Child Successful learners Make informed decisions and choices about their personal finances Confident individuals Manage money on a day-to-day basis Planning ahead Choosing financial products Making ends meet CHEERS FOR Responsible citizens Develop an awareness of the social and ethical impact of their financial decisions Effective contributors Apply their financial knowledge and skills in innovative and creative ways CREDIT UNIONS! Learning about credit unions is an opportunity to address the money outcomes of Curriculum for Excellence and allows connections across learning to be made. Giving children and young people ownership of running their school credit union allows them to develop financial capability through active citizenship and become effective contributors and responsible citizens. Education Scotland has developed this resource in partnership with Glasgow City Council, Lochend Learning Community, Glasgow Credit Union, Greater Easterhouse Money Advice Project, Renfrewshire Council, Glencoats Primary School, Renfrewshire Credit Union and PricewaterhouseCoopers. A list of related websites can be found on Glow: https://portal.glowscotland.org.uk/establishments/nationalsite/Financial%20Educatio n/default.aspx Education Scotland The Optima 58 Robertson Street Glasgow G2 8DU Keeping track of finances Staying informed about economic and financial matters P R A C T I T I O N E R S’ F A C T S H E E T JOINING ADVANTAGES Pupils can save for the things they want, with the ease of doing so in their own school. Pupils earn interest on the money saved rather than simply keeping their money in a coin bank at home. Saving at school will be the start of a good savings habit that will continue into adulthood. Pupils can learn how to manage and be responsible for their own finances. PROCESS Every pupil who attends a participating nursery, primary or secondary school is eligible to join. Pupils simply complete an application form, distributed to classes by credit union representatives. Trustees are required for nursery and primary pupils, so they must complete the application form. The trustee must be the registered contact for the child. Verification forms to confirm pupil and trustee identity are completed by school office staff or Employability Officer. SAVING Types of account Nursery and primary school Junior accounts: the trustee is initially given full control of the account. The trustee can then determine the age (from 8 years upwards) at which the pupil is given responsibility for the account. Secondary school Parent/carer signature of consent is required for young people under 16. The pupil is then given full and sole control over the account. Returns Interest is paid at the same rate as the dividend for adult members. This is paid into members’ accounts on an annual basis following the credit union AGM. Withdrawals Must be requested a week in advance, either by trustee or by the pupil if they have control over their own account. Nursery and primary school Withdrawals permitted for special occasions. More frequent withdrawals are at the discretion of the individual school. Secondary school Withdrawals permitted throughout school year. FAQs TRANSACTING THE BUSINESS Children and Young People Pupils and parent/staff helpers are trained in collecting and cashing up deposits. Adult helpers are made aware of money laundering regulations and the importance of highlighting any suspicious transactions or potential bullying. Q How long can they save for? A For as long as they attend a participating school. They can save with the credit union after school too – the credit union will contact them when they are 16 to see if they want to remain a member. All participants are made aware of confidentiality. Q How much can they save? A Up to £1000 in their first year, then up to a maximum of £5000. Day, time and place for collections is agreed. Staff, pupils and parents are made aware of collection days. Cashbox, forms and other relevant materials for collections are made available from credit union. Passbooks containing member number, which corresponds to the number held on the credit union database are distributed. These must be presented at collections. Minimum deposit amount will be required for collections, however pupils are not required to save every week. Money boxes distributed to members to save up their coins and notes in between collection days. Money is stored in a designated cashbox and locked in secure place within school, to be collected by credit union representatives on an agreed date. Q How do they check their balance? A They can use their PIN to log in to the secure credit union website or contact the credit union office by telephone. Q Are there any extra benefits? A Exclusive member competitions, prizes, newsletters and free joining gifts. Parents and Carers Q How safe is the children’s money? A Credit unions are regulated by the Financial Services Authority and are protected by the Financial Services Compensation Scheme (FSCS), which means members’ money is protected up to £85,000. Staff Q What is the cost to the school? A There is no cost to the school – the credit union will provide all required materials.