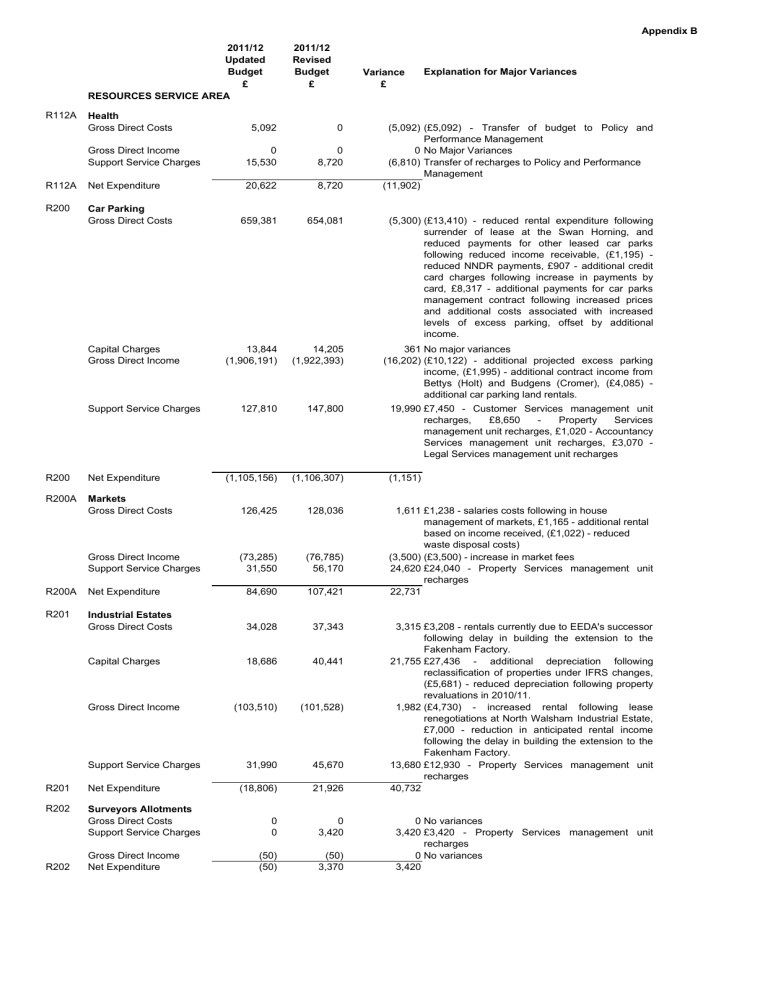

Appendix B 2011/12 Updated Revised

Appendix B

2011/12

Updated

Budget

£

RESOURCES SERVICE AREA

R112A Health

Gross Direct Costs 5,092

Gross Direct Income

Support Service Charges

R112A Net Expenditure

0

15,530

20,622

2011/12

Revised

Budget

£

0

0

8,720

8,720

R200 Car Parking

Gross Direct Costs 659,381 654,081

Variance

£

Explanation for Major Variances

(5,092) (£5,092) - Transfer of budget to Policy and

Performance Management

0 No Major Variances

(6,810) Transfer of recharges to Policy and Performance

(11,902)

Management

Capital Charges

Gross Direct Income

Support Service Charges

13,844

(1,906,191)

127,810

(1,105,156)

14,205

(1,922,393)

147,800

(1,106,307)

(5,300) (£13,410) - reduced rental expenditure following surrender of lease at the Swan Horning, and reduced payments for other leased car parks following reduced income receivable, (£1,195) reduced NNDR payments, £907 - additional credit card charges following increase in payments by card, £8,317 - additional payments for car parks management contract following increased prices and additional costs associated with increased levels of excess parking, offset by additional income.

361 No major variances

(16,202) (£10,122) - additional projected excess parking income, (£1,995) - additional contract income from

Bettys (Holt) and Budgens (Cromer), (£4,085) additional car parking land rentals.

19,990 £7,450 - Customer Services management unit recharges, £8,650 Property Services management unit recharges, £1,020 - Accountancy

Services management unit recharges, £3,070 -

Legal Services management unit recharges

(1,151) R200 Net Expenditure

R200A Markets

Gross Direct Costs 126,425 128,036

Gross Direct Income

Support Service Charges

R200A Net Expenditure

R201 Industrial Estates

Gross Direct Costs

(73,285)

31,550

84,690

34,028

(76,785)

56,170

107,421

37,343

1,611 £1,238 - salaries costs following in house management of markets, £1,165 - additional rental based on income received, (£1,022) - reduced waste disposal costs)

(3,500) (£3,500) - increase in market fees

24,620 £24,040 - Property Services management unit recharges

22,731

Capital Charges

Gross Direct Income

18,686

(103,510)

31,990

(18,806)

40,441

(101,528)

45,670

21,926

3,315 £3,208 - rentals currently due to EEDA's successor following delay in building the extension to the

Fakenham Factory.

21,755 £27,436 additional depreciation following reclassification of properties under IFRS changes,

(£5,681) - reduced depreciation following property revaluations in 2010/11.

1,982 (£4,730) increased rental following lease renegotiations at North Walsham Industrial Estate,

£7,000 - reduction in anticipated rental income following the delay in building the extension to the

Fakenham Factory.

13,680 £12,930 - Property Services management unit recharges

40,732 R201

R202

R202

Support Service Charges

Net Expenditure

Surveyors Allotments

Gross Direct Costs

Support Service Charges

Gross Direct Income

Net Expenditure

0

0

(50)

(50)

0

3,420

(50)

3,370

0 No variances

3,420 £3,420 - Property Services management unit recharges

0 No variances

3,420

R203 Handyman

2011/12

Updated

Budget

£

2011/12

Revised

Budget

£

Variance

£

Explanation for Major Variances

Appendix B

Appendix B

R219

R219

R251

R251

R260

IAS 19 Adjustment

Net Expenditure

(251,277)

0

Benefits & Revenues Management

Gross Direct Costs

Gross Direct Income

Support Service Charges

71,981

0

(71,981)

Net Expenditure 0

Personnel & Payroll Support

Gross Direct Costs 342,862

R260

R262

Non Distributed Costs

Gross Direct Costs

Gross Direct Income

Support Service Charges

Net Expenditure

2011/12

Updated

Budget

£

251,277

2011/12

Revised

Budget

£

269,260

(269,260)

0

Variance

£

Explanation for Major Variances

17,983 £12,347 - Actuarial strain costs funded from an earmarked reserve. £5,565 - Inflation on Added

Years costs.

(17,983)

0

0

(342,862)

0

Administration Buildings Service

Gross Direct Costs 501,220

72,744

0

(72,744)

0

360,203

0

(360,203)

0

528,267

763 No Major Variances

0

(763) No Major Variances

0

17,341 £5,681 - Salaries and on costs. £10,000 -

Professional Fees re external employment advice, which is to be funded by an earmarked reserve.

0 No Major Variances

(17,341) Increased recharges reflecting higher direct costs.

0

27,047 (£3,422) - reduction in Caretakers salary costs,

(£5,931) - reduced NNDR costs for Cromer

Offices, £8,125 - professional fees and charges for

Office condition survey to be funded from Asset

Management Reserve, £4,980 - NNDR for Upper

Sheringham Depot not disposed of in 2010/11,

£3,887 - additional NNDR following Fakenham

Connect revaluation, £12,425 - contract cleaning costs for Fakenham Connect and North Walsham

Offices following their removal from the Kier contract, £4,960 - Windmill Restaurant staff costs following backdated regrading, £2,200 - Restaurant purchases, offset by income.

Capital Charges

Gross Direct Income

Support Service Charges

87,424

(72,752)

(477,551)

38,341

81,528

(81,702)

(428,967)

99,126

(5,896) (£5,896) - reduction in depreciation following adjustments to the life expectancy of Admin

Buildings.

(8,950) (£5,208) - 5 months rental from North Norfolk

Health Teams occupation of Cromer offices, £831 - reduction in rental income following Adult

Educations vacation of Fakenham Connect offices,

(£2,373) - recoverable NNDR and service charges for North Walsham Offices, (£2,200) - restaurant sales offset in part by additional costs.

48,584 £2,920 - Computer Network and PC recharges,

(£1,820) - Admin Buildings recharge, £21,220 -

Property Services recharge, £2,830 - Central Costs recharge, £24,600 - Reduction in recharges to other final services from Admin Buildings cost centres.

60,785 R262 Net Expenditure

R262A Property Services

Gross Direct Costs 378,324 414,841

R262A

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

0

(41,500)

(331,569)

5,255

0

(40,690)

(374,151)

0

36,517 £3,544 - staff turnover savings not achieved,

£22,120 - additional staffing costs funded from

Asset Management Reserve, £963 - essential car user allowance for Markets staff, £9,500 -

Leadership of Place (LOP) repairs and maintenance to North Walsham offices funded from carry forward of LOP grant.

0 No variances

810 No major variances

(42,582) £8,100 - Computer Network recharges, £7,900 -

Central Cost recharges, £11,830 Legal Service

Recharges, (£70,820) - Additional recharges to other final services from Property Services

(5,255)

Appendix B

2011/12

Updated

Budget

£

2011/12

Revised

Budget

£

R263 Corporate Finance

Gross Direct Costs

Gross Direct Income

Support Service Charges

R263B Net Expenditure

R263C Internal Audit

Gross Direct Costs

Support Service Charges

R263C Net Expenditure

R263D Policy & Performance

Mgmt

Gross Direct Costs

618,197

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

2,170

0

(620,367)

0 R263

R263B Insurance & Risk Management

Gross Direct Costs 248,109

2,435

0

(604,247)

0

279,150

(650)

(264,126)

(16,667)

(650)

(278,500)

0

111,467

(111,467)

0

601,812

111,467

(111,467)

0

115,099 161,015

(54,430)

60,669

(161,015)

0

Support Service Charges

R263D Net Expenditure

R301 Foreshore

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

99,600

7,996

0

64,080

128,376

7,354

0

43,140

171,676 178,870

Variance

£

Explanation for Major Variances

(16,385) (£9,770) Post Transferred to Council Tax . (£3,469)

Adjustment to IAS19 pension costs. (£2,578)

265

0

16,667

0

Savings on Bank Charges.

0

16,120 Lower direct costs to recharge to services.

31,041 (£5,158) - Savings in salaries and on costs.

£36,567 - Reorganisations costs, funded by an earmarked reserve.

0 No Major Variances

(14,374) Increased recharges reflecting higher direct costs.

0 No Major Variances.

0 No Major Variances

45,916 £49,645 - Transfer of budgets to Policy and

7,194

Performance Management as a result of restructuring.

(106,585) Increased recharges reflecting higher direct costs.

(60,669)

28,776 £34,000 - transfer from Foreshore (Community) for

Handrails, following staff restructuring, (£5,149) - staff vacancy in Foreshore Officers.

(642) No major variances

0 No variances

(20,940) (£24,110) - Property Services recharges, £1,210 -

Central Costs recharges, £4,950 Coastal

Protection recharges, (£4,580) - Internal Audit recharges

R301

R302

R302

R318

Net Expenditure

Community Centres

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

Investment Properties

Gross Direct Costs

Capital Charges

R318

Gross Direct Income

Support Service Charges

Net Expenditure

6,190

0

(2,000)

30,470

34,660

104,800

2,900

(208,887)

100,850

(337)

6,190

27

(2,000)

3,730

7,947

104,207

24,569

(204,749)

67,550

(8,423)

0 No major variances

27 No major variances

0 No variances

(26,740) (£26,680) - Property Services management unit

(26,713) recharges

(593) No major variances

21,669 £3,469 - depreciation associated with the prior year purchase of additional beach huts, £18,200 - additional depreciation following the reclassification of properties from Investment Properties, under

IFRS.

4,138 £6,717 - loss of rental income following transfer of

Sackhouse and Maltings to the Wells Maltings

Trust, (£1,829) - additional rental and service charge income from Other Lettings

(33,300) £1,200 - Computer Network recharges, (£35,400) -

Property Services recharges

(8,086)

R340 Coast Protection

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

R340

R341

Net Expenditure

Pathfinder

Gross Direct Costs

Gross Direct Income

Support Service Charges

2011/12

Updated

Budget

£

379,657

468,477

(25)

239,880

1,087,989

2011/12

Revised

Budget

£

429,583

466,135

(8,525)

139,900

1,027,093

Variance

£

Explanation for Major Variances

49,926 £8,500 Additional rock at Happisburgh. £41,426

Roll forward of 2010/11 under spend on sea defence works.

(2,342)

(8,500) (£8,500) Contribution from Coastal Concern towards addition rock at Happisburgh

(99,980) £15,470 Additional recharge from Property

Services. (£116,090) Reduced charge from

Coastal Management reflecting establishment changes and increased work undertaken on

Pathfinder projects.

(60,896)

Appendix B

0

0

46,530

575,153

0

176,030

751,183

575,153 £575,153 Roll forward of 2010/11 under spend

0

129,500 £140,720 Contract extensions for Pathfinder staff

704,653 grant.

plus additional work undertaken by staff in Coastal

Management. (£11,220) Reduction in charges from other support services.

R341

R410

Net Expenditure 46,530

Coast & Community Partnership

Gross Direct Costs 288,075 300,282

Gross Direct Income

R410

R413

Support Service Charges

Net Expenditure

Community Safety

Gross Direct Costs

Gross Direct Income

Support Service Charges

(109,603)

106,300

284,772

56,123

(10,346)

25,630

71,407

(117,568)

127,010

309,724

81,936

(10,346)

7,370

78,960

12,207

(£10,939) - Savings in North Norfolk Community

Partnership (NNCP) running costs. £40,967 -

Reorganisations costs, funded by an earmarked reserve. (£43,983) - Transfer of budgets to Policy and Performance Management as a result of restructuring. £28,000 - Expenditure incurred in relation to Holt Vision Study.

(7,965) (£28,000) - Grant income from NNCP and Holt

Town Council relating to Holt Vision Study.

£20,035 - Contributions towards NNCP costs no longer being received.

20,710 £26,560 - Recharge from Property Services.

24,952

25,813 £25,690 - Reorganisation costs, funded by an

(18,260) This consists of various recharges, e.g.

Insurances, Personnel, Computers and Central

Costs that are recharged based on where staff costs are allocated.

7,553 earmarked reserve.

0 No Major Variances

R413

R414

R414

R450

Net Expenditure

CCTV

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

Central Costs

Gross Direct Costs

196,747

21,072

(22,696)

20,370

215,493

188,470

197,300

25,479

(22,696)

56,190

256,273

187,542

553 No Major Variances.

4,407

0 No Major Variances.

35,820 £31,180 - Recharge from Property Services.

40,780

R450

Support Service Charges

Net Expenditure

(188,470)

0

R450A Corporate & Democratic Core

Gross Direct Costs 353,631

(187,542)

0

353,585

(928) £2,317 - Salaries and on costs.

(£3,250) -

Professional fees payable to Norfolk Pension Fund for various actuarial reports.

928 No Major Variances.

0

R450A

Capital Charges

Support Service Charges

Net Expenditure

0

842,110

1,195,741

0

860,440

1,214,025

(46) £4,285 - Salaries and on costs. (£4,426) - Local

Government Association subscription costs lower than expected

0

18,330 £19,100 - Recharge from Corporate Leadership

Team.

18,284

Appendix B

2011/12

Updated

Budget

£

R460A Corporate Leadership Team

Gross Direct Costs

Gross Direct Income

Support Service Charges

742,799

(335)

(742,464)

0 R460A Net Expenditure

R472 Coastal Management

Gross Direct Costs 188,678

2011/12

Revised

Budget

£

748,642

0

(748,642)

0

187,455

Gross Direct Income

Support Service Charges

(26,780)

(193,591)

(31,693)

(20,420)

(167,035)

0

Variance

£

Explanation for Major Variances

5,843 £5,325 Turnover savings not made.

335

(6,178) Increased direct costs recharged out to services.

0

(1,223) (£15,339) Coastal Technician appointed on lower grade.

£25,619 Contract extensions for staff engaged on Pathfinder.

(£4,401) Coastal

Engineer appointed later in the year. (£3,320)

Lease car rental no longer required. (£3,055)

Pension deficit funding.

6,360 (£6,360) Reduced recharges to Pathfinder capital projects.

26,556 £53,780 Increased charges in from Property

Services & £13,210. (£140,720) Increased recharges out to Pathfinder, (£14,100) Cromer Pier

& (£4,950) Promenade Mgt. £116,090 Reduced recharges out to Coast Protection & £3,250

Democratic Representation.

31,693 R472 Net Expenditure

Total

Gross Direct Costs

IAS 19 Adjustment

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

40,349,817 43,006,880

(251,277)

665,978

(36,547,433) (38,365,090)

(538,428)

3,678,657

(269,260)

701,116

(488,633)

4,585,013

2,657,063

(17,983)

35,138

(1,817,657)

49,795

906,356