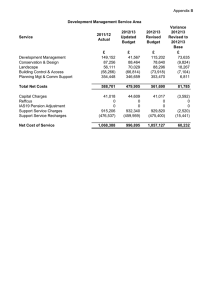

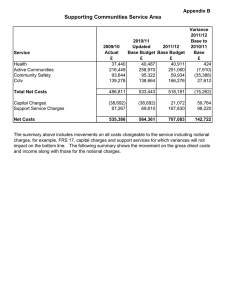

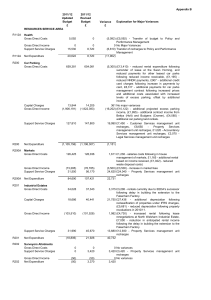

Appendix B 2011/12 Updated Revised

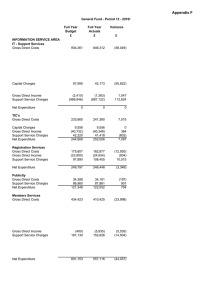

INFORMATION SERVICE AREA

R261 It - Support Services

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

R261 Net Expenditure

R311 Tourist Information Centres

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

2011/12

Updated

Budget

£

2011/12

Revised

Budget

£

Variance

£

929,217

37,742

(2,410)

(958,549) (1,009,212)

6,000 0

245,384

9,556

(40,732)

45,540

932,829

76,793

(410)

247,184

8,105

(40,732)

79,920

3,612

39,051

2,000

(50,663)

(6,000)

1,800

(1,451)

0

34,380

R311 Net Expenditure

R400 Registration Services

Gross Direct Costs

259,748

288,939

294,477

466,648

34,729

177,709

Gross Direct Income

Support Service Charges

(31,189)

98,820

(226,435) (195,246)

118,390 19,570

Appendix B

R400 Net Expenditure

R430 Publicity

Gross Direct Costs

Support Service Charges

R430 Net Expenditure

R450B Members Services

Gross Direct Costs

Gross Direct Income

Support Service Charges

R450B Net Expenditure

356,570 358,603 2,033

26,388

76,650

103,038

26,388

70,840

97,228

0

(5,810)

(5,810)

419,374 392,874 (26,500)

(400)

161,850

580,824

(400)

139,910

532,384

0

(21,940)

(48,440)

INFORMATION SERVICE AREA

R481 Legal Services

Gross Direct Costs

2011/12

Updated

Budget

£

2011/12

Revised

Budget

£

Variance

£

351,079 367,264 16,185

Gross Direct Income

Support Service Charges

R481 Net Expenditure

R481B Graphical Info System

Gross Direct Costs

Capital Charges

Support Service Charges

R481B Net Expenditure

R481C Media & Communications

Gross Direct Costs

Gross Direct Income

Support Service Charges

R481C Net Expenditure

R481D Customer Services - Corporate

Gross Direct Costs

(11,050)

(340,029)

0

(40,050)

(327,214)

0

(29,000)

12,815

0

36,412

4,519

(40,931)

0

28,412 (8,000)

3,780

(32,192)

0

(739)

8,739

0

387,000

(7,500)

(379,500)

0

385,391

(7,500)

(377,891)

0

(1,609)

0

1,609

0

537,556 531,717 (5,839)

Capital Charges

Gross Direct Income

Support Service Charges

R481D Net Expenditure

Gross Direct Costs

Capital Charges

Gross Direct Income

Support Service Charges

Net Expenditure

11,573

(8,000)

12,835

(12,000)

1,262

(4,000)

(546,129) (532,552) 13,577

(5,000) 0 5,000

3,221,349

63,390

3,378,707

101,513

157,358

38,123

(101,281) (327,527) (226,246)

(1,882,278) (1,870,001) 12,277

1,301,180 1,282,692 (18,488)

Appendix B

Explanation for Major Variances

£3,526 - Salaries and on costs are higher as a result of no staff turnover.

£2,000 - Income from recharges lower than expected

Increased charges as a result of increased direct costs.

No Major Variances

No Major Variances

£40,820 Recharge from Customer

Services. (£4,580) - Recharge of Internal

Audit costs.

£6,778 - Salaries and on costs are higher as a result of a new staffing structure. -

£8,000 - Cost of Postal Vote refresh.

£162,865 - Additional costs resulting from

Referendum.

(£195,246) - Additional grant for administering Referendum.

(£9,960) - Reduced recharges from Postal

Services and Customer Services. £11,260

- Recharge from Reprographics Service.

£18,380 This consists of various recharges, e.g. Insurances, Personnel,

Computers and Central Costs that are recharged based on where staff costs are allocated.

No Major Variances

(£5,760) - Recharge from Media and

Communication .

(£5,829) - Salaries and on costs are lower than anticipated. (£20,000) - Lower

Members Allowances as a result of the decision to no longer pay for Member

Champions.

No Major Variances

(£24,600) Reduced recharge from

Computer Network and PCs

Appendix B

Explanation for Major Variances

(£4,434) - Savings in Salaries and on costs. £7,000 - Project management, training days for new case management system. £8,000 - Legal case updates higher as a result of a greater number of legislative changes. £7,000 - 7 licences for new case management system

(£29,000) - Increased fee income in line with actual amount earned to date.

Reduced recharges reflecting lower direct costs.

(£8,000) - Computer Software Licences, reduced number of licences required for

Map Editor.

Reduced recharges reflecting lower direct costs.

No Major Variances.

No Major Variances.

No Major Variances.

(£13,354) - Savings in salaries and on costs. £4,415 - Transfer of budgets from other service areas as a result of centralising the purchase of stationery.

£2,000 - Higher postal charges.

(£2,000) - Recharge of additional postal costs. (£2,000) - Additional income from the processing of bus pass applications

Reduced recharges reflecting lower direct costs.

Appendix B