Document 12928495

advertisement

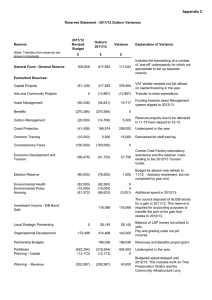

Agenda Item No______8______ 2011/12 OUTTURN REPORT Summary: This report presents the outturn position for the revenue account and capital programme for the 2011/12 financial year. Details are provided within the report of the more significant year-end variance. The report provides details of recommended contributions to earmarked reserves for future spending commitments. An update to the current capital programme is also included within the report and accompanying appendices. Conclusions: The outturn position on the revenue account as at 31 March 2012 shows an underspend for the year of £241,601. This is after allowing for a number of underspends to be rolled forward within earmarked reserves to fund ongoing and identified commitments. The general fund balance remains within the current recommended level. Recommendations: Members are asked to consider the report and recommend the following to Full Council: a) The final accounts position for the general fund revenue account for 2011/12; b) The transfers to and from reserves as detailed in the report; c) Transfer the surplus to the restructuring reserve; d) The financing of the 2011/12 capital programme as detailed within the report; e) The balance on the general reserve of £1,946,590 at 31 March 2012; f) The updated capital programme for 2012/13 to 2013/14 and the associated financing of the schemes as outlined within the report and detailed at Appendix E. Cabinet Member(s) Ward(s) affected Contact Officer, telephone number and email: Karen Sly, 01263 516243, Karen.sly@north-norfolk.gov.uk 1. Introduction 1.1 This report presents the draft outturn position for the 2011/12 financial year. Commentary on the more significant year-end variances is included within the report with further supporting information provided within the report appendices. The 2011/12 revised budgets for revenue and capital were approved by Full Council on 14 December 2011 and this report now compares the outturn position compared to those budgets. The report also includes a current position statement on the level of reserves along with the outturn position for the 2011/12 capital programme and an update for the capital programme for the period 2012/13 to 2013/14. 1.2 All budgets have been monitored throughout the year by both Service Officers and Finance with regular reports being presented to Cabinet and Overview and Scrutiny. The last budget monitoring position was reported to Members in March 2012 and reported a projected underspend on the revenue account of £21,807, this report now presents the final budget monitoring position for the year. The contents of this report will be considered by the Overview and Scrutiny Committee on 26 June. 1.3 Following the production of the outturn position the Council’s statutory accounts are then produced. At the time of reporting the outturn there are still some entries that are required within the Statement of Accounts, for example impairment costs that are chargeable to service accounts but are then reversed out therefore having no impact on the overall general fund position. These will be entered in the published accounts and will be fully reconciled to the position now reported. The draft accounts must be produced by 30 June and then audited with the final audited version being approved and published by 30 September annually. The audited accounts will be presented to the Audit Committee on 18 September 2012. 1.4 Any material adjustments to the figures used within this report will either be reported at the meeting or reflected in the draft Statement of Accounts when they are produced. 2. Revenue Account 2011/12 2.1 The revenue account position for the year shows an underspend of £241,601 as detailed at Appendix A. This is after allowing for a number of transfers to earmarked reserves for current and known commitments. As part of setting the annual budget each year, the Council approves a policy framework for earmarked reserves and the optimum level of the general reserve. Earmarked reserves are typically used to set aside funds for known or specific liabilities. Transfers to earmarked reserves have been made where an underspend has occurred within a service mainly due to the timing of work not being completed as planned and by 31 March 2012 and where no future budget exists. Further details on the movements to and from reserves are included at section 3 of the report. Service Variances 2.2 The following sections of the report seek to highlight the more significant variances compared to the revised budget. Comments on some of the smaller variances are included within Appendix B. 2.3 Accounting standards require a number of notional charges to be made to service accounts. Notional charges include transactions in relation to capital charges and pension costs and whilst they do not have an impact on the ‘bottom line’ i.e. the surplus or deficit for the year, they are included for reporting purposes. Appendix A shows the overall revenue position including notional charges, however to assist the reporting and explaining variances table 1 provides a summary of the position excluding notional charges. Table 1 – 2011/12 Revenue Account (Excluding Notional Charges) Community Environment Information Resources Net Cost of Services (excluding notional charges) Parish Precepts Non Service Expenditure Contributions to/(from) earmarked reserves Contributions to/(from) general reserves Net Expenditure to be met from Grant and Taxpayers Income (Surplus)/ Deficit 2011/12 Revised Budget £ 1,917,349 6,800,894 1,161,179 4,224,472 14,103,894 2011/12 Outturn £ 1,878,364 6,602,837 1,120,551 3,054,620 12,656,372 Variance (Under)/Over Spend £ (38,985) (198,057) (40,628) (1,169,852) (1,447,522) 1,450,222 142,302 (1,808,522) 1,450,222 (349,912) (227,277) 0 (492,214) 1,581,245 500,928 14,388,824 617,952 14,147,357 117,024 (241,467) (14,388,824) (14,388,958) 0 (241,601) (134) (241,601) 2.4 The significant variance within the contributions to and from earmarked reserves largely represents the earmarking of underspends in the year of which the most significant are in relation to the Pathfinder project and coastal protection spend. Commentary on these and other significant variances is provided in the following paragraphs. The explanations seek to identify the more significant variances and concentrates only on the direct costs and income movements compared to the revised budget. Where figures are shown in brackets, this represents an underspend or additional income. Further comments can be found within Appendix B to the report. 2.5 Community a) Development Management £61,594 – As reported within the last budget monitoring report the income budget for the service anticipated that a new local fee setting scheme would commence in the year, this was not the case resulting in an income shortfall compared to the level budgeted. b) Planning Policy (£18,386) – The underspend largely relates to professional fees not yet incurred for work on the Community Infrastructure Levy report and liability assessment which will require funding in 2012/13, therefore £15,000 has been carried forward in an earmarked reserve. c) Landscape (£36,197) – The period 10 budget monitoring report highlighted a full year variance for this service. The outturn position now reports a saving of £10,000 relating to the North Norfolk Biodiversity Strategy which was not undertaken in the year. There has also been an underspend of £25,000 due to the completion of the Tree Preservation Orders review being delayed due to other service priorities and commitments. This has now been rescheduled for 2012/13 and is to be funded from Area Based New Burdens Grant which has been carried forward into 2012/13. d) Planning Division (£15,669) – The outturn position now reports savings in a number of supplies and service budgets. Overall a saving of £15,000 has been rolled forward to mitigate the impact of budgeted savings that will not be achieved in 2012/13 due to protracted discussions with Central Norfolk Councils (CNC) regarding the Building Control service. e) General Economic Development (£17,839) – The underspend reflects the budget previously identified to support the Cromer Crab Factory. This had not been expended by the year-end and has been carried forward within an earmarked reserve. 2.6 Environment a) Environmental Protection (£18,499) – The underspend for the year is made up of savings within a number of smaller demand led budgets, for example air quality management, assisted burials, contaminated land and rechargeable works. b) Environmental Health Service Management (£17,733) – The year-end position is made up of a number of underspends on various supplies and services budgets including equipment, furniture and computer purchases. c) Parks and Open Spaces (£73,423) – The significant variance within the service is due to two commuted sum payments received. Accounting practice requires such receipts to be accounted for through the revenue account before being transferred to an earmarked reserve. d) Woodlands Management £20,569 – The year-end position reflects a number of smaller variances including additional costs in relation to the Access to Nature Project which have not been fully funded from the grant, pond dredging and emergency tree works. e) Public Conveniences £17,141 – The outturn position is mainly due to an overspend on costs associated with water and sewerage, mainly due to increased cost and usage above the level budgeted. f) Waste Collection and Disposal £22,516 – The overall overspend for the service at the year-end is made up of a number of variances within the individual budget headings, the more significant of which are: • • • Lower level of recycling credits received than budgeted, £45,818. This was due to a reduced tonnage of garden waste and dry recyclables being processed; Additional cost of processing recyclable materials and plastic sorter contribution of £20,804; Garden bin purchases £14,879; • • Additional profit shared received due to a higher resale price of materials (£33,932); Additional fee income from prescribed/commercial customers and clinical waste disposal recharges (£10,874). g) Environmental Strategy (£20,219) – Of the year-end variance £14,100 relates to costs that were previously charged to revenue but can be capitalised. A compensating revenue contribution to capital outlay (RCCO) has been made to finance the expenditure. 2.7 Information a) IT Support Services (£63,414) – The underspend reported for the service is largely due to software and computer purchases that were budgeted for within the revenue account but can be capitalised and funded as part of the capital programme. A revenue contribution to capital has been made in the year to fund these. b) TIC’s (£49,688) – Of the year-end surplus £34,479 relates to a one-off adjustment in relation to commission for ticket sales relating to previous years. Of the remaining variance £7,800 is due to employee costs being less than budgeted due to staff vacancies. c) Media and Communications (£33,975) – The outturn position is made up of a number of smaller variances including graphics purchases not made in the year, lower paper usage, equipment rental payments and external media consultancy services not employed in the year. 2.8 Resources a) Car Parking (£42,896) – The overall underspend for the service is largely due to the following: • Additional pay and display fee income (£21,570); • Additional penalty charge notice income (£28,467), this is after allowing for the increased administration charge which is based on the level of income; • Lower management fee (£28,635); • Additional rental of £17,132 payable partly due to moving to financial years as opposed to calendar years and additional income collected on related car parks; • Additional reactive repairs carried out on a number of car parks totalling £20,541. b) Industrial Estates (£43,063) – Rental payments are no longer payable to EEDA but have been transferred to an earmarked reserve to fund relevant regeneration projects. c) Benefits (£392,483) – This service includes the total of benefit payments made in the year which is recovered through subsidy. The amount of benefit payments made total approximately £34 million. Of the year end variance £196,036 relates to the balance of the partnership fund and grant established for the Revenues and Benefits Shared Services project. This has been transferred to an earmarked reserve to fund the ongoing project costs. The balance of the variance reflects the outturn position of subsidy payments including the recovery of overpayments which reflects less than 1% of the total payments made. The subsidy claim will be audited later in the year. d) Non Distributed Costs £212,000 - This service reflects the notional charges in relation to the International Accounting Standard 19 (IAS19) for Pension costs. The variance consists of £18,000 for Settlements and Curtailments which represents the cost of the early payment of pension benefits as a result of redundancies. Also included is £194,000 for Past Service Costs which arise as a result of awarding added years or allowing employees to retire early on unreduced benefits on the grounds of efficiency. The impact of these costs are reversed out of the account to ensure there is no impact on the bottom line. e) Personnel and Payroll (£39,293) – Of the variance £29,426 relates to an underspend on the common training budget of which £15,000 has been transferred to an earmarked reserve to fund training needs in 2012/13. f) Administration Buildings (£72,372) – The outturn position includes £41,000 in respect of a creditor provision no longer required for rentals previously payable under an old partnership arrangement. Of the remaining underspend £12,374 reflects repairs and maintenance and £6,900 for equipment rental hire not used in the year. g) Policy and Performance Management (£29,834) – Budgeted expenditure of £9,248 in relation to the North Norfolk Youth Voice was not incurred in the year. Other smaller year-end variances include staff training and travel expenses of £4,635 not spent and computer and related purchases not made totalling £5,742. h) Foreshore (£22,642) – The main year-end variance is due to a reduced repairs and maintenance expenditure of £18,061 part of which is being used as a revenue contribution to capital to finance the Old Red Lion capital project. i) Coast Protection (£181,016) – Of the underspend £174,986 reflects delays in undertaking programmed sea defence works partly due to the Assistant Coastal Engineer post not yet filled. The underspend has been transferred to the Coast Protection earmarked reserve to be spent in 2012/13. j) Pathfinder (£404,062) – The year-end variance reflects the unspent pathfinder project grant. The grant remains fully allocated against a number of ongoing projects and has therefore been carried forward within the Pathfinder earmarked reserve to fund these commitments. k) Coast and Community Partnership (£38,282) – Of the variance £28,144 relates to the balance of the Ideas into Action fund that has been transferred to the LSP reserve. l) Transport (£18,549) – £17,500 of the variance reflects the balance of a creditor provision from the previous financial year which is no longer required. This has been released to the general reserve. m) Central Costs (£142,685) – The budget assumed that the pay and grading review would be implemented in the year with one-off costs being incurred by 31 March 2012. This was not the case and therefore the unspent budget has been rolled forward within the organisational development reserve. n) Corporate and Democratic Core (£22,197) – The saving in the year is due to external professional fees not being incurred in the year and external audit costs being below the level budgeted. o) Corporate Leadership Team £97,205 – The year end position shown at the service level reflects phase one of the management restructure, the costs of which have been funded from the restructuring reserve. p) Coastal Management (£27,426) – Of the variance £19,739 relates to external consultancy fees not yet utilised. This underspend has been carried forward within the coast protection earmarked reserve. Of the remaining underspend £5,736 relates to the vacant post of Assistant Coastal Engineer. Non Service Expenditure and Income 2.9 The non-service expenditure and income predominantly relates to investment income. The 2011/12 outturn position achieved from the Council’s treasury management activity was £72,435 above the amount anticipated in the revised budget. Investment income for the year was £536,435 at an average rate of 2.09% from an average balance available for investment of £25.7m. This compares to the revised budget which anticipated a total of £464,000 would be earned at an average rate of 1.77% from an average balance of £26.2m. 2.10 The variance in investment income above the revised budget results from the sale of £4m of European Investment Bank bonds in December 2011. These bonds were sold for £116,068 more than the value of the bonds in the Council’s accounts, and this gain was placed in an earmarked reserve. The gain in the year has been reduced (from £116,068 to £72,435) because the proceeds from the sale of the bond were re-invested in the money market at current (lower) interest rates. 2.11 The Treasury Management Annual Report is included as a separate item on this Agenda and provides more details on the performance of the Treasury Management activity for the year. 3. Reserves 3.1 The Council holds a number of earmarked reserves which are held to meet known or predicted liabilities and which are separate from the general fund reserve. Earmarked reserves provide a means at the year-end for carrying funds forward to the new financial year to fund ongoing commitments and known liabilities for which no separate budget exists. 3.2 The general reserve is held for the purpose of providing a working balance to help cushion the impact of uneven cashflows to avoid temporary borrowing and also as a contingency to help cushion the impact of unexpected events or emergencies. 3.3 Section 2 of the report highlighted some areas where an underspend had occurred in the year and a transfer to reserves had been made to ensure funds are available to meet future spending commitments. Unlike capital budgets, underspends on revenue budgets in the year are not automatically rolled forward at the year-end where there is an annual budget provision. Where the underspend represents a grant received which has not yet been fully utilised or there has been a delay in the planned use, the unspent grant has been rolled forward within an earmarked reserve. 3.4 The revised budget assumed a net transfer of £1,808,522 in the year from earmarked reserves, actual transfers from earmarked reserves total £303,677. Appendix C shows the budgeted and actual net movement to and from earmarked reserves in the year along with comments on the more significant movements. 3.5 A detailed statement of the position on all reserves is attached at Appendix D. The overall position gives a total of reserves and balance of £7,850,944 at 31 March 2012. The appendix also shows the planned use of reserves over the medium term in light of the movements for 2011/12. 3.6 The general reserve balance at 31 March 2012 is £1,946,590. After taking account of the planned spend in 2012/13 the forecast balance at 31 March 2013 is £1,645,066, although this does include £300,000 within the reserve which the current financial forecast assumes will be used over the following two financial years. The recommended balance on the general reserve will be reviewed as part of the financial planning process over the coming months. 4. Summary – Revenue Account 2011/12 4.1 The Council’s budget which includes all service budgets were reviewed and updated as part of approving the revised budget in December 2011. 4.2 The outturn position for the year ending 31 March 2012 is a £241,601 surplus. This is after allowing for a number of underspends identified within services to be rolled forward within earmarked reserves to meet spending pressures and commitments in 2012/13. This report recommends that the surplus be transferred to the Restructuring and Invest to Save earmarked reserve. 5. Capital Programme 2011/12 5.1 This section of the report presents the financing of the capital programme for 2011/12, along with an updated programme for 2012/13 to 2013/14. Appendix E provides the detail of the outturn on the 2011/12 capital programme for non-housing, housing and coast protection along with the financing of each. The updated capital programmes for the period 2012/13 to 2013/14 are attached at Appendix F. 5.2 The outturn position for the 2011/12 capital programme highlights where schemes have slipped between financial years. The reasons for slippage include where schemes have not progressed as originally planned, and the funding has been carried forward to the new financial year, or where schemes have progressed ahead of schedule, which has required funding to be brought forward from 2012/13. The following paragraphs provide further details of each of the capital programmes for non-housing, housing and coast protection schemes. Non Housing 5.3 The non-housing capital programme as detailed in Appendix E provides details of the outturn expenditure for the individual schemes. Explanations have been provided where there is a variance between actual expenditure and the profiled budget. Expenditure for the year on these schemes totalled £1,231,730 compared to an updated budget of £2,289,369, giving a variance of (£1,057,909). There has been a requirement to claw back at total of £151,219 from 2012/13 capital budgets where schemes have either commenced earlier or progressed faster than originally anticipated. The outturn position now reported shows slippage of (£1,337,920), together with other movements in year of £128,793. 5.4 The following provides further comments on the schemes showing variances at the end of the year:- 5.4.1 Stalham Sports Improvements - The Stalham multi use games area was completed during 2011/12, and came in £5,284 under budget. 5.4.2 Playgrounds – The Playgrounds budget is split into two elements; one for Playbuilder and the second for a scheme for Sadlers Wood which is to be fully funded from a Section 106 contribution. In 2011/12 the Playbuilder scheme was completed, but this resulted in an over spend of £1,385. This additional expenditure is to be funded from capital receipts. The remaining budget available for Sadlers Wood, of £30,800 is to be slipped for use in 2012/13. 5.4.3 Provision of Electricity at Holt Country Park – The scheme is showing an over spend at the end of the project, of £1,562. This additional funding will be financed through a Revenue Contribution to Capital Outlay (RCCO). 5.4.4 Worstead Churchyard Wall – The works initially identified under this scheme were completed in 2011/12 and came in £870 under budget. Unfortunately due to a motor accident there are additional works to be undertaken to the wall, which will be financed through an insurance claim. 5.4.5 New Schemes - As part of the year end process four schemes that had originally been coded to revenue have been established as being eligible for capitalisation. The costs of these schemes have therefore been transferred to capital and financed through Revenue Contributions to Capital Outlay, and in the case of the Benefits Atlas Project, from grant received. The schemes are detailed in Table 2. Table 2 - 2011/12 New Schemes Capital Scheme Benefits Atlas Project Bulk Software Purchases IT Hardware Purchases CCTV Hardware Purchases Total Expenditure £ 52,485 31,393 30,379 19,128 133,385 5.4.6 Budget claw backs - There were three schemes that have either started slightly earlier than anticipated, or where the spend level in the year was higher than anticipated. Where this is the case, and there is budget available within the 2012/13 capital programme, this has been clawed back to cover the expenditure. The updated programme for 2012/13 onwards (Appendix F) reflects these adjustments. The schemes and amounts are listed in table 3. Table 3 - Capital schemes slipped from 2012/13 Capital Scheme Fakenham Factory Extension Administrative Buildings Asbestos Works Total Claw Back Amount £ 150,654 474 91 151,219 Housing 5.5 The outturn on the general fund housing programme is also shown in Appendix E, together with the financing details for all of the individual schemes. Expenditure for the year totalled £1,649,864 compared to the budget of £4,126,481. The outturn position as reported shows slippage amounts of (£2,490,055), alongside one claw back of budget totalling £13,437. 5.6 The original financing of the housing capital programme assumed receipts of Disabled Facilities Grants totalling £443,000. However, further allocations in the 2011/12 financial year have resulted in a total of £526,957 being received, which has been used to finance a higher proportion of the direct grant payments in relation to Disabled Facilities. 5.7 For Private Sector Renewal Grants the outturn position shows an over spend against the updated budget of £13,437. £319,246 of the budget originally identified for 2011/12 was requested for slippage to 2012/13 when the revised budget report was taken to Cabinet in November 2011. The additional expenditure incurred will therefore be funded by means of a claw back of budget of the equivalent value into 2011/12. 5.8 There is an under spend in 2011/12 of £258,473 against Disabled Facilities Grants. The nature of these types of grants means that they can be approved and therefore committed, up to a year in advance of the works actually being completed. The under spend is therefore requested to be carried forward into 2012/13. 5.9 The Housing Associations budget was also subject to slippage of £2,011,582 against a budget of £2,856,481, following delays experienced in the implementation of eligible schemes. 5.10 Approval is also sought for slippage of £20,000 in relation to the Strategic Housing and Choice Based Lettings system, with a further £200,000 being requested for the Empty Homes Project, which are due to continue into 2012/13. Coastal Protection 5.11 The outturn on the Coast Protection capital programmed for 2011/12 is also shown in Appendix E. This shows a total expenditure in the year of £1,174,102, compared to a budget of £1,654,657. Slippage of £480,465 is requested into 2012/13 for the Cromer Coast Protection Scheme 982 (£19,520), the SMP Preparation of Common Version for Approval and Other Additional Studies (£2,769) and the Pathfinder project (£458,176). 5.12 The expenditure incurred on the Coast Protection capital programme is fully funded from the Environment Agency Grant and DEFRA Pathfinder Grant. 6. Capital Programme 2012/13 Update 6.1 Appendix F shows the updated capital programmed for the period 2012/13 to 2013/14. The programme has been updated to take into account slippage of approved capital projects between financial years, along with the following amendments / additions. 6.1.1 New Trade Waste Bins - On the 22 February 2012 Cabinet agreed to increase this budget by £61,700, to reflect the additional cost associated with the purchase of a new waste vehicle. This has been reflected in the appendix with the revised scheme total budget amounting to £272,700. 6.1.2 North Lodge Park – At the Cabinet meeting on the 16 April 2012 approval was given to the inclusion of a budget of £197,000 for the provision of a high quality play area and the opening up of other space within North Lodge Park, in order to provide a wider variety of activities. This budget is now shown within the appendix, being fully funded from capital receipts. 6.1.3 Budget Claw Backs – As discussed above in 5.4.5, during 2011/12 there were three projects that either started earlier than anticipated, or where the expenditure incurred in year was higher than anticipated. Where this was the case, and budget was available in 2012/13, this was clawed back to 2011/12 to cover the additional expenditure. The updated programme for 2012/13 onwards (Appendix F) reflects these adjustments. 6.2 As part of the 2012/13 Base Budget Report that was presented to Cabinet on 6 February 2012, and approved by Full Council on the 22 February 2012, there were three new capital schemes recommended and approved. These have also been included within Appendix F, and are summarised in table 4. Table 4 - 2012/13 New Capital Schemes New Capital Schemes e-Financials Financial Management System Software Upgrade Refurbishment Works to Seaside Shelters Car parks Resurfacing and Refurbishment Total Scheme Total £ 33,000 155,000 186,000 374,000 6.3 The financing of the amended capital programme is detailed within Appendix F. The financing at this point in the year assumes capital receipts totalling £3,603,791 will be used to finance schemes in 2012/13. The progress of achieving the capital receipts as forecast will continue to be monitored throughout the year as part of the budget monitoring process. 6.4 In addition to the changes previously incorporated into the Capital Programme Appendix there are two further amendments which have been included which are requested for approval, details of which are identified below. 6.4.1 Procurement for Upgrade of Civica System – In January 2012, a grant was received from EEDA as a contribution towards the Upgrade of the Civica system. The sum of £53,800 was received and this has replaced the equivalent sum of capital receipts required to be used to fund the scheme in 2012/13. 6.4.2 Sheringham Prom Lighting – In March 2012, a capital contribution (receipt in advance) of £25,000 was received from Sheringham Plus, to fund additional prom lighting in Sheringham. A further £8,000 has been identified as receivable in 2012/13, from Sheringham Town Council. Both sums have been identified as being in addition to the existing scheme budget of £45,000, bringing the total budget available up to £78,000. 6.5 Housing Capital Programme – The updated Housing capital programmed is included within Appendix F, and reflects the slippage from 2011/12. 6.6 The Housing capital programme continues to be financed from capital grants, preserved right to buy receipts, the Capital Projects Reserve and housing capital receipts. The receipts position will continue to be monitored to ensure that the programme remains affordable. 6.7 Coast Protection Capital Programme – The 2012/13 Coast Protection capital programme was approved by Full Council on 22 February 2012. There have been no changes to the programme since the budget report, other than those related to slippage, which have already been detailed in paragraph 5.11 above and these adjustments are reflected within Appendix F. 7. Forecast 2012/13 Update 7.1 The budget for 2012/13 was approved in February 2012. At the same time financial projections for the following three years to 2015/16 were also presented. The budget for 2012/13 includes savings and additional income totaling £897,096. This year is the final year of the two-year finance settlement for local government previously announced as part of the 2010 Comprehensive Spending Review. 7.2 Forecasts of future grant allocations have been made for the period 2013/14 to 2015/16 but these will not be confirmed until later in the year. At the time of producing the budget the forecast gaps for future years were £266,508 in 2013/14, £1,072,432 in 2014/15 and £1,232,022 in 2015/16. This assumed grant reductions of 7% in the first two years, reducing to 3% in 2015/16. In response to changes introduces as part of the Finance Bill it would be prudent to revise these forecasts. The forecast for 2013/14 onwards will be updated as part of the financial planning process which will commence over the coming months. 7.3 As part of the financial planning process all earmarked reserves and commitments against current balances will be reviewed. The balance on the general reserve at 31 March 2012 was £1,946,590. After taking account of budgeted and projected transfers from the reserve over the current and following two financial years the forecast balance is £1,345,066. At this time it would be prudent to maintain sufficient reserves to cushion the impact of future grant settlement announcements being worse than anticipated. A review of the general reserve will be carried out as part of the forthcoming financial planning process. 7.4 Two significant internal changes that have previously been identified as having a financial impact on the Council are the Management Restructure and the Pay and Grading Review. 7.5 Members were appraised of the Senior Management Restructure at the meeting of Full Council in April 2012, the report outlined that ongoing savings of £150,000 had been included in the revenue budget from 2012/13 and that this was the minimum level of saving that could be expected. The restructure is yet to be finalized and therefore more accurate projections of the level of savings cannot be made at this time, but will be factored into the detailed financial forecast that will be updated later in the year. 7.6 Council approved the implementation of a new pay model at the meeting of Full Council on 18 April 2012. Staff are due to be moved to the new terms and conditions and new pay model on 2 October 2012. The report to Full Council outlined the estimated financial implications of the pay and grading review along with the changes from the review of car allowances. The appeal process for the pay and grading review has not yet been completed and therefore where appeals are successful this will reduce the level of savings forecast and potentially increase the costs of back pay entitlement 7.7 An estimate of the costs and savings from the pay and grading review has been factored into the 2012/13 budget and future projections, although the budget for 2012/13 did assume an implementation date of 1 April 2012 and was also based on the previous model. The full financial implication in terms of a net saving of the new model and results of the appeals is yet to be quantified but it will almost certainly be lower than the level assumed in the base budget for 2012/13 due to the six months delay in implementation compared to that budgeted. An earmarked reserve is currently being maintained and will be used to fund the one-off costs for pay and grading along with cushioning the impact of a reduced level of savings if required, however the ongoing impact will need to be considered as part of the updated financial forecasts included in the Financial Plan 2013/14. 7.8 As part of the 2012/13 budget process a new reserve was established for the earmarking of the New Homes Bonus, a report is being brought forward next month in relation to how this money will be utilised. 8. Financial Implications and Risks 8.1 The underspend for the 2011/12 financial year has been earmarked for known and potential liabilities. A number of significant risks still remain in terms of the current and future financial years, the most significant of which are highlighted below. 8.2 Local Government Finance Bill - implications arising from the localization of council tax support and retention of Business Rates both in terms of preparing schemes and the ongoing impact to the council in terms of funding schemes and implications to the grant funding. 8.3 Savings and Additional Income – The base budget for 2012/13 includes savings and additional income totaling £897,096. These will be monitored throughout the year and highlight corrective action where necessary to ensure the budget remains achievable. 8.4 Pay and Grading – The delay in implementation and changes to the model since the budget was set for 2012/13 will have an impact on the overall financial impact of the review some of which can be mitigated by the earmarked reserve. 9. Sustainability 9.1 None as a direct consequence from this report. 10. Equality and Diversity 10.1 This report does not raise any equality and diversity issues. 11. 11.1 Section 17 Crime and Disorder considerations This report does not raise any Crime and Disorder considerations.