Document 12928441

advertisement

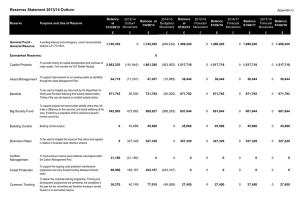

Agenda Item No______8______ 2012/13 OUTTURN REPORT Summary: This report presents the outturn position for the revenue account and capital programme for the 2012/13 financial year. Details are included within the report of the more significant year-end variances compared to the revised budget for 2012/13. The report also makes recommendations for contributions to earmarked reserves for future spending commitments. An update to the current capital programme is also included within the report and accompanying appendices. Options considered: The report essentially provides a final budget monitoring position for the 2012/13 financial year, whilst there are options available for earmarking the underspend in the year or transferring the underspend to the general reserve, the report makes recommendations that provide funding for ongoing commitments and earmarks funding for future projects. Conclusions: The outturn position on the revenue account as at 31 March 2013 shows an underspend for the year of £185,662 which is being recommended to be transferred to the Invest to Save earmarked reserve. The final position allows for a number of underspends to be rolled forward within earmarked reserves to fund ongoing and identified commitments. The general fund balance remains within the current recommended level. . Recommendations: Members are asked to consider the report and recommend the following to Full Council: a) The final accounts position for the general fund revenue account for 2012/13; b) The transfers to and from reserves as detailed within the report (and Appendix C) along with the corresponding updates to the 2013/14 budget; c) Transfer the surplus of £185,662 to the Restructuring and Invest to Save Reserve; d) The financing of the 2012/13 capital programme as detailed within the report and at Appendix D; e) The balance on the general reserve of £1,745,452 at 31 March 2013; f) The updated capital programme for 2013/14 to 2014/15 and the associated financing of the schemes as outlined within the report and detailed at Appendix E. Reasons for Recommendations: To approve the outturn position on the revenue and capital accounts for 2012/13 that will be used to produced the statutory accounts for 2012/13. To provide funding for ongoing projects and commitments within earmarked reserves as detailed in the main body of the report and to earmark funding for one-off costs in relation to business transformation in respect of ICT and Customer strategies. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on the write the report and which do not contain exempt information) Cabinet Member(s): Cllr Wyndham Northam Ward(s) affected All Contact Officer, telephone number and email: Karen Sly, 01263 516243, Karen.sly@north-norfolk.gov.uk 1. Introduction 1.1 This report presents the draft outturn position for the 2012/13 financial year which will be used to inform the production of the Council’s statutory accounts. 1.2 Commentary on the more significant year-end variances is included within the report with further supporting information provided within the appendices. The 2012/13 revised budgets for revenue and capital were approved by Full Council in December 2012 and this report now compares the outturn position with those budgets. The report also includes a current position statement on the level of reserves along with the outturn and financing position for the 2012/13 capital programme. The capital programme for the period 2013/14 to 2014/15 has also been updated to take account of the outturn position. 1.3 All budgets have been monitored during the year by Service and Finance Officers with regular reports being presented to Cabinet and Overview and Scrutiny. The last budget monitoring position was reported to Members in March 2013 and identified a projected underspend on the revenue account of £18,935, this report now presents the final budget monitoring position for the year. The contents of this report will be considered by the Overview and Scrutiny Committee on 26 June 2013. 1.4 At the time of preparing this report there are a number of final figures for 2012/13 which have not yet been confirmed and therefore estimates have had to be made. This is not unusual due to the timing of producing the outturn report and the lead in time for publication of committee papers. Some of these figures are in relation to the benefit subsidy and Council Tax collection where the system reports from the new Revenues and Benefits System have needed further work/analysis to interpret. Any material adjustments to the figures used within this report will either be reported at the meeting or reflected in the draft Statement of Accounts when they are produced. 1.5 In addition there are still some entries that are required within the statutory Statement of Accounts, for example impairment costs that are chargeable to service accounts but are then reversed out therefore having no impact on the overall general fund position. These will be entered in the published accounts and will be fully reconciled to the position now reported. The draft accounts must be produced by 30 June each year and then audited with the final audited version being approved and published by 30 September. The audited accounts will be presented to the Audit Committee on 17 September 2013. 2. Revenue Account – Outturn 2012/13 2.1 The revenue account position for the year shows an underspend of £185,662 as detailed at Appendix A. This is after allowing for a number of transfers to earmarked reserves for current and known commitments. As part of setting the annual budget each year, the Council approves a policy framework for earmarked reserves and the optimum level of the general reserve. Earmarked reserves are typically used to set aside funds for known or specific liabilities. Transfers to earmarked reserves have been made where an underspend has occurred within a service mainly due to the timing of work not being completed as planned and by 31 March 2013 and where no future budget exists. Generally requests to transfer funds to earmarked reserves are made where no specific budget exists in the following financial year. Further details on the movements to and from reserves are included at section 3 of the report. In addition where grants have been received in the 2012/13 financial year but the expenditure has not yet been incurred, these amounts have been carried forward within reserves at the year end. Service Variances 2.2 The following sections of the report aim to highlight the more significant variances compared to the revised budget and concentrate on the direct costs and income. Comments on some of the smaller variances are also included within Appendix B to the report. 2.3 Accounting standards require a number of notional charges to be made to service accounts. Notional charges include transactions in relation to capital charges and pension costs and whilst they do not have an impact on the ‘bottom line’ i.e. the surplus or deficit for the year, they are included for reporting purposes. Appendix A shows the overall revenue position including notional charges, however to assist the reporting and explaining ‘cash’ variances, table 1 provides a summary of the position excluding notional charges. Table 1 - 2012/13 Revenue Account (Excluding Notional Charges) Revised Actual £ Budget £ Assets & Leisure 1,635,375 1,586,094 CLT / Corporate 517,503 460,755 Community, Econ Dev & Coast 1,783,905 1,314,685 Customer Services 337,311 360,111 Development Management 1,016,108 912,472 Environmental Health 3,995,776 3,724,413 Finance 3,403,085 3,457,575 Organisational Development 327,246 336,102 Net Cost of Services 13,016,309 12,152,207 Parish Precepts Net Interest Receivable/Payable Capital Financing Net Contributions to/(from) Earmarked Reserves Net Contributions to/(from) General Reserves Net Expenditure to be met from Government Grant & Taxpayer Government Grants and Council Tax Net (Surplus)/Deficit for year Variance £ (49,281) (56,748) (469,220) 22,800 (103,636) (271,363) 54,490 8,856 (864,102) 1,538,934 (269,900) 460,501 1,538,934 (206,240) 630,253 0 63,660 169,752 (639,176) (156,193) 482,983 (265,126) (304,468) (39,342) 13,841,542 13,654,493 (187,049) (13,841,542) (13,840,155) 1,387 0 (185,662) (185,662) 2.4 Commentary on the more significant variances for direct costs and income is provided in the following paragraphs. Further comments can be found within Appendix B to the report. 2.5 Assets and Leisure a) Car Parks £67,773 underspend – Overall the car parks service has resulted in a net favourable variance at the year end. The most significant is the additional car park fee income of £58,794 and penalty charge notice income of £21,194. These have been offset partly by increased administration fee in respect of penalty charge notices. b) Parklands £15,420 overspend – The main reason for the year end overspend is due to additional repairs and maintenance works in relation to a water leak. c) Foreshore £36,284 underspend – Of the underspend £28,900 has been carried forward to 2013/14 for repairs and maintenance expenditure that was not able to be completed during 2012/13 due to poor weather. d) Woodlands Management £17,338 overspend – The overspend within the service is made up a number of smaller variances including emergency tree works, staff turnover savings not achieved in the year and vehicle repair costs. e) CCTV £15,083 underspend – The underspend in the year is largely due to replacement cameras not being purchased in the year pending the current review of the service. 2.6 Corporate a) Legal Services £47,033 underspend – Of the outturn position £34,623 relates to additional legal fee income generated above the budget, this has been transferred to an earmarked reserve to fund costs related to developing Eastlaw to generate further income in the future. 2.7 Customer Services a) IT Support Services £24,166 underspend – The outturn position is made up of a number of service variances including £11,815 underspend/credits in respect of telephone calls, lines and contract credits received, £28,364 employee savings due to a vacant post. These have been offset by some additional costs in the year in relation to computer software licences. Of the overall saving, £6,480 is being used as a revenue contribution to capital to finance the purchase of replacement computers in the year and £10,000 is being carried forward to fund additional costs in the 2013/14 year for essential upgrade work. b) Media and Communications £36,480 underspend – £16,562 of the outturn position relates to graphics materials costs and external media work being less than budgeted. There was also an underspend on paper costs in the year of £8,536. The balance of the underspend is made up of a number of smaller underspends including furniture and stationery purchases and training costs. Part of the overall underspend has been used as a revenue contribution to capital to fund the purchase of new scanners in the year. 2.8 Community and Economic Development a) Planning Policy £35,269 underspend – The most significant variance within the service is in relation to Community Infrastructure Levy consultant fees which have yet to be incurred, as such £20,000 has been rolled forward to 2013/14. The balance of the underspend relates mainly to employee turnover and officer transport costs not incurred in the year. b) General Economic Development £31,597 overspend – The outturn variance is largely due to grant income that is held in a reserve and is matched by a transfer from reserves in the year. c) Coast Protection £59,897 underspend – The underspend represents delays to planned sea defence works due to adverse weather and has therefore been carried forward to 2013/14 within an earmarked reserve. d) Pathfinder £60,151 underspend – The year-end variance reflects an underspend on the Integrated Coastal Management fund and has been rolled forward to 2013/14 within the Pathfinder earmarked reserve. e) Community and Localism £130,011 underspend – This service includes the items being funded from the second homes money that is returned to the Council from Norfolk County Council, including the Big Society Fund (BSF) grants, any underspend on the grants has been carried forward within the BSF earmarked reserve. The underspend also includes some external grants that have been received in the year but have not yet been expended, these too have been carried forward within the Grants earmarked reserve. 2.9 Development Management a) Development Management £110,408 underspend – As reported during the year within the budget monitoring reports the annual income budget has been exceeded due to a number of large planning applications. £45,000 of the additional income has been carried forward within an earmarked reserve to fund temporary staff within 2013/14. b) Building Control and Access £47,946 overspend – The outturn position reflects the reduction in income from building control fees. 2.10 Environmental Health a) Licensing £23,319 underspend - The outturn position reflects additional general licensing income from new applications and variations to current licences of £10,228 and £13,268 for additional taxi licensing income. Of the net underspend £13,200 has been transferred to the Environmental Health earmarked reserve. b) Environmental Protection £39,485 underspend – Of the underspend ££26,306 relates to employee and related costs due to vacant posts within the service. Of the remaining variance there are a number of smaller underspends within the services demand led budgets and also additional income/contributions for assisted burials and towards noise equipment. c) Environmental Health, Service Management £22,085 underspend – The variance at the year-end relates to savings in a number of supplies and services budgets. d) Waste Collection and Disposal £87,329 underspend – The overall underspend for the service is made up of a number of variances within the service budget headings, including: Additional fee income from trade and garden waste customers of £66,376; Higher recycling credits due to increased tonnages of garden waste and glass being processed resulted in £23,301 being received above the budget; Reduced profit share of £48,403 due to the reduced value of re-sale materials; Recycling initiatives budget not fully spent in the year of £23,488, this has been carried forward in the Environmental Health earmarked reserve to fund additional promotional and marketing during 2013/14. 2.11 Finance a) Local Taxation £56,160 overspend – The main reason for the variance relates to court costs not being awarded to the level of the budget. This was due to court action not being taken in the year as a consequence of the implementation of the new system, although it is anticipated that some of the costs will be recovered in the 2013/14 financial year. b) Benefits £14,430 overspend – Whilst the net position on the service does not show a significant variance from the revised budget, there are a number of variances within the service. The outturn position includes net costs of £102,485 in relation to the final subsidy claim for 2011/12, this has been funded by a contribution from the benefits earmarked reserve which is maintained for such purposes, i.e. to mitigate any in-year impact to the revenue account. The outturn position takes into account the initial subsidy claim for 2012/13 which will be audited later in the year. Due to the system conversion and some backlog within the service the bad debt provision has been reviewed to reflect these issues and a transfer has been made to the benefits earmarked reserve to mitigate any impact from the final audited subsidy return. c) Discretionary Payments £21,168 underspend – The variance relates to a lower level of rate relief awarded in the year, the balance has been carried forward to 2013/14 within an earmarked reserve. d) Corporate Finance £33,994 underspend – The year end variance is largely due to employee costs not incurred due to a vacant post along with advertising costs not expended in the year. £28,500 of the underspend has been carried forward to 2013/14 for interim cover and recruitment costs in 2013/14. 2.12 Organisational Development a) Human Resources and Payroll £55,036 underspend – Of the year end underspend £43,369 relates to the corporate training programme expenditure being lower than expected; of the balance £9,924 is due to lower than anticipated spend on printing and other professional fees and charges. £20,000 has been transferred to the Organisational Development earmarked reserve to cover costs relating to Investors in People accreditation and officer restructuring and £5,000 has been transferred to the Common Training reserve for Members' induction training. b) Policy and Performance Management £33,143 underspend – The outturn position is made up of a number of savings within the service, including, £8,048 employee cost savings, £9,606 consultation costs not incurred in the year, £6,936 expenditure not incurred by the North Norfolk Youth Voice and £6,304 on grants. Non Service Expenditure and Income 2.13 The non-service expenditure and income predominantly relates to investment income. The 2012/13 outturn position achieved from the Council’s treasury management activity was £63,419 below the amount anticipated in the revised budget. Investment income for the year was £206,481 at an average rate of 0.82% from an average balance available for investment of £25.1m. This compares to the revised budget which anticipated a total of £269,900 would be earned at an average rate of 1.1% from an average balance of £24.6m. 2.14 The original budget for investment income in 2012/13 was £269,900 and was unchanged for the revised budget. The rate of interest on the types of investment the Council had been making was falling, and it was decided to invest £5m in the LAMIT Pooled Property Fund to maintain the overall return and meet the revised budget. However, it was not possible to make the investment in the Fund until the 31 March 2013, and consequently there is a shortfall which in line with the amount reported to members in the monitoring reports from Period 10. 2.15 The Treasury Management Annual Report is included as a separate item on this Agenda and provides more details on the performance of the Treasury Management activity for the year 3. Reserves 3.1 The Council holds a general reserve for which the recommended balance was £1.6 million when the 2013/14 budget was approved in February 2013. The general reserve is held for the purpose of providing a working balance to help cushion the impact of uneven cash flows to avoid temporary borrowing and also as a contingency to help cushion the impact of unexpected events or emergencies. As part of approving the budget for the 2013/14 financial year the general reserve recommended balance was increased from £950,000 to £1.6 million. The reason for the increase was in response to the significant changes that have been introduced to the funding of Local Authorities from 2013/14 onwards, essentially from a fixed formula funding mechanism to one whereby funding is related to the local raised business rates and also the introduction of the Localised System of Council Tax support. 3.2 Since recommending the minimum balance of £1.6 million Cabinet have received a report (13 May 2013) on the use of the New Homes Bonus (NHB) from 2013/14. The report (subject to Full Council approval) recommended the use of the New Homes Bonus from 2013/14 onwards within the base budget, in approving this it was recommended that £600k of the unallocated NHB within the NHB earmarked reserve be reallocated to the general reserve to mitigate the impact of future changes to the NHB within the overall funding formula. 3.3 In addition to the general reserve a number of earmarked reserves are held to meet known or predicted liabilities. The earmarked reserves provide a means at the year-end for carrying funds forward to the new financial year to fund ongoing commitments and known liabilities for which no separate budget exists in future financial years. 3.4 Section 2 of the report highlighted some areas where an underspend had occurred in the year and a transfer to reserves had been made to ensure funds are available to meet future spending commitments. Unlike capital budgets, underspends on revenue budgets in the year are not automatically rolled forward at the year-end where there is an annual budget provision. Where the underspend represents a grant received which has not yet been fully utilised or there has been a delay in the planned use, the unspent grant has been rolled forward. 3.5 The transfers to and from reserves (general and earmarked) are included within the reserves statement as detailed at Appendix C. The overall position gives a total of reserves of £7,978,968 at 31 March 2013. The appendix also shows the planned use of reserves over the medium term to take account of where funding has been rolled forward from 2012/13 for use in 2013/14. 3.6 The general reserve balance at 31 March 2013 is £1,745,452. After taking into account the budgeted contributions to and from the reserve in 2013/14, the forecast balance at 31 March 2014 is £2,030,868, although this does include £400,000 within the reserve which the current financial forecast assumes will be used over the following two financial years, excluding this leaves an unallocated balance of £1,630,868. 4. Summary – Revenue Account 2012/13 4.1 The outturn position for the year ending 31 March 2013 is a £185,662. This is after allowing for a number of underspends identified at the service level which have been rolled forward within reserves to fund ongoing commitments in 2013/14. It is recommended that the surplus for the year be transferred to the Invest to Save reserve which could then be used fund investment decisions related to the ICT and Customer Improvement Strategies. Release of the funds from the reserve would be subject to the sign-off of relevant business cases by the Transformation Board which is made up of the Leader, Portfolio Member and Officers. 5. Capital Programme 2012/13 5.1 This section of the report presents the financing of the capital programme for 2012/13, along with an updated programme for the financial years 2013/14 to 2015/16. Appendix D provides the detail of the outturn on the 2012/13 capital programme for all service areas, together with the financing for all schemes. The updated capital programmes for the period 2013/14 to 2015/16 are attached at Appendix E. 5.2 The outturn position for the 2012/13 capital programme, at Appendix D, highlights where schemes have slipped between financial years. The reasons for slippage include where schemes have not progressed as originally planned and the funding is requested for carry forward to the new financial year, or where schemes have progressed ahead of schedule requiring funding to be brought back from 2013/14. The following paragraphs provide further explanations and where necessary commentary on individual schemes in the capital programme, which are now reported in line with the subheadings used in the Corporate Plan. The details include the outturn expenditure compared to the 2012/13 budget, and explanations of variances where applicable. 5.3 In total, the expenditure on the capital programme for the year was £4,545,815, compared to a revised budget of £11,650,111, giving a variance of (£7,104,296). There has been a requirement to claw back a total of £29,618 from the 2013/14 budget where schemes have progressed faster than originally anticipated. In addition to this there is significant slippage of (£7,117,695), together with other movements in year totalling a net (£16,219). 5.4 The following three paragraphs provide summary commentary where actions on schemes have been similar at year end :- a) Budget Claw Backs – There were 6 schemes in total that have either started slightly earlier than anticipated, or where the spend level in the year was higher than anticipated. Where this is the case, and there is budget available within the 2013/14 capital programme, this has been clawed back in order to cover the expenditure incurred in year. The updated programme for 2013/14 onwards (Appendix E) reflects these adjustments to the capital programme. The schemes and amounts are listed in table 2. Table 2 – Capital Schemes Claw Back Required from 2013/14 Budget Capital Scheme Claw Back Amount £ Car Park Resurfacing and Refurbishment 26,077 Playground Improvements 3,000 Other Schemes 541 Total 29,618 b) Schemes Completed in Year – Overspent - A total of eight capital schemes were completed in year with overspends. The schemes and amounts of overspend are listed in table 3, together with the source of the additional financing. Table 3 – Capital Schemes Completed in Year with Overspends Capital Scheme Cromer Red Lion Toilet Refurbishment Car Park Ticket Machines Sheringham East Prom PC Sheringham Little Theatre SMP Preparation of Studies Amount £ 4,484 Source of Additional Financing Capital Receipts 1,346 6,350 8,198 3,162 Capital Receipts Capital Receipts Capital Receipts Environment Agency Grant Capital Receipts Other Schemes Total c) 1,064 24,604 Schemes Completed in Year – Under Budget – Within the 2012/13 financial year a further four schemes have been completed within budget, with the remaining balance of budget no longer being required. These schemes are identified within table 4, together with the budget sums to be relinquished. Table 4 – Capital Schemes Completed in Year – Under Budget Capital Scheme Fakenham Factory Extension Asbestos Works Openwide Loan Repayment North Walsham Public Conveniences Total 5.5 Amount £ (23,256) (1,634) (495) (1,619) (27,004) In addition to these scheme there are further explanations of other significant variances on a scheme by scheme basis below:- a) Fakenham Industrial Estate – This scheme has been in existence for a number of years, with the balance of budget being taken forward to cover any additional expenditure. As the scheme is now complete Cabinet are requested to remove the remaining budget of £6,736 from the capital programme. b) Carbon Reduction Scheme – The current plans for the Carbon Reduction Scheme relate solely to the improvement of water usage at NNDC public conveniences. The value of works arising from this scheme are estimated at £5,000, with a budget of this value being requested for slippage to the new financial year. The remaining budget of £34,939 is no longer required and is to be removed from the capital programme for 2013/14. c) Equity Loans – A total of £47,000 has been received in the year as part of a funding initiative from East of England Regional Assembly (EERA), for the provision of equity share loans to enable properties to be improved. A total of £19,845 has been paid to owners or tenants to facilitate this process in the 2012/13 financial year, and the balance of funding has been taken to Receipts in Advance. This scheme has been incorporated into the capital programme for 2013/14, with a balance of £27,155 being included as the amended budget for the year. d) Big Society Fund - During 2012/13 the value of capital grants made from the Big Society Fund has exceeded the revised budget, with additional expenditure of £82,000 being incurred in year. Although this has been offset by an equivalent reduction in revenue grants, the additional expenditure will be financed in year from capital receipts. This has resulted in a net increase in the overall Big Society Fund capital budget by £82,000 which has been reflected in the capital programme information included at Appendix D. e) Street Signs Improvement Programme – The original intentions of this scheme have been delivered, and as such there is no future requirement for the £25,825 balance of budget. This is to be removed from the capital programme for 2013/14 onwards. f) Personal Computer Replacement Fund – In 2012/13 there was a requirement to replace all personal computers within the Benefits section, in order for the section to function efficiently. The over spend in year of £6,480 is to be financed in year from revenue contribution, and will result in a net increase to the overall PC Replacement Fund capital budget by an equivalent sum. This has also been reflected within the capital programme shown in Appendix D. g) Fakenham Connect – This scheme has been completed, and there is no future requirement for the £6,218 balance of budget. This scheme is therefore to be removed from the 2013/14 capital programme. h) Fakenham Community Centre – This scheme has been completed, and there is no future requirement for the £8,720 balance of budget. This scheme is also to be removed from the 2013/14 capital programme. 5.6 In addition to the above there have been a number of schemes where slippage of budgets in excess of £100,000 have been identified from the 2012/13 budget to the new financial year. This has arisen mainly due to delays in scheme implementation, and more accurate re-profiling of these expenditure budgets will be undertaken as part of the Capital Budget Monitoring Process in the new financial year. These schemes have been summarised in Table 5. Table 5 – Slippage on Capital Schemes in Excess of £100,000 Capital Scheme Disabled Facilities Grants Empty Homes Gypsy and Traveller Short Stay Stopping Facilities Cromer Pier Structural Works (Phase 2) Cromer Coast Protection Scheme 982 Pathfinder Project Trade Waste Bins/Vehicles Procurement for Upgrade of Civica System Administrative Buildings Total Amount £ (127,536) (199,050) (305,646) (726,655) (4,636,290) (312,232) (121,688) (163,240) (137,220) (6,729,557) 6. Capital Programme –2013/14 Update 6.1 Appendix E shows the updated capital programme for the period 2013/14 to 2015/16. The programme has been updated to take into account the slippage as identified within this report and the capital outturn appendix. Alongside these changes, the capital programme has also been updated for the following amendments / additions. 6.2 Carbon Reduction Scheme – As identified in paragraph 5.5(c) the budget requirement for this scheme has been reduced to £5,000 in 2013/14. As such the balance of budget of £34,939 as at the end of the 2012/13 financial year has been removed from this schemes total budget requirement. 6.3 Equity Loans – As discussed above in paragraph 5.5(d) a sum of £47,000 has been received for the provision of equity share loans in order to facilitate approved home improvements. The total provision of £47,000 has been included within the capital programme, with £19,845 of this money already having been spent in the 2012/13 financial year. The balance of the monies from EERA, of £27,155, has been included as the amended budget for 2013/14. 6.4 Gypsy and Traveller Short Stay Stopping Facilities – There was slippage of £305,646 requested into the 2013/14 financial year. Of this sum a total of £260,000 has been re-profiled into subsequent financial years in order to reflect more accurately the accounting period to which this scheme relates. 6.5 Big Society Fund – During the 2012/13 financial year an additional £82,000 of expenditure was incurred in relation to capital grants made from the Big Society Fund throughout the year. The overall budget for the Big Society Fund has been increased by this value to reflect the additional expenditure already incurred, thereby leaving a full £200,000 to be available for the 2013/14 financial year for the Big Society Fund/Enabling Fund as reported to Members in April 2013. 6.6 Personal Computer Replacement Fund - Following the requirement to replace all Benefits Computers during the 2012/13 financial year, as identified within paragraph 5.5(g), the overall budget for this scheme has been increased by £6,480. This increase will ensure that the budgets of £20,000 per annum for the 2013/14, 2014/15 and 2015/16 financial years, are still available. 6.7 Budget Claw Backs – As discussed above during 2012/13 there were 6 projects that either started earlier than anticipated or where the expenditure incurred in year was higher than anticipated. Where there was budget available in 2013/14, this was clawed back to 2012/13 to cover the additional expenditure. The updated programme for 2013/14 onwards (Appendix E) reflects these adjustments. 6.8 Committee Management Information System (CMIS) – This report recommends approval of £16,000 within the 2013/14 capital programme for an electronic committee management system. Following the review and subsequent merger of the administrative and democratic services teams the need for an electronic committee management system was identified. The system will support improved performance and productivity to underpin the corporate administration and democratic services functions for the Council. Currently there is no electronic committee management system used in the service with committee and meeting agendas and papers being produced manually in pdf format. 6.9 The financing of the amended capital programme is detailed within Appendix E. The financing at this point in the year assumes capital receipts totalling £5,366,265 will be used to finance schemes in 2013/14. The progress of achieving the capital receipts as forecast will continue to be monitored as part of the budget monitoring process. 7. 2013/14 Budget Implications and Financial Forecast 2014/15 Onwards 7.1 The budget for 2013/14 was approved in February 2013. At the same time financial projections for the following three years to 2016/17 were also presented. The budget for 2013/14 includes new savings and additional income totalling £163,000, these are in addition to the ongoing savings of £897,000 from the 2012/13 financial year. The budget for 2013/14 and future financial forecasts also take account of the new system of Local Government Finance for which the key components are the local council tax support scheme and the retention of business rates which came into effect from April 2013. 7.2 The forward projections take account of the provisional finance settlement for 2014/15 announced at the time of the 2013/14 settlement and forecast funding reductions of up to 25% over the next three years. Based on the assumptions at the time of approving the budget for 2013/14 the forecast funding gap by 2016/17 was £2.272 million. Since approving the budget for 2013/14, Cabinet have recommended (subject to Full Council decision) that the New Homes Bonus grant be taken into the base budget from 2014/15 onwards. As reported to Cabinet in May 2013, this will reduced the forecast deficit (based on current expenditure and income projections) as illustrated in the table 7. Table 7 – Current Funding Forecast 2014/15 £000 Current Funding Gap1 917 Use of NHB (821) Revised Funding Gap 96 2015/16 £000 1,552 (936) 616 2016/17 £000 2,272 (1,051) 1,221 7.3 The forward projections of expenditure and income are in the process of being updated to take account of the outturn position and also other spending/income pressures where applicable. These will be reported to Members in the coming months to enable early preparation for the 2014/15 budget process. 8. Financial Implications and Risks 8.1 There are a number of financial risks facing the authority in terms of the changes to Local Authority Funding in particular the Local Council Tax Support Scheme and Local retention of Business rates which came into effect in April this year. These where reported in detail within the budget report and the general reserve was increased in response to these risks. 8.2 This outturn report has identified a number of underspends at a service level where due to some constraints outside of the Council’s control has meant that expenditure has not been incurred as planned, for example coast protection and repairs which were restricted by weather. These underspends have been carried forward within earmarked reserves to mitigate any overspends in the 2013/14 financial year. 8.3 Benefits subsidy (Housing and Council Tax for 2012/13) does present a financial risk in terms of the size of the expenditure on the service, for 2012/13 the expenditure was in the region of £37 million with comparative levels of subsidy recovered. Whilst the initial subsidy claim for 2012/13 has been submitted, there are risks as a result of the system conversion mid year which could have an impact on the final audited subsidy return. Much of this risk is reduced by the benefits earmarked reserve which is maintained to help mitigate the impact of any claw back from the Department for Work and Pensions following the final audited subsidy claim. 9. Sustainability – None as a direct consequence of this report. 10. Equality and Diversity – None as a direct consequence of this report. 11. Section 17 Crime and Disorder considerations – None as a direct consequence of this report. 1 As reported in the 2013/14 Budget Report