Does Equity Behave like a Component of the Cost of Capital? Bonen

advertisement

Does Equity Behave like a Component

of the Cost of Capital?

Evidence from Crossed Mixed Effects Panels

Anthony Bonen∗

March 2016

Abstract

Using a q theoretic framework to control for firm value and expected cash

flows, we test whether firms’ cost of equity capital rE depends on their choice

of payout mechanism. Firms are exclusively but not exhaustively categorized

as persistent share repurchasers and issuers, and compared. Two measures

of rE are estimated. In both specifications share issuing firms conform more

closely with standard capital structure and investment theory. Repurchasers

deviate from theoretical predictions suggesting these firms’ expected equity

returns do not accurately signal real-sector investment costs.

JEL classification: G32, C33

Keywords: q Theory, Weighted Average Cost of Capital, Linear Mixed Effects Models, Share Repurchases

∗

Economics Department, New School for Social Research

1

Introduction

Over the past three decades there has been a rapid rise in the rate of share repurchases

by US publicly-listed firms, and a concurrent decline in capital investment. This

trend has resulted in widespread concern that (excessive) share buybacks are reducing

corporations’ long-term value as net-positive investment projects are foregone in favor

of short-term payouts to shareholders (Lazonick, 2007; Mayer, 2013; Mackenzie,

Braithwaite, & Bullock, 2014; Hecht, 2014; Mason, 2015; Lazonick, 2015). This

would seem, on the face of it, counter to shareholders’ interest since stock markets

are supposed to price the risk-adjusted returns of firms’ investment opportunities.

Failing to undertake profitable capital projects should therefore lead to a fall in

equity’s value. On the other hand, with buybacks now outpacing new equity issuances

on average (see Fig. 1), the expected return on equity investment priced by the

typical shareholder is arguably a further step removed from setting the firm’s effective

cost of capital. This paper examines whether, and to what extent, persistent share

repurchasing firms’ market-based cost of equity deviates from standard theoretical

predictions of how equity covaries with the other canonical cost of capital, debt.

We investigate this issue through a q theoretic framework implemented in a linear

mixed effects model (LMM) on a panel of publicly-listed US firms. Using a crossed

(unnested) structure allows for covariation estimates in our variable of interest, the

cost of equity rE , to be simultaneously pooled toward idiosyncratic and macroeconomic tendencies. The results show that firms which are classified as repurchasers1

1

Defined as firms which repurchase a significant number of their shares (> 1%) in more commonly than they raise capital through equity issuances. See §4.4.

1

consistently deviate from theoretical predictions. Conversely, share issuing firms’

capital cost components covary closer to the expected behavior, and, when covarations do deviate from predicted tendencies, it is to a significantly lesser extent

than repurchasing firms’ deviations. The results reveal that, in addition to market

frictions and imperfect information, the weighted average cost of capital’s (WACC)

relevancy to investment decisions is contingent on the firm’s behavior vis-à-vis equity

markets. This suggests firms’ payout policy mechanisms are an important aspect to

consider in evaluating capital structure and q theories.

The paper is organized as follows. Section 3 presents a model of firm value based

on Abel and Blanchard’s (1986) VAR decomposition of marginal q into expected

cash flows and the WACC. After isolating the marginal costs of debt and equity,

we control for, inter alia, leverage and expected earnings to hypothesize – in line

with modern capital structure theory – that the marginal capital cost components

covary inversely. Section 4 presents the Compustat/CRSP data universe used for the

analysis. Section 5 provides a brief overview of the LMM approach to panel data.

Section 6 presents and discusses the empirical findings. Section 7 concludes. We

begin below with a review of the literature.

2

Related Literature

At least since the seminal Modigliani and Miller (1958) paper, firms’ cost of capital

has been canonically theorized as the tax-adjusted, weighted average of the rate of

interest on borrowed funds, rD , and the so-called “required return” to equity capital,

2

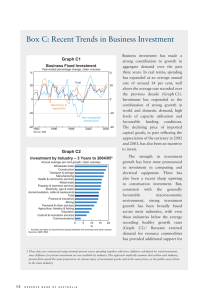

Figure 1: Average Investment and Shareholder Payouts relative to Total Assets

Compustat quarterly data, weighted average by firms’ total assets. Includes only firms based in the United States;

excludes utilities, public companies and financial sector companies. Quarterly figures include any quarterly financial

report in which the majority of the days are within the 3-month period (Jan-Mar, Apr-Jun, Jul-Sep, Oct-Dec).

Data are smoothed by a 4-period moving average. Investment, Investment, repurchases, issuances and dividends are

calculated from the year-to-date variables CAPXY, PRSTKCY, SSTKY and DVY, respectively. Net issuances are

SSTKY less PRSTKCY. Total asses are available quarterly in series ATQ.

rE , for which the weights are the leverage ratio and its complement, respectively.

This is commonly referred to as the weighted average cost of capital (WACC). While

it has long been recognized that firms more frequently turn to debt markets to

finance investment, Modigliani and Miller (1963, p. 441) argue this does not vitiate

the capital structure irrelevancy theorem because “over the long pull, all of the

firm’s assets are really financed by a mixture of debt and equity capital even though

only one kind of capital may be raised in any particular year.” However, for a

firm that expends more on the repurchase and retirement of shares than it raises

3

through new issuances, it is not clear what mechanism compels the firm to consider

expected equity returns as a component of its hurdle rate of investment. This raises

the question as to whether the appropriate measure of the cost of capital relevant

for investment decisions determined by the Modigliani-Miller (MM) theorem – the

WACC – is contingent on the firm’s payout and financing policies.

The question studied here differs from the bulk of capital structure literature

that considers deviations from the MM theorem in terms of real world imperfections

and frictions. For example, the dynamic tradeoff theory branch of the literature

focuses on the adjustment costs of moving to some managerially-determined target

leverage ratio that balances the interest tax-shield benefits of debt with the cost of

increased financial fragility (Jensen & Meckling, 1976; Fischer, Heinkel, & Zechner,

1989; Flannery & Rangan, 2006; Abel, 2015). In the financial hierarchy (viz. peckingorder) literature, emphasis is on the informational asymmetries that exist between

executive managers and outsiders. Although the former know the true value of

investment opportunities, they can only raise the required funds by issuing securities

at a discount – a discount which rises with the security’s riskiness (Myers, 1984;

Myers & Majluf, 1984; Oliner & Rudebusch, 1992; Myers, 2001; Leary & Roberts,

2010). In contrast, we consider deviations from the MM postulates based on firms’

policy mechanisms – specifically, on whether the firm primarily uses the stock market

as a source of capital financing or as a medium for shareholder payouts.

The q theory of investment provides a natural framework in which to address this

issue because it provides a straightforward model for relating the value of the firm,

investment and the cost of capital. Consider the relationship between the present

4

value of the firm V , its expected future cash flow π generated by investment I, and

the discount rate capitalizing these flows, ρ. Taking each as the expected value of

independent random variables, they are mechanically related by2

V = π(I)/ρ

(1)

Stripped down, q theory provides an optimal rule for selecting I to maximize V when

ρ is fixed: Invest in any project for which the present value of earnings π are greater

than the present value costs of investment, π 0 (I ∗ ) = ρ. This equalization of marginal

return to marginal opportunity cost is the reason for identifying the WACC as the

appropriate hurdle rate for investment decisions. From the perspective of capital

markets, the basis of MM theory is that investors determine V in response to changes

in π. Changes in capital structure independent of π(I) lead equity investors, per MM

Proposition II, to revalue their claims such that ρ is held constant in equilibrium.

This in turn requires the components of ρ – the marginal cost of debt and equity,

and leverage – balance out when V and π(I) are fixed.

When capital markets fail to accord with the MM postulates, the market-based

construction of q should not be expected to drive investment rates (Blanchard, Rhee,

& Summers, 1993; Schoder, 2014). Hence, it should not be surprising that, in spite

of its solid conceptual foundation, q theory has not performed well at predicting

aggregate and firm-level investment rates (e.g., Oliner, Rudebusch, & Sichel, 1995;

Gilchrist & Zakrajsek, 2007). However, there are two important caveats regarding the so-called ‘empirical failure’ of q, which provide support for investigating if

2

For expositional purposes the theory is greatly simplified.

5

that problem lies with the construction of the WACC as the appropriate metric for

investment costs.

First, q’s explanatory power is more robust in studies that move away from the

construction of q as the ratio of firms’ market value to book value of capital. For

example, Blanchard et al. (1993) focus on profitability as the relevant metric for

determining investment policy and find it to be a far more powerful predictor than

stock market valuations. Gilchrist and Himmelberg (1995) apply the Abel-Blanchard

methodology employed here and find the VAR-approximated q to perform better

than standard measures. Erickson and Whited (2000) find q to be more empirically

relevant than cash flow when GMM is used to control for higher moments in the

distribution.3 Phillipon (2009, p. 1012) argues this has led to an “uncomfortable

situation” of basing the benchmark investment equation on non-market data. He

overcomes the problématique by casting aside the equity market entirely and uses

the Merton (1974) debt pricing model to proxy q. The resultant “bond market q”

performs well under comparative testing (see Schoder, 2014).

Secondly, most empirical studies of q, including those just discussed, emphasize

investment decisions’ impact on expected earnings. However, as shown in equation

(1), the value of a firm is the product of expected earning and a discount factor

derived from the cost of capital. On the rare occasion the discount factor has been

tested directly, it has generated unexpected results. Using aggregate manufacturing

data, Abel and Blanchard (1986) find two surprising anomalies: a majority of the

cyclical variation in q is due to changes in the discount factor, and; the discount

3

In contrast to the seminal work of Fazzari, Hubbard, and Petersen (1988), Erickson and Whited

find that firms with cash flow constraints exhibit less investment sensitivity to cash flow variability.

6

factor (cost of capital) is positively (negatively) associated with changes in marginal

profit. In other words, they find capital costs substantially influence q in the opposite

direction predicted by theory. Frank and Shen (2015) apply the Abel-Blanchard (AB)

approach to firm-level data and find the cost of capital is a significant explanator

of investment behavior. However, their cost of equity measure based on a factor

model4 exhibits a positive correlation with investment. Conversely, the correlation is

negative – in accordance with standard theory – when equity costs are measured by

in an implied cost of capital model. They also regress investment on the cost of debt

and the cost of equity as separate covariates and find that interest cost coefficients

are consistently negative. Hence, their unexpected WACC results are entirely due to

the cost of equity measure.5

Given their similar empirical focus we follow Frank and Shen (2015) in constructing and testing two classes of equity cost estimates, one based on factor models such

as the capital asset pricing model (CAPM), and the other on implied cost of capital

(ICC) models. However, since our interest lies in whether these equity cost measures conform with capital structure theory predictions, we rearrange the investment

equation such that the covariation between the cost components of the WACC, rD

and rE , is studied directly. Building on a q model has the added benefit of providing a theoretical foundation for how to control for the value of the firm, investment

and expected cash flows. As discussed below, rD and rE are predicted to covary

negatively when these other variables are fixed, and covary positively otherwise.

4

See Section 4 for details on the two classes of equity cost measures.

In addition to the q theoretic analyses, the user cost of capital (UCC) literature demonstrates

debt costs are a highly significant driver of investment (e.g., Dwenger, 2014). Although the cost of

capital in UCC theory is also the WACC, empirical work typically relies on borrowing costs alone.

5

7

3

Theoretical Framework

The baseline model employed here is the Abel and Blanchard (1986) linearized estimation of marginal q, for which the the cost of capital components are then separated

as in Frank and Shen (2015). Part 3.2 discusses how the Merton (1974) bond pricing

model builds on the MM theorem to provide theoretical predictions of the covariation between between rD and rE . In part 3.3, we integrate these capital structure

postulates into the Abel-Blanchard (AB) q model to establish testable hypotheses.

3.1

q Theory of Investment

In a dynamic setting the value of the firm Vt at time t equals the expected value of

future earnings discounted by the cost of capital ρt = 1 + rt ,6

"

∞

X

πt+k (It+k , Kt+k )

Vt = E

Qk

j=0 (1 + rt+j )

k=0

#

(2)

subject to the capital accumulation dynamic

Kt+1 = (1 − δ)Kt + It .

where profit, πt+k (It+k , Kt+k ), is the firm’s net cash flow after operating expenses and

taxes, but before the deduction of interest. Profits are assumed to exhibit diminishing

returns to capital

∂πt

∂Kt

2

> 0, ∂∂Kπ2t < 0 and the cost of investment is positive and convex,

t

6

Although the AB model assumes the manager is risk-neutral, the WACC can be shown as

the appropriate discount rate under risk-aversion and tax-adjustment provisions (Liu, Whited, &

Zhang, 2009).

8

∂πt

∂It

2

< 0, ∂∂Iπ2t < 0. Capital depreciation 0 < δ ≤ 1 is assumed to be constant.

t

The solution to (2) yields marginal q as the sequence of marginal profit generated

by an additional unit of investment discounted by the cost of capital r,

"

qt = E

∞

X

Qk

k=1

where Mt+k ≡

∂πt+k

(1 − δ)k .

∂Kt+k

Mt+k

j=1 (1 + rt+j )

#

.

(3)

Abel and Blanchard (1986) decompose (3) with a first-

order Taylor expansion7 and solve for the linearized qt by assuming a convergent

VAR(1) process. Following this approach Frank and Shen (2015) show that if the

coefficient matrix is diagonal8 then the linearized value of q reduces to the sum of two

AR(1) series for marginal profit Mt+k and the cost of capital rt+j . The steady-state

of the AR(1) processes for the linearized marginal q yields the finite sequence (see

Appendix A for derivation).

L(qt ) :=

M̄ · ρr

β̄ · ρM

M̄ β̄

(Mt − M̄ ) −

+

(rt − r̄)

1 − β̄ 1 − β̄ρM

(1 − β̄)(1 − β̄ρr )

(4)

where β̄ ≡ (1 + r̄)−1 is the mean cost of capital, M̄ is average marginal profit,

0 < ρM , ρr < 1 are the lag coefficients for Mt and rt , respectively.

As is standard in this approach we assume linear-quadratic investment function,

∂πt

∂It

= −1 − φ KItt such that investment and L(qt ) are related by an error-adjusted

affine relationship,

It

Kt

=

1

φ

+ φ1 L(qt ) + t . Using the definition in (4) and rearranging,

7

They also test a second-order expansion but find differences between the linear and quadratic

approximations to be negligible.

8

For this simplification Frank and Shen (2015) state that the first element of the coefficient

matrix has an absolute value less than one and all other elements are zero. This is more restrictive

than necessary: one need only assume a diagonal coefficient matrix to derive AR(1) dynamics.

9

the investment equation becomes

−α

α

}|2

{

z

}|1

{

It

1

M̄ β̄

β̄ · ρM

M̄ · ρr

= +

−

M̄ +

r̄ +α1 rt + α2 Mt + t

Kt

φ 1 − β̄ φ(1 − β̄ρM )

φ(1 − β̄)(1 − β̄ρr )

|

{z

}

z

α0

Or simply,

It

= α0 + α1 rt + α2 Mt + t

Kt

(5)

where α1 < 0 and α2 > 0 and t is the NID disturbance term.

There are two things to note about equation (5). First, even though an autoregressive stochastic profile is a necessary intermediate assumption, the investment regression does not require the AR coefficients ρM , ρr to be determined independently

of the coefficients αi , i = 0, 1, 2. Third, the covariates Mt and rt are well-defined in

theory as marginal profit and the cost of capital. Although the cost of debt is defined

by the interest rate paid, there is no consensus on how to measure the cost of equity.

We will therefore follow Frank and Shen (2015) and construct two measures of the

required return to equity, rE .

3.2

Cost of Capital Components

The WACC is the weighted sum of returns payable to holders of debt and equity,

where the weights are given by the relative share of these securities in firm value:

rt := (1 − Lt )rE,t + (1 − τt )Lt rD,t

10

(6)

The market value leverage is given by Lt := Dt /(Et + Dt ) = Dt /Vt ∈ [0, 1] where

Dt is the stock of debt, and Et the value of equity. The marginal capital costs are

for equity and debt are rE,t and rD,t , respectively. Since interest payments are tax

deductible, the cost of debt is reduced by the tax shield 1 − τt .

The capital structure trade-off theory is driven by equity investors’ response to

leverage, as shown by rearranging (6),

rE,t = rt + (1 − τt )(rt − rD,t )

Dt

.

Et

(7)

Since rt capitalizes the firm’s stream of expected earnings, (7) suggests the components of the cost of capital should move inversely. However, Modigliani and

Miller’s theorem takes borrowing costs as exogenously determined by the risk-free

rate, thereby focusing attention on the stock market’s reaction to changes in leverage

and taxation. The relationship between rE and rD was not formalized until Merton

(1974) developed a debt pricing model atop the MM propositions.

Depending on the root cause of the variation, the Merton (1974) model posits

both positive and negative bond-stock correlations. This class of “structural models”

considers equity as a call option on the value of the firm where the strike price is

the face value of debt. Default ensues when equity matures ‘out of the money’, and

debt holders obtain the remaining – less than face – value of the firm. Debt claims

are therefore structurally equivalent to holding a short position on an American put

option with a face value strike price. For any increase (decrease) in the underlying’s

value, the price of bonds will rise (fall) and the yield will fall (rise). From this perspective, the value of both positions (short put, long call) will covary positively with

11

changes in present market value-cum-expected earnings.9 Conversely, an increase in

the volatility of the underlying’s value raises the value of both call and put options

(thus lowering the value of a short position on the put).10 Put another way, if expected earnings and the risk-free rate are controlled for, then rE and rD should be

inversely correlated as suggested by (7). Intuitively, the model says debt and equity

are both positively related to the firm’s expected stream of earnings, but as the variability of that income stream increases those holding only up-side risk gain, whereas

those earning a fixed income, but face the downside risk, lose.11

On the basis of current market price and expected earnings, Merton’s extension

of the MM framework provides a theoretical foundation for the inverse rD , rE relationship asserted in (7). In the “corrected” version of their paper, Modigliani and

Miller (1963) derive the value and earnings relations to the WACC as,

rt =

π̄t − τt rD,t Dt

Vt − τt Dt

9

(8)

Under log-normal dynamics an increase in the present market value or in the risk-free rate

raises the value of a call option and reduces value of a put option. In terms of “The Greeks”, calls

(puts) have a positive (negative) ∆ and positive (negative) ρ, which are the partial derivatives of

the options’ value to, respectively, the underlying’s value and the risk-free rate.

10

In finance parlance, the ν – the derivative of the option’s value with respect to the standard

deviation of returns – is positive for both calls and puts under log-normality.

11

Empirical studies of firm-specific returns covariance are surprisingly scarce. This is in spite of

the fact there is an expansive literature on the relationship between aggregate stock returns and

average (or risk-free) interest rates (e.g., Barsky, 1986; Campbell & Ammer, 1993; Fama & French,

1993; Chordia, Sarkar, & Subrahmanyam, 2003; Choi, Richardson, & Whitelaw, 2014). The limited

firm-level evidence does seem to confirm the predictions of the Merton model. Nieto and Rodriguez

(forthcoming) find evidence of the theorized positive correlation between a firm’s stock and bond

prices, the strength of which varies with firm specific characteristics (e.g., correlations increase with

leverage) and time-specific/ macroeconomic factors (e.g., correlations decrease with the volatility

of consumption growth). On the other side, Alexander, Edwards, and Ferri (2000) find evidence

of negative covariation between rE and rD among firms with high-yield bonds, for which returns

variance is an important driver.

12

i

h

PJ

−1

is the the average expected future earnwhere π̄t := Et limJ→∞ J

j=1 πt+j

ings.12 Substituting (8) into (7) and rearranging produces the off-setting relationship

between rE and rD discussed above in terms of expected earnings:

rD,t =

π̄t

Et

− rE,t .

Dt

Dt

(9)

Equation (9) is a simple reformulation of the weighted average cost of capital that

Modigliani and Miller (1963, p. 441) argue is the relevant cost consideration for

investment planning. To this point we have merely imbued it with the insights and

intuition from Merton’s later work.

3.3

A Combined Model

Returning to the regression equation (5) and replace rt with the WACC from (7),

It

= α0 + α1 (rE,t (1 − Lt ) + (1 − τt )rD,t Lt ) + α2 Mt + t .

Kt

Proxying marginal profit by average profit as in Abel and Blanchard (1986), permits

us to replace Mt by π̄t /Vt . Isolating the cost of capital components yields

(1 − τt )rD,t = α̃0

Et

π̄t

It /Kt

Vt

+ α̃1 rE,t

+ α̃2

+ α̃3

Vt + t

Dt

Dt

Dt

Dt

(10)

The coefficients α̃i , i = 0, 1, 2 are equal to the coefficients in (5) scaled by −α1 > 0.

This implies that α̃1 = −1, α̃2 > 0 and α̃3 =

1

α1

< 0. Although one would expect

12

the WACC

should also be defined by its average expected value rt =

i

h To be exact

PJ

−1

Et limJ→∞ J

j=1 rt+j .

13

the inverse of market leverage, Vt /Dt , to be negatively related to interest costs (i.e.,

α̃0 < 0), the model is ambiguous about the sign of α0 and, therefore, also of α̃0 .

Equation (10) is essentially the same as the pure theory trade off relationship in

the Merton model (9), but with the explicit controls for leverage, investment and

expected earnings introduced through q theory.

Implementing (10) is challenging because there is no consensus on the correct

measure of equity costs rE and it is not possible to perfectly proxy for expected profitability π̄. We test two types of equity cost estimates: rE,CAPM based on the capital

asset pricing model (CAPM), and; rE,ICC derived from residual income value models

(RIVM). For expected profitability, we draw on the empirical finance literature to

develop a breadth of current and expectational variables known to reasonably project

movements in firm value. Thus, for each firm i year t observation, we test

(1 − τit )rD,it = α0int ξit + α̃0

(rE,ζ Eit )

Iit /Kit

Vit

+ α̃1

+ α̃3

+ α02 Xit + it

Dit

Dit

Lit

(11)

where Xit is a vector of firm-specific value controls such as cash flow and expected

earnings, each of which is normalized by the firm’s stock of debt in year t−1 per (10).

ξit is a set of classification controls that can include size, industry, corporate policy

indicators and a macroeconomic variable. ζ = {CAPM, ICC} indicates which equity

cost measure is tested. In either case we expect α̃1 < 0 when sufficient controls are

introduced through X and ξ, but without such controls α̃1 is expected to be positive.

(j)

The model also predicts α̃3 < 0 and α2 > 0 for any X (j) ∈ X that is positively

associated with expected earnings.

14

4

Data

Our dataset consists of the Compustat/CRSP merged universe of publicly listed

companies in the United States from fiscal year 1984 (when the daily CRSP data

series begins) through 2014. The Daily CRSP dataset provides end of day stock prices

and factor adjustment returns (for in-year splits and dividends). As in Fazzari et al.

(1988) and Schoder (2014) we exclude observations in which merger or acquisition

expenses (or losses) are greater (less) than 20% of a firm’s operating income. To

control for the influence of outliers the remaining data remain are winsorized at 1%

on both tails. We further require tax-adjusted interest rate (1 − τ )rD and all rE

estimates to be between 0 and 1. To take advantage of the panel nature of the data,

we require firms to appear in the merged dataset for at least 5 consecutive years.

Details of data construction are provided in Appendix B.

4.1

Capital Cost Calculations

Cost of Debt. The cost of debt is proxied by total interest expenses over the stock

of short-term and long-term debt. This measure has the advantage of scaling interest

expenses by the same factor used for all dollar-value covariates in (11), namely total

debt at the start of the fiscal year. To account for the tax deductibility of interest

charges we adjust the interest rate by the average tax rate τ . The effective borrowing

cost measure is therefore the average interest after tax, aiat, for firm i in year t,

aiatit := (1 − τit )rDit .

15

(12)

We keep values of τit and rDit between 0 and 1, thus 0 < aiatit ≤ 1 ∀i, t.

Factor-based Cost of Equity. From daily returns data we calculate standard the

standard 1-factor CAPM and the Fama and French (1992) 3-factor extension for

each firm-year.13 Linear projections of the year’s average returns on these factors

produces two factor-based cost of equity estimations, the average of which we denote

by rE,CAPM . As is standard we require that each year has at least 60 in-year daily

return observations from which to calculate the loading factors.

ICC-based Cost of Equity. The implied cost of equity capital (ICC), denoted

by rE,ICC , equalizes the firm’s stock market value M Vτ at time τ to its expected

dividends, Dτ +t , t = 1, 2, . . . as in the discounted dividend model (Gordon, 1959).

Gebhardt, Lee, and Swaminathan (2001) were among the first to translate this into

a residual income value model (RIVM). RIVMs use “clean surplus” accounting in

which net income N It is allocated either to payouts Dt or added to book equity Bt

(Ohlson, 1995). Book equity therefore evolves according to Bt = Bt−1 + N It − Dt .

Substituting N It − ∆Bt for Dt into the discounted dividend model yields,

M Vτ =

∞

X

Eτ [N Iτ +t − Bτ +t + Bτ +t−1 ]

(1 + rE,ICC )t

∞

X

Eτ ROEτ +t − rE,ICC Bτ +t−1

= Bτ +

(1 + rE,ICC )t

t=1

t=1

13

(13)

The 1-factor model regresses firms’ monthly excess returns (over the 1-month Treasury bill

daily return) on the excess return of a value-weighted portfolio of NYSE, AMEX and NASDAQ

stocks. The 3-factor regression additionally includes: (a) the difference in returns between a highvalue and low-value portfolio (HML, high-minus-low), and; (b) the difference in returns between a

small-cap and large-cap portfolio (SMB, small-minus-big).

16

The implied cost of equity capital, rE,ICC , solves (13).14 The difference between the

return on equity, ROE, and the cost of equity is the firm’s ‘residual income’.

To convert the infinite series in (13) to observable metrics with proxies for expected earnings, we employ the methodology developed by Hou, van Dijk, and Zhang

(2012). They project firms’ cash earnings for up to five years ahead using current balance sheet data.15 In comparing these estimates with analysts’ forecasts, the authors

demonstrate that their method reduces forecast bias, but at the cost of lower forecast

accuracy.16 More importantly, their projections are associated with a significantly

larger earnings response coefficient (ERC), implying the balance sheet projections

better approximate investor expectations. Implementation details are provided in

Appendix C.17 For consistency and convenience we calculate rE,ICC for the same five

residual income models tested in Hou et al. (2012), and add a 5-period finite-horizon

Gordon model.18 Following Hou et al. (2012), we define rE,ICC as the median of the

available ICC estimates for each firm-year observation.

14

Note that the second equality holds with the return on equity defined as ROEt ≡ N It /Bt−1

and by assuming the ‘normal’ growth rate of Bt is equal to investors’ required return.

15

Typically, expectations are proxied by analysts’ earnings predictions available in the I/B/E/S

database. The data loss involved in merging these data with the Compustat/CRSP universe is

substantial; furthermore I/B/E/S coverage is skewed toward larger, well-known firms.

16

Bias is measured difference between forecasted earnings and realized earnings; accuracy is the

absolute value of forecast bias.

17

The original RIVM-based ICC estimates are based on (see Gordon & Gordon, 1997; Gebhardt

et al., 2001; Claus & Thomas, 2001; Easton, 2004; Ohlson & Juettner-Nauroth, 2005). Details of

the RIVMs are in Appendix D.

18

Most models define rE as an implicit polynomial. We use the rootSolve package in R to solve

for rE . We constrain the solution space to rE ∈ [0, 1]. If multiple solutions obtain we select the

result with the smallest absolute difference from that ICC model’s mean estimate.

17

4.2

Summary Statistics

The summary statistics for the tax-adjusted average interest rate aiat, the two

CAPM-based and six RIVM-based estimates of the cost of equity are reported in

Table 1. Because the equity cost estimates, rE,CAPM and rE,ICC , are averages of the

available model-specific measures, aggregation increases the total number of valid

firm-year observations (N = 27, 600). In line with previous studies, ICC estimates

of equity’s cost are generally lower than the factor-based models. Mean estimates

for the ICC rE ’s range from 4.4% for the Claus and Thomas (2001) model to 21%

for the 5-period Gordon and Gordon (1997) model. The rE,ICC mean of 11.0% is

close to the 11.7% rE,CAPM mean, but this largely because of the former’s skewness

(the median values are 6.6% and 10.7%, respectively) and greater variance (12.6%

vs. 6.1%). Indeed, with the exception of the rE,CT model, each of the ICC measures

exhibit this higher variance and skewness. The variability of the model’s response

variable, aiat, is comparable to the rE measures with a mean value of 6.4% and a

standard deviation of 5%.

In the model the marginal cost estimates are scaled by the equity/debt ratio for

which the firm’s stock market value is used for E.19 Table 2 reports correlations of

the full cost of capital estimates, rE E/D, and the marginal cost of debt. As expected

we find a significant positive relationship between aiat and each rE metric. Within

the class of ICC models, there is robust positive correlation amongst the estimates

and correlations of 0.57 and above with average rE,ICC estimate. The average ICC

19

There is no qualitative difference in the results when rE is included as an additional term or

E

in place of rE D

in equation (11). This indicates that our results are driven by the marginal equity

cost measure and not the equity/debt ratio.

18

Table 1: Cost of Capital Summaries

Variable

N

Mean

St. Dev.

Pctl(25)

Median

Pctl(75)

Source

Average Interest After Tax-Deduction

aiat

27,600

0.064

0.050

0.040

0.054

0.073

Implied Cost of Equity Capital Models

rE,GLS

26,073

0.114

0.124

0.042

0.080

0.135

Gebhardt, Lee,

and Swaminathan (2001)

rE,CT

25,841

0.044

0.034

0.030

0.041

0.055

Claus and

Thomas (2001)

rE,OJ

22,113

0.115

0.148

0.032

0.062

0.130

Ohlson and

JuettnerNauroth

(2005)

rE,East

18,799

0.164

0.159

0.065

0.111

0.201

Easton (2004)

rE,G-1

21,794

0.107

0.143

0.029

0.057

0.118

Gordon and

Gordon (1997)

(1 Period)

rE,G-5

21,330

0.212

0.210

0.065

0.135

0.281

Gordon and

Gordon (1997)

(5 Period)

rE,ICC

27,600

0.110

0.126

0.041

0.066

0.126

Median of the

above

Factor-based Cost of Equity Capital Models

rE,1 factor

27,438

0.097

0.042

0.068

0.092

0.122

Standard

CAPM

rE,3 factor

26,947

0.137

0.096

0.082

0.116

0.161

Fama and

French (1992)

rE,CAPM

27,600

0.117

0.061

0.079

0.107

0.142

Mean of the

above

estimate has a correlation of approximately 0.3 with each factor model estimate. The

factor-based models also correlate as expected with aiat, but at a lower magnitude

(≈ 0.08) than the ICC measures.

19

Table 2: Pearson’s Correlations: Equity (rE E/D) and Marginal Debt Costs (aiat)

rE,GLS

rE,CT

rE,OJ

rE,East

rE,G-1

rE,G-5

rE,GLS

rE,CT

rE,OJ

rE,East

rE,G-1

rE,G-5

rE,ICC

aiat

0.11∗

0.16∗

0.25∗

0.26∗

0.25∗

0.26∗

0.22∗

0.43∗

0.28∗

0.36∗

0.63∗

0.68∗

0.57∗

0.31∗

0.77∗

0.35∗

0.55∗

0.78∗

0.50∗

0.97∗

0.63∗

0.64∗

0.60∗

0.81∗

0.84∗

0.87∗

0.76∗

0.87∗

rE,1 factor

rE,3 factor

rE,CAPM

0.08∗

0.07∗

0.08∗

0.11∗

0.17∗

0.16∗

0.71∗

0.66∗

0.71∗

0.11∗

0.11∗

0.11∗

0.43∗

0.49∗

0.49∗

0.11∗

0.12∗

0.12∗

0.25∗

0.30∗

0.29∗

∗

4.3

rE,ICC

rE,1 factor

rE,3 factor

0.31∗

0.32∗

0.33∗

0.81∗

0.91∗

0.98∗

p < 0.01.

Control Variables

To avoid the use of noisy market capitalization values, annual share values are determined by the average of the firm’s daily closing prices in each year smooth by a

low-pass filter. Market capitalization is this value scaled by the number of outstanding shares. Total enterprise value, V in (11), is the sum of market capitalization and

book value assets less the value of preferred equity and deferred taxes (see Frank &

Shen, 2015). As with all other continuous variables, the inverse of market leverage

is enterprise value scaled by the start-of-year debt load,

V

.

D

The investment rate

I/K is measured by capital expenditures over the net value of plant, property and

equipment at the start of the fiscal year and is scaled up by the former ratio per

equation 11. A full description of variable construction is in Appendix B.

A multitude of proxies for expected profitability, M , are embedded in X. The

20

baseline earnings controls are current net income N I and the next three year’s expected earnings N It+j , j = 1, 2, 3 generated by the Hou et al. (2012) methodology.

In an extended version of the model we include operating income cash flow cf , total accruals of short-term assets, AC, and total shareholder payouts (buybacks plus

dividends). All seven of these variables are normalized by start-of-period debt.

In addition, full controls in X include growth in sales from the previous year

∆SALE, growth in total assets gT A, and year-on-year shareholding capital gains

dP . Two binary variables, N oDLC and recession indicate if the firm has no shortterm debt and/or if the economy is in contraction, respectively.

Three standard risk metrics are also included. From the empirical finance literature, expected profitability is expected to correlate negatively with systemic risk,

proxied by the log of the book equity to market equity (BM ) (Fama & French, 1992,

1993; Hahn, O’Neill, & Swisher, 2010) and the Ohlson (1980) score of bankruptcy

risk, OH.20 Thirdly, following Kogan and Papanikolaou (2013), firms’ idiosyncratic

volatility ivol is derived from residuals from the 1 factor CAPM regression. That is,

as described in §4.1, from the rolling regressions

(realized return premium)it = αit + βit (market return premium)t + it

(14)

we obtain the market-β factor loadings to estimate rE,CAPM , as well as the metp

ric ivol = var(it ). Thus, the data used to estimate rE,CAPM and ivol are, by

construction, orthogonal.

20

Despite its age, OH is still used to explain portfolio returns (e.g., Griffin & Lemmon, 2002;

Fama & French, 2006).

21

4.4

Subsetting by Observed Equity Market Policy

Repurchases have become an important mechanism for payout policy (Allen & Michaely,

2002; Bonaimé, Hankins, & Jordan, 2015), but it is unclear how – if at all – they affect firms’ weighted average cost of capital.21 While it is tempting to simply compare

aggregate share repurchases to issuances over any particular time period (e.g. van

Rixtel & Villegas, 2015), such an approach is unlikely to capture a firm’s persistent

interactions “over the long pull” since a single large repurchase program can easily

swamp the sum of occasional seasoned equity issuances. To avoid these outlier-type

issues of firm’s typical behavior we develop an ordinal categorization to uniquely

group each firm in the sample.

Firms are categorized as share “repurchasers” or “issuers” as follows. In each

year the number of shares repurchased (issued) is estimated by dividing the amount

spent (raised) by the smoothed annual share price. The number of years the firm

buys back and/or issues more than 1% of its outstanding shares are counted. Firms

for which the number of significant share repurchasing years are greater than the

number of significant share issuing years are classified as “repurchasers”; they are

“issuers” if the converse holds. Firms with no or an equal number of significant

issuing/repurchasing years are classified as “neither”. To save space we do not report

results for the “neither” group here.22

21

As one recent example, Chay, Park, Kim, and Suh (2015) test pecking order theory. In doing

so, they remove all observations in which firms repurchase more equity than they issue because

“negative values of internal and external funds do not represent financing and thus including them

could hamper proper interpretation of the relative role of internal and external funds in financing

investments” (p. 150). This assumes repurchases should not be seen as a negative cost and implies

that equity somehow differs qualitatively when it is issued versus when it is repurchased by the firm.

22

These results are available upon request

22

5

The Structure of Linear Mixed Effects

Mixed effect (ME) coefficients allow selected covariates differ by factor groups (e.g.,

firm ID and year). This is achieved by treating k covariate coefficients as random

variables. The vector-valued random variable coefficients b ∈ B produce the conditional distribution of the n × 1 response variable vector Y|B, which is aiat in our case

and n is the number of firm-year observations (Bates, Mächler, Bolker, & Walker,

forthcoming). For a multivariate Gaussian distribution this is

Y|(b = B) ∼ N Xβ + Zb, σ 2 I ,

where B ∼ N (0, Σθ ).

(15)

X is the n × p matrix of fixed effect, or pooled, coefficients as in a standard linear

model.23 Z is n × q matrix of random effects. For any covariate in Z that is also

included in X, a mixed-effects coefficient is obtained. Since mixed-effects are specified for each group j ∈ J, Z consists of J non-zero blocks each with k columns of

covariates and nj rows (i.e., the number of members i in group j). Thus, q = J · k

and the j[i]th row of Z is zero in all columns corresponding to J \ j.

The minimization of the residuals from (15) maximizes the joint distribution of

Y and B (see Bates, 2010, Chapter 5). Gelman and Hill (2007, ch. 12-13) offer an

intuitive interpretation of the k resultant β, b coefficients as “shrinkage” or “pooling”

toward toward the grand mean. Consider a univariate model with a pooled covariate

23

Gelman (2005) argues that the terms ‘fixed effect’ and ‘random effect’ have become unmanageably muddled. We use ‘pooled’ and ‘unpooled’ to refer to, respectively, ‘fixed’ and ‘random’ effects,

in the sense of a standard OLS estimate versus an analysis of variance model (i.e., not in the sense

of a random intercept vs. a random slope, which are both random effects in an LMM structure).

23

xi and a mixed-effect intercept, which can be written as

yi = αj[i] + βxi + i

where, i ∼ N (0, σy2 ) and αj ∼ N (µα , σα2 ). Here, β is the pooled slope coefficient and

αj[i] is the group-specific intercept drawn from an uncentered normal distribution.

Each intercept is approximated by a weighted average between the in-group mean

(ȳj − x̄j β) and the grand mean (µα ),

αj ≈

nj /σy2

1/σα2

·

(ȳ

−

x̄

β)

+

· µα

j

j

nj /σy2 + 1/σα2

nj /σy2 + 1/σα2

(16)

where nj is the number of observations in the j th group. From (16) it is evident

that for relatively smaller groups more weight is put on the overall mean; for higher

inter-group variability (σα2 large) more weight is placed on the in-group mean.

In terms of equation (15), each αj in (16) is equivalent to the sum of the corresponding j[i]th elements in vectors β and b. The intuition in (16) applies to any

number of ME intercept and slope coefficients, but the weighting factors become

increasingly complex. Even though each group-level ME coefficient is determined

in the LMMs below, the ME coefficients reported are the mean of these estimates,

P

namely ᾱ = J −1 j αj . The R package lme4 is used with the restricted-estimation

maximum likelihood (REML) algorithm to compute all mixed effects models.

Crossed Effects Mixed Models. In the mixed effects models specified below,

all intercept terms are the average of partially pooled firm-specific constants. In

24

terms of equation (16), x̄j = 1 for each j th firm and nj is the number of years

the firm appears in the merged dataset. The cost of equity estimates, rE,CAPM or

rE,ICC , are implemented as crossed, or un-nested, mixed effects. This means the

rE slope coefficients are partially pooled across each firm over time and across all

firms within each year. In other words, the crossed mixed effect structure provides for

simultaneous idiosyncratic (i.e., firm-specific) and macroeconomic (i.e., time-specific)

variations in our estimate of the covariance of the components of the weighted average

cost of capital.

The generic form of the crossed effects models tested is

aiati,t = Xit β + Zj[i,t] bj + it

∀i, t

(17)

where it ∼ N (0, σ), ∀i, t and bj ∼ N (0, Σθ ), ∀j as in equation (15). Equation (17)

restates equation (11), but with all covariates bundled into Xit . The random effects

matrix Zj[i,t] matrix has q columns equal to the total number of factors (no. of firms +

no. of years). The unreplicated crossed design of the data gives the sparse Z matrix

a block diagonal structure in which the firm-specific blocks allow for covariation

between the intercept and rE random effects (see Bates, 2010, ch. 2 for details).

Finally, the mixed models approach also allows for group-level predictors since

their coefficient estimate will simply assign a weight of zero to the in-group variability

(Gelman & Hill, 2007, §12.6). Hence, in addition to the theoretical control variables,

we include tbond to control for annual changes in the 10-year risk-free rate of interest

in all specifications. In certain specifications, we include either a dummy of the firm’s

average total assets quintile, sizeIV , or a 5-sector industry dummy SIC.

25

6

Results

6.1

Repurchasing vs. Issuing Firms

The four tables below report the crossed effects model results for six specifications

for share issuing firms (Tables 3, 5) and repurchasing firms (Tables 4, 6), depending

whether the factor-based model (Tables 3, 4) or ICC measure (Tables 5, 6) of equity

costs is specified. In each case, the linear model is fit to the log of aiat.24 Intercept

estimates are partially pooled toward firm-specific information and the grand mean

E

coefficients are generated by a partial cross pooling of

estimate. Similarly, the rE D

firm-specific, year-specific and full sample estimates (see Sec. 5). Note, that all other

continuous variables are normalized by their ungrouped sample mean and variance

so as to aid convergence of the REML algorithm.

The ME Models 1 through 6 employ an increasing number of covariates. Model

1 looks at the direct covariation of rE with log(aiat), controlling only for the constant term and risk-free interest rate, tbond. Model 2 adds the inverse of market

leverage

V

D

and the investment-leverage ratio

I/K

L

as determined in (10). Model 3

adds current earnings N I, and expected earnings N It+1,2,3 estimated by the Hou

24

The log transformation of aiat renders a better fit with the Gaussian distribution assumed by

the REML algorithm as compared to aiat (see Appendix E). Identical tests have been run on aiat

directly, and do not differ substantially from the log(aiat) results presented here. These are available

upon request. It is further worth noting that the sample distribution of aiat approximates the Log

Normal distribution more closely than the log-transformed normal distribution, or Weibull (e.g.,

exponential) distributions. However, the Generalized Linear Mixed Model (GLMM) algorithm

in lme4 required for a Log Normal maximum likelihood estimation is plagued with convergence

problems – GLMM optimization routine failures are persistent for large samples and/or multifactor

models, as we have here. Many of the GLMM results are therefore unreliable. They are, with

caution, also available upon request.

26

et al. (2012) methodology, and firms’ idiosyncratic volatility ivol as baseline proxies

for π̄t . Recognizing these proxies will fail to fully control for firms’ intrinsic value

and expected marginal profit, Models 4 through 6 introduce ten additional variables

typically found in the financial forecasting literature.

In addition, Model 5 includes the industry SIC dummy variable, whereas Model

6 adds a sizeIV dummy for firms’ average asset quintile. These two firm-invariant

controls can be included in LMMs (unlike standard variance-component approaches)

because the indicator simply gets embedded in each firm’s intercept estimate. However, including two (or more) group-level variables would lead to overdetermination

of the group-specific estimates (i.e., within the firm, or within the year). These classification variables are important because Modigliani and Miller (1958, p. 267, fn. 9)

are explicit that their theorem applies to firms within the same class, which they

note is closely related, but not identical, to the firm’s industry of operation. We

return to this issue in §6.2 below.

Capital Cost Component Correlations. The theoretical model predicts that

with few value and expectational controls, the costs of debt and equity should covary

positively. This is indeed the case across Models 1-3 in which positive covariation

cov(rE , rD ) > 0 is found to be significant at the 1% level in each specification (save

for share issuing firms in Model 3 for which the rE,ICC coefficient is significant at

the 5% level). As expected, the baseline proxies do not sufficiently control for firm

value and expected profitability. It is notable that for both equity costs measures

in Models 1 to 3, share issuing firms exhibit a lower magnitude of covariation with

log(aiat) than do their repurchasing counterparts: 0.007 compared to 0.035 for the

27

CAPM measure, and 0.11 versus 0.16 for the ICC measure. Yet, in each case the

rE,ICC specifications exhibit greater covariation than the rE,CAPM estimates.

The rE,CAPM correlation with log(aiat) among share issuing firms falls from 0.007

in Model 1 to 0.001 in Model 3 (see Table 3). In Models 4 through 6, the average

correlation coefficient becomes negative as predicted, but is too small in magnitude

to be significantly below zero. Among share repurchasing firms in Table 4, a similar

but less pronounced pattern is observed. The rE,CAPM coefficient falls from 0.035

in Model 1 to 0.025 in Model 3 and remains significant at the 1% level. Through

Models 4-6 the correlation again loses significance, but the point estimate remains

positive for the repurchasers. Preliminarily, we note that the equity cost covariation

with debt costs is an order of magnitude greater among buyback firms versus share

issuing firms in each model.

Share repurchasing firms under the rE,ICC specification also exhibit a higher magnitude of covariation with log(aiat) than do issuers (cf. Tables 6 and 6). However,

for both subsets the covariation remains positive and significant at the 1% level in

all models. Nevertheless, there is again a noticeable difference in the rate of decline

in the correlations in moving from Model 1 to Models 4-6. For share issuing firms

the rE coefficient’s magnitude is 70% lower when all controls are introduced versus a

relative decline of only 40% for the share repurchasing firms. These imperfect results

suggest further refinements to the dataset or better proxies many help uncover the

tradeoff relationship between rE and rD posited by standard capital structure theory.

Before turning to this, we discuss the other covariate estimates.

28

Table 3: Share Issuing Firms, log(aiat) ∼ rE,CAPM

(Intercept)

rE,CAPM E/D

tbond

Model 1

Model 2

Model 3

Model 4

Model 5

Model 6

−2.8457∗∗

(0.0113)

0.0065∗∗

(0.0009)

0.1960∗∗

(0.0072)

−2.8401∗∗

(0.0113)

0.0037∗∗

(0.0007)

0.1948∗∗

(0.0072)

−0.0095

(0.0148)

0.0508∗∗

(0.0108)

−2.8568∗∗

(0.0108)

0.0010∗

(0.0004)

0.2002∗∗

(0.0070)

−0.0309∗

(0.0138)

0.0618∗∗

(0.0097)

−0.0593∗∗

(0.0071)

0.0819∗∗

(0.0178)

−0.1465∗∗

(0.0282)

0.1391∗∗

(0.0178)

0.0536∗∗

(0.0061)

No

No

No

−2.8570∗∗

(0.0111)

−0.0005

(0.0007)

0.1870∗∗

(0.0068)

−0.0096

(0.0134)

0.0226∗

(0.0090)

−0.2579∗∗

(0.0106)

0.0918∗∗

(0.0170)

−0.1116∗∗

(0.0268)

0.0714∗∗

(0.0171)

0.0554∗∗

(0.0058)

0.0488∗∗

(0.0098)

−0.0294∗∗

(0.0073)

0.1941∗∗

(0.0106)

0.0712∗∗

(0.0045)

0.0584∗∗

(0.0047)

−0.0222∗∗

(0.0044)

0.0186∗∗

(0.0066)

−0.1106∗∗

(0.0206)

No

−2.7916∗∗

(0.0344)

−0.0005

(0.0006)

0.1871∗∗

(0.0069)

−0.0095

(0.0134)

0.0226∗

(0.0091)

−0.2575∗∗

(0.0106)

0.0915∗∗

(0.0170)

−0.1122∗∗

(0.0268)

0.0722∗∗

(0.0171)

0.0548∗∗

(0.0059)

0.0490∗∗

(0.0098)

−0.0300∗∗

(0.0073)

0.1937∗∗

(0.0106)

0.0710∗∗

(0.0045)

0.0583∗∗

(0.0047)

−0.0224∗∗

(0.0044)

0.0192∗∗

(0.0066)

−0.1167∗∗

(0.0208)

SIC

−2.8057∗∗

(0.0233)

−0.0005

(0.0007)

0.1842∗∗

(0.0070)

−0.0095

(0.0133)

0.0227∗

(0.0090)

−0.2582∗∗

(0.0106)

0.0922∗∗

(0.0170)

−0.1083∗∗

(0.0268)

0.0666∗∗

(0.0172)

0.0526∗∗

(0.0060)

0.0498∗∗

(0.0098)

−0.0267∗∗

(0.0074)

0.1942∗∗

(0.0106)

0.0713∗∗

(0.0045)

0.0580∗∗

(0.0047)

−0.0216∗∗

(0.0044)

0.0182∗∗

(0.0066)

−0.1118∗∗

(0.0206)

sizeIV

0.1158

0.0000

0.0000

0.2067

0.1168

0.0000

0.0000

0.2069

0.1021

0.0000

0.0000

0.2025

0.1026

0.0000

0.0000

0.1798

0.1018

0.0000

0.0000

0.1798

0.1024

0.0000

0.0000

0.1797

V

D

I/K

L

NI

N It+1

N It+2

N It+3

ivol

SHpay

BM

cf

∆AT

AC

dP

OH

N oDLC

IV included

Variances

Firm’s Intercept

Firm’s rE

Annual rE

residual

∗∗ p

< 0.01 (bold face), ∗ p < 0.05. Each model contains 9,648 observations across 1,164 firms and 31 years. Standard

Errors in parentheses.

29

Table 4: Buyback Firms, log(aiat) ∼ rE,CAPM

(Intercept)

rE,CAPM E/D

tbond

Model 1

Model 2

Model 3

Model 4

Model 5

Model 6

−3.0405∗∗

(0.0108)

0.0348∗∗

(0.0043)

0.2092∗∗

(0.0061)

−3.0307∗∗

(0.0109)

0.0323∗∗

(0.0043)

0.2091∗∗

(0.0061)

0.1049∗∗

(0.0293)

−0.0182

(0.0241)

−3.0163∗∗

(0.0110)

0.0254∗∗

(0.0044)

0.2084∗∗

(0.0061)

0.0929∗∗

(0.0292)

−0.0086

(0.0240)

0.0183

(0.0114)

−0.0520

(0.0284)

−0.0008

(0.0466)

0.1053∗∗

(0.0322)

0.0179∗∗

(0.0066)

No

No

No

−2.9786∗∗

(0.0114)

0.0057

(0.0045)

0.1873∗∗

(0.0064)

0.0755∗∗

(0.0286)

−0.0284

(0.0229)

−0.1759∗∗

(0.0155)

−0.0786∗∗

(0.0271)

0.0889∗

(0.0444)

0.0119

(0.0308)

0.0289∗∗

(0.0064)

0.0548∗∗

(0.0041)

0.0045

(0.0082)

0.1358∗∗

(0.0128)

0.1174∗∗

(0.0070)

0.0584∗∗

(0.0053)

−0.0158∗∗

(0.0053)

0.0030

(0.0116)

−0.1276∗∗

(0.0202)

No

−2.9328∗∗

(0.0541)

0.0059

(0.0045)

0.1887∗∗

(0.0064)

0.0769∗∗

(0.0286)

−0.0298

(0.0229)

−0.1760∗∗

(0.0155)

−0.0775∗∗

(0.0271)

0.0884∗

(0.0444)

0.0117

(0.0308)

0.0291∗∗

(0.0064)

0.0547∗∗

(0.0041)

0.0044

(0.0082)

0.1359∗∗

(0.0128)

0.1168∗∗

(0.0070)

0.0583∗∗

(0.0053)

−0.0159∗∗

(0.0053)

0.0038

(0.0116)

−0.1291∗∗

(0.0202)

SIC

−2.9600∗∗

(0.0325)

0.0058

(0.0045)

0.1889∗∗

(0.0064)

0.0785∗∗

(0.0286)

−0.0292

(0.0229)

−0.1770∗∗

(0.0155)

−0.0779∗∗

(0.0271)

0.0889∗

(0.0444)

0.0111

(0.0309)

0.0313∗∗

(0.0064)

0.0547∗∗

(0.0041)

0.0069

(0.0082)

0.1365∗∗

(0.0128)

0.1174∗∗

(0.0070)

0.0586∗∗

(0.0053)

−0.0161∗∗

(0.0053)

0.0107

(0.0118)

−0.1249∗∗

(0.0202)

sizeIV

0.0719

0.0033

0.0000

0.1631

0.0706

0.0032

0.0000

0.1630

0.0709

0.0029

0.0000

0.1617

0.0745

0.0025

0.0000

0.1452

0.0728

0.0025

0.0000

0.1453

0.0730

0.0025

0.0000

0.1452

V

D

I/K

L

NI

N It+1

N It+2

N It+3

ivol

SHpay

BM

cf

∆AT

AC

dP

OH

N oDLC

IV included

Variances

Firm’s Intercept

Firm’s rE

Annual rE

residual

∗∗ p

< 0.01 (bold face), ∗ p < 0.05. Each model contains 8,619 observations across 864 firms and 31 years. Standard Errors

in parentheses.

30

Table 5: Share Issuing Firms, log(aiat) ∼ rE,ICC

(Intercept)

rE,ICC E/D

tbond

Model 1

Model 2

Model 3

Model 4

Model 5

Model 6

−2.9034∗∗

(0.0113)

0.1142∗∗

(0.0108)

0.1971∗∗

(0.0070)

−2.9023∗∗

(0.0113)

0.1089∗∗

(0.0108)

0.1957∗∗

(0.0070)

−0.0326∗∗

(0.0121)

0.0518∗∗

(0.0100)

−2.9196∗∗

(0.0113)

0.1097∗∗

(0.0112)

0.1955∗∗

(0.0069)

−0.0383∗∗

(0.0120)

0.0594∗∗

(0.0100)

−0.0620∗∗

(0.0084)

0.0861∗∗

(0.0210)

−0.1404∗∗

(0.0326)

0.0801∗∗

(0.0218)

0.0557∗∗

(0.0059)

No

No

No

−2.8786∗∗

(0.0118)

0.0318∗∗

(0.0088)

0.1832∗∗

(0.0068)

−0.0215

(0.0117)

0.0267∗∗

(0.0095)

−0.2707∗∗

(0.0128)

0.0943∗∗

(0.0199)

−0.1029∗∗

(0.0308)

0.0497∗

(0.0204)

0.0563∗∗

(0.0058)

0.0476∗∗

(0.0108)

−0.0199∗∗

(0.0073)

0.2012∗∗

(0.0129)

0.0727∗∗

(0.0045)

0.0552∗∗

(0.0049)

−0.0237∗∗

(0.0043)

0.0183∗∗

(0.0064)

−0.0995∗∗

(0.0203)

No

−2.8154∗∗

(0.0343)

0.0314∗∗

(0.0088)

0.1834∗∗

(0.0068)

−0.0209

(0.0117)

0.0267∗∗

(0.0095)

−0.2703∗∗

(0.0128)

0.0945∗∗

(0.0198)

−0.1043∗∗

(0.0308)

0.0510∗

(0.0204)

0.0559∗∗

(0.0058)

0.0477∗∗

(0.0107)

−0.0205∗∗

(0.0073)

0.2008∗∗

(0.0129)

0.0726∗∗

(0.0045)

0.0551∗∗

(0.0049)

−0.0239∗∗

(0.0043)

0.0188∗∗

(0.0064)

−0.1054∗∗

(0.0205)

SIC

−2.8320∗∗

(0.0239)

0.0311∗∗

(0.0088)

0.1810∗∗

(0.0069)

−0.0212

(0.0117)

0.0268∗∗

(0.0095)

−0.2715∗∗

(0.0128)

0.0948∗∗

(0.0198)

−0.0994∗∗

(0.0308)

0.0455∗

(0.0205)

0.0540∗∗

(0.0059)

0.0485∗∗

(0.0108)

−0.0178∗

(0.0074)

0.2013∗∗

(0.0129)

0.0729∗∗

(0.0045)

0.0551∗∗

(0.0049)

−0.0231∗∗

(0.0043)

0.0180∗∗

(0.0064)

−0.1002∗∗

(0.0203)

sizeIV

0.1062

0.0262

0.0007

0.1828

0.1059

0.0247

0.0007

0.1825

0.0965

0.0257

0.0006

0.1805

0.0993

0.0103

0.0003

0.1674

0.0987

0.0101

0.0003

0.1674

0.0992

0.0103

0.0003

0.1673

V

D

I/K

L

NI

N It+1

N It+2

N It+3

ivol

SHpay

BM

cf

∆AT

AC

dP

OH

N oDLC

IV included

Variances

Firm’s Intercept

Firm’s rE

Annual rE

residual

∗∗ p

< 0.01 (bold face), ∗ p < 0.05. Each model contains 9,648 observations across 1,164 firms and 31 years. Standard

Errors in parentheses.

31

Table 6: Buyback Firms, log(aiat) ∼ rE,ICC

(Intercept)

rE,ICC E/D

tbond

Model 1

Model 2

Model 3

Model 4

Model 5

Model 6

−3.0851∗∗

(0.0120)

0.1573∗∗

(0.0196)

0.1985∗∗

(0.0066)

−3.0835∗∗

(0.0120)

0.1554∗∗

(0.0196)

0.1986∗∗

(0.0066)

0.0317

(0.0245)

−0.0118

(0.0220)

−3.0922∗∗

(0.0132)

0.1990∗∗

(0.0232)

0.1984∗∗

(0.0066)

0.0267

(0.0244)

−0.0043

(0.0221)

−0.0125

(0.0131)

−0.0669∗

(0.0313)

−0.0413

(0.0517)

0.0836∗

(0.0373)

0.0172∗∗

(0.0064)

No

No

No

−3.0195∗∗

(0.0137)

0.0940∗∗

(0.0234)

0.1783∗∗

(0.0070)

0.0350

(0.0241)

−0.0165

(0.0213)

−0.1611∗∗

(0.0172)

−0.0633∗

(0.0301)

0.0134

(0.0496)

0.0566

(0.0358)

0.0242∗∗

(0.0063)

0.0491∗∗

(0.0044)

0.0100

(0.0078)

0.0943∗∗

(0.0151)

0.1151∗∗

(0.0068)

0.0610∗∗

(0.0055)

−0.0158∗∗

(0.0052)

0.0035

(0.0115)

−0.1284∗∗

(0.0200)

No

−2.9814∗∗

(0.0557)

0.0948∗∗

(0.0235)

0.1798∗∗

(0.0070)

0.0360

(0.0241)

−0.0176

(0.0213)

−0.1612∗∗

(0.0172)

−0.0616∗

(0.0301)

0.0119

(0.0496)

0.0563

(0.0358)

0.0244∗∗

(0.0063)

0.0491∗∗

(0.0044)

0.0102

(0.0078)

0.0944∗∗

(0.0151)

0.1145∗∗

(0.0068)

0.0608∗∗

(0.0055)

−0.0157∗∗

(0.0052)

0.0035

(0.0115)

−0.1298∗∗

(0.0200)

SIC

−2.9976∗∗

(0.0350)

0.0940∗∗

(0.0234)

0.1802∗∗

(0.0070)

0.0367

(0.0241)

−0.0167

(0.0213)

−0.1621∗∗

(0.0172)

−0.0617∗

(0.0301)

0.0126

(0.0497)

0.0557

(0.0359)

0.0265∗∗

(0.0064)

0.0491∗∗

(0.0044)

0.0123

(0.0078)

0.0944∗∗

(0.0151)

0.1151∗∗

(0.0068)

0.0612∗∗

(0.0055)

−0.0159∗∗

(0.0053)

0.0104

(0.0116)

−0.1259∗∗

(0.0200)

sizeIV

0.0839

0.0682

0.0039

0.1506

0.0837

0.0681

0.0039

0.1505

0.0832

0.0714

0.0048

0.1493

0.0808

0.0524

0.0043

0.1380

0.0804

0.0526

0.0043

0.1379

0.0805

0.0523

0.0043

0.1379

V

D

I/K

L

NI

N It+1

N It+2

N It+3

ivol

SHpay

BM

cf

∆AT

AC

dP

OH

N oDLC

IV included

Variances

Firm’s Intercept

Firm’s rE

Annual rE

residual

∗∗ p

< 0.01 (bold face), ∗ p < 0.05. Each model contains 8,619 observations across 864 firms and 31 years. Standard Errors

in parentheses.

32

Value and Expectational Control Variables. The risk-free interest rate exhibits a persistent correlation with log(aiat) at around 0.2 across each model and

specification. The investment and leverage variables, included in Model 2 onwards,

have greater similarities across policy groups than between equity cost specifications.

While there is no formal prediction on the sign of

V

,

D

the ‘common sense’ negative

relationship is consistently found for both sets of share issuing firms, though it does

not achieve significance at the 5% level in Models 4 through 6. Among share repurchasing firms,

V

D

is consistently positive and, for rE,CAPM , significant at the 1% level

in all models. Conversely, the predicted negative relationship between aiat and

I/K

L

is found consistently among buyback firms, but with no instance of significance. The

opposite holds for issuers:

I/K

L

is significant and positively related to interest costs

in each model. Although these result are somewhat mixed, consistent differences

between the share repurchasing and issuing firms supports the argument that there

are important valuation differences between these qualitatively distinct groups.

Current earnings, N I, are consistently negatively related to current interest costs

across Models 3-6 in each specification, and significant at the 1% level in all but

two cases (namely, Model 3 for repurchasing firms). This result is not unexpected

as higher earning firms are less cash constrained. The expected earnings measures

N It+1,2,3 are positively related to log(aiat) as predicted in (11). Although the signs

for these three estimates vary, the sum of each model’s coefficients is positive.

In the full control Models 4-6 shareholder payouts (SHpay), cash flows (cf ), asset

growth (∆AT ), and accruals (AC) are taken as signals of future firm performance.

Consistent with the theoretical predictions in (11), each of these forecasting vari-

33

ables are positively and significantly related to interest costs across all models and

specifications. The stock market capital gains, ∆P , is also in line with expected

results: The negative correlation between share price growth and interest costs in

each specification implies a positive covariation between the the value of bonds and

stocks as in Merton’s theory (see §3.2). The Ohlson score measure of bankruptcy

risk is also positive and significant across the models as expected, but significant only

among share issuing firms. Sales growth is the only variable insignificant across all

models and specifications, and has therefore been suppressed in the tables.

Finally, the ordinal and binary indicators generally behave as expected. The

indicator for no short-term debt is associated with a lower interest rate burden,

significant at the 1% level in all models. The sizeIV levels (Model 6; not shown)

have mixed coefficients, but only negative coefficients are significant at the 5% level

or less in each specification. That is, we find firm size is either not statistically

significant for interest costs or is associated with lower borrowing rates. We have no

prior expectation for which industries typically face lower or higher interest costs,

but the categorical variable SIC (Model 5) has some significance in each case except

for share repurchasing firms under the rE,ICC specification.

Model Comparison. As mentioned, MM theory is applicable to firms of the same

“class”, but we are limited to one firm-specific classification variable in the LMM

structure. We would therefore like to subset the dataset further into their true

classes. It also important to verify that the SIC and/or sizeIV classifications contain relevant information. Since Models 1-4 are sequentially nested, and Models 5

and 6 are nested within 4, we conduct ANOVA tests that also allow us to ensure

34

the data are not overfit. Tables 7 and 8 display the test results for the rE,CAPM and

rE,ICC models, respectively. In spite of the large number of covariates included in

Model 4, there is consistent and robust support for implementing this full model as

compared to the simpler version in Model 3.

Table 7: Anova Tests for Models with rE,CAPM

Issuance Firms

Model

AIC

BIC

logLike

1

2

3

4

SIC

sizeIV

14312.40

14284.24

13904.89

12897.77

12893.99

12896.08

14369.79

14355.98

14012.51

13069.96

13094.88

13096.97

-7148.20

-7132.12

-6937.45

-6424.88

-6419.00

-6420.04

BIC

logLike

deviance

Chisq

Chi Df

Pr(>Chisq)

14296.40

14264.24

32.16

13874.89 389.35

12849.77 1025.12

12837.99

11.78

12840.08

9.68

2

5

9

4

4

0.0000

0.0000

0.0000

0.0191

0.0461

Buyback Firms

Model

1

2

3

4

SIC

sizeIV

AIC

deviance

Chisq

Chi Df

Pr(>Chisq)

10679.40 10735.90 -5331.70 10663.40

10659.18 10729.80 -5319.59 10639.18

10589.37 10695.30 -5279.68 10559.37

9765.49 9934.97 -4858.75 9717.49

9755.47 9953.20 -4849.73 9699.47

9755.68 9953.40 -4849.84 9699.68

24.23

79.81

841.88

18.02

17.82

2

5

9

4

4

0.0000

0.0000

0.0000

0.0012

0.0013

The F-tests for Models 5 and 6 are against Model 4 in which both are nested.

The ANOVA tests confirm that firms’ industry classification contains important

information: In all four cases the informational content of Model 5 is significantly

better than 4 at the 5% level for share issuing firms, and at the 1% level for share

repurchasers. The sizeIV ordinal measure provides a marginal improvement over

35

Model 4. For share buyback firms, the informational improvement is robust with p

values less than 1%. For share issuing firms, however, the informational content of

sizeIV has a p-value of 4.6% for the rE,CAPM specification, and over 10% for rE,ICC .

Therefore, in refining the analysis below, we keep the firm-size indicator, but find

more utility with industry classification. We therefore subset firms into four SIC

groups, and include a sizeIV for quintile within each industry. This has the added

benefit of being closer to the theoretical position of MM theory.

Table 8: Anova Tests for Models with rE,ICC

Issuance Firms

Model

AIC

BIC

logLike

1

2

3

4

SIC

sizeIV

13704.95

13677.77

13511.71

12677.11

12673.54

12677.38

13762.34

13749.51

13619.33

12849.30

12874.42

12878.26

-6844.47

-6828.88

-6740.86

-6314.56

-6308.77

-6310.69

BIC

logLike

deviance

Chisq

Chi Df

Pr(>Chisq)

13688.95

13657.77 31.18

13481.71 176.05

12629.11 852.60

12617.54 11.58

12621.38

7.73

2

5

9

4

4

0.0000

0.0000

0.0000

0.0208

0.1018

Chisq

Chi Df

Pr(>Chisq)

10310.31 10366.81 -5147.16 10294.31

10310.66 10381.28 -5145.33 10290.66

3.65

10263.29 10369.22 -5116.64 10233.29 57.37

9580.77 9750.25 -4766.38 9532.77 700.52

9573.78 9771.50 -4758.89 9517.78 14.99

9571.70 9769.42 -4757.85 9515.70 17.07

2

5

9

4

4

0.1609

0.0000

0.0000

0.0047

0.0019

Buyback Firms

Model

1

2

3

4

SIC

sizeIV

AIC

deviance

The F-tests for Models 5 and 6 are against Model 4 in which both are nested.

36

6.2

Mixed Effects by Industry Groups

The subsamples of repurchasing and share issuing firms are here further divided into

four industry classifications: Manufacturing (Man); Business and Consumer Services

(Svc); Transportation, Communication and Energy (TCE); and, Wholesale and Retail Trade (WRT). Furthermore, given the imperfect fit of the log-transformed sample

distribution of aiat, we refine the admissible set of interest rates. In the above analysis any positive, tax-adjusted average interest rate less than 100% was admissible.

By limiting average interest rates to the far more reasonable the range of 1-30%,

the log-transformed Gaussian distribution of aiat is now the best fit (see Appendix

E).25 These restrictions reduce the fifth industry group – agriculture, mining and

construction (AMC) – to fewer than 140 unique firms, of which only 31 are share

repurchasers. We have therefore omitted the AMC group from the analysis. The

remaining four industry groups are tested according to Model 6. To save space, only

the coefficients of interest are reported in Tables 9 through 12.

E

and log(aiat) are posiAs before, the industry-specific correlations between rE D

tive for all share repurchasing firms for both equity cost measures. Repurchasers in

the Manufacturing, WRT and TCE sectors retain highly significant rE,ICC estimate

correlations with the cost of debt. In the service sector, share repurchasers’ rE,CAPM

estimate covaries significantly (at the 1% level) with the cost of debt. Thus, for each

industry group, we find at least one instance of persistent and statistically significant

deviations from the MM postulates discussed in Section 3.

25

The distribution of aiat ∈ [0.01, 0.3] itself remains too skewed and heavy-tailed to be well

approximated by the Gaussian distribution directly.

37

Table 9: Model 6 for SIC Manufacturing

Response Variable: log(aiat)

rE,CAPM

rE,ICC

Repurchasers

Issuers

Repurchasers

Issuers

sizeIV included

0.0047

(0.0038)

0.0836∗∗

(0.0259)

−0.0301

(0.0204)

yes

0.0003

(0.0011)

−0.0217

(0.0230)

0.0213

(0.0152)

yes

0.1118∗∗

(0.0229)

0.0236

(0.0224)

0.0032

(0.0199)

yes

0.0122

(0.0097)

−0.0358

(0.0196)

0.0301∗

(0.0142)

yes

Log Likelihood

Total Obs.

No. Firms

No. Years

-1673.7298

4412

444

31

-2244.7773

3898

502

31

-1595.5542