Workshop on International Law, Natural Resources and Sustainable Development

advertisement

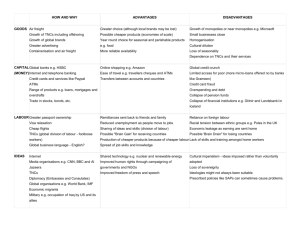

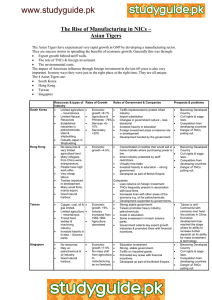

Workshop on International Law, Natural Resources and Sustainable Development Unitary Taxation of TNCs and its Relevance for Natural Resource Industries Sol Picciotto School of Law, University of Lancaster Heightened concern about the impact of international tax avoidance by transnational corporations (TNCs) has led to new pressures for the radical revision of international corporate tax rules. The project on `base erosion and profit shifting’, initiated in its usual low-key way by the OECD’s Tax Centre in 2012 was given a strong political momentum by the G20, resulting in an action plan put forward in July 2013. This initiative, the details of which are not known at this time of writing, is likely to contribute to a growing momentum to change the basis of taxation of TNCs, towards a unitary approach. This paper will sketch out the historical development of the tax rules for TNCs, showing the increasingly dysfunctional nature. It will then outline alternative approaches to profit apportionment based on a unitary approach, and strategies for a transition. Finally, it will consider the implications of such a system for the natural resource sector.