University of Southern California – Marshall School of Business

advertisement

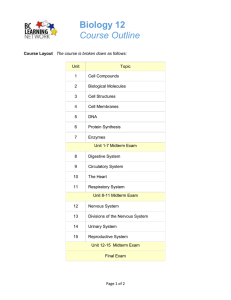

University of Southern California – Marshall School of Business BUAD 215: Business Finance, Fall 2012 Instructor Dr. Bemis E-mail: abarquez@usc.edu Office Hours: Wednesdays 12:00 pm – 2:00 pm; or by appointment. Office: Accounting 228 Extra Help: Through the Finance Learning Center in Bridge-203. Description This course integrates the core principles and fundamental analytical techniques used in financial management to prepare the student to assess and manage the financial health of the organization. Students will be exposed to accounting and financial information used in making effective business decisions. Capital investment analysis and other budgeting methods are studied in relation to goal attainment and organizational success. The effect of activities in the functional areas of business on the financial viability of the organization is emphasized. Course Materials _ Required: Ross, Westerfield, and Jordan: Essentials of Corporate Finance, Seventh Edition. ISBN 978-0-07-7427689 _ Required: Calculator with financial functions: I recommend the Hewlett Packard 12c for those who expect to continue in finance. You should bring your calculator to all classes and exams. Absolutely No graphing calculators allowed. Registration If you are currently registered for the class, you must be present at one of the first two class meetings to keep that registration. If you are absent from both, you will be dropped from the class. If you are not registered for the class and wish to be, you should add your name to the signup sheet during both of the first two class sessions. The success of this course is dependent on adequate preparation for classes by the students and instructor. The most effective and efficient use of classroom time aims at reinforcing or clarifying what YOU tried to learn on an individual (or group) basis prior to coming to class. You are responsible on exams for all material covered in the lectures. There is significant lecture material not in the book and significant book material not in the lectures, but the exams come from the lectures. This is a course that requires your daily hands-on participation. You are required to attend all class meetings, read the assigned materials, contribute to class discussions by asking questions or presenting possible solutions to the questions of others, and to complete the assigned problems. Students bring experience, observation, reflection to the course. This class will encourage students to think about the relationships between practice and theory, and to find ways to draw from and build for their future endeavors. At the same time, this course encourages participants to deepen their knowledge and understanding of literatures and theoretical perspectives relevant to the study of Finance. Successful students develop a sense of their goals and are motivated by questions to which they seek answers through their study, professional practice, interactions with peers and faculty, and on –going habits of inquiry. Course Activities/Organization Active participation is essential to successful completion of the course. The preparation for such participation and the quality of participation each week will constitute a major portion of the final grade assessment for each class member. Course content will focus primarily on contemporary issues representing a broad spectrum of areas in Finance. However, some allowance may be made for accommodating additional issues raised during the course of the semester by current events and the unique background of the class member interests. Grading Basis Your grade is made up of the following categories: Homework Assignments and Group Project 5% 1. Homework Assignments: Students will receive approximately 8 assignments over the course of the semester, each due before class starts on Wednesdays. 2. Group Project: Students should work in groups of three to four. Rules of Engagement All group work will be self policed, except in extreme circumstances. There will be one grade per group, no matter how the work load is distributed among the group members Grading Criteria: Class Participation/ Attendance 10% Midterm Exams 40% Group Project 5% Final Exam 45% Total 100% 3. Class Participation, 10%. Class Participation is a measure of a student’s positive or negative impact on the class. An example of a positive contribution is asking questions in lecture. An example of a negative contribution is being disruptive in lecture, especially during exams. 4. Midterm Exams, 40%. There will be two midterm exams during the semester. 5. Final Exam, 45% Homework The homework grade will be assessed over approximately 8 assignments, each due on Wednesdays in class before class starts. Assignments will be given a grade of “check” or “no credit”. A “check” will be assigned if homework is reasonably complete and correct, while “no credit” will be assigned otherwise. Homework assignments are to be completed in neat handwriting. There will be no typed answers and no faxes accepted without permission before the due date. Late homework will receive no credit. Working in groups is encouraged, but each group member must turn in his or her own separate write-up. Homework will not be returned. Please keep a copy the homework assignment before turning it in. Homework assignments are kept in storage. Exams All exams are closed book. You must take your exams in the lecture section to which you are registered. Students must provide their own pencils. You are required to be present for midterm exams and for the final exam during exam week. There are no make- up exams. Sunglasses, hats, and other headgear are prohibited during exams except for verifiable medical or religious reasons. Availability: I care about each of my students and will make myself available as needed to ensure student understanding of the course materials. You may also email me 24 hours a day. I will be happy to meet with you during office hours or after class, by appointment. Class Rules: Conducting yourself in a professional manner is essential to being successful in any environment. This classroom is a safe platform to practice behaving in a professional manner. Professional decorum is based on respect for your colleagues and peers. Professional decorum demands that your behavior show respect for the value of their time and yours, respect for their time and yours, respect for their expertise, and respect for earned positions. Laptop and Internet usage is not permitted during academic sessions. Use of personal communication devices, such as cell phone, is considered unprofessional and also is not permitted during academic sessions. Respect: Active participation in class requires a safe and trusting environment. It is important for us to respect the views and comments made by others, even if we disagree with such comments. I encourage critical discussion, yet it must be respectful, polite and professional. Academic Dishonesty The use of unauthorized material and communicating with fellow students during an exam are unacceptable. Examples of academic dishonesty include copying off another student, allowing someone else to copy one’s own work, and refusing to stop when exam time is called. The minimum penalty for academic dishonesty is to fail the class. The maximum penalty is expulsion from the university. Blackboard The primary means for communication for BUAD 215 will be the Blackboard System (http://blackboard.usc.edu). Grades will be distributed through this system. You are responsible for registering your email address with Blackboard so that you can receive course material. Disabilities Any student requesting academic accommodations based on a disability is required to register with Disability Service and Program (DSP) each semester. Please ensure that a letter of verification is delivered to me as early in the semester as possible. Advance notice is very important. Course Outline and Readings Class Topic Chapters 1 8/27 Introduction to Corporate Finance 1 2 8/29 Working with Financial Statements 3 3 9/5 4 9/10 Introduction to Valuation: The Time Value of Money 5 9/12 Future Value and Compounding 6 9/17 Present Value and Discounting 7 9/19 Discounted Cash Flow Valuation 8 9/24 Annuities 9 9/26 Perpetuities & Loan Amortization 10 10/1 Review 11 10/3 Midterm Examination 12 10/8 Interest Rates and Bond Valuation Ratio Analysis &The Du Pont Identity 4 4 5 6 & More on Bond Features 13 10/10 Determinants of Bond Yields 6 14 10/15 Equity Markets and Stock Valuation 7 15 10/17 Common Stock Valuation 16 10/22 Net Present Value and Other Investment Criteria 17 10/24 Payback Rule 18 10/29 Profitability Index 7 8 8 19 10/31 Practice of Capital Budgeting 20 11/5 21 11/7 Depreciation 22 11/12 Review 23 11/14 Midterm II 24 11/19 Historical Variance and Standard Deviation 25 11/26 Risk and Return Making Capital Investment Decisions 8 9 10 11 & The Security Market Line 26 11/28 Cost of Capital 27 12/3 Weighted Average Cost of Capital 12 Bankruptcy & Liquidation Process 13 28 12/5 Dividends and Dividend Policy FINAL REVIEW Wednesday 12/12 FINAL EXAMINATION 8:00 am – 10:00 am 12 14