M E C R

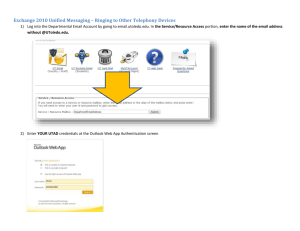

advertisement