Quantitative Techniques:

advertisement

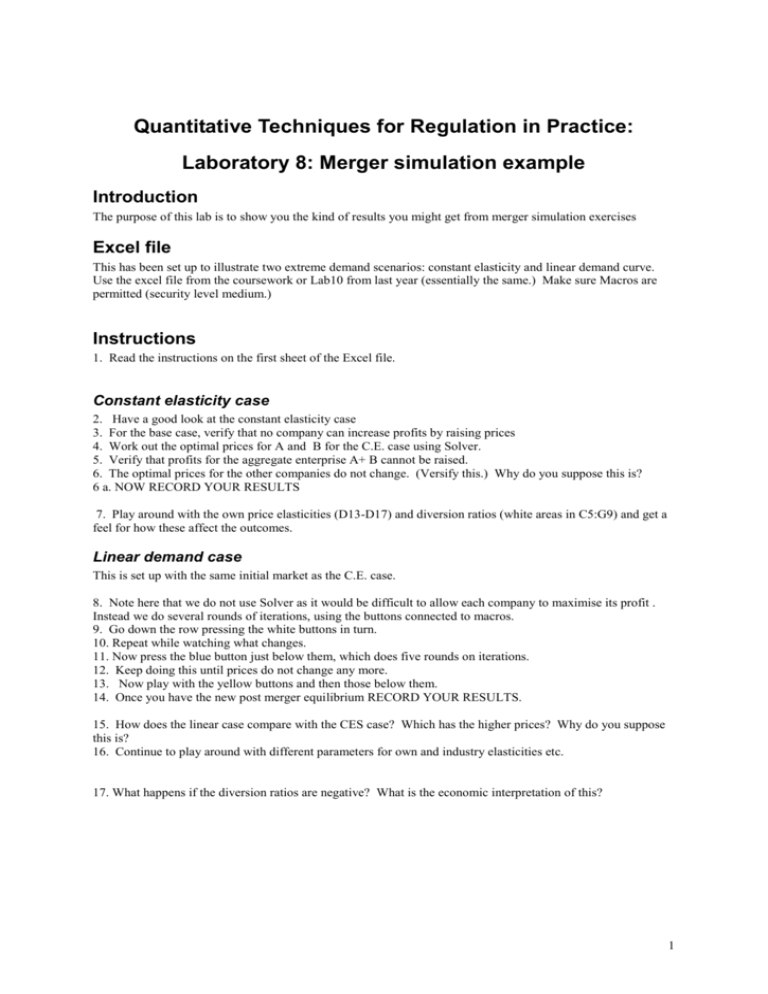

Quantitative Techniques for Regulation in Practice: Laboratory 8: Merger simulation example Introduction The purpose of this lab is to show you the kind of results you might get from merger simulation exercises Excel file This has been set up to illustrate two extreme demand scenarios: constant elasticity and linear demand curve. Use the excel file from the coursework or Lab10 from last year (essentially the same.) Make sure Macros are permitted (security level medium.) Instructions 1. Read the instructions on the first sheet of the Excel file. Constant elasticity case 2. Have a good look at the constant elasticity case 3. For the base case, verify that no company can increase profits by raising prices 4. Work out the optimal prices for A and B for the C.E. case using Solver. 5. Verify that profits for the aggregate enterprise A+ B cannot be raised. 6. The optimal prices for the other companies do not change. (Versify this.) Why do you suppose this is? 6 a. NOW RECORD YOUR RESULTS 7. Play around with the own price elasticities (D13-D17) and diversion ratios (white areas in C5:G9) and get a feel for how these affect the outcomes. Linear demand case This is set up with the same initial market as the C.E. case. 8. Note here that we do not use Solver as it would be difficult to allow each company to maximise its profit . Instead we do several rounds of iterations, using the buttons connected to macros. 9. Go down the row pressing the white buttons in turn. 10. Repeat while watching what changes. 11. Now press the blue button just below them, which does five rounds on iterations. 12. Keep doing this until prices do not change any more. 13. Now play with the yellow buttons and then those below them. 14. Once you have the new post merger equilibrium RECORD YOUR RESULTS. 15. How does the linear case compare with the CES case? Which has the higher prices? Why do you suppose this is? 16. Continue to play around with different parameters for own and industry elasticities etc. 17. What happens if the diversion ratios are negative? What is the economic interpretation of this? 1