T President Bush Offers Multi- Pollutant Proposal

advertisement

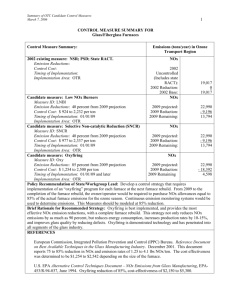

Flash: EU Environment Minister Cochet says EU to ratify Kyoto on March 4th. EMISSIONS BROKERAGE DESK President Bush Offers MultiPollutant Proposal T he Bush Administration issued its long-awaited multi-pollutant proposal on February 14, 2002. The CLEAR SKIES initiative establishes the general framework for a proposal to reduce power plant emissions of NOx, SO2, and mercury over the next 16 years. Implementation of this initiative will require amending the Clean Air Act. This policy position is intended to give the Administration a voice in the debate over multi-pollutant legislation on Capitol Hill. The legislative activity on reductions of power plant emissions has centered on the Senate Environment and Public Works (EPW) Committee chaired by Senator Jeffords (I-VT). In March 2001, Senator Jeffords introduced legislation (S. 556) to address emissions from power plants. Senator Smith (R-ME), the ranking minority member of the committee, also supports multi-emissions legislation, as does a majority of the committee. Mark-up of S.556 could occur in April. Several aspects of the CLEAR SKIES initiative deserve particular attention. The CLEAR SKIES initiative has less stringent reduction levels and more relaxed (later) deadlines than Environmental Protection (continued on page 6) UK Emissions Trading Scheme Auction Rescheduled march 1, 2002 Volume 5, Issue 3 Phone: 212-232-5305 Fax: 212-232-5353 he UK Government has decided to reschedule the incentive auction to participate in the direct entry route of the UK Emissions Trading Scheme from February 25, 2002 to Monday March 11, 2002. T March 4, 2002 how much of the £215m ($308m) set aside will actually be committed during the auction, as well as the level of the incentive cap—the maximum percentage of the budget any one participant can take. Of the 46 auction entrants, over half registered for entry in the final two weeks prior to the February 1st deadline. After discussions with potential participants, the Government decided to allow extra time in order to resolve outstanding questions and eligibility issues as effectively as possible. The Government will also provide further clarity to the auction by announcing on The start of the scheme remains unchanged from the beginning of April 2002, at which time allowances may be transferred through the registry. As the auction date approaches, Natsource continues to work with potential participants in developing trading structures that assist their auction strategy. Dear Clients and Friends, With the first ever UK incentive auction for greenhouse gas reductions joining the longstanding annual SO2 allowance auction sponsored by US EPA, March is looking to be an interesting month for auction enthusiasts. While Natsource operates most frequently in the continuous auctions, such as that for SO2 allowances, we are also ready and willing to assist our clients in developing bidding strategies for these auctions. Sincerely, Mike Intrator In This Issue: US SO2 Market Page 2 OTC NOx Index Page 3 NOx ERC Index Page 4 Global/GHG News Page 5 US Regulatory Update Page 6 S O 2 A L L O W A N C E SO2 (UER bi-weekly spot) 12 weeks volatility page 2 M A R K E T SO2 Market Gets Bounce From Bush Plan 80% 70% 60% 50% T 40% 30% 20% 10% Jan-02 Jul-01 Oct-01 Apr-01 Jan-01 Jul-00 Oct-00 Apr-00 Jan-00 Jul-99 Oct-99 Apr-99 Jan-99 Jul-98 Oct-98 Apr-98 Jan-98 Jul-97 Oct-97 Apr-97 Jan-97 Jul-96 Oct-96 Apr-96 Jan-96 0% SO2 (UER bi-weekly spot) 1 year volatility 45% 40% 35% raditionally, February is a fairly quiet month in the SO2 market. Compliance for the previous year, along with preparation for the EPA allowance auction upcoming in March, usually keeps traders heavily occupied, apart from a little early jockeying around to test market consensus before the auction. This February has taken a different tone. There has been healthy price movement and volume this month. One reason for the volume may be the upcoming March 15th options expiration. For the past several months, March options have continued to trade at all different strikes, particularly the $180 and $170 strikes. 30% 25% The month began with the spot market trading between $156 and $161. It seemed like there was some heavy selling pressure above $160, but natural buyers continued to take all they could get below $160. After a couple days of bouncing around, the market settled in briefly around $162. 20% 15% 10% 5% Jan-02 Oct-01 Jul-01 Apr-01 Oct-00 Jan-01 Jul-00 Apr-00 Oct-99 Jan-00 Jul-99 Apr-99 Jan-99 Jul-98 Oct-98 Apr-98 Jan-98 Jul-97 Oct-97 Apr-97 Oct-96 Jan-97 Jul-96 Apr-96 Jan-96 Oct-95 Jul-95 Apr-95 0% (continued on page 3) SO2 (UER bi-weekly spot) 3 Year Volatility Bi-weekly Spot SO2 Price Indication 45% $250 40% 35% $200 30% $150 25% 20% $100 15% 10% $50 5% 0% Jan-02 Sep-01 Jan-01 May-01 Sep-00 Jan-00 May-00 Sep-99 Jan-99 May-99 Sep-98 Jan-98 May-98 Sep-97 Jan-97 May-97 Sep-96 Jan-96 May-96 Sep-95 Jan-95 May-95 Sep-94 May-94 Jan-02 Nov-01 Sep-01 Jul-01 Mar-01 May-01 Jan-01 Nov-00 Jul-00 Sep-00 Mar-00 May-00 Jan-00 Nov-99 Sep-99 Jul-99 Mar-99 May-99 Jan-99 Nov-98 Sep-98 Jul-98 May-98 Jan-98 Mar-98 Nov-97 Sep-97 Jul-97 May-97 $0 NATSOURCE 140 Broadway 30th Floor New York, NY 10005 Tel: +1 (212) 232 5305 +1-(888)-562-8762 Fax: +1 (212) 232 5353 Boulder: +1 (303) 938 6882 London: +44 (0) 20 7827 2942 Sydney: +61 (2) 9240 5584 Tokyo: +1 (212) 232 5305 Toronto: +1 (416) 204 2026 Washington: +1 (202) 496-1423 +1-888-496-8885 email: mintrator@natsource.com http://www.natsource.com Emissions Brokers David Oppenheimer Brian Carroll Matthew Williamson Samantha Unger Gerhard Mulder Rich Weihe Managing Directors Michael Intrator Richard Rosenzweig Dirk Forrister Paul Bailey Frank Joshua Asset Management Strategic Services Kathleen McGinty Robert Youngman Nicole Giannini Elissa Gutt Ben Feldman Radha Kuppalli Matthew Varilek Duncan Marsh Al Mannato Coal Richard Thomas (Manager) Brian Carroll Kerry Crowley Ross Berman Ann Chernow GHG Brokers Neil Cohn George Tung Nicole Fabri Albie von Ruffer Kedin Kilgore Global Louise Drolz (Australia) Dan O'Sullivan (Australia) Lisa Reed (Australia) Peter Drazilov (Canada) Nina Marenzi (Europe) Martin Collins (Europe) Yasumasa Tsugane (Japan) Itsuho Haruta (Japan) Tim Atkinson (UK) Fiona Santokie (UK) Statements and information contained in Airtrends that are not historical facts are based on Natsource LLC’s opinions in light of information currently available, and should not be interpreted otherwise. Natsource price indices are intended for information purposes only and under no circumstances should they be considered offers to sell or solicitations to buy any commodity or asset. Any price information in Airtrends is based on information we believe to be reliable but no guarantee is given as to its accuracy or completeness. Markets are volatile and therefore subject to rapid and unexpected price changes. Any person relying on information contained in Airtrends does so at their own risk entirely and no liability is accepted by Natsource LLC in respect thereof. Airtrends is the property of Natsource LLC and may not be reproduced or further circulated, in whole or in part, without the express written permission of Natsource LLC. The information contained herein is the property of Natsource and may not be reproduced or further circulated, in whole or in part, without the express written permission of Natsource. N O x page 3 M A R K E T S NOx Update: SIP Call Rallies NOx Allowance Mid-Market Prices ($/ton) 2500 Banked 1999 Vintage 2000 Vintage 2001 Vintage 2002 Vintage 2000 1500 1000 500 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 Oct-01 Sep-01 Aug-01 Jul-01 Jun-01 Apr-01 May-01 0 Mar-01 Increasingly, the end game for the OTC is a driving force for pricing. The spread between V2000/1 allowances and the vintage 1999s has remained significantly wider than that for the 2000 to 2002, approaching $150. This differential has arisen because unused vintage 1999 OTC allowances will expire worthless at the end of the 2002 true-up period while the others will be converted into Compliance Supplement Pool allowances (though at a significant discount). As of March 1, 2002 Feb-01 P rices in the OTC NOx allowance market have dipped slightly since the end of January, with the spread between the banked vintages 2000 and 2001 all but disappearing and the premium of the spot to these two diminishing as well. Midmarket for vintage 2002 is currently $900/ton, which is also where the last trade occurred. The main banked vintages last traded at $700/ton and have been maintaining a discount of about 25% to the spot 2002s. NOx SIP Call Allowances Mid-Market Price $7,000 SO2 Market Update (continued from page 2) Activity jumped on the morning of the 14th, when news of President Bush's CLEAR SKIES plan began leaking into the market. The spot market initially traded up in response, reaching $173 in an orderly fashion, and settled in for an hour before falling off, just as orderly back down to $165. (See "Bush Offers Multi-Pollutant Plan" in this issue of Airtrends). The market gravitated back to $170 and above in the following days. This momentum continued with some large blocks of 25,000 and 15,000 allowances trading above $170. The market has seen significant support at $170 and has remained in the $170-$176 range. Some vintage 2007 allowances have traded recently as well helping to define price expectations for the vintage 2009 allowances to be auctioned by the EPA on March 25th. The vintage 2007 traded at $146 when spot was trading $173, and again $143 when spot was trading $171. 2003/4 Stream 2003/7 Stream $6,000 $5,000 Allowance Price ($/ton) $4,000 $3,000 $2,000 $1,000 Jan-02 Feb-02 Feb-02 Jan-02 Jan-02 Dec-01 Dec-01 Nov-01 Oct-01 Oct-01 Nov-01 Sep-01 Sep-01 Jul-01 Aug-01 Aug-01 Jul-01 Jul-01 Jun-01 Jun-01 May-01 Apr-01 May-01 Apr-01 Mar-01 Mar-01 Feb-01 Feb-01 Jan-01 Jan-01 $- Jan-01 SIP Call allowances have continued to move upward from their low in December and early January. The latest spurt occurred on the last day of the month, as vintage 2004 allowances traded for $5000/ton, a level not seen since September. A stream of 50 tons per year of 2004-2007 vintage allowances was also reported to trade for $3900/ton. This is a substantial premium to what we had seen trade previously in the market and was further surprising because of the abruptness of the price move. Should support at this level develop, it would indicate a significant flattening of the forward curve. NOx Budget Market Mid-Market Prices Ozone Transport Commission 1999 Vintage $550/ton 2000 Vintage $675/ton 2001 Vintage $675/ton 2002 Vintage $900/ton SIP Call/Section 126 Market 2003/4 Vintage Stream $4,800/ton 2003/7 Vintage Stream $3,600/ton With a large option expiration and the auction coming up in March, the next few weeks should prove very active. For more information on the details of the EPA auction, refer to http://epa.gov/airmarkets/forms/auctions/howtobid02.pdf. N O x M A R K E T S page 4 As of March 1, 2002 State PERMANENT EMISSION REDUCTION CREDIT MARKETS (New Source / Offsets) Moderate Serious Connecticut Severe NOx $6,500/tpy $12,000/tpy VOC $4,000/tpy $6,000/tpy Massachusetts NOx $6,300/tpy Maine NOx New Jersey NOx $1,800/tpy VOC $475/tpy New York - Pennsylvania (linked) Texas Rhode Island $6,000/tpy NOx $1,700/tpy $12,000/tpy VOC $1,450/tpy $6,000/tpy NOx $3,000/tpy VOC $6,000/tpy NOx $6,200/tpy ERC Market Update T he main transactions of note recently are in the Discrete markets in New Jersey, where several transactions have gone through at approximately $1,000/ton. Further in NJ, we are once again seeing interest in transacting on ERCs that are part of the large set with expirations in April 2003. In California, PM and ROG (essentially equivalent to VOC in other markets) transactions have been occurring in the L.A.'s South Coast Air Quality Management District. South Coast PM10 is trading in excess of $21,500 per pound per day; meanwhile, ROG is $1,800 and seems to be falling. Other ERC markets have been slow this month. COMPLIANCE MARKETS DERs/VERs State Ozone Season Non-Ozone Season Connecticut $1,100/ton $1,000/ton Massachusetts $750/ton $500/ton New Jersey $1,000/ton $950/ton New Hampshire $600/ton $300/ton Texas $4,000/ton N/A G l o b a l U p d a t e / G H G N e w s page 5 President Bush Announces New U.S. Climate Policy O n February 14th, President Bush announced his administration's long-awaited climate change policy. The policy sets a voluntary goal to reduce the greenhouse gas (GHG) intensity of the U.S. economy by 18% by 2012. If the goal is achieved, the current GHG intensity level—183 metric tons of carbon equivalent (mtce) emissions per million dollars of GDP in 2002—would be reduced to 151 mtce per million dollars of GDP in 2012, according to the administration. The plan allows the U.S. to demonstrate progress against this metric through voluntary actions. At the same time, the plan reflects the administration's view that mandatory emissions caps, such as those enshrined in the Kyoto Protocol, would unduly constrain economic growth. The administration's announcement states that the GHG intensity target "sets America on a path to slow the growth of GHG emissions, and as the science justifies, to stop and then reverse that growth." According to the administration's estimates, achieving the GHG intensity target would reduce emissions in 2012 by 100 million mtce, or 4.5%, relative to business-asusual emissions in that year. Natsource estimates that the administration's plan would result in U.S. GHG emissions in 2012 that are approximately 13% above 2000 levels, 31% above 1990 levels, and 41% above the U.S.' Kyoto Protocol target of 7% below 1990 levels. In addition to the GHG intensity target, the plan calls for the development of revisions to the existing voluntary program for reporting GHG emissions and emissions reductions under section 1605b of the 1992 Energy Policy Act. Revisions will be aimed at improving and standardizing measurement protocols for emission reductions and carbon sequestration. Additional revisions will seek to ensure that early reductions are not penalized under future climate change policies, and to provide "transferable credits" to companies that can achieve real reductions. Other measures in the President's plan include: • Tax credits totaling $555 million in 2003, $4.6 billion over the next 5 years, and $7.1 billion over 10 years to spur investment in solar, wind, and biomass energy sources, hybrid and fuel cell vehicles, cogeneration, and landfill gas. Many of these provisions were included in the President's FY 2003 budget request. (continued on page 6) New Natsource Website Goes Live N atsource has renovated its website! A work in progress, we invite you to visit regularly as we post new data and analysis to www.natsource.com. Make our site your go-to source for energy and environmental industry news and information. Comments/Requests: -Want to add a colleague to the Airtrends distribution list? -Remove yourself from the list? -Comment on an article? -Suggest an area for coverage? If so, contact the editor: Matt Williamson 212-232-5305 mwilliamson@natsource.com Natsource's new website reflects the company's energy and environmental brokerage in markets worldwide. With up-to-theminute industry news and trends, the Natsource website links users to market and policy information in the coal, electricity, natural gas, and environmental markets. The website helps users navigate these markets through case studies, regulatory and market background information, and glossaries of industry terminology. With links to relevant government agencies, associations, educational entities, and congressional sites, the Natsource website is a one-stop research goldmine. The convenient search feature will find the information you need. You may also use the website to contact our brokers in one of our many international offices. Visit the Natsource website at www.natsource.com www.natsource.com U . S . N a t i o n a l page 6 U p d a t e Bush Offers Multi-Pollutant Proposal (continued from page 1) Agency proposals that were the subject of debate within the Administration. The second phase deadline for reductions of all three pollutants is 2018, 12 years later than the S. 556 deadline (see accompanying chart for details). In addition, the West will have less stringent reductions for SO2 than the East. The Administration also stated that there would be different reduction caps and separate East and West trading regions for NOx, though exact East/West levels are not specified. The initiative also includes incentives for power plants that install scrubbers early in the program. Details for this early action incentive program also have not been released. The CLEAR SKIES initiative includes a 15ton mercury cap (two-thirds reduction from current emission levels) to be achieved by 2018, apparently with trading. However, EPA has started to develop what could be a more stringent requirement, through rulemaking. This regulatory requirement is unlikely to allow for trading and would be implemented by December 2007 under existing Clean Air Act authority. The CLEAR SKIES initiative would replace the mercury regulatory requirement. Cap and Trade Is Front and Center A cornerstone of the CLEAR SKIES initiative is cap and trade. The Administration estimates that a cap and trade program could result in compliance costs savings of as much as $1 billion annually and supports trading for all three pollutants, including mercury. While S. 556 provides for NOx and SO2 trading, it would prohibit mercury trading, reflecting concern within the environmental community that trading would lead to localized "hot spots" of emissions. Prospects for Legislation Legislation on multi-emissions in this Congress is very uncertain. Chairman Jeffords likely has the votes to report "four pollutant" legislation out of the Senate committee. However, action in the full Senate is not anticipated and passage of any legislation with S.556-like levels and dates is extremely unlikely. A key point to watch will be whether Senators Smith and Voinovich (R-OH) negotiate a compromise with Senator Jeffords before or during mark-up of S. 556. As we move closer to the fall Congressional elections, Hill action on this issue will become more unlikely. Prospects for legislation in the next Congress can be better assessed after the next election. (1) All reductions are achieved through a cap and trade program except where noted. (2) All reductions are calculated from the current levels in the table. (3) S. 556 does not allow mercury trading. CLEAR SKIES Initiative vs. S. 556 Annual Emissions (1) Current Levels CLEAR SKIES Initiative S. 556 2008 2010 2018 2007 NOx (Million tons) 5 2.1 (58% red. (2)) -- 1.7 (67% red.) ~1.5 (70% red.) SO2 (Million tons) 11 -- 4.5 (59% red.) 3 (73% red.) ~2.2 (80% red.) Hg (Tons) 48 -- 26 (46% red.) 15 (69% red.) ~5(3) (90% red.) Bush Announces GHG Plan (continued from page 5) • Plans to recommend updated corporate • Increased spending on climate-related average fuel economy (CAFÉ) standards. science and technology. • An increase in funding from $1 billion to • Assorted international projects geared $3 billion to implement the conservation title of the Farm Bill, which would result in an additional 35.7 mmtc of sequestration annually. toward climate research, technology transfer to developing countries, and debt-fornature swaps. • A pledge to consider additional measures if the U.S. is not on track to meet the GHG intensity goal in 2012. Such measures could include "a broad, market-based program". A full summary and analysis of the Bush administration's climate change plan is provided in a special supplement to this edition of Airtrends. U . S . N a t i o n a l U p d a t e page 7 Reduction in Auto Emissions Proposed in California; CAFE Considered in U.S. Senate O n January 30th, the California State Assembly passed bill 1058 requiring the California Air Resources Board (CARB), the air regulatory commission in California, to develop measures to reduce CO2 emissions from cars and light duty vehicles by 2004. The proposed legislation, which now moves to the State Senate, reflects a trend at the state level to push forward with climate change policies in advance of decisions at the national level. The State Senate is likely to begin review of AB 1058 in April. The bill is expected to receive support from the Democratic majority, though perhaps with some modifications. Opponents criticize the bill for providing CARB with a "blank check" to develop policies, while supporters favor the bill's broad mandate to "develop and adopt regulations that achieve the maximum feasible and cost-effective reduction of carbon dioxide" emitted from cars and light trucks. Auto manufacturers who believe the legislation will harm productivity are also likely to contest the bill strongly. If passed, AB 1058 could have far-reaching effects on U.S. and global vehicle markets. By requiring CO2 emission reductions from vehicles, the bill is likely to encourage improvements in fuel-efficiency standards in the state. California has already taken an initial step to increase fuel economy performance in the state; in October 2001, it enacted S. 1170, a law mandating the purchase of fuel-efficient vehicles for the state-owned fleet. Approximately 10% of new car sales in the U.S. occur in California, where local and regional air quality problems have often led to the adoption of environmental policies more stringent than national policies. At the national level, the Bush administration hopes to allay criticism from environmentalists by introducing the first increase in fuel-efficiency standards in 15 years. In December 2001, the Bush Administration lifted the ban on new federal CAFE rulemaking, opening the door for review and debate of new standards. CAFE standards are currently 27.5 miles per gallon (mpg) for cars and 20.7 mpg for light trucks. These standards were enacted in 1985 and 1987, respectively. The Administration's recently unveiled climate proposal calls for the Secretary of Transportation to issue recommendations on establishing updated CAFE standards, and to take into consideration the recommendations of a July 2001 National Academy of Sciences (NAS) report. The administration highlighted that the NAS report recommended allowing manufacturers to trade fuel economy credits. Senators John Kerry (D-MA) and John McCain (R-AZ) favor a Congressionallymandated CAFE standard and have introduced competing bills, both of which would establish a clear fuel-economy standard to be achieved within a defined period of time. Kerry's bill, S.1926, proposes a CAFE standard of 38.3 mpg for cars and 32 mpg for light trucks by 2013, and an average for fleets of 35 mpg. McCain's bill, S.1923, proposes an average fuel-economy standard of 36 mpg for cars and light trucks by 2016. The Kerry bill has been included in the Democrats' comprehensive energy bill, which is now scheduled for debate by the Senate. Significantly, both legislative proposals contain credit trading components, under which manufacturers can earn credits for exceeding the CAFE standards and then trade these credits with other manufacturers. Senator Kerry's proposal would allow for trading between manufacturers and fleet types (car and light truck, domestic and import). Senator McCain's bill would allow manufacturers to purchase emissions reduction credits, including credits earned for exceeding CAFE standards, from a national registry to offset up to 10% of the fuel economy standard for any model year. Inclusion of credit trading proposals in the Senate bills, and the specific reference to CAFE credit trading in the President's climate plan, suggest that market-based incentives may be included as part of any updated CAFE standards passed by Congress. EMISSIONS PORTFOLIO RISK MANAGEMENT & TRADING WORKSHOP A Two-Day Workshop on Managing Generation & Emissions Assets LAST CHANCE TO REGISTER Workshop Dates: March 05 & 06, 2002 New York City, NY Contact us at +1 (212) 232-5305