RÉPONSE DU TRANSPORTEUR À L'ENGAGEMENT 13 (DEMANDÉ PAR EBMI) Demande R-3738-2010

advertisement

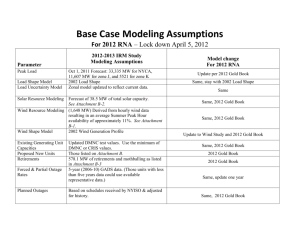

Demande R-3738-2010 RÉPONSE DU TRANSPORTEUR À L'ENGAGEMENT 13 (DEMANDÉ PAR EBMI) Original : 2010-12-02 HQT-14, Document 3.13 (En liasse) Demande R-3738-2010 Engagement 13 (demandé par EBMI le 2010-11-30) Fournir le rapport produit par le docteur Makholm (troisième avant-dernier de la page 4 de son curriculum vitae). R13 : Voir les pages suivantes. Original : 2010-12-02 HQT-14, Document 3.13 (En liasse) n/e/r/a NATIONAL ECONOMIC RESEARCH ASSOCIATES Consulting Economists 200 CLARENDON STREET BOSTON, MASSACHUSETTS 02116-5089 TEL: 617.621.0444 FAX: 617.621.0336 INTERNET: http://www.nera.com DOCKET NO. OA08-13-000 AFFIDAVIT OF JEFF D. MAKHOLM, PH.D On behalf of Consolidated Edison Company of New York January 7, 2008 Brussels, Belgium / Boston, MA / Chicago, IL / Ithaca, NY / London, UK / Los Angeles, CA / Madrid / New York, NY Philadelphia, PA / San Francisco, CA / Sydney, Australia / Washington, DC / White Plains, NY An MMC Company UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULTORY COMMISSION New York Independent System Operator, Inc. Docket No. OA-08-13-000, Order No. 890 Transmission Planning Compliance Filing AFFIDAVIT OF JEFF D. MAKHOLM, PH.D Dr. Jeff D. Makholm declares: 1. I have personal knowledge of the facts and opinions herein and if called to testify could and would testify completely hereto. I. Purpose of this Affidavit 2. On December 7, 2007, the New York Independent System Operator (NYISO) submitted a transmission planning compliance filing for Federal Energy Regulatory Commission (FERC) Order No. 890. The compliance filing, in Attachment I (described as “Attachment Y” New York ISO Comprehensive System Planning Process), described significant revisions to the NYISO tariff regarding the procedures for analyzing and funding of what it calls “regulated economic transmission projects” in Section 15.1 of Attachment Y (which I will call “economic transmission enhancements”). Economic transmission enhancements are those designed to alleviate transmission constraints, and reduce congestion but are not n/e/r/a Consulting Economists -2required to maintain system reliability by the Independent System Operator (ISO), as such.1 I have been retained by Consolidated Edison Company of New York (Con Edison) to review aspects of those revisions and to present the advantages of alternative proposals. 3. I comment on a number of aspects of the revisions to the NYISO tariff. My comments relate to definitional questions, empirical issues associated with the proposed benefit/cost test and governance issues associated with how projects will be eligible for approval and cost allocation among the ISO load members. a. The definition of the “benefits” related to the costs of economic transmission is clearly enough stated in NYISO’s proposal. The NYISO states that the benefits of a proposed economic transmission project are defined as the lower net overall resource cost of generating electricity. There remains, however, the issue of whether those benefits, so defined, will entirely accrue in lower net load payments across the NYISO. A change in load payments is an additional valid perspective from which to examine a project—and an important one from the perspective of those who will pay the cost of what will become a regulated transmission asset. For this reason it is important to provide the results of a second test, or a “load payment savings test.” These twin tests, in combination with the voting scheme for beneficiaries of an economic transmission 1 Some writers on the subject of transmission enhancements have commented that economic and reliability-based transmission projects are fundamentally interdependent, in that they both affect economic decisions in the competitive generating market (see Joskow, P.L., “Patterns of Transmission Investment,” Working Paper, MIT Center for Energy and Environmental Policy, March 15, 2005). I agree with Joskow regarding that type of market interdependence. But the split between economic and reliability-based transmission projects envisioned by Order No. 890 is not so much related to that economic interdependence as to the separate governance and payment structures specified for those two definitions of electricity transmission. n/e/r/a Consulting Economists -3upgrade, would fulfill the purpose of allowing those load serving members to determine whether the project’s cost is acceptable to them. b. The NYISO’s proposed analysis period for prospective economic transmission projects has various interrelated problems. The first is the study period associated with both cost allocation eligibility and beneficiary designations, which stretches well beyond any time horizon for which benefits, however defined, can reasonably be known. The NYISO’s proposed horizon for evaluating benefits (10 years from a project’s in-service date) reaches forward to a time when those benefits are highly speculative in relation to the transmission construction and operation costs. I propose a shortened period for analysis, where there is a better prospect that any benefits from economic transmission enhancement projects will come to pass. Being mindful of the uncertainties associated with projected benefits is consistent with the notion that regulated cost recovery mechanisms should pass a stringent test when they serve to complement a competitive generating market. c. The NYISO’s proposed treatment of costs is also a problem, for it deals with only a portion of the capital costs of transmission projects. The NYISO proposal is to match 10 years of project costs with 10 years of benefits. But under traditional cost-of-service principles, including amortization over the full 30-40 year life of the project, much of the cost of a transmission project is still to be recovered after year 10. For the later period, the amortized transmission costs are well known while any benefits from an economic transmission enhancement project will be manifestly speculative. It is not hard to see why those who might pay for economic transmission enhancement projects n/e/r/a Consulting Economists -4could object to leaving these known costs out of an initial benefit/cost analysis. Rather than leave much of the capital cost out of the analysis, I propose to include it all. d. The NYISO is, as much as anything, a governance structure to effect joint planning and cost allocation for those elements of reliable and reasonably economical electricity supply that cannot be left to the market. In this respect, with modifications, the NYISO’s proposal reasonably fulfills the requirements of Order No. 890. In particular, the NYISO’s proposed voting mechanism gives those targeted for the payment of economic transmission enhancement costs a proportional vote in deciding its adoption. In addition, the NYISO’s proposal for an 80 percent super majority threshold for approval is helpful. It means that over four-fifths of those who will pay the allocated costs will have to agree to the economic transmission enhancement proposal for it to pass. I support the stringency of such a test for jointly-funded, cost-of-service regulated, economic transmission enhancement projects. 4. I address each of these issues in the following sections of my affidavit. Following a discussion of my qualifications in Section II, I describe in Section III the context for electricity transmission that makes such complex governance structures for electricity transmission enhancements unavoidable. In Section III, I discuss the concept of economic transmission enhancements. Section IV deals with the definition of benefits, and Section V deals with the time frame for measuring them. Section VI discusses the perils of fuel price forecasting as a component of benefits. Section VII addresses how to assess the cost of economic transmission projects. Finally, in Section VIII, I discuss the NYISO’s voting proposal. n/e/r/a Consulting Economists -5- II. Qualifications 5. I am a Senior Vice President with National Economic Research Associates (NERA). NERA is a firm of consulting economists with its principal offices in a number of major U.S. and European cities. My business address is 200 Clarendon Street, Boston, Massachusetts, 02116. 6. I have M.A. and Ph.D. degrees in economics from the University of Wisconsin, Madison, with a major field of Industrial Organization and a minor field of Econometrics/Public Economics. My 1986 Ph.D. dissertation at Wisconsin is entitled “Sources of Total Factor Productivity in the Electric Utility Industry.” I also have B.A. and M.A. degrees in economics from the University of Wisconsin, Milwaukee. Prior to my latest full-time consulting activities, I was an Adjunct Professor in the Graduate School of Business at Northeastern University in Boston, Massachusetts, teaching courses in microeconomic theory and managerial economics. 7. My work as a consulting economist principally involves the area of regulated industries— both those that operate networks (such as electricity transmission and gas/oil pipelines, electricity and gas distribution systems, telecommunications networks, water utility systems and rail/subway lines) and those operating infrastructure business at specific sites, such as airports, electricity generation plants, gas processing plants, oil refineries and sewage treatment plants. In such industrial settings, I have researched and given evidence regarding regulated pricing, the presence of absence of market power, competition, the fair rate of return, regulatory rulemaking, incentive ratemaking, load forecasting, least-cost planning, cost measurement, contract obligations and bankruptcy, among other issues. n/e/r/a Consulting Economists -6Since 1981, I have prepared expert testimony and statements, and I have appeared as an expert witness in many state, federal, and United States District Court proceedings, as well as in regulatory and court proceedings abroad. 8. I have also directed studies on behalf of utility companies, governments, and the World Bank in many countries. In these countries, I have drafted regulations, established tariffs, recommended financing options for major capital projects and advised on industry restructurings. I have also assisted in the privatization of state-owned utilities and have been a witness in international arbitrations under international investment treaties regarding the expropriation by national governments of utility assets. As part of my international work I have conducted formal training sessions for government, industry, and regulatory personnel on the subjects of privatization, pricing, finance and regulation of the regulated industries. I have published articles in publications such as Public Utilities Fortnightly, Natural Gas, The Electricity Journal and speak frequently at national and international economic conferences regarding regulatory issues. 9. I provided live testimony before the FERC in its 1998 Public Conference on ISO’s in Docket No. PL98-5-000 on behalf of the Edison Electric Institute (as part of the panel on ISOs and transmission pricing). I subsequently provided a paper to the FERC in 2000 on behalf of the PJM Transmission Owners regarding their transmission enhancement proposal as part of the PJM’s Order No. 2000 compliance filing. In 2001, I provided an affidavit on behalf of members of GridFlorida, regarding their transmission pricing plan, as part of its own Order No. 2000 compliance filing. n/e/r/a Consulting Economists -710. My curriculum vitae is attached hereto. III. The Concept of Economic Transmission Enhancements 11. An economic transmission enhancement project is defined as one that will alleviate a transmission constraint and reduce congestion, but is not considered necessary to eliminate a reliability-based need.2 From an economic perspective this definition is somewhat artificial, and the line between “economic” and “reliability” transmission enhancements is not a sharp or obvious one. But a workable distinction has developed in Order No. 890 for the planning and governance of transmission enhancements. 12. “Reliability transmission” is designed to satisfy a Regional Transmission Operator/Independent System Operator’s (RTO/ISO(s)) criteria for assuring adequate connections between electrical load and available energy supply from power plants. In most instances the reliability transmission will be sufficient enough to allow for the economic flows of energy supply by taking advantage of the existing reserve capacity on the RTO system. As load declines in the shoulder periods, generation in higher cost areas is dispatched downward or off-line, and the generation in lower cost areas is dispatched above the local demand level, utilizing the reliability transmission to supply the otherwise higher cost area. However, the reliability transmission may not always be able to accommodate the least cost dispatch of the region’s generation resources, leading to the divergence of wholesale electricity prices in one area versus another (i.e., congestion). 2 Congestion, for its part, is defined as the event where one or more transmission lines are filled to capacity leading to price divergence between two market areas. n/e/r/a Consulting Economists -813. Relieving transmission congestion is not solely a question of building new transmission capacity, however. Transmission congestion can also be alleviated by development of generation or consumption efficiency projects on the constrained or “high side” of an interface. Such development of new competitive generating resources can provide the equivalent reduction in transmission congestion. Some congestion costs, however, cannot reasonably be eliminated as an economic matter. In some cases, for some periods, the cost of producing electricity is just higher. Since a minimum amount of local resources may always be needed to support reliability, there may be some level of permanent congestion costs during some hours that are unavoidable as a matter of overall economic efficiency. 14. Given the interdependence of generation, transmission, and load, economic transmission enhancements serve in general to alleviate transmission constraints and prevent that congestion-based divergence in wholesale electricity prices. For those paying the higher of the divergent wholesale electricity prices, economic transmission enhancements have the prospect of lowering their price of energy supply. But the reverse is also true— transmission lines can cause the price of energy supply to increase on the other side of a congested bottleneck as the existing generation supply is re-dispatched to higher cost points on their incremental cost curves. 15. Indeed, this prospect that economic transmission enhancements will lower wholesale power costs in a particular area is where the difficulty lies—and why Order No. 890 and the various compliance filings are so complicated. For it begs the question: why, if additional transmission could lower someone’s power costs won’t they simply agree to pay for it? The problem, as anyone connected with the Order No. 890 process and its FERC n/e/r/a Consulting Economists -9antecedents knows well, is that electricity transmission is a unique sort of energy delivery network. The physics of electricity means that in most cases it is not possible to track electricity from particular producers to particular consumers—electricity goes where it will over the network that exists. The creation of a market for generated power has not changed the physics of electricity transmission. 16. Gas also goes where it will, in its own great FERC-regulated interstate network—after a fashion. But it does so at such a relatively torpid pace (15 million times slower than electricity) and with such predictable overall direction as to permit accounting and commercial conventions to trace effectively an individual producer’s gas to a particular consumer—even though for most of its journey, from the gas fields to the market areas, one producer’s gas is totally intermingled with the gas of others. Those conventions and the contract-based nature of the interstate gas transmission network (i.e., it is not a common carrier), allow for a market in gas transmission not available to electricity transmission. Interstate gas transmission in the U.S. is essentially “private carriage” for a sharply limited clientele: those with capacity contracts.3 Such a commercial regime means that if a new gas transmission pipeline (an “economic gas transmission enhancement”) could lower gas prices for a group of consumers, they can readily band together and sign contracts to pay for and build it—thus owning exclusive physical gas transmission rights to use or re-sell. Economic gas transmission enhancements—the quintessential “merchant transmission”— 3 It is true that the FERC continues to regulate the rates of all interstate gas transmission companies. But because of the manner of incrementally pricing the cost all new capacity additions, and also the secondary market for such capacity, gas transmission capacity is essentially market priced both during the planning stage and in actual operation. n/e/r/a Consulting Economists - 10 have been many, varied, and generally uncontroversial private matters in the restructured gas market in the U.S. since around 2000.4 17. But such a commercial system does not apply to electricity transmission. Over a considerable region, electricity transmission lines operate as a pooled resource with neither the ability to predictably trace electricity flows nor the means for electricity consumers to secure exclusive physical transmission pathways. Some cases do exist where electricity transmission tends to look like “private carriage,” such as for high-voltage direct current (HVDC) lines or controllable AC lines, or special connections such as a transmission line to an island. But these cases tend to attract private investors and are uncommon solutions to transmission bottlenecks. They are not where the contention lies regarding economic transmission enhancements to the existing transmission grid like that overseen by the NYISO and the subject of Section 15 of Attachment Y of its Order No. 890 compliance filing. 18. The pooled, “common carriage” nature of existing large-scale transmission systems, like that operated by the NYISO where exclusive physical transmission pathways cannot be identified, defeats most private (i.e., “merchant”) transmission efforts. Like gas pipelines, transmission wires represent a very long-term investment in sunken and immobile capital. Motivating the sinking of such private capital for the interstate transmission of anything requires extraordinarily predictable credit and payment commitments, which the current 4 The FERC still certifies new interstate gas pipeline capacity, but those certificate cases are comparatively tame since the culmination in 2000 of the new rules governing contract carriage on the nation’s gas transmission network. n/e/r/a Consulting Economists - 11 manner of operating and pricing the pooled electricity transmission network does not permit.5 19. The question, as appropriately framed by Order No. 890, is when and how the pooled transmission system operated by an ISO/RTO should cause its members to fund economic transmission enhancements as regulated assets. Which is to ask: if the market cannot make such investments privately without ISO/RTO planning and regulatory funding, how can the NYISO provide for such investment and still reasonably tie the costs of the project to its beneficiaries? IV. The Definition of Benefits 20. In various places in its filing, the NYISO discusses “benefits” or “beneficiaries.”6 Economic transmission enhancements imply by their very nature that, but for a transmission constraint, less expensive power may displace more expensive power. Economic efficiency is achieved any time this happens—fewer of society’s resources are consumed to produce the same quantity of power. The NYISO defines its benefit metric for proposed economic transmission enhancements as the “present value and annual NYCA-wide production cost savings.”7 While this test is perhaps a more fundamental metric and may be the appropriate 5 For a discussion of both the financial and economic barriers to eliciting private (i.e., “merchant”) funding for economic electricity transmission enhancements, see: Joskow, P.L., and Tirole, J., “Merchant Transmission Investment,” Journal of Industrial Economics, Vol. 53, No. 2 (June 2005), pp. 233-264; and Makholm, J.D., “Electricity Transmission Cost Allocation: A Throwback to an Earlier Era in Gas Transmission,” The Electricity Journal, Vol. 20, No. 10 (December 2007), pp. 13-25. 6 See Revised Attachment Y, section 15.2 and 15.3. 7 See Revised Attachment Y, section 15.3.b n/e/r/a Consulting Economists - 12 screen to determine a project’s eligibility for further cost /benefit analysis and consideration, it does not provide enough information to identify the load beneficiaries who will ultimately bear the cost of the project. 21. Such economic efficiency as measured by a production cost savings analysis does not automatically create what could be called “benefits” for the customers of the load beneficiary members of the NYISO. If the lower cost power does not affect the pool price or the region’s location-based marginal price (LBMP), then the “benefit” associated with the more efficient generation of power will go to the power plant’s owners, not to those who consume the electricity. Such will occur any time that an economic transmission enhancement displaces only a portion of the high-cost generation that sets the LBMP. 22. From the perspective of the load serving members of the NYISO similar to Con Edison, the beneficiaries of the economic transmission enhancement need to be reasonably well identified. If the benefits go to unregulated power plants that will now operate with a reduced physical constraint in the transmission grid—enabling additional access to a higher priced market area to sell more generation at the higher price—and the cost of energy supply to the loads remain unchanged, it would be unfair to charge the regulated transmission enhancement cost to those same loads. This is not to say that it is unreasonable to pursue lower cost generation. But the procedures contained in the NYISO’s Attachment Y are there to allocate the new regulated transmission costs (of either the reliability or economic variety), only allowing for these costs to be assigned to the ISO’s load members if and when the market does not adequately respond to either the identified reliability needs or the persistent congestion. It wouldn’t suffice, in that process, n/e/r/a Consulting Economists - 13 to assign to those load members the cost of projects whose associated benefits would be realized in the market by unregulated generators (i.e., lower cost generators receiving the pool price rather than higher cost ones). 23. For example, it is possible for a new and more efficient power plant connected to an economic transmission upgrade to have costs largely, if not wholly, below the marginal cost unit setting the energy market price. That new plant would thus realize the benefits of lower cost production instead of the loads. Ultimately the total cost to the loads—that is the cost of their energy supply plus the cost of the new transmission line—may not be lower than the cost of supply without the new transmission line. This is the potentially undesirable outcome that would likely occur if the NYISO limited its analysis to the production cost savings eligibility screen. It highlights the necessity for the further net load payment savings analysis as an essential component of the NYISO economic planning cost allocation process. 24. Recognizing that not all benefits of an economic transmission enhancement are realized by the load serving members, the NYISO proposal also “measure[s] the present value and annual zonal LBMP load savings for all load zones which would have a load savings, net of reductions in TCC payments, and bilateral contracts (based on available information)”8 to designate project beneficiaries. This more stringent benefits analysis is critical in determining whether a project should move forward. It will supply the primary 8 See Revised Attachment Y section 15.4.b n/e/r/a Consulting Economists - 14 information—whether the net present value (NPV) of the load payment savings is sufficient to meet the assigned project costs—utilized by voting beneficiaries. 25. The voting mechanism proposed in section 15.6 of Attachment Y does indeed imply that the load payment savings analysis and its definition of benefits, focusing on load members, is important. Recognizing that project benefits are not always realized by the load beneficiaries, it is vital that the NYISO process include: (1) the combination of the two part eligibility screen/benefit designation analysis so that load beneficiary members have the appropriate decisional information; and (2) the voting mechanism, so that load members who will bear the costs of economic transmission upgrades have a key voice in allowing the projects to go forward. I recommend that the combined two step analysis and voting mechanism in the NYISO proposal be adopted. I specifically discuss below in Section VIII the appropriateness of the voting mechanism. V. The Time Frame for Measuring Benefits 26. The NYISO proposes to study benefits for an economic transmission enhancement “over a ten-year period commencing with the proposed commercial operation date for the project.” (Attachment Y, Section 15.3.a.) There are two problems here. The first is that this period does not align with the period that the NYISO uses for its other planning processes, either for the Comprehensive Reliability Plan (CRP) or for the Congestion Assessment and Resource Integration Study (CARIS). The second is that for such a time frame (which would place the 10 year analysis after what could be a lengthy development period), the benefits, as such, are largely—if not wholly—speculative. n/e/r/a Consulting Economists - 15 27. Transmission projects may have lead times ranging from three to 10 years. This means that the analysis period for benefits stretches three to 10 years beyond the 10 year reliability and congestion study period of the CRP and CARIS, respectively. Extending the analysis of benefits beyond the limitation of the current NYISO modeling capabilities (for its CRP and CARIS) is a cause for concern. Models such as those supporting CRP and CARIS are not by their nature simple trend lines. Moving the analysis further into the future to encompass the extra duration beyond the planning period would either require a comprehensive extension of the model (which the NYISO has not proposed specifically for the CRP and the CARIS, and is not needed for these processes), or a simpler type of model adjustment that is either ad hoc or comparatively subjective. Further, moving any of these analyses further into the future introduces uncertainty with respect to load growth and development of new competitive resources that may include generation, energy efficiency, or competitive (likely controllable) transmission. In a joint planning process under the aegis of the ISO, those proposing potential regulated economic transmission projects would know that their own project justification depends on that simpler and less robust type of modeling, which will essentially result in forecasting without the advantage of a sound baseline set of projects necessary to maintain the reliability of the system. This could result in uncertain and advantageous identification of benefits for the economic transmission enhancement project in question, as the developers wish to present it in the best possible light. 28. A more debilitating problem of an analysis period that goes beyond that used for CRP and CARIS is the essentially speculative nature of anything that occurs in those extra years in particular beyond the 10 years. Predicting the cost or utilization of particular power plants n/e/r/a Consulting Economists - 16 on a grid quickly becomes a speculative activity. The following factors, among others, defeat easy predictions: (1) power plant fuel price levels change (sometime rapidly); (2) “basis differentials” (meaning the relative fuel prices in one location versus another) can change rapidly also; (3) load growth absorbs plant capability that may have been rendered idle by a transmission constraint; (4) congestion payments are quixotic, model-dependent and uncertain, particularly in the later years; (5) load patterns change between regions; and (6) environmental constraints (such as potential carbon taxes), costs, and subsidies depend on unpredictable legislative or regulatory action. More specifically: a. The benefits of economic transmission enhancements will depend on lower fuel capacity in one region versus another. Over time, such surpluses will diminish as load in that region grows. When local load grows faster than anticipated, whatever benefits for economic transmission enhancements exist will diminish more quickly. Those benefits are sensitive to this factor, and it is clearly difficult to forecast it well beyond a handful of years. b. Actual and forecasted congestion payments depend on the underlying topography9 of the ISO and the models it uses to derive its LBMPs. Going beyond the normal planning horizon for the NYISO means that any forecasting will have to assume a continuation of a topography that is likely to change as new competitive power plants come on line, others are retired and other transmission ties or reinforcements are built. 9 By topography, I mean the collection of all of the ISO’s power sources, transmission links and loads that are spread out over the landscape that it serves. n/e/r/a Consulting Economists - 17 c. Load patterns change between regions. As with the topography of the RTO/ISO, these changes affect any forecasts of benefits. d. Environmental issues are an important factor to the economical production of power from different types of plants. Carbon taxes would raise the relative cost of coal-fired power and the persistence of wind power subsidies (or new subsidies directed at nuclear power) will do the same. All depend on the timing and content of regulatory actions or legislation (in addition to possible international treaties), which is manifestly unpredictable. 29. It should be apparent that my point is this: if the period for measuring benefits lies beyond the ISO’s normal planning horizon, the calculation of benefits is inherently speculative. No competitive entity would bank (as a literal matter) on sources of such benefits beyond the ISO’s 10 year planning horizon. Investment capital for transmission links in competitive markets requires a much more certain stream of both benefits and payments available for investors and lenders.10 We should not expect the ISO’s members to think that the calculation of those benefits beyond 10 years is based on any sort of firm footing. I would recommend that the limit for the calculation of benefits stop with the ISO’s planning horizon for CRP and CARIS. 10 In Makholm (2007), p. 19, I describe the difficulty that the financiers of the gas transmission links in the 1950s to create mechanisms to underwrite gas pipeline transmission expansions. The U.S. insurance industry had to create new loan instruments to make it possible—instruments that relied upon the highly predictable nature of FERC gas pipeline ratemaking, on the nature of the physical transport contracts and on the stable and highly credit worthy nature of the buyers (generally regulated gas distribution companies). n/e/r/a Consulting Economists - 18 - VI. Fuel Forecasting 30. Fuel forecasting has particular problems when it serves to form the basis for new transmission investments. In particular: a. Fuel price level forecasting is a perilous activity, as those prices essentially exhibit a “random walk.”11 Unlike the weather, there is no predictable measure of central tendency for future fuel prices. They depend on both microeconomic (production cost) and macroeconomic (currency exchange rate and global economic activity) conditions that themselves are very difficult to forecast. Changes in direction for fuel prices are particularly hard to anticipate—a persistent failure of those in that business of forecasting. b. Relative fuel price levels in different locations depend on many things, including the weather, the presence of gas transmission bottlenecks and the creation of significant new gas or oil transmission links. Basis differentials change over time between gas producing and consuming regions of the country, all of which affect the cost of power generated at different locations. 31. I reviewed historical forecasts of oil and natural gas prices prepared by the Energy Information Agency (EIA) of the Department of Energy. These forecasts are published as part of the Annual Energy Outlook (AEO). In particular, I reviewed the EIA’s comparisons of AEO price forecasts for oil and natural gas to the actual realized prices for these 11 “Random walk” is defined as an example of a time series in which the current value of a variable is equal to its most recent value plus a random element. n/e/r/a Consulting Economists - 19 commodities. On a consistent basis, the forecasts often diverge widely from the prices that actually occur. Such a divergence is unsurprising, given the volatile nature of fuel prices generally. Further, most of the error is on the high side. 32. I attach three tables to my affidavit to illustrate my point. Table 1 shows that the forecast prices for oil and natural gas have been greater than the actual prices more than 60 percent of the time, with an overall forecast error of over 50 percent. Table 2 shows oil price forecasts made in various years before each year (1-year, 2-year, 5-year, etc.) as compared to the actual observed oil prices for that particular year. In percentage terms, Table 2 shows a 128.5 percent difference is seen in the 5-year forecast for 1987. This means that the forecast of prices made 5-years earlier in 1982 was 128.5 percent greater than the prices realized in 1987. Such forecast errors have exceeded 400 percent. Table 3 shows a similar analysis for natural gas prices. The evidence is both clear and unsurprising: forecasts for inherently volatile fuel prices are not very reliable, and have tended to significantly overstate actual oil and natural gas prices. 33. Given the uncertainty in fuel cost forecasts and the likelihood that relative fuel costs will be a determining factor in the cost/benefit test, I would conclude that the proposed study period for economic cost allocation, and beneficiary designation, in the NYISO’s Attachment Y contains a time horizon that is much too long. VII. Including the Whole Cost of the Economic Transmission Enhancement 34. Future benefits for an economic transmission upgrade are uncertain—the costs of the upgrade, however, are comparatively well known. Like other forms of energy transmission n/e/r/a Consulting Economists - 20 (as in the case of gas and oil pipelines), transmission costs are up-front and sunk. Other than the relatively predictable costs of maintaining the facilities, and line losses, the price for their use over time is not much more than the amortization of the sunken costs (including carrying costs for the outstanding rate base). Such is part and parcel of the way that the “revenue requirement” in regulated utility investments of all types is recouped through regulated charges in the U.S. 35. In such an instance, it would appear to make little sense to weigh the benefits of an economic transmission enhancement with only a portion of the amortized cost. Yet, that is what the NYISO proposes: “[t]he project cost allocated under this Section 15.4 will be based on the total project revenue requirement, as supplied by the developer of the project, for the first ten years project operation.” (Attachment Y, Section 15.4.e.) What about the rest of the 20-30 year lifetime of an economic transmission upgrade? 36. Failing to take into account the remainder of the revenue requirement will cause a reasonably obvious bias in the weighing of benefits and costs. It will result in a bias toward regulated transmission projects over market alternatives to a bottleneck. If the great majority of actual costs of economic transmission upgrades occur up-front, and the benefits become quickly and increasingly speculative over time, then using only the first 10 years of regulated revenue requirements will present a bias in favor of projects that look economical today, but which may not be economical over the useful life of such a transmission upgrade. 37. I would propose that the recovery period for the economic transmission enhancement project be closely aligned to the benefit study period, as it would for other alternatives n/e/r/a Consulting Economists - 21 developed by the market in response to pricing signals. This process should complement and not supplant the development of market resources in response to such signals. VIII. Voting on the Outcome of the NYISO Planning Process 38. To reiterate, because project benefits are not always realized by the load paying beneficiaries, it is important that the NYISO process include a voting mechanism. Then, the load members, who will bear the costs of economic transmission upgrades, can have a key role in allowing the projects to go forward. The NYISO proposal to hold a vote of those members designated as beneficiaries of a proposed economic transmission project is both sound and reasonable. There are two good features of the voting proposal: (1) the beneficiaries receive proportional votes; and (2) a super majority of 80 percent of those votes is required for the project to move forward. 39. To a certain extent, such a voting scheme elicits the kind of verdict that a market would if there were no barriers to merchants providing new electricity transmission investments. If one or a number of the ISO load members believed that the benefits to their customers were sufficiently substantial and long-lived to absorb the cost of a particular transmission enhancement, there is no particular reason why they wouldn’t seek to fund it themselves outside of the process described by Attachment Y. But as I discussed above,12 both technology and the method for recouping transmission charges do not permit independent lenders or investors to be assured of the repayment of their long-lived capital (except under 12 See Paragraphs 15-18. n/e/r/a Consulting Economists - 22 the circumstances that I mentioned). Hence the NYISO proposed to do it as a group planning activity, subject to a vote by those who would ultimately pay. 40. To the extent that the benefits of an economic transmission enhancement are speculative, or the costs are mismatched with the benefits, voting members would be able to consider these issues and develop an appropriate position. This is particularly so if a member perceives that the allocation of costs is disadvantageous to its customers as compared to projected benefits. 41. The proposed voting method, then, is a practical and reasonably effective way to avoid the building of economic transmission enhancements whose benefits do not dependably cover their cost and/or whose cost allocation may be subjective or otherwise perceived to be unfair. Alternately, if the project makes sense, voting for it would allow its costs to be recovered proportional to the measured benefits from all load serving members in the region or zone, and would allow the realization of the compelling benefits without any concerns about “free rider-ship.”13 42. It may seem that the NYISO, in its voting proposal, has created a high threshold to build regulated transmission enhancements for the purpose of alleviating congestion caused by transmission constraints. In the end, that is not terrible, for the FERC, as well as much of the market, recognize that it is better for those stakeholders that would most directly and 13 Those “free riders” could either be LSEs who benefit—but who do not pay for—the economy transmission upgrade, or competitive generators who appropriate the economic benefit of the upgrade, as I had discussed earlier. n/e/r/a Consulting Economists - 23 objectively benefit from transmission upgrades (like groups of power generators or other sub-sets of the ISO membership) to find a way to fund such transmission links directly. 43. This concludes my affidavit. Dated: January 7, 2008 Jeff D. Makholm, Ph.D. Subscribed and sworn to before me this day of January 2008 Notary Public My commission expires: n/e/r/a Consulting Economists - 24 - Table 1 Summary of Differences between Annual Energy Outlook Reference Case and Realized Outcomes All AEOs Absolute Percent OverPercent Estimated Differences (1) (2) World Oil Prices Natural Gas Wellhead Prices 68.0% 61.0% 52.9% 63.5% Source: Energy Information Administration / Annual Energy Outlook Retrospective Review. http://www.eia.doe.gov/oiaf/analysispaper/retrospective/index.html Note The comparison summarizes the relationship of the Annual Energy Outlook case projections since 1982 to realized outcomes for AEO1982 through AEO2006. Explanation: Column 1 shows the proportion of years for which the deviation between the EIA forecast and the actual outcome was such that the forecast was greater than actual. Column 2 shows the average absolute percentage deviation between the forecast and the actual.. n/e/r/a Consulting Economists - 25 - Table 2: World Oil Summary of Differences between Annual Energy Outlook forecast and Realized Outcomes Percentage Differences in Real Prices Length of forecast End of Forecast Year 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 1 year 2 years 5 years 7.7 84.7 -12.5 7.4 110.0 36.9 128.5 -19.6 32.4 10.2 25.5 10.9 0.8 -14.0 4.8 56.1 -21.0 -21.3 13.0 -7.3 -2.9 -31.7 -27.5 4.6 -24.9 40.6 28.0 36.9 6.4 -11.7 0.3 62.4 15.1 -47.0 -4.6 -3.7 -13.4 -28.4 -49.9 10-11 years1 12-16 years2 105.9 55.1 19.0 19.6 34.3 65.5 27.5 35.0 83.7 25.1 -19.3 -1.5 -5.0 -29.1 -37.0 -51.6 331.0 117.3 168.3 252.7 168.6 66.7 81.1 81.2 40.4 -5.3 -37.8 492.7 351.0 241.7 132.5 82.8 69.9 42.0 41.4 Source: Energy Information Administration / Annual Energy Outlook Retrospective Review. http://www.eia.doe.gov/oiaf/analysispaper/retrospective/index.html Notes: 1) If forecast was available for years 10 and 11, year 11 was used. 2) Longest forecast was used for 12-16 years. For example if a forecast was available for all years, 16 year forecast was used. 3) Table presents the percent differences between actual and projected prices. 4) Negative values indicate underestimates and positive overestimates. 5) Percentages are based on real current prices and avoid any inflation assumptions. Explanation: Each row in the table above represents percentage differences (i.e. percentage overestimated/underestimated) between actual world oil prices in the year mentioned in column one and forecasts made regarding world oil prices in previous Annual Energy Outlook reports published by the Energy Information Administration. For example for the year 1995, a forecast made one year prior in 1994 overestimated the price by .8%, a forecast 2 years prior overestimated price by 6.4%, and a forecast made 5 years prior overestimated price by 65.5% and so on. In general, as can be seen in the table, the longer the forecast period the less accurate are the projections. n/e/r/a Consulting Economists - 26 - Table 3: Natural Gas Wellhead Summary of Differences between Annual Energy Outlook forecast and Realized Outcomes Percentage Differences in Real Prices Length of forecast End of Forecast Year 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 1 year 10.4 34.4 17.1 15.2 0.6 10.2 15.8 6.2 -5.1 14.9 28.9 -19.8 -21.4 12.1 -1.9 -39.3 -12.9 -30.1 -33.2 -26.8 -26.5 2 years 5 years 16.7 49.3 59.0 35.4 24.6 11.4 21.3 -0.4 13.0 46.2 -10.0 -19.7 -2.8 3.0 -40.1 -43.3 0.8 -48.1 -42.8 -50.5 10-11 years1 12-16 years2 299.6 132.5 144.6 95.9 91.9 56.6 49.1 61.7 15.7 12.0 39.2 9.6 -40.4 -46.6 -17.1 -48.1 -54.0 -62.3 501.7 213.0 231.9 195.8 193.7 45.8 7.8 60.5 -1.4 -29.5 -43.2 721.7 339.9 341.8 193.4 71.9 18.2 18.1 21.9 Source: Energy Information Administration / Annual Energy Outlook Retrospective Review. http://www.eia.doe.gov/oiaf/analysispaper/retrospective/index.html Notes: 1) If forecast was available for years 10 and 11, year 11 was used. 2) Longest forecast was used for 12-16 years. For example if a forecast was available for all years, 16 year forecast was used. 3) Table presents the percent differences between actual and projected prices. 4) Negative values indicate underestimates and positive overestimates. 5) Percentages are based on real current prices and avoid any inflation assumptions. Explanation: Each row in the table above represents percentage differences (i.e. percentage overestimated/underestimated) between actual world oil prices in the year mentioned in column one and forecasts made regarding Natural Gas Wellhead prices in previous Annual Energy Outlook reports published by the Energy Information Administration. For example for the year 1995, a forecast made one year prior in 1994 overestimated the price by 28.9%, a forecast 2 years prior overestimated price by 46.2%, and a forecast made 5 years prior overestimated price by 61.7% and so on. In general, as can be seen in the table, the longer the forecast period the less accurate are the projections. n/e/r/a Consulting Economists