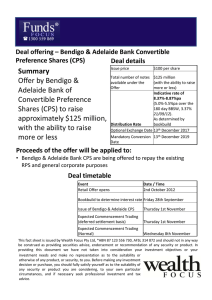

Bendigo & Adelaide Bank CPS

advertisement

Bendigo & Adelaide Bank CPS Bendigo & Adelaide Bank has just announced the launch of a new income offer: Bendigo & Adelaide Bank Convertible Preference Shares (CPS). The first round of access is through a broker firm allocation, prior to shareholder offer and listing in November. The Shares will pay a semi annual coupon of 5.0%-5.5% (rate determined by the bookbuild) over the 180 day bank bill swap rate (BBSW), which was 3.37% as of 21st September, with an initial indicative rate of 8.37%-8.87%pa. (The first pricing is due to be set on date of issue) The Shares are expected to redeem on the 13th December 2019*. The Shares will be tradable on the ASX. Bendigo & Adelaide Bank CPS Offer Details Issuer Security Name First Call Date Maturity Date Bendigo & Adelaide Bank Bendigo & Adelaide Bank CPS (BENPD) 13th December 2017 13th December 2019 (unless redeemed earlier) Margin Size Minimum Parcel 180 day BBSW + 5.0%-5.5% (rate to be determined by bookbuild) $125m+ $5,000 (Wealth Focus minimum is $10,000) Source: Bendigo & Adelaide Bank CPS prospectus Background to Bendigo and Adelaide Bank Bendigo & Adelaide Bank is capitalised at $3 Billion, an ASX 100 listed company and is one of the largest regional banks with a network of 500 branches. Its loan book is split 65% residential mortgages, 22% commercial, 10% consumer and 5% margin lending. Focus on loan book One of the main concerns with any bank post GFC is its lending practices and the history of bad debts. The concern is a weaker economy may lead to increased defaults. The view is that banks with historically high bad debt ratios are more likely to suffer in an economic downturn. We note that Bendigo’s impairment is well below that of its peers. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 25/09/12 Furthermore, the increase in tier 1 capital to 8.09% provides investors with a reasonable buffer over the 5.125% Common Equity Trigger ratio that APRA requires within these issues. However, we do have a concern over the MIS provisions for Great Southern litigation risk and the $20 Million provision is arguably just to cover their own lawyer’s fees. The litigation is currently in court ordered mediation, due to begin trial towards the end of October, and is seeking to have $791 Million of loans deemed void or unenforceable. Comparative Securities This issue is similar to the recent bank and insurance issues such as ANZPC, CBAPC, WBCPC and IAGPC in that these securities all contain non-viability clauses that convert the hybrids into ordinary shares in the event of that either the tier 1 capital ratio falls below 5.125% and/or APRA views that the company is no longer viable and as such commands a premium to historical margins. With a margin of 5%-5.5% over the BBSW, (CBAPC was set at 3.8% over the BBSW), BENPD reflects the higher risk associated with smaller banks. Key Points 1. Indicative floating yield of 8.37%-8.67% provides investors the opportunity to take advantage of historically high hybrid margins. 1. Option to redeem at year 5 with mandatory conversion at year 8 – Bendigo & Adelaide Bank has the option to convert in December 2017 or on any subsequent dividend payment date. 2. Financial Strength – Bendigo & Adelaide Bank provides investors with exposure to an ASX 100 listed company and a market cap of $3bn. 3. Automatic conversion under the Capital Trigger Event – we encourage you to be familiar with this clause as it is the reason that this hybrid structure requires a higher margin for investors to consider investing 4. Redemption highly likely in 5 years - although BENPD has a 7 year maturity, we think BEN will redeem/convert at the first call date in December 2017. As we have highlighted on previous hybrid issues, there are major incentives for redemption/conversion. These include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 25/09/12 We note that Bendigo & Adelaide Bank have highlighted they are looking for $125 Million on this issue. This seems a little misleading considering there are $90 Million of BENPA that they are due for repayment. We would guess that BEN are really looking for over $200 Million. Our View This issue has all the hallmarks of what you would look for in hybrid offer. A relatively small issue size, of which we would guess $60 Million of existing BENPA holders will roll into the new issue, a high margin, a bank lender with a relatively low bad debt ratio and high tier 1 capital ratio. This is likely to result in the hybrids listing at a premium. However, we view the key risk as the Great Southern loan litigation. A $791 Million write off for a $3Billion company is no small change and could easily result in BEN breaching their tier 1 capital requirements and triggering the Capital Trigger event. We should add that BEN’s confidence in winning this case is reflected in their measly $20 Million provision for Great Southern litigation. Our view is that relative to other recent bank hybrids, this is a reasonable premium for an issuer like Bendigo, however, we would rather wait to see the outcome of the Great Southern case. Note: Bendigo & Adelaide Bank CPS will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. Investors looking for an allocation can contact us on 1300 559 869 We encourage you to view our online presentation An Introduction to Fixed Income www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 25/09/12