For personal use only Prospectus and RPS Reinvestment Offer Information Relevant.

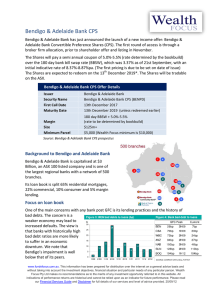

advertisement