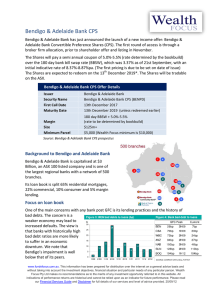

Bendigo and Adelaide Bank Retail Bonds Series 1 customer connected

advertisement