BTAL U.S. Market Neutral Anti-Beta Fund

advertisement

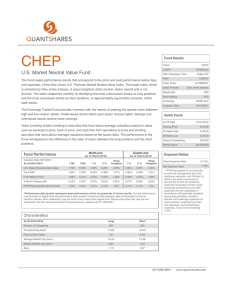

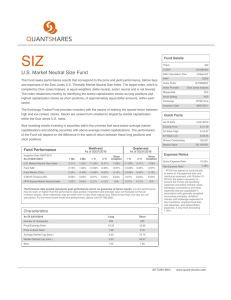

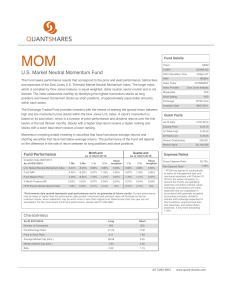

BTAL Fund Details Ticker U.S. Market Neutral Anti-Beta Fund The Fund seeks performance results that correspond to the price and yield performance, before fees and expenses of the Dow Jones U.S. Thematic Market Neutral Anti-Beta Index. The target index, which is compiled by Dow Jones Indexes, is equal weighted, dollar neutral, sector neutral and is not levered. The index rebalances monthly by identifying the lowest beta stocks as long positions and highest beta stocks as short positions, of approximately equal dollar amounts, within each sector. The Exchange Traded Fund provides investors with the means of seeking the spread return between low and high beta stocks. Low beta stocks are those stocks that are less volatile than the market index, and high beta stocks are those stocks that are more volatile than the market index. Anti-beta investing entails investing in securities that have below-average betas and shorting securities that have above-average betas. The performance of the Fund will depend on the differences in the rates of return of these long positions and short positions. BTAL CUSIP 351680707 NAV Calculation Time 4:00pm ET INAV BTALIV Index Ticker Index Provider DJTMNABT Dow Jones Indexes Marginable YES Short Selling NYSE Arca Inception Date 09/13/2011 Quick Facts As Of Date 12/31/2015 Closing Price $ 22.20 52 Week High $ 23.66 52 Week Low Month-end As of 03/31/2016 Fund Performance Inception Date 09/13/2011 As of 03/31/2016 3 Yr 3.70% 0.28% 14.54% 3.70% 0.28% 0.73% -2.27% 10.32% 0.73% -2.27% 0.83% -2.28% 9.40% 0.83% -2.28% 1 Yr 3 Yr U.S. Market Neutral Anti-Beta Index -2.36% 7.60% 14.54% Fund NAV -2.25% 6.81% 10.32% Fund Market Price -2.17% 6.76% 9.40% S&P 500 Index 6.78% 0.05% 1.35% 0.07% 1.78% Market Value 1 Yr 3 Mo 0.02% Shares Outstanding Since Inception 1 Mo 3 Month Treasury Bill Quarter-end As of 03/31/2016 0.04% 0.04% 11.82% 15.85% 0.07% 1.78% 0.04% 11.82% As Of 03/31/2016 Number of Companies Price/Earnings Ratio Long Short 200 200 20.64 17.60 Price to Book Ratio 3.04 1.87 Average Market Cap (blns.) 17.48 16.52 Median Market Cap (blns.) 7.65 5.51 Beta 0.77 1.32 $ 18.81 2,600,001 $57,720,022 Since Inception 0.04% 15.85% *Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment and principal value will fluctuate so that an investors shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For the most recent month end performance, please call 617-292-9801. Characteristics YES Exchange Expense Ratios Gross Expense Ratio 7.43% Net Expense Ratio* 1.49% * FFCM has agreed (i) contractually to waive its management fees and reimburse expenses until October 31, 2016 to the extent necessary to prevent the Fund's net operating expenses (excluding interest, taxes, brokerage commissions and other expenses that are capitalized in accordance with generally accepted accounting principles, dividend, interest and brokerage expenses for short positions, acquired fund fees and expenses, and extraordinary expenses, if any) from exceeding 1.49% (617)292-9801 www.quant-shares.com Sector Weightings As Of 03/31/2016 % Long Weight % Short Weight Basic Materials 3.98% -4.00% Consumer Goods 10.06% -10.02% Consumer Services 13.03% -13.48% Energy 5.51% -5.07% Financials 23.56% -23.54% Health Care 10.52% -10.50% Industrials 17.00% -17.04% Technology 11.02% -11.02% Telecommunications 1.00% -1.01% Utilities 4.51% -4.52% What are Spread Returns? Our market neutral ETFs seek to generate positive returns when after expenses, the basket of approximately 200 names that the fund buys (long positions) outperforms the basket of approximately 200 names that we sell (short positions). Our ETFs combine bullish and bearish positions within one ETF. The spread return generated between the buys and sells is what is important, not the absolute return of the market. If the long positions rise more than the short positions the ETFs will generate positive returns. Additionally, if the long positions fall less than the short positions the spread return will be positive. Therefore, regardless of the direction of the overall stock market, up, down or sideways, as long as the long positions outperform the short positions the Fund will have a positive return. Alternatively, the fund will have a negative return when the long positions underperform the short positions regardless of the direction of the market. Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus which can be obtained by visiting www.quant-shares.com. Please read the prospectuses carefully before you invest. Risks: There is no guarantee that the Fund will achieve its objective. Investing involves risk, including possible loss of principal. There is a risk that during a "bull" market, when most equity securities and long only ETFs are increasing in value, the Fund's short positions will likely cause the Fund to underperform the overall U.S. equity market and such ETFs. There is a risk that the present and future volatility of a security, relative to the market index, will not be the same as it has historically been and thus that the Fund will not be invested in low beta securities. In addition, the Fund may be more volatile than the universe since it will have short exposure to the most volatile stocks in the universe and long exposure to the least volatile stocks in the universe. The value of an investment in the Fund may fall, sometimes sharply, and you could lose money by investing in the fund. The Fund may utilize derivatives and as a result, the Fund could lose more that the amount it invests. When utilizing short selling the amount the Fund could lose on a short sale is potentially unlimited because there is no limit on the price a shorted security might attain. For further risk information, please read the prospectus Shares are not individually redeemable and can be redeemed only in Creation Units. The market price of shares can be at, below or above the NAV. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00PM Eastern time (when NAV is normally determined), and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Beta is a measure of an asset's sensitivity to an underlying index. Long is purchasing a stock with the expectation that it is going to rise in value. Short is selling stock with the expectation of profiting by buying it back later at a lower price. Spread Return is the return earned between the long and short portfolios within each ETF. Price to earnings ratio is a valuation of a company's share price compared to its per-share earnings. Price to book is a ratio that compares a stocks book value to its market value. S&P 500 is an index of 500 large cap common stocks actively traded on the NYSE and NASDAQ. The owners of Shares may purchase or redeem Shares from the Fund in Creation Units only, and the purchase and sale price of individual Shares trading on an Exchange may be below, at, or above the most recently calculated NAV for such shares. Distributor: Foreside Fund Services, LLC (617)292-9801 www.quant-shares.com