oi 711 t[sfI)) n

advertisement

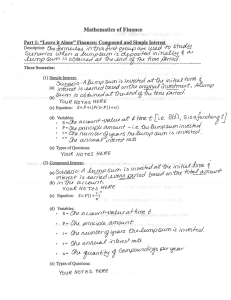

Mathematics of Finance

Part 2: “Looking for a Lump Sum in the Future”:

Investing via Multiple Deposits

lc J7) s?La%

e-iznc

Th zhIs S€ce,n d

,77tzd! )n fz a-n )n tcSi’7?U/7/ a7’ L-rIôcJ’c //7fl’-/(

ic

Description:

u’Ain

z

711

oi

a-

o2

et

Three Scenarios:

(1) Future Value of an Ordinaiy Annuity

(a) Scl7a-rio PerôS;c ctpoth’ a

ch ½mcPtr’od w’th 77c

1

(l+r )N_

(b) Equation: SR(

r

-i

vzJ

s=

•

R= 2ke amocn

•

r

t[sfI))

a

•

N=

ac

a &tmp S’’un

ifl lv l7ii

(c) Variables:

•

ôJ

n

-

‘

,n

1

71

s ncbn

(#oQ

not)ftJi Th

p

m413)

.* o 2e,npoL&2 ct’Itr4

(O r

ClntLrZiJs)6’

YcLr rutc ALH.

(2) Sinking Fund Payment Formula

Sc,rtØr1o:

(a) In

&n

oô /7’s In i

1

peno c//s I(e-

6 ma-kr

;n’c/

r

7

ziI7I-a C-U..f,?L

(b) Equation:

3f C4 j

‘u U. U)ttl7 7’

/J

i-ti

iWt2.

r

)N

R=S((

1

(c) Variables:

• S=

a

7’

•

R=

•

N=1

•

=

-

(d) Types of Questions:

1&.e

LL-i cfluf2

a_&t

7kJ11

cLLpo6ñ

=

(d) Types of Questions:

]

paf?//dPO6,?L

r4-

n

e/RJ

ljt

2

U4-r

1

/c&-pO/7

Annuíj

(3) Future Value of an Annuity Due

5èfu-1-?’C: P€ioc/tc ciLtpO7/3

(a)

tc

/77O(k ifljt 77zi

&cc,ccrn’

0

p yum in

(b) Equation:

I&c

Lui”

127I5

St pscnp

(c) Variables:

S

•

(1+r

1

)N_

Sdiie=R(1 +r)(

c

=

is

r.

•

t’fflZ’ti7

t2nruLF

=

‘ime 7:’

iii-

IsfD

R=

)S(1+r)

PJ/?un t

In k,s1’zt’

Lütn parntin/

N

a

CLII

/n12

•

s

=

=

Th ?trd

&int€I?7 JcLtjô ,13

pnW7

=

(d) Types of Questions:

2

t&cL

C)

C

Example 1: Suppose Jessica wants to create a college fund for her daughter, Olivia, who was just born.

Jessica will deposit each of her annual $2,000 bonus checks in this college account on Olivi&s birthday

each year (i.e. at the end of each year of her life) for the next 18 years. The account earns 8% interest,

compounded yea&. How much money will Olivia have toward college when she turns 18 years old?

4 6,o0 c PrV 1’-&m.

ObSrtJiOflS: wipte dc-po/ 1LtO Ja-mp m In

AItou.

LLS

‘

J-u -Qflc/

,q,tL) uc/

‘r?-cncTh

AOoSQ

Jñ7U

63,vp 2

iiiU-€51

/12,1

m.//s tL S

IS 7

c) Aitô& LLS h’

0-n

/Ji-’7’ocJ

od?i 0nfl.L

i1’tMt:

&J c,JiOfl:

d

_J]

áhc)fl “ok-cIl[Ly

C.&e)o

“SIn

UrzLL-e

9ornwJ-’-

tn Ord’,irj

Anhu%ik/

I-c

UJ*fL.OWfl

r’ _O’r

.0?

w

-.

j

-

Example 2: Suppose that you can afford to put $500 per month into an investment account to save

toward your retirement. You regularly invest this amount for 20 years in an account that you predict

will earn 7.5% interest compounded monthly, without taking to much risk. What will the account be

worth upon your retirement?

ô

,,i’re fip t

.

No cxrte22en f abôa f

cV

fllJ0

g

)

/

S

end fOtr/ifl-rj

/7’Ot{) /U(Ci

Rf

m p un in

jri’ or

4 7u /fl.n /77

/,6/

?P

1

1

J

&1D

0

7

S-’

Voni%S:

J-i’. 7)I

r

S’

J

=

11L21

(,-i

flL9l

=

U-fl

oo

.075

Nn./(20)

n)

2tD

Example 3: Mark has a debt of $28,000 to pay in 5 years. How much must he invest at the end of each

quarter in an account earning 12% interest compounded quarterly to be able to pay off the debt?

a) j-L1ip dpô

7’tcfl

En

1-

R

.Oøi

poi

‘i?- si

S

(j+c)

—I

7

L’

=.ooo

?= LflIC1lOtJ)/)

r

/

p

-

Nnt=41’6)

,-,

J

N

2

0

-

/

-j

Example 4: Find the future value of an account, earning 6% compounded monthly, with $150

deposited at the beginning of every month for 8 years.

C6s5n s: 0 ii’fip ldf üpo/I C) Qumpum in Th

6ci nfl

c

‘

‘4flr1A4 IJJ

;>

(g

‘

;auz

n

b7 S(*)

7

Vb-&S:

.O(o

V

10(p

/Z,

,Y?

.o(,

0

(,+0

6

,

J2

J’fl.Jr/2(’)

\9’

F(/) —‘]iio

I

—

.

Example 5: George and Mary have a friendly contest between them to see who can earn the most

money in the next 5 years. They each can only invest a total of $10,000 in an account earning 10%

interest compounded monthly, but neither of them has that much money up front. George decides to

invest $5,000 at the beginning of the 5 years, and then add $85 at the end of each month to his account.

Mary invests $170.00 at the end of every month for 5 years. Who has more money at the end of 5

years?

5000 U)

J: Jump m

fjflfl+

nI2.

c

gpo5;fs

cf7ij

-I

Lh01 Jtit IktLLCA

rVLc4D

k

1

J

f3’LRif

f’tfl

In

771

.1. StflCL-flO

sarhavrO

JLh

cjnki

.juic/

P (/+

i i

/nbtS.’

5

rIO

7H

(6)

5ooo

:r; ,eshrLu7 fr

1

(/4

L2

/2

J

5000

12()

—

S(

2

Vcc,ro-&es

s

=

7.

W [ Lz’

—

c(5z

)

N=° I2(S)

-i

lb

j

rib

rLZ

Example 6: You graduate from college at the age of 25 and because you’re tired of living with little

money, you decide not to invest toward your retirement for the first five years of your career. This

allows you to enjoy more of your money for that time interval. After that five-year period, you invest

$400 at the end of every month in an account earning 9% interest compounded monthly for the next 35

years.

(a) How much will your retirement account be worth at age 65?

(b) How much more would your account have been worth if you had only invested the $400 per

month for the first eight years and then let the money sit there earning compound interest for the

entire 40 years?

(c) How much would the account be worth if you had invested the $400 monthly for the entire

40 years?

t 14i

a) iiwJJiple d po/Jw ,

Qd

(i-i-r€)

U)

Q-aCJ /J’Vfl

I

_j

VCL,(iOJ-&:

]

/235

I

øçJJAflip

Ifl

Z

j2Jiøc

ScLpIcr1otor

7?

rc

Nn-t=-/2(3S)

7

7J

O9

.o9

n.!2

-

-100

t3S

/2

/, I3.

-

06 rzJ

X

Ofl S

Ce/?OI7s:

.Q!N

s(

/2—

xp 1- t

2

S

=

:mpm —&hrn

iiskd uii

& c—eitpt-iun ci

/drCSZC(u-,7fr

8(12)

32

I

—1

1

LQ

/2

1?.T

55, c/f2

3Z

/2(32

-1 z(j iJ

Jc) -__l

-

Example 7: A $50,000 machine will have a market value of $6,000 in 15 years, which is the usable

lifespan of this machine. A new machine is expected to sell for $68,000 at that time. The company sets

up a sinking fund to pay for the new machine in the future. Payments are made to the fund twice each

year. If the fund earns 7% interest compounded twice yearly, how much should each payment be?

‘iij

/ tWC ( 000 to 00

CpaJ73-J ,Cø-n &LU’ zZt rr

Jiut for Ce O ô

20O0

6ruZ

PC

QJ:

fl

—

/ipU

1LtC&iinp In

/l coinrtten fr r

fl:

)J

5

6cinni?

?

Vc-rfoJ

4

5’

+)fv_/

1

L (

J7lL

a 5 tz

ôJ(/

7

S= (oz000

(A17

tL-p

i’

id

-

—

Sn i

1

.07

1

c-/I

/‘v’h-

‘

zoooL_(i---qy°-IJI

—---

-

t

z/,s)

I

-

1tip1i dpcs/f rvco,

4

s h: D ) tA

ObS,rvM’Ofl!

J

S.

tri

kru’ fl

/

-&mp i,-

Jfl

7

J2.

—

,

o

n /

(a)

j

L

*)°_j

C

(