Macro-prudential Regulation of Real Estate Markets: Why, What, and How?”

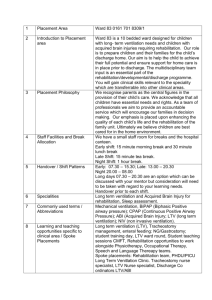

advertisement

Disclaimer: Views expressed in the presentation and during the talk are those of the presenter and should not be ascribed to the IMF. Before the crisis… Financial sector a black box, macro-finance nexus rarely in forefront Asset prices a concern only through their impact on GDP and inflation Monetary policy to focus on inflation and output gap (exclusively in AE, more flexible in EMs) Benign neglect approach to boom/busts: Bubbles difficult to identify Costs of clean up limited and policy effective Better clean up than prevent Then came the crisis… Bust had enormous consequences Standard policies rapidly hit their limits Limited effectiveness of less traditional policies Large fiscal and output costs Need to reconsider “consensus” Benign neglect approach may be dead But, problems and trade offs with more interventionist strategy remain: Bubbles difficult to detect in real time Risks associated with pricking bubbles Traditional policies may be ineffective And have large costs Real estate booms are dangerous Not all asset-price booms should be target of policy But how to choose? Emerging consensus: culprit is leverage (Nasdaq crash was fine) Real estate markets are special: Leverage (link to crises) Large storage of wealth Major supply-side effects Network externalities Boom, Leverage, and Defaults Real Effects of Housing Busts Figure 2. House Price Run-Up and Severity of Crisis Cumulative decline in GDP f rom start to end of recession 10 IND 0 AUS CHN NZL CAN FRA GRC CHE CYP PRT AUT USA KOR NLD CZE HRV HUN DNK SWE BGR FIN SVN -10 ZAF ESP GBR NOR ITA POL y = -0.0416x - 4.1152 R² = 0.1496 IRL ISL UKR EST -20 Bubble size shows the change in bank credit f rom 2000 to 2006. LTU LVA -30 -20 0 20 40 Source: Claessens et al (2010). 60 80 100 120 140 160 Change in house prices f rom 2000 to 2006 180 200 220 240 Leverage and Link to Crises: Recent Episode Booms, Financial Instability, Macroeconomic Performance Followed by … Boom systemic banking crisis significant drop in real GDP growth either both Real estate 53% 77% 87% 43% Credit 67% 78% 93% 52% Real estate but not credit 29% 71% 71% 29% Credit but not real estate 100% 75% 100% 75% Both 61% 78% 91% 48% Neither 27% 18% 45% 0% 50 150 Leverage and Link to Crises: Examples from the Past cps_gdp 30 40 Philippines 1997 0 10 20 50 cps_gdp 100 Thailand 1997 1970 1980 year 1990 1960 2000 1970 1980 year 1990 2000 1980 year 1990 2000 60 100 1960 cps_gdp 40 Chile 1982 0 20 40 20 cps_gdp 60 80 Finland 1991 1960 1970 1980 year 1990 2000 1960 1970 Calling it in real time: Should have, would have, could have? Deviation from house price “fundamentals” Price-income ratio Price-rent ratio Error-correction models Turning point models Monitoring credit indicators Leverage Credit growth rates Measures of lending standards Measures of “overvaluation” (as reported in October 2008 WEO) Did predictions come true? Back to Earth 15 Actual change in house prices, 2008-09 CAN AUS 10 5 NOR BEL SWE GBR FRA JPN NLDITA FIN NZL USA 0 DEU KOR -5 ESP -10 DNK -15 -20 IRE -25 -30 -35 -30 -25 -20 -15 -10 Change in house prices, predicted in Oct. 2008 WEO Sources: IMF staff calculations, and OECD. -5 0 5 10 Recognize an elephant when you see one… 250 1000 900 200 800 150 600 Home Prices 500 100 400 300 Building Costs Population 50 200 Interest Rates 0 1880 1900 Source: Robert Shiller. 1920 1940 1960 1980 2000 100 0 2020 Population in Millions Index or Interest Rate 700 Monetary Policy: (Sometimes) Effective at a (large) cost Make borrowing more expensive and may limit leverage and risk taking But: Too blunt: costly for the entire economy (unless in context of general overheating) Issues for small open economies Effect on speculative component may be limited Panel VAR suggests impact on house prices at considerable cost to GDP growth 100 basis points reduce house price appreciation by 1 but also lead to a decline of 0.3 in GDP growth Fiscal Tools: Distortionary and limited cyclical use Debt-financed ownership favored: allow deductibility of mortgage interest (DMI) do not tax imputed rents and capital gains fully But: No link between favorable treatment and the crisis Cyclical use is difficult and violates tax smoothing Evidence: Structurally, removal of DMI may help reduce leverage Cyclically, transaction taxes may help during busts less so during booms with impact falling on transaction volumes rather than prices Transaction Value Growth in Selected Asian Real Estate Markets (In percent, year-on-year) 400 600 China Hong Kong SAR Korea Singapore (right scale) 300 200 450 300 Recent data 100 0 150 0 -100 Source:National authorities, CEIC, IMF staff estimate. Note: Korea data represent units of transactions Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 Sep-08 Jun-08 -150 Macroprudential Tools: Promising but still at infancy, learning by doing Most ‘experiments’ in emerging markets, particularly Asia Common tools: Maximum LTV/DTI limits Differentiated risk weights on high-LTV loans Dynamic provisioning Discretion rather than rule-based Potential issues Circumvention Calibration Political resistance Macropru in practice Range of triggers: Rapid price and credit growth, overvaluation Household leverage Bank concentration, nonbank activity NPLs by vintage, “exotic” loans and speculative activity (FXdenominated, high LTV, long tenor, multiple loans at a time, etc) Calibration: No magic numbers (LTV 60–85%, DTI 30–50%) Variation by loan type Frequent changes (often in response to leakages) Exemptions for certain groups Enforcement: Narrow gap between announcement and implementation Often not discussed with stakeholders Decision power: CB involved in many cases Multi-agency or committee approach not common Mixed evidence on effectiveness (so far) Promising: reduction in procyclicality of credit and negative link to incidence of booms and booms turning bad More success in building up buffers than preventing a boom Analysis of household surveys point to an impact on expectations Emerging Europe case indicates effectiveness of some (CAR and non-standard liquidity measures) Latin America case shows moderate, transitory effect Use of LTV and DTI since 2000 Countries that changed LTV 10 Bangladesh China Hong Kong India Indonesia Korea Malaysia Nepal Singapore Thailand 8 6 Countries that changed DTI 6 Bulgaria Cyprus Hungary Israel Netherlands Norway Poland Romania Spain 5 4 Argentina Bahamas Brazil Canada Chile 4 2 Serbia Netherlands Romania Norway Poland Oman Pakistan 0 3 2 Saudi Arabia Kuwait Hong Kong Korea Bahamas Canada 1 0 Africa Asia & Pacific Europe Middle East Western & Central Hemisphere Asia Africa Asia & Pacific Europe Middle East Western & Central Hemisphere Asia 0 Serbia Saudi Arabia Romania Poland 20 Netherlands 40 Kuwait 80 Korea 100 Hong Kong Limits on Loan-to-Value ratios Canada 120 Bahamas Argentina Bahamas Bangladesh Brazil Bulgaria Canada Chile China Cyprus Hong Kong Hungary India Indonesia Israel Korea Malaysia Nepal Netherlands Norway Oman Pakistan Poland Romania Singapore Spain Thailand Range of LTV and DTI Limits on Debt-to-Income ratios 70 60 50 40 60 30 20 10 0 “Effect” of LTV and DTI Macro, cross-country data supports some impact on both credit and house price growth Different story with disaggregated/micro, country-specific data HKG: effect on household leverage, not house price KOR: short-lived effect on both mortgage and house price, LTV more effective than DTI ROM: effect on consumer credit, not house price MYS: effect on speculative borrower activity only, not on house price Hong Kong Volatile house prices, conservative LTV limits Hong Kong: Fighting to rein in a boom 160 New loans approved Prices 170 150 150 140 130 110 90 70 2009 - Mar 2009 - May October 2009: Maximum LTV for properties over HK$20 million lowered to 60 percent, maximum loan size for mortgage insurance eligibility reduced and non-owner-occupied properties disqualified. August 2010: LTV for properties over HK$12 million lowered to 60 percent, applications for mortgage insurance exceeding 90% LTV and 50% DTI suspended, maximum loan size for mortgage insurance eligibility if LTV>90%. 130 120 110 2009 - Jul 2009 - Sep 2009 - Nov 2010 - Jan 2010 - Mar 2010 - May 2010 - Jul Korea Limits on LTV and DTI to curb price increases in ‘speculation zones’ Korea: Effective but difficult to calibrate? 6% 6 Month-on-month house price changes in 'speculation zones' (LHS) 5% Policy rate (RHS) September 2002: Introduced LTV limits 4% 5 4 3% 2% September 2009: Tightened DTI October 2003: Lowered LTV in speculative areas 1% 3 February 2007: Tightened DTI 2 0% June 2003: Lowered LTV in speculative areas -1% -2% 2000 - Jan July 2009: Lowered LTV in non-speculative areas August 2005: Introduced DTI limits 1 0 2001 - Apr 2002 - Jul 2003 - Oct 2005 - Jan 2006 - Apr 2007 - Jul 2008 - Oct 2010 - Jan Tentative policy taxonomy Macroprudential tools first line of defense especially if concern about a single sector Target leverage Strengthen balance sheets Monetary policy definitely to be involved when there are other signs of overheating Fiscal tools hard to use cyclically But removing distortions may help at the structural level Could macroprudential tools have prevented the Euro Zone crisis? Greece and (to lesser extent) Portugal classic fiscally driven crises: Large fiscal deficits Relatively low growth (and very low productivity growth) Large current account deficits But Spain, Ireland, Latvia different Prudent fiscal (at time of crisis, plenty of fiscal room) But buoyant private sector Asset price bubbles and credit booms Large current account deficits (especially Spain/Latvia) Common currency a constraint for all Bottom line Strong association between real estate boom-busts and financial crises/recessions Leverage is key Macroprudential policy promising but still learning (by doing): When to take action Deviation from yardsticks (valuation ratios, leverage, credit growth) Bubbles difficult to spot but many policy decisions are taken under such uncertainty Objectives Prevent unsustainable booms and leverage buildup Increase resilience to busts No silver bullet Broader measures: hard to circumvent but more costly Targeted tools: limited costs but challenged by loopholes Important Open Questions Rules versus discretion Far away from IT standards Risks associated with excessively interventionist policy Making “constrained discretion” operational? Who does what? Where should macro-prudential authority reside? Evidence (we need more!) Effectiveness : Differences across instruments, between emerging and industrial countries, based on position in the business cycle? Calibration: Optimal level for LTV limits? Circumvention: Leakages and waterbed effects? Relationship among instruments: To what extent are these independent tools? Timing: Best leading indicators to predict a real estate market crisis? Any differences across countries? Main data challenges?