VIRGIN MOBILE: A Pricing Decision

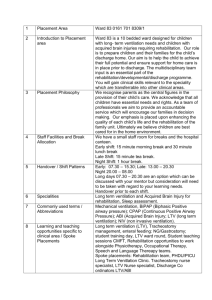

advertisement

1 AEM 4160: STRATEGIC PRICING PROF.: JURA LIAUKONYTE VIRGIN CELL CASE: EXCERCISES Pricing Structure from the Carrier Perspective Contracts: Annual churn rate WITH contracts Annual churn rate WITHOUT contracts The difference: =2% * 12 months = 24% (p.8) =6% * 12 months = 72% (p.8) 72% - 24% = 48% Take AT&T example: customer base = 20.5 million If AT&T abandons the contract based plan how many new customers would it need to acquire to offset customers from an increased churn rate? Additional customers lost to churn: Acquisition cost per customer: Total cost of offsetting higher churn rate: 48% * 20.5 mln = 9.84 mln $370 (case p.2) $370 * 9.84 mln =$3.64 bil. Not surprising that major players still continue to hold the contracts. “Menu” pricing: Actual Usage Bucket/”Menu” pricing In reality most consumers are paying more than their optimal rate = if they new exactly how much they will consume “industry makes money from consumer confusion” Pricing menus allow carriers to advertise low per minute rates But most consumers end up choosing the wrong menu. Hidden Fees Able to promote low per minute prices, but still collect additional revenues Acquisition costs Advertising per gross add: from $75 to $100 (p.5) Sales commission paid per subscriber: $100 (p.5) Handset subsidy provided to the subscriber: $100 to $200 (p.9) Total: from $275 to $405 (let’s assume somewhere in the middle = $370) Break Even point Monthly ARPU (average revenue per unit): $52 (p.3) Monthly Cost-to-Serve: $30 (p.3) Monthly Margin: $22 Time required to break even on the acquisition cost = $370/ $22= 17 months In the cellular industry the monthly margin is relatively fixed across periods, therefore the traditional LTV can be simplified (assuming infinite horizon): LTV = M 1-r+i - AC M = margin the customer generates in a year r = annual retention rate = (1-12*monthly churn rate) i = interest rate (assume 5%) AC = acquisition cost LTV with contracts The annual retention rate in the industry = 1-12*0.02=0.76 LTV = 22 * 12 1- .76 + .05 - 370 = $540 LTV without contracts Eliminate contracts -> churn rate increases to 6% Calculate the LTV: LTV = 22 * 12 1- .28 + .05 - 370 = -27.14 Eliminate Hidden Costs $ 29 cellular bill becomes $35 due to hidden costs If hidden costs were eliminated, the margin would certainly be reduced. Assume that it would be reduced to $18 from $22. Break even would become 20.5 months ~= 370/18 What happens to LTV? Without hidden costs, but with contracts LTV = - 370 = 374.82 Without hidden costs and without contracts LTV = 18 * 12 1- .76 + .05 18 * 12 1- .28 + .05 - 370 = -89.48 Elimination of contracts drives LTV below zero Hidden costs boost the bottom line Option 3: different pricing approach Target audience: Youth Loathe contracts Fail credit checks Ideal plan: no contracts, no menus, no hidden fees… How to differentiate itself, and have a positive LTV Look at the factors that affect LTV Options for Lowering Acquisition Costs Advertising costs per customer Industry=from $75 to $100 Virgin planned ad costs = 60 mil/1mil= $60 (p.5) Handset subsidies: Current industry handset cost: $150 to $300 (assume $225) (p.5) Current industry handset subsidy: $100 to $200 (assume $150) (p.9) Current industry handset subsidy as a %: 67% Virgin’s handset cost: $60 to $100 (assume $80) Assume Virgin’s subsidy around 30% = $30 Acquisition costs Then Virgin’s AC would be just $120 vs. industry average $370 Sales commission: $30 Advertising per gross add: $60 Handset Subsidy $30 Total: $120 Consumer friendly plan: how to achieve profitability Break Even analysis: at what per minute price would Virgin break even: Virgin’s monthly ARPU: (200 minutes)*(p), where p=price per minute Monthly cost to serve: .45 * 200 * p Monthly margin: 200p - 90p = 110p LTV = 12*110p 1- .28 + .05 p > 0.07 - 120 > 0 Other price points What if Virgin charged per minute price comparable to other industry prices, somewhere in between 10 and 25 cents: At 10 cents: LTV = 12*110*.1 1- .28 + .05 - 120 = $51 At 25 cents: LTV = 12*110*.25 1- .28 + .05 - 120 = $309 Virgin’s Pricing Plan: What happened A prepaid plan No contracts No hidden charges No peak off peak hours Very low handset subsidies No credit checks No Monthly bills Price: 25 cents per minute for the first 10 minutes; 10 cents/minute for the rest of the day No exact numbers, but churn rate lower than 6%