2014-15 First Quarter Financial Status Report -- Status of Fund Balance

advertisement

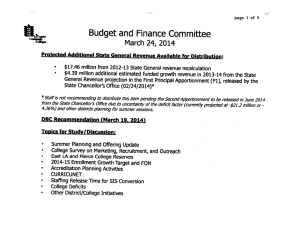

BUDGET AND FINANCE COMMITTEE 2014-15 First Quarter Financial Status Report November 5, 2014 2014-15 First Quarter Financial Status Report -- Status of Fund Balance Enrollment Planning and Targets State Budget Outlook for FY 2015-16 2015-16 Budget Planning and Development Budget Cautions and Concerns 2014-15 First Quarter Financial Status Report November 5, 2014 FY2014-15 (as of First Quarter, since the Board of Trustees has not granted any salary increases, The first quarter projection assumes no salary increases at this time) Projected Revenue Projected Expenditures $546.91 m 546.50 m Proj. Revenue Over Expenditures $ 0.41 m Balances Carried Forward for 2013-14 $73.31 m Projected Ending Balance Percent of Projected Expenditures $73.72 m 13.49% 2014-15 First Quarter Financial Status Report November 5, 2014 Status of Fund Balance Financially favorable – projected to end the year with $73.7 million in Unrestricted General Fund with new revenue from: • $4.14 million in COLA (0.85%) • $12.59 million in enrollment growth revenue (2.75%) FTES 4 2014-15 Funded Base = 99,613 FTES 2014-15 Budget Year Targets = 104,344 FTES • • • Planning Growth Target = 4.75% State Funded Enrollment Growth = 2.75% District will fund colleges at cost = $2,324 per FTES for a 2% over-cap from Contingency Reserve 2014-15 Reserves General Reserve (6.5%) Contingency Reserve (3.5%) Deferred Maintenance Program Reserve (1%) Total Reserves 34,440,765 19,085,721 5,453,063 $58,979,549 State Budget Outlook 2015-16 California Community College System Budget Request - $735 million • $120 million for Access => approximately 2% growth in FTES • $180 million for COLA (3%) => estimated statutory COLA for FY 2015-16 is estimated by School Services of California to be 2.1% • $100 million for Full-time and Part-time faculty • $200 million Student Success and Student Equity Plans • Enhanced Noncredit Rate – Commencing in 2015-16, the Enhanced Noncredit rate will equal the credit rate • Implementation of New State Growth Allocation Formula LACCD – 2015-16 Proposed Budget Planning Assumptions • • • • • • • The Budget will be based on Governor’s State Proposed Budget to be released in January 2015 The Budget Plan will reflect the Board’s visions and priorities to support the educational programs and services of the district Focus on Student Success and improve Student Equity Meet accreditation standards Cover hiring of full-time faculty to maintain the Faculty Obligation Number Ensure funding is adequately provided for facilities maintenance and operation needs Maintain a minimum of 10% reserves Budget Cautions and Concerns Proposition 30 is temporary Sale tax increase terminates at the end of 2016 (approximately 21% of Prop 30 revenues) Income tax increase terminates at the end 2018 STRS Obligations Employee contribution rate will increase to 8.88% in 2014-15 to 19.1% as of 2021 Significant costs for the District and Colleges FON Obligations and Penalties Fall 2008 was 1,461 and reported 1,434.53, for a difference of 26.47 full-time equivalent faculty =>penalty for Fall 2008 of $1,699,930. The penalty amount will be adjusted on the 2013-14 Recalculation Exhibit C and appear as a prior year adjustment. FON Planning and Obligation for Fall 2015 Accreditation OBAMA Care – “Cadillac Tax”? Deficits