2013-14 Notice of Tentative Budget Finance & Audit Committee June 12, 2013 1

advertisement

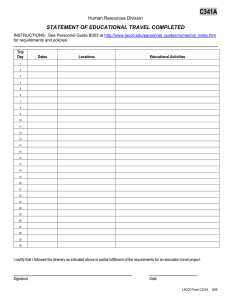

2013-14 Notice of Tentative Budget Finance & Audit Committee June 12, 2013 1 Total Tentative Budget— All Funds 6 2 2013-14 Proposed Tentative Budget All Funds =$3,181,503,141 2011-12 2012-13 2013-14 Actual Final Budget Proposed Tentative Budget 515,254,653 90,815,197 2,364,281 21,780,325 8,672,212 45,521,752 383,318,174 17,218,260 239,594,642 544,670,719 82,943,271 2,506,327 27,792,132 4,134,381 23,884,053 2,444,328,101 5,310,000 342,705,907 APPROPRIATIONS Unrestricted General Fund Restricted General Fund Cafeteria Bookstore Child Development Centers Special Reserve Building Fund Debt Services Student Financial Aid Less Inter/Intra-fund Transfers TOTAL BUDGET (13,142,171) (8,017,064) 601,819,093 43,674,829 2,298,974 28,103,298 2,123,752 15,555,096 2,279,033,680 5,315,000 211,827,643 (8,248,224) 1,311,397,325 3,470,257,827 3,181,503,141 3 2013-2014 PROPOSED TENTIVE BUDGET Summary of all Funds – Three-Year Comparison 4 Finance and Audit Committee Presentation TOPICS FOR DISCUSSION State Budget Update and Effects on LACCD 20132013-14 Budget Development 20132013-14 Proposed Tentative Budget - Unrestricted General Fund 5 Governor’s May Revise May Revise proposes Proposition 98 funding of $56.5 billion in fiscal 2012-13 and $55.3 billion in fiscal year 2013-14 for K-12 and Community Colleges. May Revise reflects a $2.8 billion increase in Proposition 98 funding in current year 201213 and a projected decrease of $1.8 billion in budget year 2013-14 for K-12 and Community Colleges. Governor proposes to use these one-time funds to reduce the deferrals of payments to schools and community colleges and to support the implementation of new academic standards. Governor proposes the following funding for California Community Colleges -- Current year 2012-13 - $340 million deferral buy down -- Budget year 2013-14 - approximately $300 million augmentation to community colleges -- Withdrawn - Adult Education Proposal, 90-unit Cap Proposal, and Census Proposal. 6 Impact on LACCD Budget 2013-14 Budget Year (about $300 million increase in funding) Apportionment $227 m for CCC (about $30 m more than January’s Proposal) $87.5 m for COLA (1.57%) => LACCD = $7.3 m $89.5 m for Restore Access (1.63%) => LACCD = $7.1 m $50 m Increase for Student Access and Support (former Matriculation Program) => LACCD =$9 m (Restricted) Other Additional Funding $30 m for Adult Education (applied toward 2-yr planning and implementation) $16.9 m for Delivery of Online Courses through Technology $1.5 m additional in funding for Proposition 39 for total of $51 m $64.5 m additional deferral buy down – LACCD $6 m reduction (from $76 m to $70 m) Other Proposal Policies: 90-unit cap proposal - withdrawn Adult Education Proposal - withdrawn Online proposal doesn’t change Require FAFSA for Waiver – Require BOG to develop process for determining student independence. Allow one term grace period for completion of FAFSA 2012-13 Current Year ($340 m deferral buy down) • • Additional deferral buy down - LACCD =$26 m (from $102 m to $76 million) State to backfill any shortage in property tax related to the dissolution of RDAs 7 State Budget Update Senate Version Assembly Version Conference Committee To be updated on Monday or Tuesday with comparison using the latest state budget update. 8 FY 2013-14 Budget Development 2012-13 Projected Balances and Current Reserves • FTES • Budget Assumptions • 2013-14 Proposed Tentative Budget • 9 FY 2013-14 Budget Development FY2012-13 Projected Balance Projected Revenue $512.56 m Projected Expenditures 506.67 m Revenue over Expenditures $5.89 m Prior Year Adjustments Mid-year deficit Balances Carried Forward for 2011-12 Projected Ending Balance % of Projected Expenditures 1.27 m (0.00 m) $74.68 m $81.84 m 16.15% 10 FY 2013-14 Budget Development Current Reserves ◦ General Reserve = $23.49 m (5%) ◦ Contingency Reserve = $24.37 m (5%) Contingency Reserve (@7.5%) Uses of Contingency Reserve to date: Accreditation Planning Activities Redistributed to Colleges (2.5%) Faculty Hiring (FON) Subsidy Remaining Contingency Reserve (0.738) m (9.988) m (0.140) m $24.37 m ◦ Deferred Maintenance Reserve (0.5%) $ 2.35 m $35.24 m 11 FY 2013-14 Budget Development Contingency Reserve Funds Set Aside from new revenue May be used during current year, for example, mid-year budget corrections Requires Board Approval to be used General Reserve Funds set aside from the previous year’s ending balance May not be used during the current year for appropriations or expenditures Ensures minimum level of balances available to be carried forward for future fiscal years 12 FY 2013-14 Budget Development FTES Second Period FTES – 2012-13 = 97,759 FTES • Funded FTES = 96,840 FTES • 936 unfunded FTES or about 1% over cap 2013-14 Budget Year Targets = 98,776 FTES • Planning Growth Target = 2% or 1,936 FTES 13 2013-14 Budget Development Revenue Assumptions Revenue Adjustments – Reduce COLA and Restoration/Growth based on May Revise: • COLA – 1.57% • Restoration/Growth – 1.63% Allocation Assumptions: • Maintain college and district allocations at the Preliminary Budget Level based on the Governor’s Proposed Budget • No COLA and Growth Reduction/Adjustments to locations pending State’s Adopted Budget • Maintain a 5% General Reserve Reserve and a 5% Contingency Reserve • No distribution of the projected balances until year end. 14 2013-2014 PROPOSED TENTIVE BUDGET Unrestricted General Fund 15 16 17 2013-2014 PROPOSED TENTIVE BUDGET Budget Planning for Final Budget • Budget Development Revenue Assumptions are based on the Governor’s May Revise, potential changes will be made for Final Budget when State Budget is adopted. • Increase funding for categorical programs and one-time funding programs. • Open Orders and Balances. 18 Supplemental Information 19 20 21 22