COUNTERCYCLICAL CAPITAL BUFFER

advertisement

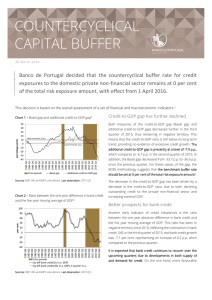

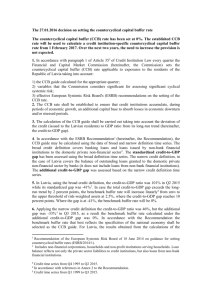

COUNTERCYCLICAL CAPITAL BUFFER 29 December 2015 The countercyclical buffer rate for credit exposures to the domestic private non-financial sector is set at 0% of the total risk exposure amount, with effect from 1 January 2016. This decision is based on the overall assessment of recent developments in a set of financial and macroeconomic indicators, as follows1: Chart 1 – Basel gap and additional credit-to-GDP gap3 CREDIT-TO-GDP GAP REMAINS NEGATIVE 50 The additional credit-to-GDP gap is below 0 p.p. (i.e., the percentage points 40 credit-to-GDP ratio is below its long-term trend) and has 30 exhibited a decreasing trend since 2013. Data for the second 20 10 quarter of 2015 indicates that the additional credit-to-GDP Upper threshold: 10 p.p. 0 gap is currently at a level of -6.66 p.p.. The Basel gap has Lower threshold: 2 p.p. -10 exhibited a similar trend but is currently at a level of -33.73 -20 p.p.. Both gap measures deliver a benchmark buffer rate of 0% -30 of total risk exposure amount, according to the BCBS Crisis periods Basel gap 2014Q4 2012Q4 2010Q4 2008Q4 2006Q4 2004Q4 2002Q4 2000Q4 1998Q4 1996Q4 1994Q4 1992Q4 1990Q4 1988Q4 1986Q4 1984Q4 1982Q4 -40 Additional credit-to-GDP gap methodology2. The recent developments of the credit-to-GDP gap are explained by both the decrease in the outstanding credit to the domestic private non-financial sector and the increase in Sources: BdP, INE and BdP’s calculations. Last observation: 2015Q2. nominal GDP. REAL BANK CREDIT GROWTH IS STILL NEGATIVE Chart 2 – Real bank credit growth4 The year-on-year growth rate of bank credit granted to the 30 private non-financial sector has been in a descending trend 25 since the onset of the global financial crisis, entering into per cent 20 negative territory in 2010 year end. This decrease has been 15 decelerating in the last quarters. 10 5 Notwithstanding the risks associated with the current 0 macroeconomic context, the low interest rate environment -5 and the positive outlook for the Portuguese economy should Crisis periods Real bank credit, y-o-y growth rate Real bank credit, 4 quarter m.a., y-o-y growth rate Sources: BdP, INE and BdP’s calculations. Last observation: 2015Q3. 2014Q1 2012Q1 2010Q1 2008Q1 2006Q1 2004Q1 2002Q1 2000Q1 1998Q1 1996Q1 1994Q1 1992Q1 1990Q1 1988Q1 1986Q1 1984Q1 1982Q1 1980Q1 1978Q1 -10 have a positive impact on households’ disposable income and firms’ profitability, reducing the debt service ratio and potentially promoting a reversal in credit demand. However, a potential acceleration in credit dynamics is not a reason for concern at the current juncture, given the marked reduction in lending business in previous years. 2 COUNTERCYCLICAL CAPITAL BUFFER BANKS REPORT SOLID IMPROVEMENTS IN THE LOAN-TO-DEPOSIT 170 RATIO 160 In pre-crisis years, the strong bank lending growth was to a 150 large extent financed by short-term wholesale funding and led 140 to a significant increase in the loan-to-deposit ratio. During the crisis this ratio decreased substantially reaching a level close 130 to 100% as a result of both a contraction in the lending Loan-to-deposit ratio 2014Q4 2013Q4 2012Q4 2011Q4 2010Q4 2009Q4 2008Q4 2007Q4 2006Q4 2005Q4 improving banking system resilience to shifts in market 2004Q4 100 2003Q4 structure has changed to more stable funding sources, 2002Q4 business and an increase in deposits. Overall, banks’ funding 110 2001Q4 120 2000Q4 per cent Chart 3 – Loan-to-deposit ratio5 sentiment. Spreads against the Euribor rate on new loans have more Loan-to-deposit ratio, 4 quarter m.a. recently declined both for households and non-financial Sources: BdP and BdP’s calculations. Last observation: 2015Q2. corporations, but still stand at levels higher than those observed prior to the financial crisis. In addition, banks are allocating new funds to non-financial corporations with better risk profile and seem to be applying lower LTV and LTI ratios to new household loans. 10 8 6 4 2 0 -2 -4 -6 -8 -10 DEVELOPMENTS IN HOUSE PRICES REMAIN SUBDUED One risk of the current low interest rate environment relates to the search-for-yield behavior and price misalignments, for instance, in the real estate market. Despite the slight increase 2015Q1 2013Q1 2011Q1 2009Q1 2007Q1 2005Q1 2003Q1 2001Q1 1999Q1 1997Q1 1995Q1 1993Q1 1991Q1 in the year-on-year growth rate of real house prices over the 1989Q1 per cent Chart 4 – Real house price growth6 Crisis periods Real house price index, y-o-y growth rate Real house price index, 4 quarter m.a., y-o-y growth rate Sources: OECD and BdP’s calculations. Last observation: 2015Q2. second quarter of 2015, it still remains below the historical maximums, at around 2%. Thus, there is no evidence, at the aggregate level, suggesting an overvaluation in housing prices. CURRENT ACCOUNT CONTINUES TO IMPROVE The current account deficit as a percentage of GDP has declined sharply during the recent crisis (2008Q4-2014Q4). Chart 5 – Current account deficit as a % of GDP7 15 Since the first quarter of 2013, Portugal has repeatedly generated current account surpluses. Further improvements are expected in 2015 mainly due to developments in the balance of goods and services on account of increased per cent 10 exports, which benefited from the recovery in relevant trading partners in the euro area, and a favourable price effect 5 associated with the sharp fall in oil prices. The external imbalances thus seem to continue to adjust, towards more sustainable levels, although a long way is still ahead of us. 0 GENERAL ASSESSMENT 1996Q1 1997Q1 1998Q1 1999Q1 2000Q1 2001Q1 2002Q1 2003Q1 2004Q1 2005Q1 2006Q1 2007Q1 2008Q1 2009Q1 2010Q1 2011Q1 2012Q1 2013Q1 2014Q1 2015Q1 -5 Current account deficit (as a % of GDP) Current account deficit (as a % of GDP) - 4 quarter m.a. Sources: BdP, INE and BdP’s calculations. Last observation: 2015 Q2. In line with the overall risk assessment, current credit and GDP growth rate forecasts do not point to an increase in the countercyclical buffer rate during 2016. The less strict bank lending conditions, the low interest rate environment and the positive economic prospects for Portugal might be the only indication that the credit cycle may revert in the future. COUNTERCYCLICAL CAPITAL BUFFER 3 NOTES 1 2 3 4 5 6 7 The assessment is based on available data up to 6 November 2015. This set of indicators covers the six categories set out in Recommendation ESRB/2014/1. In case the gap exceeds 2 p.p., the benchmark buffer rate will increase linearly from 0% to the upper threshold of 2.5% of the total risk exposure amount, which is associated with a gap of 10 p.p.. See Recommendation ESRB/2014/1 Annex Part II available at http://www.esrb.europa.eu/pub/pdf/recommendations/2014/140630_ESRB_Recommendation.en.pdf?03a7c5c908620b34673b6f290b5 4c13d. BCBS thresholds of 2 p.p. and 10 p.p. were determined using the Basel gap. Nevertheless, they are used as an approximation to map the additional credit-to-GDP gap into a benchmark buffer rate. Credit to the domestic private non-financial sector, comprising all lending (loans and debt securities) extended by domestic and foreign banks, non-banks and debt markets. The credit-to-GDP ratio is computed using a four-quarter moving sum of nominal GDP. Credit is obtained from National Financial Accounts Statistics produced by BdP and nominal GDP from National Accounts (ESA2010, base 2011) produced by INE. The credit-to-GDP gap is calculated as the percentage point difference between the observed credit-to-GDP ratio and its long-term trend, where the trend is estimated employing a one-sided HP filter with a smoothing parameter set to 400,000. The additional credit-to-GDP gap is computed as the percentage point difference between the observed credit-to-GDP ratio augmented with ARIMA(p,1,0) forecasts, using a maximum forecast horizon of 28 quarters, and its long-term trend, where the trend is estimated employing a one-sided HP filter with a smoothing parameter set to 400,000. Crisis periods as identified for the ESCB Heads of Research Group’s banking crises database. Credit includes loans granted to the domestic private non-financial sector plus debt securities issued by the domestic private non-financial sector. Bank credit extended by resident monetary financial institutions as available in Monetary and Financial Statistics produced by BdP. The credit variable is adjusted for inflation using the consumer price index (2012=100) produced by INE. Crisis periods as identified for the ESCB Heads of Research Group’s banking crises database. Both loans and deposits are retrieved from the supervisory database and refer to values reported on a consolidated basis. Data for 2000Q4 to 2004Q4 correspond to banking system values according to local GAAP. Data for 2005Q1 to 2006Q4 correspond to values for the 6 largest banking groups according to IFRS. Data for 2007Q1 onwards correspond to banking system values according to IFRS. Real house price index (2010=100) produced by the OECD. The house price index is adjusted for inflation using the private consumption deflator (2010=100) taken from the National Accounts. Crisis periods as identified for the ESCB Heads of Research Group’s banking crises database. Current account deficit seasonally adjusted as available in the Balance of Payments Statistics produced by BdP. ABBREVATIONS ARIMA BCBS BdP ESA ESCB ESRB GAAP GDP HP IFRS INE LTI LTV m.a. OECD p.p. y-o-y Autoregressive Integrated Moving Average Basel Committee on Banking Supervision Banco de Portugal European System of Accounts European System of Central Banks European Systemic Risk Board Generally Accepted Accounting Principles Gross Domestic Product Hodrick and Prescott International Financial Reporting Standards Instituto Nacional de Estatística (Statistics Portugal) loan-to-income ratio loan-to-value ratio moving average Organisation for Economic Co-operation and Development percentage points year-on-year