Finance for the Non-Financial Manager Course Overview

advertisement

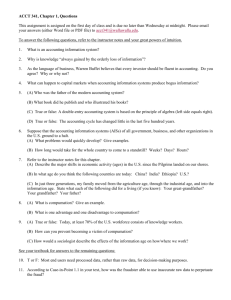

Finance for the Non-Financial Manager Course Overview Introduction The West Virginia University Center for Executive Education’s Finance for the Non Financial Manager Course is designed to teach the fundamentals of basic finance and accounting to professionals who are either new to financial concepts or who wish to update their knowledge. This course is taught from the perspective of a reader of financial documents and budgets versus the perspective of one who would generate the data. Who Should Attend Mid to upper level managers and executives from all functional areas who want to improve communication with people in financial areas, contribute to financial decisions, and better understand the impact of strategic decisions on shareholder value should attend. This course addresses the needs and concerns of managers of non-financial areas who may not have formal training in the uses and reporting of financial information. Prior knowledge of accounting or finance is not necessary. What You Will Learn As a participant you will become familiar with financial statements, learn where the information on those statements originates and how that information is captured. You will learn how to use and analyze financial and accounting information to run your department more efficiently and effectively. We will begin with an overview of the accounting cycle, not to teach you to become accountants, but rather to make you aware that there is an accounting cycle and just how that cycle builds the financial statements. We will use examples and models to explain the concepts. As a result of attending participants will: • Communicate more effectively with financial executives • Learn how financial data is generated • Learn how financial data is reported • Learn how to use financial data for decision-making, analysis, and valuation Finance for the Non-Financial Manager Abbreviated Overview Finance for the Non-Financial Manager Course Overview 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Understanding of the relationship between Net Income and Cash Flow Emphasis on cash flow statement Reasoning by analysis: What stories do the financial statements tell Read the financials from base level (departmental) reporting up to the consolidated income statement Make conversions to unit size comparisons so that base level connections may be made for local decision-making Extend the financials to an understanding of when departments are winning v. losing from their decisions Emphasize the dual issues with margin management and product mix including a sense of the tradeoffs between volume and price Criteria for capital expenditures Within the balance sheet, emphasize working capital management Show the share price calculation and the relationship to performance at the unit level Discuss challenges for the future with respect to the cost of standing still Decision Making • Objectives for financial management • Departmental reporting a look up to the consolidated income statement Financial Statement Analysis • The income statement • The balance sheet • The cash flow statement • Financial statements and value • Monthly and annual report • Threshold performance measures • Contribution margin • Targeted formulas Evaluating Financial Performance • Ratio standards • Historical tracking of unit and company measures • Ratio analysis o Profitability, liquidity and leverage ratios o Monthly statements Resource Allocation: Value-Based Decision Criteria • Net present value • Internal rate of return • Economic value added • Capital evaluation and project decision making through the use of cases Personal Financial Planning • Personal Financial Planning Self-Assessment • The basics of Mutual Funds • Developing a strategy with 401K options • Wills, insurance, and other preparations • When will I be able to retire? Case • Time Value of Money • Present value • Using a spreadsheet financial calculator • Using templates in Excel Finance for the Non-Financial Manager Abbreviated Overview Case unique to industry or organization o Evaluation of recent/future internal business decisions o Executive team narrative of situation described to written case