COUNTERCYCLICAL CAPITAL BUFFER

advertisement

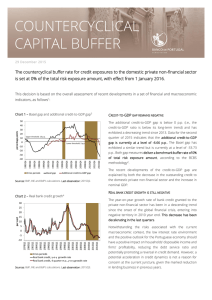

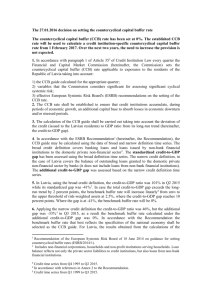

COUNTERCYCLICAL CAPITAL BUFFER 30 March 2016 Banco de Portugal decided that the countercyclical buffer rate for credit exposures to the domestic private non-financial sector remains at 0 per cent of the total risk exposure amount, with effect from 1 April 2016. This decision is based on the overall assessment of a set of financial and macroeconomic indicators1: Chart 1 – Basel gap and additional credit-to-GDP gap3 50 Both measures of the credit-to-GDP gap (Basel gap and 40 additional credit-to-GDP gap) decreased further in the third 30 quarter of 2015, thus remaining in negative territory. This 20 10 percentage points Credit-to-GDP gap has further declined means that the credit-to-GDP ratio is still below its long-term Upper threshold: 10 p.p. 0 Lower threshold: 2 p.p. -10 trend, providing no evidence of excessive credit growth. The additional credit-to-GDP gap is presently at a level of -7.9 p.p., -20 which compares to -6.7 p.p. in the second quarter of 2015. In -40 addition, the Basel gap decreased from -33.7 p.p. to -36.6 p.p. 1982 Q4 1984 Q2 1985 Q4 1987 Q2 1988 Q4 1990 Q2 1991 Q4 1993 Q2 1994 Q4 1996 Q2 1997 Q4 1999 Q2 2000 Q4 2002 Q2 2003 Q4 2005 Q2 2006 Q4 2008 Q2 2009 Q4 2011 Q2 2012 Q4 2014 Q2 -30 Crisis periods Basel gap Additional credit-to-GDP gap Sources: BdP, INE and BdP’s calculations. Last observation: 2015 Q3. since the previous quarter. For these values of the gap, the BCBS methodology suggests that the benchmark buffer rate should be set at 0 per cent of the total risk exposure amount2. The decrease in the credit-to-GDP gap has been driven by a decrease in the credit-to-GDP ratio, due to both declining Chart 2 – Ratio between the one year difference in bank credit and the five year moving average of GDP4 outstanding credit to the private non-financial sector and increasing nominal GDP. Better prospects for bank credit 100 Another early indicator of credit imbalances is the ratio 60 between the one year absolute difference in bank credit and 40 the five year moving average of GDP. This ratio has been in 20 negative territory since 2010, reflecting the contraction in bank 0 credit. Still, in the third quarter of 2015, real bank credit growth -20 was -7.1 per cent, representing an increase of 0.2 p.p. when -40 compared to the previous quarter. per cent 80 1981 Q4 1983 Q2 1984 Q4 1986 Q2 1987 Q4 1989 Q2 1990 Q4 1992 Q2 1993 Q4 1995 Q2 1996 Q4 1998 Q2 1999 Q4 2001 Q2 2002 Q4 2004 Q2 2005 Q4 2007 Q2 2008 Q4 2010 Q2 2011 Q4 2013 Q2 2014 Q4 -60 Crisis periods (1y diff bank credit/5y m.a. GDP) (1y diff bank credit)/(5y m.a. GDP), 4 quarter m.a. Sources: BdP, INE and BdP’s calculations. Last observation: 2015 Q3. It is expected that bank credit continues to recover over the upcoming quarters due to developments in both supply of and demand for credit. On the one hand, more favourable 2 COUNTERCYCLICAL CAPITAL BUFFER Chart 3 – Spreads on new loans granted to non-financial a renewed pick-up in the credit market, especially if corporations5 accompanied by a similar evolution in banks’ spreads applied percentage points in lending to households. However, the spread to non7 financial corporations for the third quarter of 2015 (3.7 p.p.) 6 still stands well above the historical and pre-crisis averages 5 and, in particular, the minimum value observed around 2007- 4 end. Moreover, the results of the January 2016 Bank Lending 3 Survey show that the largest banking groups are not lowering 2 spreads for high risk loans. In addition, banks have continued to adjust their balance sheets as shown by the constant 1 improvements in the loan-to-deposit ratio, and the private Crisis periods 2015 Q1 2014 Q2 2013 Q3 2012 Q4 2012 Q1 2011 Q2 2010 Q3 2009 Q4 2009 Q1 2008 Q2 2007 Q3 2006 Q4 2006 Q1 2005 Q2 2004 Q3 2003 Q4 2003 Q1 0 Spreads on new loans to non-financial corporations Sources: BdP, Reuters and BdP’s calculations. Last observation: 2015 Q3. non-financial sector continues to deleverage. Therefore, there is no evidence pointing to excessively loose bank credit conditions. The current account was positive in the third quarter of 2015 Chart 4 – Current account deficit as a percentage of GDP6 In the third quarter of 2015, the current account as a percentage of GDP registered a positive value in line with the 16 14 12 10 8 6 4 2 0 -2 -4 adjustment observed during the crisis, standing at 1.5 per cent. This recent development is also aligned with the still negative growth in total lending to households and non- per cent financial corporations. Against this background, current account developments do not point to an acceleration in the credit market in the near future. 1996 Q1 1997 Q1 1998 Q1 1999 Q1 2000 Q1 2001 Q1 2002 Q1 2003 Q1 2004 Q1 2005 Q1 2006 Q1 2007 Q1 2008 Q1 2009 Q1 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 General assessment Current account deficit as a percentage of GDP Current account deficit as a percentage of GDP, 4 quarter m.a. Sources: BdP, INE and BdP’s calculations. Last observation: 2015 Q3. The assessment regarding the need to implement the countercyclical capital buffer in Portugal has not changed significantly since December 2015. From a macroprudential perspective, financial market conditions are still in a post crisis phase and, accordingly, there is no reason for changing the current countercyclical buffer rate. prospects for the Portuguese economy - in particular, for the housing market - and the improvement in bank’s financial position should contribute to an increase in the supply of credit. On the other hand, credit demand may benefit from a recovery in consumer confidence and investment, related to, among other factors, a reduction in households’ debt service and non-financial corporations’ financing costs as a result of low interest rates. Banks’ spreads are still above the historical average The narrowing of banks’ spreads on new loans granted to nonfinancial corporations since late 2012 entails the possibility of COUNTERCYCLICAL CAPITAL BUFFER 3 Notes 1 2 3 4 5 6 The assessment is based on available data up to 18 January 2016. This set of indicators covers the six categories set out in Recommendation ESRB/2014/1. In case the gap exceeds 2 p.p., the benchmark buffer rate will increase linearly from 0 per cent to the upper threshold of 2.5 per cent of the total risk exposure amount, which is associated with a gap of 10 p.p.. See Recommendation ESRB/2014/1 Annex Part II available at http://www.esrb.europa.eu/pub/pdf/recommendations/2014/140630_ESRB_Recommendation.en.pdf?03a7c5c908620b34673b6f290b5 4c13d. BCBS thresholds of 2 p.p. and 10 p.p. were determined using the Basel gap. Nevertheless, they are used as an approximation to map the additional credit-to-GDP gap into a benchmark buffer rate. Credit to the domestic private non-financial sector, comprising all lending (loans and debt securities) extended by domestic and foreign banks, non-banks and debt markets. The credit-to-GDP ratio is computed using a four-quarter moving sum of nominal GDP. Credit is obtained from National Financial Accounts Statistics published by BdP and nominal GDP from National Accounts (ESA2010, base 2011) published by INE. The credit-to-GDP gap is calculated as the percentage point difference between the observed credit-to-GDP ratio and its long-term trend, where the trend is estimated employing a one-sided HP filter with a smoothing parameter set to 400,000. The additional credit-to-GDP gap is computed as the percentage point difference between the observed credit-to-GDP ratio augmented with ARIMA(p,1,0) forecasts, using a maximum forecast horizon of 28 quarters, and its long-term trend, where the trend is estimated employing a one-sided HP filter with a smoothing parameter set to 400,000. Until the first quarter of 2015, the optimal lag order (p) of the forecasting model is recursively determined. From the second quarter of 2015 onwards, p is set to three quarters, which is the optimal lag length when data until the first quarter of 2015 is used. Crisis periods as identified for the ESCB Heads of Research Group’s banking crises database. Calculated as the ratio between the one year absolute difference of bank credit and the five year m.a. of GDP, as proposed in Kalatie et al. (2015), “Indicators used in setting the countercyclical capital buffer”, Bank of Finland Research, Discussion Papers, No. 8/2015. Bank credit extended by resident monetary financial institutions as available in Monetary and Financial Statistics published by BdP. Nominal GDP is obtained from National Accounts, ESA2010, base 2011, published by INE. Crisis periods as identified for the ESCB Heads of Research Group’s banking crises database. Average of spreads weighted by the corresponding outstanding loan amounts at the end of the quarter. Spread is calculated against the three month Euribor rate as available in Reuters. Only interest rates on new loans granted by other monetary financial institutions to residents with initial rate fixation up to one year are considered. Interest rates on new loans as available in Monetary and Financial Statistics published by BdP. Current account deficit seasonally adjusted as available in the Balance of Payments Statistics published by BdP. Abbreviations ARIMA BCBS BdP ESA ESCB ESRB GDP HP INE m.a. p.p. 1y diff Autoregressive Integrated Moving Average Basel Committee on Banking Supervision Banco de Portugal European System of Accounts European System of Central Banks European Systemic Risk Board Gross domestic product Hodrick and Prescott Instituto Nacional de Estatística (Statistics Portugal) Moving average Percentage points 1 year absolute difference