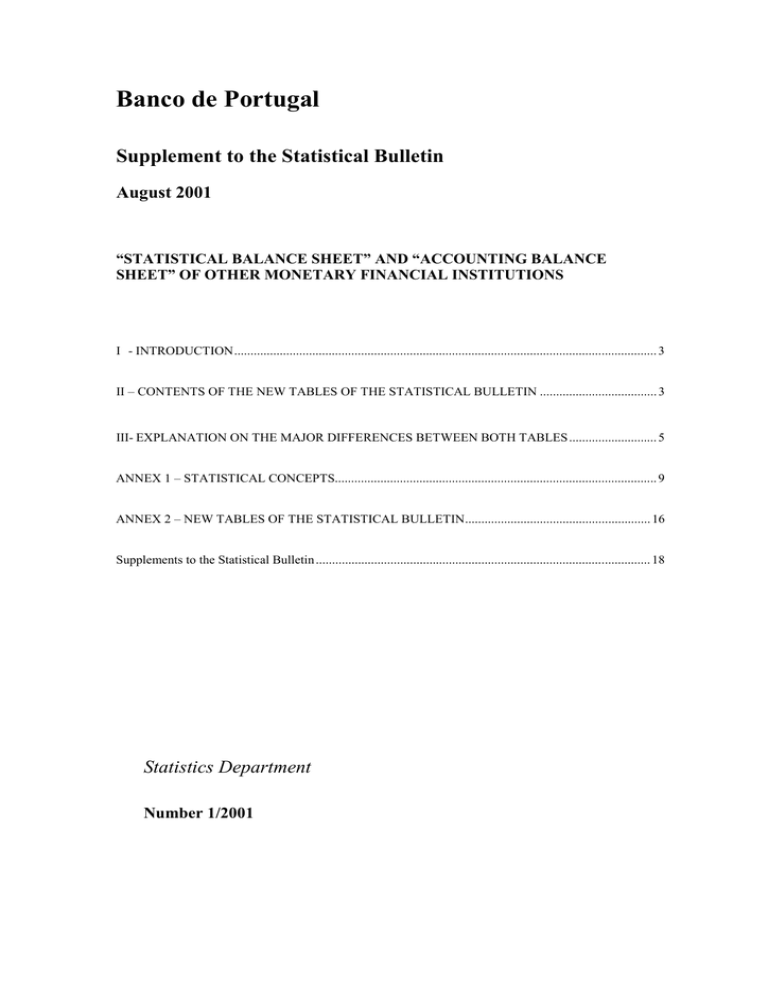

Banco de Portugal Supplement to the Statistical Bulletin August 2001

advertisement

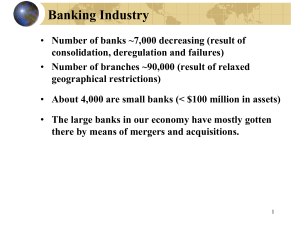

Banco de Portugal Supplement to the Statistical Bulletin August 2001 “STATISTICAL BALANCE SHEET” AND “ACCOUNTING BALANCE SHEET” OF OTHER MONETARY FINANCIAL INSTITUTIONS I - INTRODUCTION.................................................................................................................................. 3 II – CONTENTS OF THE NEW TABLES OF THE STATISTICAL BULLETIN .................................... 3 III- EXPLANATION ON THE MAJOR DIFFERENCES BETWEEN BOTH TABLES ........................... 5 ANNEX 1 – STATISTICAL CONCEPTS................................................................................................... 9 ANNEX 2 – NEW TABLES OF THE STATISTICAL BULLETIN......................................................... 16 Supplements to the Statistical Bulletin ....................................................................................................... 18 Statistics Department Number 1/2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions I. INTRODUCTION The publication of two new tables will begin with the present issue of the Statistical Bulletin: A.3.13 Other (resident) monetary financial institutions’ consolidated balance sheet: table compiled from information sent to the Banco de Portugal for the purpose of reporting monetary statistics. The methodologies and concepts used are consistent with the remaining information of the Other Monetary Financial Institutions’ (OMFIs) balance sheet presented in the Statistical Bulletin. A.3.14 Aggregated balance sheet of the banking system – consolidated activity: table compiled from accounting information sent to the Banco de Portugal on a consolidated basis. The reporting concepts and methodologies are different from those used in the construction of monetary statistics. Both tables correspond to balance sheets of financial institutions. However, in view of the underlying concepts and methodologies, the readings that one might take of the tables are substantially different. The purpose of the present note is to briefly describe the contents of both tables, pointing out the major differences. These are chiefly the result of the noncoincidence of the reporting population and of the different consolidation procedures. Therefore, the first table presents the consolidated activity of resident OMFIs, whereas the second table also includes the activity carried on by non-resident entities, provided that they are integrated in financial groups subject to the Banco de Portugal supervision on a consolidated basis. perspective, gathering information included in the tables of chapters B.1 to B.7. Table A.3.14. Aggregated balance sheet of the banking system – consolidated activity is an exception in the set of information supplied in the Statistical Bulletin, since, as previously mentioned, it is based on accounting information received by the Banco de Portugal. This information on the financial situation of the banking system, in particular with regard to the composition of the net position of the national banking system vis-à-vis other foreign credit institutions, supplements the information made available within the monetary and financial statistics. Both tables publish end-of-month figures expressed in Euro million. These tables will also include historical information (since December 1998), and will be published on a quarterly basis. Table A.3.13 – Other monetary financial institutions’ consolidated balance sheet This table is a consolidated balance sheet of resident other monetary financial institutions (OMFIs). The statistical concept of monetary financial institution (MFI) has been harmonised across all European Union countries1. The OMFI sector consists of MFIs excluding national central banks. Therefore, in Portugal, the OMFI sector does not include the Banco de Portugal and consists of all other banks (including the Caixa Geral de Depósitos), savings banks, mutual agricultural credit banks and money market funds. It should be noted that the other credit institutions (investment companies, financial leasing companies, factoring companies and credit-purchase financing companies), from a statistical perspective, are classified as other financial intermediaries (a statistical subgroup of non-monetary financial institutions (NMFIs)) and therefore are not covered by the OMFI concept. II. CONTENTS OF THE NEW TABLES OF THE STATISTICAL BULLETIN Both tables will be integrated in Chapter A3 of the Statistical Bulletin, which presents main monetary statistical indicators. A more detailed explanation of the statistical concepts underlying the monetary statistics component of the Statistical Bulletin is presented in Annex 1. It describes the residence concept, the sectoral 1 Table A.3.13 allows a reading of the consolidated situation of the OMFI sector, from a statistical 2 This concept is defined in Regulation (EC) no. 2819/98 of the European Central Bank, and has also been adopted in the European System of National and Regional Accounts (ESA 95). Banco de Portugal / Supplement no. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions breakdown and the classification of the financial instruments included in that component. The fact that table A.3.13 is a consolidated balance sheet of OMFIs means that, in the aggregation of the balance sheets’ data of every institution integrating this sector, the balances of operations between those institutions were netted out. For instance, the balances of loans or deposits between institutions of this sector are not shown in this balance sheet as a result of consolidation, as a debtor balance of an institution corresponds to a creditor balance to the same amount in the balance sheet of the counterparty of that operation, resulting in a nil position for the sector, in net terms. For the same reason, and also by way of example, the liability items “Securities other than capital” and “Capital and reserves” do not include liabilities vis-à-vis other institutions of this sector, which result from the direct holding by OMFIs of securities issued by institutions of the same sector. This last item includes “Operating income” net of “Operating costs”, that are included under “Remaining accounts” in the other tables of the Statistical Bulletin. As of December 1999, it also includes provisions for non-performing loans2 previously included under “Remaining liabilities”. “Other accounts” are included in net terms under “Remaining assets” and “Remaining liabilities”, depending on the respective sign. Table A.3.14 – Aggregated balance sheet of the banking system – consolidated activity Portugal4. It does not include money market funds. The information used is based on an accounting report, in line with the System of Accounts for the Banking System and with the accounting data disseminated by the institutions. Unlike table A.3.13, the consolidation of the activity is carried out from a financial group point of view, irrespective to whether the participating entities are resident or non-resident. This means that whenever an institution of the OMFI sector is integrated in a financial group, its activity is consolidated with that of the other credit institutions, similar entities5 and ancillary services companies6, resident and nonresident, belonging to that financial group. Against this background, two companies are deemed to belong to the same financial group when one of the companies is controlled by the other7, either directly or indirectly. Therefore, consolidated activity covers both subsidiaries and branches located in Portugal or abroad. The consolidation of accounts mentioned in this aggregated balance sheet is limited at each financial group level (intra-group consolidation). This consolidation is followed by the aggregation of information of the consolidated groups and of the institutions not integrated in consolidated groups, without any consolidation of asset and liability positions among each other. 4 Resident OMFIs having their head office abroad, in particular branches in Portugal of credit institutions having their head office abroad and authorised to receive repayable funds from the public, This table presents the aggregated balance sheet of the banking system – consolidated activity calculated by simple aggregation of: (i) balance sheets, on a consolidated basis, of the financial groups that include in the consolidation perimeter3 at least one OMFI the principal activity of which is carried on in Portugal, and (ii) balance sheets, on an individual basis, of the OMFIs that are not consolidated in are considered on an individual basis. 5 Pursuant to point a) of Article 130 (2) of the Legal Framework of Credit Institutions and Financial Companies, approved by DecreeLaw no. 298/92, of 31 December, entities similar to credit institutions shall be financial companies and any legal person, other than a credit institution or a financial company, the principal activity of which is to acquire holdings (e.g. Holding Companies). 6 Ancillary services companies shall be companies whose chief purpose is complementary to the principal activity of one or more 2 In the case of the consolidated balance sheet of OMFIs, credit is presented in gross terms (not net from provisions). 3 In the case of OMFIs having their head office in Portugal and with credit institutions, namely the holding or management of data processing services, pursuant to Article 13 (11) of the Legal Framework of Credit Institutions and Financial Companies. the participants of financial groups having their head office and 7 main activity abroad, the consolidation perimeter is defined in such Article 13 (2) of the Legal Framework of Credit Institutions and a manner that no type of consolidation is performed with the parent Financial Companies, which may be consulted on-line on the institutions having their head office abroad. website of the Banco de Portugal. An accurate description of the control relationship is provided in Banco de Portugal / Supplement no. 1/2001 to the Statistical Bulletin – August 2001 3 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions In short, this table is an aggregated balance sheet of the following groups of institutions, after previous consolidation at the level of each financial group: − Credit institutions, financial companies, other entities similar to credit institutions8 and ancillary services companies, either resident or non-resident, belonging to financial groups the principal activity of which is located in Portugal; − Resident OMFIs9 having their head office in Portugal, not belonging to any financial group; − Resident OMFIs10 having their head office abroad. The accounting balance sheet does not include equivalent concepts applicable to all assets and liabilities vis-à-vis non-residents. These are, in assets side: (i) “Cash and liquid assets in central banks”, which, deducted from the values “in the Banco de Portugal” leads to the determination of assets in foreign central banks, and (ii) “Credits to other credit institutions – abroad”; and in liabilities side: (i) “Resources from central banks”, also with separate information on the Banco de Portugal, and (ii) “Resources from other credit institutions – abroad” III. EXPLANATION OF THE MAJOR DIFFERENCES • Assets and liabilities vis-à-vis resident OMFIs and other credit institutions BETWEEN BOTH TABLES The balance sheet structure is, as much as possible, similar in both tables. There are, however, methodological and conceptual differences, the most important of which are explained below. In order to facilitate the explanation, the other monetary financial institutions consolidated balance sheet (table A.3.13) will be mentioned as “statistical balance sheet” and the aggregated balance sheet of the banking system – consolidated activity (table A.3.14) will be mentioned as the “accounting balance sheet”. • Assets and liabilities vis-à-vis non-residents The assets and liabilities of OMFIs vis-à-vis nonresidents are almost fully defined in the statistical balance sheet, covering every balance vis-à-vis nonresident entities, irrespective of the instrument by which they are represented. The exception consists in liabilities represented by securities, the current holders of which are not known by the institutions, wherefore it is not possible to identify the portion held by nonresidents. Thus, the portion of these liabilities that is not recorded under assets of resident OMFIs is fully reflected in the items “Securities, other than capital” and “Capital and reserves”. Liabilities represented by securities issued by OMFIs and that are included in the portfolio of OMFIs are deducted in the process of consolidation of intra-sector positions. 8 See Footnote no. 5. 9 Excluding money market funds. 10 4 Idem. As previously mentioned, assets and liabilities vis-àvis resident OMFIs are not shown in the statistical balance sheet, since intra-sector positions are consolidated. In turn, assets and liabilities vis-à-vis resident non-MFI (e.g. investment companies, factoring companies, financial leasing companies and credit-purchase financing companies) are shown in “Assets vis-à-vis the non-monetary resident sector” and in “Deposit and deposit-like instruments vis-à-vis the non-monetary resident sector”. In the accounting balance sheet, non-consolidated balances vis-à-vis non-MFI are included under “Credits to (resources from) credit institutions in the country”. These items cover also non-consolidated credits to and resources from resident OMFIs (as they relate to balances among institutions belonging to different financial groups) as well as assets and liabilities of consolidated non-MFI vis-à-vis other credit institutions. It is worth noting that, in memo items, where these items are presented in net terms, the balances between resident OMFIs are cancelled out. However, the balance associated with these institutions will prevail for non-consolidated non-MFI. • Assets and liabilities vis-à-vis non-resident OMFIs and other credit institutions In the statistical balance sheet, assets vis-à-vis nonresident OMFI are fully broken down into two categories according to the type of instrument: (i) Credits and credit-like instruments, and (ii) Securities. Banco de Portugal / Supplement no. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions Credits and credit-like instruments vis-à-vis nonresident OMFI are broken down into “Credit and credit-like instruments – vis-à-vis OMFI, excluding departments abroad11” and “Credits and credit-like instruments – vis-à-vis OMFI, departments abroad”. Liabilities represented by securities, as mentioned above, are not broken down by the institutional sector of the holder, wherefore liabilities vis-à-vis nonresident OMFI include only deposits and deposit-like instruments, broken down into “OMFI, excluding department abroad” and “OMFI, departments abroad”. The accounting balance sheet presents credits to and resources from credit institutions abroad (OMFI and other credit institutions are considered on the whole), that refer to loans and deposits. The breakdown of credits and resources (loans and deposits) vis-à-vis foreign branches of the institution is not shown, since these balances are consolidated. • Loans vis-à-vis the non-monetary resident sector and credit to customers The item “Loans vis-à-vis the non-monetary resident sector” of the statistical balance sheet compares with the item “Credit to customers, net of provisions” of the accounting balance sheet. The major differences of contents between both concepts are a result of the following: - the accounting balance sheet item includes loans to non-resident entities not falling within the classification of credit institutions. In the statistical balance sheet, loans to non-resident entities that are not OMFIs are classified as “Assets vis-à-vis non-residents – credits and credit-like instruments vis-à-vis other sectors”; - the statistical balance sheet item is presented as a gross value, without deduction of provisions, whereas in the accounting balance sheet “Credit to customers” is net of specific credit provisions (provisions for overdue loans, non-performing loans and country risk); - the statistical balance sheet item includes loans granted by OMFIs to non-Monetary Financial Institutions (non-MFIs), in particular to financial leasing companies, factoring companies, credit11 Includes the head-offices of foreign MFI having branches in Portugal. - • purchase financing companies and financial holdings. In the accounting balance sheet, loans granted to these institutions, in case they fall within the consolidation perimeter of a financial group, are consolidated, wherefore they are not shown in the aggregate. In the situation in which these loans are not consolidated in the accounting balance sheet (e.g., the non-MFI receiving the loan is not consolidated in any financial group, or the loan involves institutions of different groups), the corresponding balances are shown in the item “Credits to credit institutions” instead of “Credit to customers”; the accounting balance sheet includes credit granted to customers by consolidated non-MFI. Investments in securities In the accounting balance sheet, all investments in securities, including financial fixed assets, that were not consolidated are included under assets in the item “Securities and financial fixed assets”, by their value net of provisions, irrespective of the institutional sector of the issuing entity. In the statistical balance sheet, assets do not include securities issued by resident OMFI that are deducted as a result of the intra-sectoral consolidation of OMFI. The remaining investments in securities are classified in “Assets visà-vis non-residents – Securities” and “Assets vis-à-vis the non-monetary resident sector – Securities”. • Deposits and deposit-like instruments vis-à-vis non-monetary resident sector and resources from customers In the statistical balance sheet, the item “Deposits and deposit-like instruments vis-à-vis the non-monetary resident sector” includes all deposits and deposit-like liabilities vis-à-vis resident entities not falling within the MFI concept. In the accounting balance sheet, the corresponding item is “Resources from customers”. The major differences between this concept and that of the statistical balance sheet consist in that: (i) the accounting balance sheet includes liabilities from nonresident customers that are classified as “Deposits and deposit-like instruments vis-à-vis non-residents – visà-vis other sectors” in the statistical balance sheet, and (ii) the accounting balance sheet also includes Banco de Portugal / Supplement no. 1/2001 to the Statistical Bulletin – August 2001 5 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions resources from non-resident customers obtained through foreign branches and subsidiaries which, as previously mentioned, in their quality as non-resident institutions, are not included in the statistical balance sheet. • Securities other than capital and liabilities represented by securities The scope of the items “Securities other than capital” of the statistical balance sheet and “Liabilities represented by securities” of the accounting balance sheet is similar: securitised liabilities that do not represent holding rights over the institution. There are, however, significant differences between the values of the balance sheets, chiefly explained as follows: - the accounting balance sheet includes securities issued by non-resident institutions covered by the consolidation perimeter, in particular foreign branches of financial groups. The statistical balance sheet includes only the securities of resident OMFIs. The strong growth of the issues of securities by foreign branches of Portuguese financial groups in 1999 and 2000 is behind the difference between the balances of liabilities represented by securities in both balance sheets in December 2000 (EUR 17 267 million in the statistical balance sheet and EUR 28 978 million in the accounting balance sheet); - the item “Securities other than capital” in the statistical balance sheet includes subordinated liabilities in the form of securities. In the accounting balance sheet, these are classified separately under “subordinated debt” with liabilities for loans with a subordination clause; - in the statistical balance sheet, as mentioned above, the intra-sectoral balances of the OMFIs are consolidated. The “Securities other than capital” that are issued by resident OMFIs and that are temporarily held by resident OMFIs are entered by their net value in the above-mentioned liability item. In the accounting balance sheet, the consolidation of holdings of securities is only carried out in case there is a control relationship between the issuing institution and the holding institution. 6 Banco de Portugal / Supplement no. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions ANNEX 1 STATISTICAL CONCEPTS Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions STATISTICAL CONCEPTS This Annex summarises the main concepts underlying the monetary statistics component12 published in the Banco de Portugal’s Statistical Bulletin. 1. Residence concept An institutional unit is said to be a resident unit of a country when it has a centre of economic interest on the economic territory of that country.13 2. Sectoral breakdown The monetary statistics component of the Statistical Bulletin shows the following sectoral breakdown: i. Financial sector The financial sector of the economy includes the institutions (called financial institutions) which are entrusted with money creation capacity and those which, although not having such capacity, are engaged in financial intermediation activities, by canvassing for savings and subsequently investing them in financial assets, as well as providing related financial and technical services. The table below shows the composition of the financial sector by identifying the institutions which are included in the previously mentioned concepts of credit institutions (Portuguese abbreviation: IC), financial companies (Portuguese abbreviation: SF) and other similar entities (Portuguese abbreviation: OEE) (in accordance with the classification provided for in the Legal Framework of Credit Institutions and Financial Companies – approved by Decree-Law No. 298/92 of 31 December). 12 A more detailed description of the concepts can be found in Instruction No. 43/97 of the Banco de Portugal and respective annexes, which defines the reporting requirements of Monetary Statistics, available on the Banco de Portugal’s website. 13 The distinction between resident sector and non-resident sector is, in general, in accordance with the definition of resident laid down by the International Monetary Fund, also adopted in the European System of National and Regional Accounts 1995 (see paragraph A. – Residence criterion, of Chapter II – General features of the data to be reported, in the annex to Instruction No. 43/97 ). Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions Notes FINANCIAL SECTOR Banco de Portugal Monetary financial institutions Other monetary financial institutions Banks IC Savings banks IC Mutual agricultural credit banks IC Money market funds Investment funds (excluding money market funds) Other financial intermediaries Nonmonetary financial institutions Other financial auxiliaries Risk capital companies SF Factoring companies CI Dealers SF Investment companies IC Credit-purchase financing companies IC Financial holding companies OEE Financial leasing companies IC Financial intermediaries – Other SF / IC Exchange offices SF Brokers SF Investment fund managing companies SF Wealth managing companies SF Financial auxiliaries – other SF Insurance corporations and pension funds ii. Non-financial sector GENERAL GOVERNMENT Central government State Autonomous funds and services Regional government General government excluding central government Azores Madeira Local government Mainland Azores Madeira Social security NON-FINANCIAL SECTOR (EXCLUDING GENERAL GOVERNMENT) Non-financial corporations Households Private individuals Employers and self-employed Other Non-profit institutions serving households Emigrants Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions iii. Non-resident sector With regard to the non-resident sector, the sectoral breakdown of entities is similar to that for resident entities, with the necessary changes. Reference should only be made to the following: - In effect, the concept of MFIs is only applied in countries belonging to the European Union. For the remaining countries, this sector must be understood as “Banking sector”. Similarly, the concept of non-MFIs must be understood as “Non-bank financial sector” for countries not participating in the European Union. - The OMFI sector or banking sector (whether or not it is a EU country respectively) is further broken down into “Head office and branches of the institution ” and “Other”. Head office and branches of the institution Head office or branches abroad of the reporting institutions which in the different countries are classified as MFIs or banks (whether or not it is a EU country respectively). Other Other MFIs or banks (whether or not it is a EU country respectively), excluding the Central Bank, which are not the head office or branches of each reporting institution. This means that this category includes operations with the head office or the branches of other resident MFIs other than the reporting institution. 3. Classification of financial instruments The range of financial instruments and other items, adopted for the purposes of monetary statistics, is based on the framework defined in the European System of National and Regional Accounts (ESA 95), some changes being introduced due to internal analysis requirements. The instruments shown can be included in assets, liabilities or in off-balance sheet accounts. These can be shown on an individual or aggregated basis. The two tables at the end of this section show an outline of the aggregations of assets and liabilities considered in the monetary statistics component.14 i. Currency Legal tender notes and coins held in reserve in the country or abroad (whether or not convertible). Currency is deemed to be a liability of the issuing monetary authority. This category excludes commemorative coins that are not commonly used to make payments, particularly those without legal tender. ii. Deposits These include transferable deposits, notice deposits, time deposits and savings deposits (including housing savings deposits and emigrants’ accounts) iii. Certificates of deposit Fixed-term securities representing deposits with the issuing institution, in Portuguese or foreign legal tender currency, regulated by Decree-Law No. 372/91 of 8 October, and other applicable legislation. Similar instruments issued on foreign markets are also included. 14 At the end of the Statistical Bulletin a more detailed table of these instruments is shown, as well as in Chapter IV, in the annex to Instruction No. 43/97, in which individual instruments are described in detail. 4 Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions Although certificates of deposit issued in Portugal are registered securities transferable by endorsement, they do not have a significant secondary market. Given that they are not negotiable nor normally traded, they are not included in the securities concept. iv. Repurchase agreements Operations whereby an institution or a customer (seller) sells to another institution or customer (purchaser) assets that are his/her property, simultaneously obtaining the right and obligation to repurchase it at a specific price on a future date. The ownership of the assets is retained by the seller. Reporting institutions can act as both seller and purchaser. v. Loans Supply of funds whose maturity, interest rate, repayment conditions and payment of interest are normally established in a contract. In general, it is the debtor that takes the initiative as to the loan, and the conditions regulating it are set by the creditor or agreed between both parties. Loans represented by contracts normally traded on the secondary market and considered “Other debt securities” are not included. This category includes: − Discount. − Interbank money market loans. − Subordinated loans. − Other loans. − Current account credit. − Overdrafts on demand deposits: debit balances on demand deposits. − Financial leasing operations. − Advances made within the scope of factoring operations. − Other loans. − Other assets (liabilities) of (to) third parties, similar to loans (deposits), such as repayable margin payments related to financial derivatives. − Overdue loans and other non-performing loans. vi. Securities other than shares / securities other than capital Negotiable debt securities normally traded in the financial markets, which confer on the holder the unconditional right to a contractually determined income, but which do not grant any ownership rights on the issuing entity. These include, namely: − Treasury bills (Portuguese abbreviation: BT) − Commercial paper − Bonds (except subordinated bonds) − Subordinated bonds. − Participating bonds. − Other debt securities (such as deposit securities issued by the Banco de Portugal). − Derivatives. Financial assets based on or derived from a different underlying instrument. Only the financial derivatives with market value, tradable on the stock exchanges are included in the balance sheet, namely options, futures or warrants. vii. Money market paper Tradable debt securities issued by monetary financial institutions, with a high degree of liquidity due to their trading in liquid money markets, whose participants are mostly monetary financial institutions and other financial institutions. Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions viii. Money market fund shares/units Securities corresponding to money market fund shares which can be represented by certificates of one or more units or in book-entry form. In Portugal this type of instrument only exists since April 2000, the date on which money market funds were considered for statistical purposes. ix. Shares and other equity Financial assets which represent property rights on the issuing entity. These include, namely: − Shares. − Units. Securities related to investment fund shares (except money market funds) which can be represented by certificates of one or more units or in book-entry form. − Quotas. − Supplementary instalment payments. − Guarantees with the nature of fixed assets. x. Profit and loss account Current and extraordinary profit and loss for the year and results carried forward from previous fiscal years. xi. Reserves Reserves set up by reporting institutions irrespective of their nature. These include, inter alia, issuance premia. xii. Provisions Provisions for general credit risks and other provisions which do not correspond to current or future liabilities to third parties. These include, inter alia, provisions for non-performing loans. xiii. Fixed assets Assets belonging to the reporting institutions and assigned to their activity. These include the majority of tangible fixed assets, except art collections and similar property, held on account of debts recovered, which shall be included in “Other accounts”. It should be noted that fixed assets are recorded by their value net of depreciation. 6 Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 “Statistical Balance Sheet” and “Accounting Balance Sheet” of Other Monetary Financial Institutions ASSETS Currency Deposits Discount Interbank money market loans Credits and credit-like Subordinated loans instruments Loans Other loans (except in the IMM and subordinated loans) Other assets Non-performing loans Treasury bills Commercial paper Bonds (except subordinated bonds) Securities other than shares Subordinated bonds Participating bonds Other debt securities Securities Derivatives Money market paper Money market fund shares/units Shares Investment funds units (except MMF shares/units) Shares and other equity Other equity Fixed assets Remaining assets Other assets LIABILITIES Transferable deposits Notice deposits Deposits Time and savings deposits Certificates of deposit Deposits and Repurchase agreements deposit-like instruments Discount Interbank money market loans Loans Subordinated loans Other loans (except IMM and subordinated loans) Other liabilities Commercial paper Bonds (except subordinated bonds) Subordinated bonds Securities other than capital Participating bonds Other debt securities Derivatives Money market paper Money market fund shares/units Shares Shares and other equity Other equity Capital and reserves Profit and loss account Reserves Provisions Remaining liabilities Banco de Portugal / Supplement No. 1/2001 to the Statistical Bulletin – August 2001 ANNEX 2 NEW TABLES OF THE STATISTICAL BULLETIN Table A.3.13 Table A.3.14 A.3.13 BALANÇO CONSOLIDADO DAS OUTRAS INSTITUIÇÕES FINANCEIRAS MONETÁRIAS (RESIDENTES) (1) Saldos em fim de mês OTHER (RESIDENT) MONETARY FINANCIAL INSTITUTIONS CONSOLIDATED BALANCE SHEET (1) End-of-period figures 106 euros Fonte / Source: Banco de Portugal DEZ 98 1 DEZ 99 2 MAR 00 3 JUN 00 4 SET 00 5 DEZ 00 6 MAR 01 7 ACTIVO 1 2 3 4 5 6 7 8 9 10 11 12 13 14 ASSETS Activos face ao Banco de Portugal . . . . . . . . . . . . . . . . . . . . . . Activos sobre o exterior . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Créditos e equiparados. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Face a OIFM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . OIFM excepto sede e sucursais da própria instituição . . . Sede e sucursais da própria instituição . . . . . . . . . . . . . . . Face a outros sectores . . . . . . . . . . . . . . . . . . . . . . . . . . . . Títulos . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . de OIFM. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . de outros sectores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Activos sobre o sector não monetário residente . . . . . . . . . . . . Empréstimos . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Títulos . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Activos diversos (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 508 46 975 37 998 34 681 29 037 5 644 3 317 8 977 3 453 5 524 114 871 90 989 23 882 11 141 9 891 48 154 39 406 32 716 27 668 5 049 6 690 8 747 3 370 5 377 137 761 116 662 21 100 13 789 7 666 52 194 44 208 36 625 31 359 5 266 7 583 7 986 3 541 4 445 145 252 122 797 22 455 11 493 8 066 50 254 43 061 34 983 30 901 4 082 8 078 7 193 2 933 4 261 155 850 131 512 24 338 13 617 8 051 51 584 43 437 34 674 30 640 4 034 8 763 8 146 3 283 4 864 164 380 137 163 27 217 12 367 8 466 56 677 48 173 39 801 35 101 4 700 8 372 8 504 3 062 5 441 169 259 145 126 24 132 12 148 7 948 55 376 46 979 39 804 32 738 7 066 7 175 8 397 3 001 5 396 176 393 151 292 25 100 11 761 15 Total do activo (1+2+11+14) . . . . . . . . . . . . . . . . . . . . . . . . . . . 181 495 209 594 216 604 227 787 236 381 246 549 251 477 Total assets (1+2+11+14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 PASSIVO Assets vis-à-vis Banco de Portugal . . . . . . . . . . . . . . . . . . . . . . Assets vis-à-vis non-residents . . . . . . . . . . . . . . . . . . . . . . . . . . Credits and credit-like instruments . . . . . . . . . . . . . . . . . . . . . Vis-à-vis other MFI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other MFI excluding departments abroad . . . . . . . . . . . . . Departments abroad . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Vis-à-vis other sectors . . . . . . . . . . . . . . . . . . . . . . . . . . . . Securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . issued by other MFI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . issued by other sectors . . . . . . . . . . . . . . . . . . . . . . . . . . . . Assets vis-à-vis the non-monetary resident sector . . . . . . . . . . Loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Remaining assets (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 3 4 5 6 7 8 9 10 11 12 13 14 LIABILITIES Passivos face ao Banco de Portugal . . . . . . . . . . . . . . . . . . . . . Depósitos e equiparados do exterior . . . . . . . . . . . . . . . . . . . . . de OIFM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . OIFM excepto sede e sucursais da própria instituição . . . . . Sede e sucursais da própria instituição . . . . . . . . . . . . . . . . de outros sectores . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depósitos e equiparados do sector não monetário residente . . Títulos excepto capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Passivos diversos (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Capital e reservas (3) (4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . do qual: provisões para crédito de cobrança duvidosa (3) (5) . . 1 231 48 721 41 994 33 250 8 744 6 728 100 705 10 448 6 403 13 988 . 2 582 57 628 49 737 39 723 10 014 7 891 112 296 12 991 6 102 17 996 2 311 1 534 63 512 53 413 43 517 9 896 10 099 113 572 13 463 5 585 18 937 2 277 2 690 68 644 57 352 48 527 8 825 11 292 115 769 14 228 5 897 20 559 2 173 2 031 73 092 61 311 50 861 10 449 11 781 117 534 15 555 5 157 23 011 2 224 3 299 78 365 69 074 55 183 13 891 9 292 120 094 17 267 5 673 21 850 2 285 2 433 84 703 71 149 49 543 21 606 13 554 116 934 19 116 6 306 21 986 2 206 27 Total do passivo (16+17+22+23+24+25). . . . . . . . . . . . . . . . . . 181 495 209 594 216 604 227 787 236 381 246 549 251 477 Total liabilities (16+17+22+23+24+25). . . . . . . . . . . . . . . . . . . . 27 Por memória: 28 Activos líquidos face ao Banco de Portugal (1-16) . . . . . . . . . . 29 Activos líquidos sobre o exterior (2-17) . . . . . . . . . . . . . . . . . . . 30 dos quais: créditos e depósitos (3-17) . . . . . . . . . . . . . . . . . . 31 Face a OIFM (4-18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . OIFM excepto sede e sucursais da própria instituição (5-19) 32 33 Sede e sucursais da própria instituição (6-20) . . . . . . . . . 34 Face a outros sectores (7-21). . . . . . . . . . . . . . . . . . . . . . . . 7 277 -1 746 -10 723 -7 313 -4 212 -3 100 -3 410 7 309 -9 474 -18 221 -17 021 -12 056 -4 965 -1 200 6 132 -11 319 -19 305 -16 788 -12 158 -4 630 -2 517 5 376 -18 390 -25 583 -22 369 -17 626 -4 743 -3 214 6 020 -21 508 -29 655 -26 637 -20 221 -6 416 -3 018 5 167 -21 689 -30 192 -29 272 -20 082 -9 191 -920 Memo items: 5 514 Net assets vis-à-vis Banco de Portugal (1-16). . . . . . . . . . . . . . -29 327 Net foreign assets (2-17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -37 724 of which: credits and deposits (3-17) . . . . . . . . . . . . . . . . . . . -31 345 Vis-à-vis other MFI (4-18) . . . . . . . . . . . . . . . . . . . . . . . . . . . -16 804 Other MFI excluding departments abroad (5-19) . . . . . . . . -14 540 Departments abroad (6-20). . . . . . . . . . . . . . . . . . . . . . . . . -6 379 Vis-à-vis other sectors (7-21) . . . . . . . . . . . . . . . . . . . . . . . . 16 17 18 19 20 21 22 23 24 25 26 Liabilities vis-à-vis Banco de Portugal . . . . . . . . . . . . . . . . . . . . Dep. and deposits-like instruments vis-à-vis non-residents. . . . Vis-à-vis other MFI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other MFI excluding department abroad . . . . . . . . . . . . . . . Departements abroad. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Vis-à-vis other sectores. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Dep.and dep-like instruments vis-à-vis non-monetary resident sector Securities other than capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . Remaining liabilities (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Capital and reserves (3) (4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . of which: provisions for non-performing loans (3) (5). . . . . . . . . 16 17 18 19 20 21 22 23 24 25 26 28 29 30 31 32 33 34 __________________________________________________________________________________________________________________________________________________________________________ (1) Sobre metodologias e conceitos ver Suplemento 1/01 ao Boletim Estatístico de Agosto 2001. / For information on methodologies and concepts please see Supplement to the Statistical Bulletin 1/01 of August 2001. (2) As contas diversas são consideradas em termos líquidos e afectas aos “Activos diversos” / “Passivos diversos” conforme o seu saldo. / The other accounts are considered in net terms and included under “Remaining assets “ / ”Remaining liabilities” according to its sign. (3) A partir de Dezembro de 1999, a noção de capital e reservas para fins estatísticos inclui provisões específicas para crédito de cobrança duvidosa e crédito vencido. Anteriormente as referidas provisões estavam incluídas nos “passivos diversos”. / From December 1999 onwards, the capital and reserves for statistical purposes includes specific provisions for non-performing loans and overdue loans. These provisions were previously included under “remaining liabilities”. (4) Inclui os proveitos por natureza, líquidos de custos por natureza que, em termos do Boletim Estatístico, se encontram em contas diversas. / Includes operating incomes, net from operating costs, which are considered under remaining items in the remainder of the Statistical Bulletin. (5) O conceito estatístico de provisões para créditos de cobrança duvidosa inclui também as provisões para crédito vencido. / The provisions for non-performing loans for statistical purposes includes provisions for overdue loans. Banco de Portugal / Suplemento nº. 1/2001 ao Boletim Estatístico de Agosto 2001 19 A.3.14 BALANÇO AGREGADO DO SISTEMA BANCÁRIO - ACTIVIDADE CONSOLIDADA (1) Saldos em fim de período AGGREGATED BALANCE SHEET OF THE BANKING SYSTEM - CONSOLIDATED ACTIVITY (1) End-of-period figures 106 euros Fonte / Source: Banco de Portugal DEZ 98 1 DEZ 99 2 JUN 00 3 DEZ 00 4 MAR 01 5 ACTIVO ASSETS Caixa e activos face a bancos centrais. . . . . . . . . . . . . . . . . . . . dos quais: caixa e activos face ao Banco de Portugal. . . . . . . Aplicações em outras instituições de crédito . . . . . . . . . . . . . . . País. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Estrangeiro. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Crédito sobre clientes (líquido de provisões (2)) . . . . . . . . . . . . . Títulos e imobilizações financeiras (líquidos de provisões) . . . . Imobilizado não financeiro e outros activos . . . . . . . . . . . . . . . . 9 597 8 930 37 311 n.a. n.a. 104 367 33 780 14 050 10 861 10 058 33 570 n.a. n.a. 134 327 31 988 18 531 8 949 8 178 38 118 n.a. n.a. 148 716 35 728 18 247 9 670 8 620 36 060 10 953 25 107 161 872 36 996 15 854 8 800 7 959 43 745 10 604 33 141 166 201 38 493 15 835 Cash and liquid assets in central banks . . . . . . . . . . . . . . . . . of which: cash and liquid assets in the Banco de Portugal. . Credits to other credit institutions . . . . . . . . . . . . . . . . . . . . . . In the country . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Abroad . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Credit to customers (net of provisions (2)) . . . . . . . . . . . . . . . . Securities and financial fixed assets (net of provisions) . . . . . Non-financial fixed assets and other assets . . . . . . . . . . . . . . 1 2 3 4 5 6 7 8 9 Total do activo. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 199 106 229 277 249 757 260 453 273 074 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 1 2 3 4 5 6 7 8 PASSIVO E CAPITAIS PRÓPRIOS 10 11 12 13 14 15 16 17 18 19 20 LIABILITIES AND EQUITY CAPITAL Recursos de bancos centrais . . . . . . . . . . . . . . . . . . . . . . . . . . . dos quais: do Banco de Portugal . . . . . . . . . . . . . . . . . . . . . . . Recursos de outras instituições de crédito . . . . . . . . . . . . . . . . . País . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Estrangeiro. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Recursos de clientes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Responsabilidades representadas por títulos. . . . . . . . . . . . . . . Passivos subordinados . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Provisões (3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Outros passivos . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Capitais próprios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 690 1 468 42 692 n.d. n.d. 116 730 11 246 5 680 1 874 7 112 12 082 3 158 2 658 45 638 n.d. n.d. 128 928 18 310 6 303 2 295 10 350 14 296 2 954 2 657 53 458 n.d. n.d. 135 646 23 623 6 882 2 565 9 604 15 025 3 462 3 300 52 202 10 024 42 178 140 407 28 978 7 174 3 152 9 791 15 287 2 704 2 441 58 546 9 024 49 522 141 025 33 846 7 646 3 238 10 039 16 030 21 Total do passivo e capitais próprios . . . . . . . . . . . . . . . . . . . . . . 199 106 229 277 249 757 260 453 273 074 Total liabilities and equity capital . . . . . . . . . . . . . . . . . . . . . . . 21 Por memória: 22 Caixa e activos líquidos face ao Banco de Portugal (2-11) . . . . 23 Aplicações em outras instit. de crédito líquidas de recursos (3-12) 24 País (4-13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 Estrangeiro (5-14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 463 -5 381 n.a. n.a. 7 401 -12 068 n.a. n.a. 5 520 -15 340 n.a. n.a. 5 320 -16 142 929 -17 071 Memo items: 5 517 Cash and liquid assets in the Banco de Portugal (2-11) . . . . . -14 801 Credits to other credit institutions net of resources (3-12) . . . . 1 580 In the country (4-13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -16 381 Abroad (5-14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Resources from central banks . . . . . . . . . . . . . . . . . . . . . . . . . of which: of the Banco de Portugal . . . . . . . . . . . . . . . . . . . . Resources from other credit institutions . . . . . . . . . . . . . . . . . In the country . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Abroad . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Resources from customers . . . . . . . . . . . . . . . . . . . . . . . . . . . Liabilities represented by securities. . . . . . . . . . . . . . . . . . . . . Subordinated debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Provisions (3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Equity capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 11 12 13 14 15 16 17 18 19 20 22 23 24 25 __________________________________________________________________________________________________________________________________________________________________________ (1) Sobre metodologias e conceitos ver Suplemento 1/01 ao Boletim Estatístico de Agosto 2001. / For information on methodologies and concepts please see Supplement to the Statistical Bulletin 1/01 of August 2001. (2) Provisões específicas para crédito vencido, de cobrança duvidosa e de risco país. / Specific provisions for overdue loans, doubtful loans and country risk. (3) Exclui as provisões específicas para crédito vencido, de cobrança duvidosa e de risco país. / Excludes specific provisions for overdue loans, doubtful loans and country risk. 20 Banco de Portugal / Suplemento nº. 1/2001 ao Boletim Estatístico de Agosto 2001 Supplements to the Statistical Bulletin Supplements to the Statistica1 Bulletin 1/98 Statistical information on non-monetary financial institutions, December 1998. 2/98 Foreign direct investment in Portugal: flows and stocks statistics for 1996 and stocks estimates for 1997, December 1998. 1/99 New presentation of the balance of payments statistics, February/March 1999. 2/99 Statistical information on mutual funds, December 1999. 1/00 Portuguese direct investment abroad (available only in portuguese), December 2000. 1/01 “Statistical balance sheet” and “Accounting balance sheet” of other monetary financial institutions August 2001.