28 JUNE 2011 TO: Academic Money Purchase Pension Plan Participants

advertisement

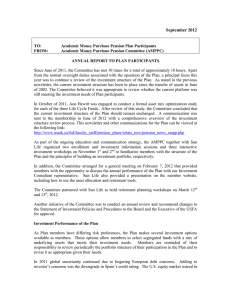

28 JUNE 2011 TO: FROM: Academic Money Purchase Pension Plan Participants Academic Money Purchase Pension Committee (AMPPC) ANNUAL REPORT TO PLAN PARTICIPANTS Since June of 2010, the Committee has met 8 times for a total of approximately 16 hours. Apart from the normal oversight duties associated with the operation of the Plan, a principal focus this year was to initiate a review of the investment structure of the Plan. This structure has been in place since the transfer of assets in June of 2002 and the Committee believes it is appropriate to review whether the structure is still meeting the investment needs of Plan participants. As a first step in the review process, the Committee conducted, with the help of Sun Life, a survey of Plan participants in March and April of this year. A summary of responses to this survey is to be found in the Appendix to this report. A second initiative of the Committee was to conduct a review of and recommend changes to the Governance Document to the Board and the Executive of the USFA for approval. In addition, the Committee reviewed the Statement of Investment Policies and Procedures and recommended changes to this document to the Board and the Executive of the USFA for approval. Finally, the Committee in conjunction with Sun Life developed an annual communication and education strategy for the Plan. As part of the ongoing education and communication strategy, the AMPPC drafted one newsletter to the membership and partnered with Sun Life Financial to circulate three newsletters dealing with financial planning and investment strategies. These newsletters can be viewed at http://www.usask.ca/fsd/faculty_staff/pension_plans/whats_new/pension_news_ampp.php The AMPPC together with Sun Life organized two enrollment and investment information sessions and two interactive investment workshops on October 28th and 29th, 2010 to familiarize members with the structure of the Plan and the principles of building an investment portfolio, respectively. In addition, the Committee arranged for a general meeting on February 7, 2011 that provided members with the opportunity to discuss the annual performance of the Plan with our Investment Consultant representative and to discuss the services of the Sun Life website with a Sun Life representative. Finally, the Committee partnered with Sun Life to hold retirement planning workshops on February 23rd and 24th, 2011. Investment Performance of the Plan As Plan members have differing risk preferences, the Plan makes several investment options available to members. These options allow members to select segregated funds with a mix of underlying assets that meets their investment needs. Members are reminded of their responsibility to review periodically the portfolio structure of their participation in the Plan and to revise it as appropriate given their needs. In 2010 stock markets around the world continued their recovery from the nadir reached in March of 2009 and the Plan’s funds participated in this recovery. The benchmark portfolios for each of the funds have been determined using the actual returns of the market indexes such as 91-Day Canadian Treasury Bills, the DEX Universe Bond Index, the S&P/TSX Capped Composite Index, 2 Standard and Poor’s 500 U. S. Stock Index and Morgan Stanley’s Europe, Australia and Far East Index. The following is a summary of the Plan’s annual investment performance as at December 31, 2010 exclusive of Plan expenses: Fund 1 year Money Market Return 0.7% Benchmark 0.5% Bond Fund Return 6.7% Benchmark 6.7% Conservative Life Cycle Fund Return 7.4% Benchmark 7.4% Balanced Life Cycle Fund Return 8.3% Benchmark 8.7% Aggressive Life Cycle Fund Return 8.7% Benchmark 9.2% Canadian Equity Fund Return 12.5% Benchmark 17.6% U.S Equity Fund Return 9.0% Benchmark 9.1% International Equity Fund Return 4.9% Benchmark 2.1% 4 year 2.4% 2.2% 5.4% 5.6% 4.2% 4.1% 1.5% 1.1% 0.1% -0.5% 4.0% 4.0% -4.7% -4.7% -4.2% -6.5% The Sun Life website at https://www.sunnet.sunlife.com/signin/mysunlife/home.wca? contains additional information about the Plan’s performance. Additionally, you can access the Plan’s Financial Statements at http://www.usask.ca/hrd/benefits/pension_plans.php. Respectively submitted by Robert F. Lucas, Chair Mike Sander, Vice-Chair Academic Money Purchase Pension Committee Appendix AMPPC Survey of Plan Participants: Summary The survey was completed by about 22 percent of Plan participants, a good response relative to industry standards of 10-15 percent. The following conclusions are based on our analysis of the responses received to five general question categories. 1. Investment Awareness (a) One third of responders have not engaged in any planning for retirement in the past twelve 3 months. (b) Approximately one half of responders consider themselves somewhat informed with respect to the investment options of the Plan, the remaining members are divided roughly equally between well informed and uninformed. Of the uninformed, three quarters suggest that either more time is required to become informed or that the default option is meeting their needs so there is little value-added in becoming informed. Lack of information is the reason offered by the remaining quarter for being uninformed. 2. Asset Allocation (a) Over 50 percent of responders place all their balances in the default option and tend not to make changes in their allocation. For responders with more than 9 years of pension contributions this percentage is about 60, and among responders who are uninformed, it is about 75 percent. The principal reasons for the use of the default option are that either it is judged to be meeting the needs of responders, or that they do not have the expertise to judge among the various options. (b) Approximately 70 percent of responders do not use the aggressive or conservative life-cycle funds. Those who are the furthest from retirement tend to utilize these funds more heavily. (c) Less than one-half of responders utilize the five distinct asset classes, but of those who do, half have at least 75 percent of their balances allocated to these asset classes, and these individuals are likely to be either well informed or somewhat informed. 3. Expansion of Asset Classes (a) There is limited demand for an expansion of asset classes, with over sixty percent of responders unwilling to pay higher fees to access new classes. Of those who expressed an interest in a GIC (36 percent), roughly half of these members have five years or fewer before retirement. (b) There were various suggestions for additional asset classes, including sector and regional funds, but the GIC option is the only one with significant support. 4. Programmed Option (a) One third of responders are interested in a programmed transfer option in the lifecycle funds, where the exposure to stocks diminishes with years of service, with another 40 percent uncertain about its value. The interest in this option is greatest among those responders who self identified themselves as uninformed investors and those furthest from retirement. 5. Email Access (a) Seventy percent of responders favour allowing Sun Life access to their email addresses to help them manage their investments within the Plan.