Document 12062885

advertisement

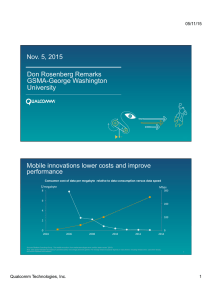

24/11/2014 Derek Aberle President, Qualcomm Incorporated Investing in mobile innovation 1 MOBILE Largest technology platform 2 1 24/11/2014 Accelerating growth of 3G/4G connections ~2.8B ~5.1B Global 3G/4G connections as of Q3 ‘14 Global 3G/4G connections expected by 2018 Source: GSMA Intelligence, Nov. ‘14 3 User demand driving continued smartphone momentum >8B Cumulative smartphone unit shipments forecast between 2014 - 2018 Source: Gartner, Sep ‘14 4 2 24/11/2014 Expanding OEM base delivers greater device selection 5,800+ 3G and 4G devices launched over past 5 years Source: CDMA Development Group and Global Mobile Suppliers Association 5 Revenue growth underscores health of mobile ecosystem 2013 US $1,996 Bn 2020 US $2,897 Bn Source: GSMA Report – “The Mobile Economy 2014” 6 3 24/11/2014 Retail Energy Education Marketing Consumer Electronics Entertainment Computing ECOSYSTEMS EVOLVING TO MOBILE Healthcare Automotive 7 Standardized technologies vital to industry Later entrants and downstream innovators have reduced investment risk Highest Risk Lowest Risk Technology contributed to standard Inter-standards competition Industry adoption unknown Standard completed Commercial deployment Standard-based products available Industry has adopted technology Evolution of technology development 8 4 24/11/2014 Cellular standards fuel mobile innovation and growth LTE Family WCDMA/HSPA + Family 300 High-bandwidth services Peak download speeds in Mbps • HD/4K video streaming • HD audio Increased-bandwidth services • Full-length movie/ video downloads • MP3 downloads • Network gaming • Video downloads Low-bandwidth services • Streaming audio/video • MMS 150 100 • Ringtones 63 • Short-format videos 42 28 7.2 1.8 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 9 Minority of standards body members actively contribute The top 10 patent owners represent ~99% of all the declared essential patents 22% 29.97% Participants With ETSI Declared Patents (1999-2012) Participants Without ETSI Declared Patents Contributor Non-Contributor 70.03% 78% Contributions ETSI FRAND Declarations (2005-2012) (1999-2012) Source: www.etsi.org; www.law.northwestern.edu/research-faculty/searlecenter/events/entrepreneur/documents/Gupta_standard-setting-process-3gpp.pdf 10 5 24/11/2014 Mobile industry total R&D expenditures (3GPP members) 12.5% 12.5% 12.5% 11.4% $200,000 R&D expense (Millions of USD) 13.0% 12.9% 13.3% 11.2% 15% 12% $160,000 9% $120,000 6% $80,000 3% $40,000 $0 R&D as a percentage of revenue $240,000 0% 2005 2006 2007 2008 2009 2010 2011 2012 Based on the financial data of 322 for-profit firms that participated in 3GPP standards from 2005-2013 Source: www.3gpp.org for participant information; Onesource for financial information 11 R&D spend as a percentage of revenue Top 10 Contributors to 3GPP; Average R&D spend as a percentage of revenue (2005-2013) Average R&D as a Percentage of Revenues 25% 20% 15% 10% 5% 0% NTT Docomo Samsung NEC Huawei ZTE Based on the financial data of top holders of patents declared as potentially essential to 3G/4G 3GPP standards to ETSI Source: www.etsi.org for patent declaration information; Onesource for financial information Motorola Nokia Ericsson Alcatel Qualcomm 12 6 24/11/2014 FRAND licensing policies balance interests of stakeholders No single policy objective should be favored above another IP Owners Potential Licensees (Contributors to Standard) Reasonable Compensation (Implementers of Standard) Access to the Standard FRAND Licensing Policies 13 Key mobile trends creating challenges for industry Rapid growth of mobile broadband data traffic Connectivity expanding into new device categories New applications and services 14 7 24/11/2014 Thank you Follow us on: For more information on Qualcomm, visit us at: www.qualcomm.com & www.qualcomm.com/blog ©2013-2014 Qualcomm Incorporated and/or its subsidiaries. All Rights Reserved. Qualcomm is a trademark of Qualcomm Incorporated, registered in the United States and other countries. All Qualcomm Incorporated trademarks are used with permission. Other products and brand names may be trademarks or registered trademarks of their respective owners References in this presentation to “Qualcomm” may mean Qualcomm Incorporated, Qualcomm Technologies, Inc., and/or other subsidiaries or business units within the Qualcomm corporate structure, as applicable. Qualcomm Incorporated includes Qualcomm’s licensing business, QTL, and the vast majority of its patent portfolio. Qualcomm Technologies, Inc., a wholly-owned subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of Qualcomm’s engineering, research and development functions, and substantially all of its product and services businesses, including its semiconductor business, QCT. 15 8