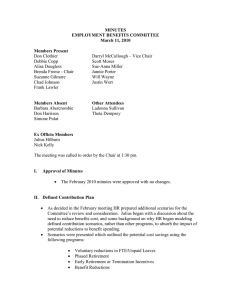

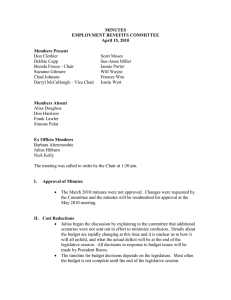

MINUTES EMPLOYMENT BENEFITS COMMITTEE November 19, 2009 Members Present

advertisement

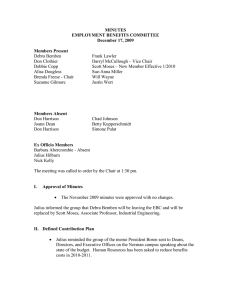

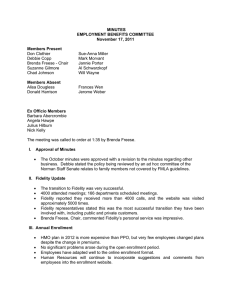

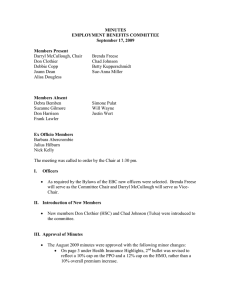

MINUTES EMPLOYMENT BENEFITS COMMITTEE November 19, 2009 Members Present Debra Bemben Don Clothier Debbie Copp Joann Dean Suzanne Gilmore Betty Kupperschmidt Darryl McCullough – Vice Chair Sue-Anna Miller Will Wayne Justin Wert Members Absent Alisa Dougless Brenda Freese - Chair Don Harrison Chad Johnson Frank Lawler Simone Pulat Ex Officio Members Barbara Abercrombie Julius Hilburn Nick Kelly The meeting was called to order by the Vice Chair at 1:30 pm. I. Approval of Minutes The October 2009 minutes were approved with no changes. II. Defined Contribution Administration Julius informed the group that there are no significant updates. However, a recap of the overall status was given. The Record Keeper firm will provide: o Online enrollment o A combined statement for all investments o Enhanced education o Streamlined customer service All fees will be highlighted and easily identifiable to employees. It is anticipated there will be a recommendation brought to the EBC in early 2010, with the goal of getting a recommendation on the March 2010 Regents Agenda. The goal is to have a three tiered investment structure which will look like the following: Target Retirement Date Funds are automatically invested based on the participant’s date of retirement. Core Line-up 10 – 15 investment options from which to choose Brokerage Window 3,000 additional options Caters to the more sophisticated investor Julius told the group that OU understands the importance of the TIAA Annuity and has negotiated options in which it would be included. Question: Will there be an on campus presence to assist employees as they make investment decisions? Response: Julius indicated it’s a cost issue at this point. An on campus presence would increase the employee fee amounts. The committee is looking for a firm that will provide increased education. III. Benefit Cost Reductions President Boren sent a memo to Deans, Directors, and Executive Offices on the Norman campus speaking very directly about the state of the budget. He has asked Human Resources to find ways to reduce benefits costs in 20102011. Health care benefits currently cost the University approximately $75 million annually, and Defined Contribution Plans cost approximately $60 million annually. Human Resources is working to gather ideas and assemble scenarios and data for review by the EBC. o Reductions in TRS is not an option as contribution levels are mandated. o There is a strong desire to avoid impacting health care. An overview of current DC plans was given as follows: Plan OTRS prior to 1995 OTRS after 1995 9% ORP 9% Hourly OU Contribution 15% of salary over $9,000 8% of salary over $9,000 9% of full salary 9% of full salary Human Resources will prepare a variety of scenarios for presentation at the December meeting. Question: Is there any chance retirement contributions will be returned to current levels after the economy recovers? Response: Julius told the group no decision has been made about that. Question: How much of a reduction can the retirement package take before it has an impact on recruiting efforts? Response: Julius said that OU is well above market on retirement plans. So, there is room for the reductions without impacting OU’s market position. Question: A committee member asked when a recommendation is expected. Response: Julius indicated that no recommendation will be made until after the first of the year. Question: A request was made for the committee to have the opportunity to review descriptive statistics on who will be eligible to retire in the coming years. Response: Julius indicated that some statistics will be provided at the December meeting. IV. PayFlex PayFlex has assigned one individual to work with OU pharmacies to resolve issues with the debit cards. Nick reminded the group that anyone wishing to participate in flexible spending or dependent care accounts in 2010 will need to re-enroll in the plan during open enrollment. An FSA survey was sent out in early November and the results will be used to guide future communications. Many of the comments were about things which are governed by the IRS, such as the need for documentation. The need to retain receipts was emphasized to the group. Any time a card is used at a vendor that is not on the IIAS system or is for an amount that does not match one of the OU copays, documentation will be requested. V. Retiree Medical President Boren has the report and is listening to campus feedback. He has indicated he will not make any changes for 2010. Julius Hilburn and Nick Kelly will meet with the Retiree Organization on 12/10/2009. VI. Annual Enrollment Benefits fairs were held on all three campuses in early November. The only changes in benefits for 2010 are the rates for health and dental. Confirmation statements will be available in Self-Service within 72 hours of an employee completing their enrollment on line. By the time 2010 open enrollment comes around, the Evidence of Insurability forms for life insurance will be available on line. VII. Other Business Darryl indicated that the next regularly scheduled EBC meeting is 12/17/2009, which is finals week. The committee decided to proceed as scheduled so that discussion can begin on the possible defined contribution reductions. The next EBC meeting will be Thursday, December 17, 2009. There being no other business, the meeting was adjourned at 2:55 p.m.