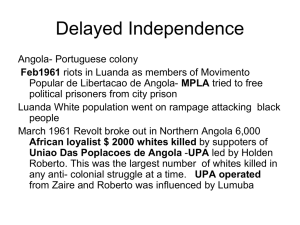

Working Paper Oil, Growth and Political Development in Angola

advertisement