The Angolan Consumer Market

advertisement

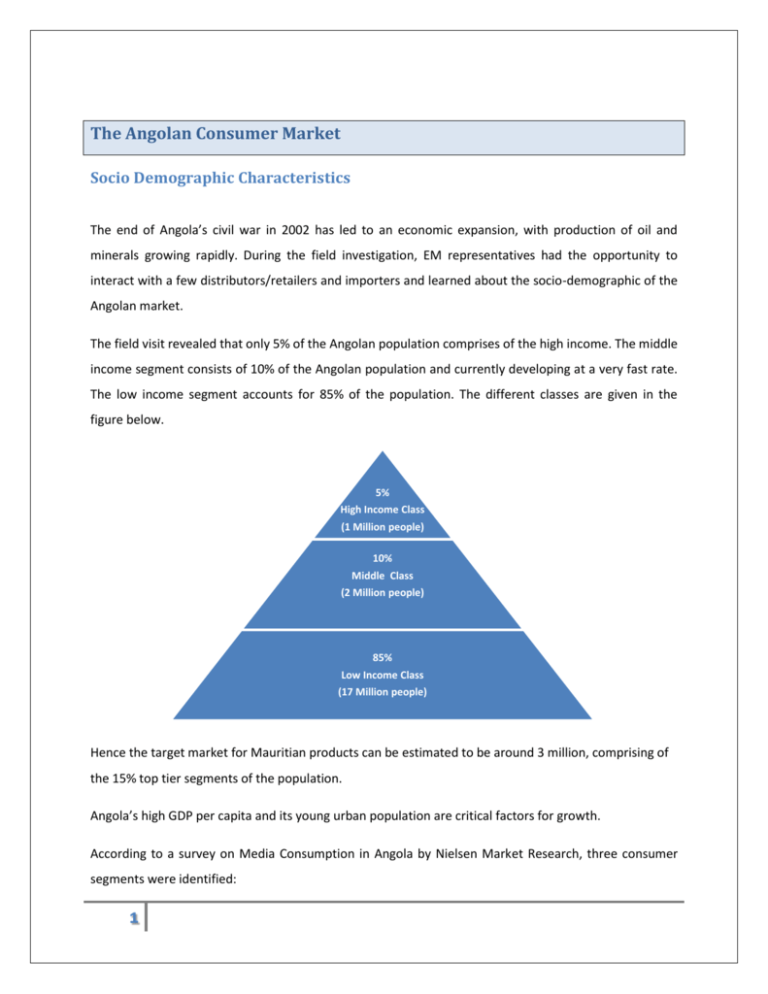

The Angolan Consumer Market Socio Demographic Characteristics The end of Angola’s civil war in 2002 has led to an economic expansion, with production of oil and minerals growing rapidly. During the field investigation, EM representatives had the opportunity to interact with a few distributors/retailers and importers and learned about the socio-demographic of the Angolan market. The field visit revealed that only 5% of the Angolan population comprises of the high income. The middle income segment consists of 10% of the Angolan population and currently developing at a very fast rate. The low income segment accounts for 85% of the population. The different classes are given in the figure below. 5% High Income Class (1 Million people) 10% Middle Class (2 Million people) 85% Low Income Class (17 Million people) Hence the target market for Mauritian products can be estimated to be around 3 million, comprising of the 15% top tier segments of the population. Angola’s high GDP per capita and its young urban population are critical factors for growth. According to a survey on Media Consumption in Angola by Nielsen Market Research, three consumer segments were identified: 1 Trendy Aspirants (39%), Evolving Juniors (21%) and Balanced Seniors (17%). In fact, print and online penetration in Angola is almost twice that recorded in other Sub-Saharan Africa. According to the study, Trendy Aspirants are opinion leaders on technology and gadgets and are open to impulse buying. This group offers good opportunities for brand growth. Evolving juniors segment is made up of teenage students. This group is brand loyal, while also being interested in trying new products. Actively interacting with this group to drive familiarity can establish effective market position in the long run. Balanced seniors segment is made up of middle-aged householders who have low brand loyalty and are also willing to try new brands on condition that the products are affordable. The research further revealed that joint families are more common in Angola than in other sub-Saharan African countries surveyed, and spending time with family is the most predominant attitude. Mauritian exporters should target the 3 million Angolans which represent the mid and up market for the textile and apparels and grocery products. 2 Consumer Behaviour/Lifestyle The below graph depicts the characteristics of the Angolan consumers that profoundly shape the way they make their choices. Characteristics of Angolan Consumers 140 120 100 80 60 40 20 0 124 88 86.7 65.6 15 15 85.2 40.2 38.5 14.7 6.8 10.6 80.9 40.4 0.7 1.3 Angola Luanda Source: Ministry of Economic Affairs & Agriculture – Retail and Food in Angola, 2012 EM officers’ interaction with several Angolan importers revealed that going shopping can be quite a hassle and time consuming in Angola. A very small percentage of the population owns a car, and many depend on candongeiro's (public mini-bus taxi's) to reach the informal market or supermarket. If public or private transport is available, Luanda is one of the world's most congested cities and traffic can be a nightmare. Many people prefer to shop close to their home, and the large new hypermarkets and supermarkets at the edge of town are out of reach for many Angolans. Moreover, service in supermarkets is low, and they can be especially crowded during weekends. Therefore, there is a strong culture of buying in bulk in Angola 3 Buying Behaviour According to importers met, food and grocery purchases account for almost half of monthly household spending. Beverages and dairy products are the most popular food categories. On the other hand, the personal care category accounts for a tenth of monthly household spending and has higher penetration compared to household products. Furthermore, the majority of retailers met mentioned that around 45% of the population shop at general stores or cantinas, while around 40% shop at supermarkets. They also stated that although familiarity and brand loyalty are key purchase considerations among the majority of Angolan consumers, the young generation is keen to try new products. Hence Mauritian products have good potential to penetrate the market if they are of good quality and are price competitive. Purchasing Power According to the “Retail and Food Report” by the Ministry of Economic Affairs1 average per capita monthly income in Angola was AOA 8,767 (USD88). Luandans earn significantly more than AOA 12,369(US $124) per month. The top 20% of earners in Luanda make around 28 more than the bottom fifth of the rural population: US $14 versus US $344. Consumer spending in Angola is AOA 6,449 (US$ 65) per month on average. Wealthy consumers in the capital city spend as much as AOA 19,582 (US $196) a month, while the bottom 20% has to make ends meet with AOA 3,594 (US $36). 1 Ministry of Economic Affairs, Agriculture & Innovation, Retail and Food in Angola (2012) 4