27 Annual Wisconsin Lenders Conference Kalahari Conference Center, Wisconsin Dells May 19-20, 2016

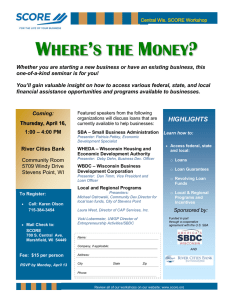

advertisement

27th Annual Wisconsin Lenders Conference Kalahari Conference Center, Wisconsin Dells May 19-20, 2016 Breakout Session Descriptions A-I A-II A-III A-IV A-V B-I B-II The SOP 50 10 Fix (Jane Butler, NAGGL) Get the latest updates on SOP 50 10 and explore case studies to help lenders understand, apply, and document complex SOP 50 10 requirements. 7(a) Small Loan Origination (<$350,000) (Curtis Lee, Loan Specialist, SBA Standard 7(a) LGPC, Hazard, Kentucky) SBA’s 7(a) Loan Program can help lenders mitigate their credit risk, increase profits, while at the same time servicing their small business community. Compliance with SBA regulations is mandatory and important to insure success for the borrower, lender and SBA. This session will guide participants through the 7(a) Small Loan origination process – eligibility, credit elsewhere, credit scoring, forms, application submission, and approval process. 504 Loan Program Overview (Cindy Esterling-Great Lakes Asset Corporation, Jason MonnettWisconsin Business Development) The SBA 504 Loan Program offers fixed asset financing for new or expanding businesses. Get an overview of the 504 loan program including the benefits for the lender and the borrower, and examples of loan structures through case studies. International Trade Finance Options for Small Business Exporters – SBA and Export-Import Bank (Dennis Foldenauer, Regional Manager Illinois & Wisconsin SBA Office of International Trade, Chicago, Illinois) Learn more about SBA’s 90 percent-guaranteed international trade loan products, Export Express, Export Working Capital and the International Trade Loan, as well as Export-Import Bank loans and credit insurance to help your clients grow through exporting and international trade. Regulators Panel Update (Representatives from FDIC, OCC, DFI – Moderated by Pete Warmenhoven, RMA) Representatives from Federal Deposit Insurance Corporation, the Wisconsin Department of Financial Institutions, and the Office of the Comptroller of the Currency will give highlights and updates from their organizations. SBA ONE Loan Origination and Servicing (Genevieve Sansom, BNY Mellon) SBA ONE is the Small Business Administration’s single portal for loan origination, servicing, reporting, liquidations and secondary market sales. Hear from an SBA ONE specialist on how to navigate Enrollment, My Workspace, Loan Origination, RAPID, Document Management and ESignatures. Learn about SBA ONE enhancements and future features. Express and 7(a) Small Loan Liquidations – Fresno Process (John Gossett, SBA Assistant Center Director for Express Liquidation, Commercial Loan Service Center, Fresno, California) SBA’s Fresno Commercial Loan Service Center (CLSC) handles Express Guaranty purchase packages. This session will focus on processing purchase requests for loans ≤$350,000 and will walk you through the documentation required and the submission process. Participants will learn about common errors and omissions that can delay the request for SBA’s guaranty as well as common deficiencies that can result in repairs or possible denials. B-III B-IV B-V C-I C-II C-III C-IV C-V SBA Lender Oversight and PARRiS Reviews (Lou Pham, Regional Supervisor, SBA Office of Credit Risk Management, Washington D.C.) SBA’s Office of Credit Risk Management (OCRM) is responsible for the oversight of SBA Lenders. OCRM’s mission is to maximize the efficiency of SBA’s lending programs by effectively managing program risk, monitoring lender performance and enforcing lending program requirements. This session is specifically for 7(a) lenders. It will cover various topics, including the PARRiS scorecard (Lender Profile Assessment), types of risk based reviews, and delegated authority process. 10-Tab Submission Packages – Herndon or Fresno? (Jane Butler, NAGGL) For anyone who completes the SBA loan application for guaranty approval. Learn to correctly complete the application forms using the 10-Tab Submission package. 2016 Economic Forecast for the U.S. and Midwest (Richard Mattoon, Federal Reserve Bank of Chicago) How will the U.S. economy perform in the second half of 2016? What are the implications of slower world growth for a U.S. economy where steady, but disappointing economic growth has been the story for several years? Finally, what are the prospects for the Midwest economy? All the Players (Panel Presentation Moderated by Rich Diemer, WBD) When addressing the financing and development needs of Wisconsin entrepreneurs and businesses, it is often necessary to look beyond the conventional lending options and even the loan programs that SBA has to offer. On a federal, state and local level there are broad arrays of alternative loan programs and technical resources that can help fill the gaps and meet the needs of both the borrower and the lender. Panelists will present their program and service offerings, how they can be accessed, and explain how they fit into the continuum of business development. 7(a) Large Loan Origination (>$350,000) (Curtis Lee, Loan Specialist, SBA Standard 7(a) LGPC, Hazard, Kentucky) SBA’s 7(a) Loan Program can help lenders mitigate their credit risk, increase profits, while at the same time servicing their small business community. Compliance with SBA regulations is mandatory and important to insure success for the borrower, lender and SBA. This session will guide participants through the 7(a) Large Loan origination process – eligibility, underwriting, forms, application submission, approval process, and pitfalls to avoid. SBA Form 1502 Reporting (Victor Cruz, Workflow Specialist, Colson Services Corp., New York, NY) This is a must-attend session for SBA loan reporting administrators and interested SBA lenders. This session will provide important guidance on how to report your SBA loans, processing cycles, handling loan discrepancies and reporting SBA loans sold on the secondary market. SBA 7(a) Loan Closing Best Practices (Nick Jellum, Anastasi/Jellum) Proper loan documentation and closing procedures are critical in protecting a lender’s SBA guarantee. In this session, we will discuss the best practices to ensure successful and efficient loan closings. The Renaissance in Commercial and Industrial Lending (William Phelan, Paynet) Most bank C&I lending is to small and medium sized businesses as Federal Reserve data show banks are a primary source of credit to these businesses. A renaissance is underway in lending to small commercial and industrial businesses in the U.S. partially a result of more strenuous regulations on all forms of lending which has raised costs and in some cases driven banks out of the market for smaller C&I loans. Many banks are adapting to this new regulatory regime by using technology, data and algorithms. In this session we’ll outline the use of FinTech to take advantage of opportunities in small business credit, sector and geographic selection and strategy for 2016 to safely grow earning assets. D-I D-II D-III D-IV D-V E Let’s Make a Deal (Panel Presentation Moderated by Rich Diemer, WBD) There are a broad spectrum of programs and technical resources available to entrepreneurs and businesses through Wisconsin to assist in business development from the idea phase, to start-up, to expansion. Panel members will explain their services and what they have to offer. SBA 7(a) Large Loan Liquidation: Understanding the Liquidation and Guarantee Purchase Process (Nick Jellum, Anastasi/Jellum) When SBA 7(a) loans enter default, it is more critical than ever for a lender to understand SBA’s expectations and requirements to ensure a successful guarantee purchase. We will discuss proper navigation of SOP 50 57 2. SBA Debt Refinancing Rules and Application with Case Studies (Jane Butler, NAGGL) It is possible to refinance loans that small businesses have outstanding with the SBA 7(a) loan program. Learn more about the rules and application process through case studies. SBA Loan Servicing (John Gossett, SBA Assistant Center Director for Express Liquidation, Commercial Loan Service Center, Fresno, California) Lenders must use “reasonable care” and “prudent lending” standards when servicing their SBA loans. Topics will include: SBA’s servicing guidelines, lender’s unilateral authority, notification and approval requirements, frequent servicing requests and issues. Crash Course in Covenants and Collateral (Bob Heinrich and Emily Clubb, Reinhart Boerner Van Deuren s.c.) This session will focus on three key areas of credit documentation: (1) structuring considerations including recommendations for avoiding fraudulent transfers, (2) basic covenants and common negotiation points between borrowers and lenders, and (3) collateral and perfection issues that go beyond simple financing statements. General Session: SBA Presenter Round Table (Moderated by Eric Ness, SBA-Milwaukee) Join us to get your final questions answered in this round table session moderated by Eric Ness. Presenters from the Small Business Administration and others will be available to address any questions or issues that didn’t get answered during the breakout sessions during the day.