Partial equilibrium analysis: Oligopoly Examples Characteristica

advertisement

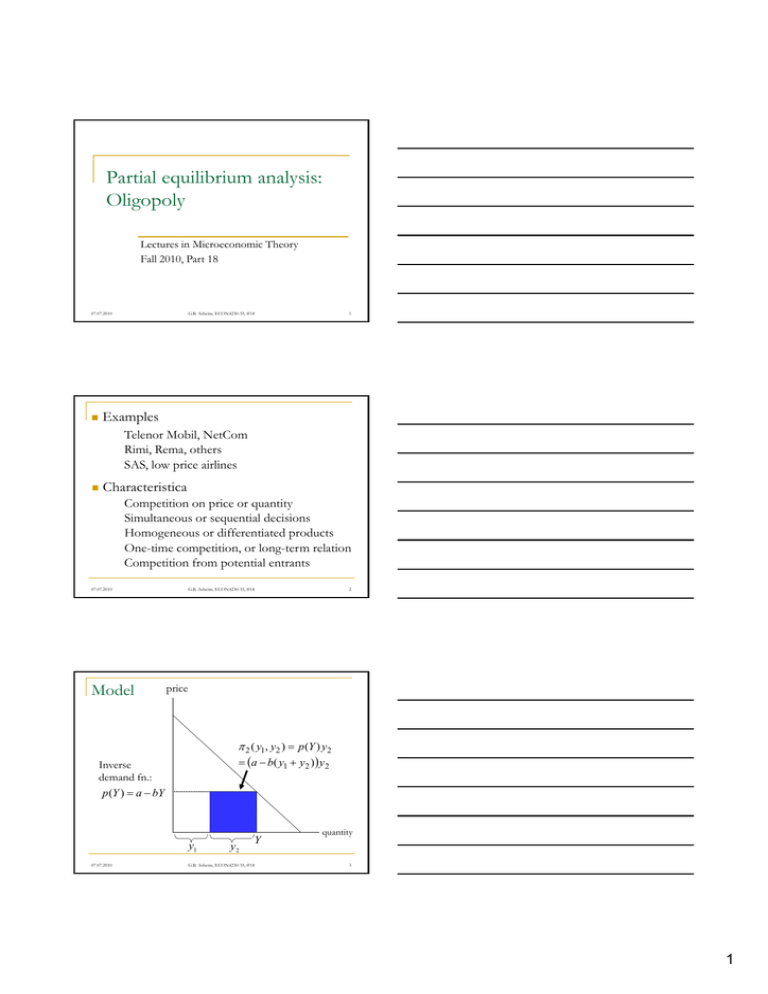

Partial equilibrium analysis: Oligopoly Lectures in Microeconomic Theory Fall 2010, Part 18 07.07.2010 G.B. Asheim, ECON4230-35, #18 1 Examples Telenor Mobil, NetCom Rimi, Rema, others SAS, low price airlines Characteristica Competition on price or quantity Simultaneous or sequential decisions Homogeneous or differentiated products One-time competition, or long-term relation Competition from potential entrants 07.07.2010 Model 2 G.B. Asheim, ECON4230-35, #18 price 2 ( y1, y2 ) p (Y ) y2 a b( y1 y2 ) y2 Inverse demand fn.: p (Y ) a bY y1 07.07.2010 y2 Y G.B. Asheim, ECON4230-35, #18 quantity 3 1 No competition — Monopoly P 1 ( y1, y2 ) 2 ( y1, y2 ) a b( y1 y2 ) y1 a b( y1 y2 ) y2 a bY Y max a bY Y p (Y m ) Y FOC : a 2bY 0 Y Y m a / 2b 1 ( y1m , y2m ) 2 ( y1m , y2m ) a bY Y m a 2 / 4b Ym 07.07.2010 P (Y m ) a / 2 m 4 G.B. Asheim, ECON4230-35, #18 Sequential quantity setting: Stackelberg Firm 1 chooses quantity first (1 is the leader) Firm 2 chooses quantity after having observed firm 1’s quantity (2 is the follower) p Is it best to be a leader or a follower? The follower follower' s problem : max a b( y1 y2 ) y2 y2 FOC : a by1 2by2 0 Y y1 y2 f 2 ( y1 ) ( a by1 ) / 2b y2 07.07.2010 Firm 2' s best respo nse fn : 5 G.B. Asheim, ECON4230-35, #18 Stackelberg (cont.) Τhe leader' s problem : y2 The follower’s best response fn p 1 max a b( y1 a 2by b ) y1 y1 max 12 a by1 y1 y1 Iso profit curve FOC : a / 2 by 0 1 for the leader y1 i e y1s a / 2b i.e., y2s a by2s / 2b a / 4b Y y1 07.07.2010 y2 s y2s 3a / 4b p (Y s ) a / 4 Y 1 ( y1s , y2s ) p (Y s ) y1s a 2 / 8b 2 ( y1s , y2s ) p (Y s ) y2s a 2 / 16b y1s G.B. Asheim, ECON4230-35, #18 6 2 Simultaneous quantity setting: Cournot comp. Are there quantities for the two firms so that no firm will regret its own quantity when told of the quantity of the other firm? y2 1' s best respo nse fn : y1 ( a by2 ) / 2b 2' s best b t respo nse fn f : y2 ( a by1 ) / 2b y1c y2c a / 3b Y 2a / 3b p (Y c ) a / 3 1 ( y1c , y2c ) 2 ( y1c , y2c ) a 2 / 9b c y1c y2c y1 07.07.2010 7 G.B. Asheim, ECON4230-35, #18 A numerical example a 60 b 1 y1c y2c 20 Y c 40 p(Y c ) 20 1 ( y , y2c ) 2 ( y1c , y2c ) 400 y2 c 1 y1s 30 y2s 15 Y 45 p (Y s ) 15 1 ( y1s , y2s ) 450 2 ( y1s , y2s ) 225 s y1m y2m 30 Y y1 07.07.2010 m 30 p (Y m ) 30 1 ( y1m , y2m ) 2 ( y1m , y2m ) 900 G.B. Asheim, ECON4230-35, #18 8 Cournot competition with production costs 1 ( y1 , y2 ) ( p (Y ) c1 ) y1 a b( y1 y2 ) c1 y1 y2 2 ( y1, y2 ) ( p (Y ) c2 ) y2 a b( y1 y2 ) c2 y2 FOC : y1 a by2 c1 / 2b y2 a by1 c2 / 2b Firm 1’s best response p fn y1c (a c2 2c1 ) / 3b y2c (a c1 2c2 ) / 3b Firm 2’s best response fn What happens if firm 1’s costs are reduced? y1 07.07.2010 G.B. Asheim, ECON4230-35, #18 9 3 Observations about Cournot competition Best response curves have negative slope Cournot’s ”reaction story” is stabile. Reduced c1 shifts 1’s curve outwards. yy22 Reduced c1 leads to increased y1 and reduced y2. Reduced c1 leads to a direct and indirect advantage for 1 and an indirect disadvantage for 2. 07.07.2010 yy11 10 G.B. Asheim, ECON4230-35, #18 General analysis of Cournot competition p (Y ) where Y y1 y2 ( Homogeneous products) i ( yi , y j ) p ( yi y j ) yi ci ( yi ) FOC : i p (Y ) p(Y ) yi ci ( yi ) 0 yi p (Y ) ci ( yi ) y Y yi s p(Y ) i p(Y ) i p (Y ) p (Y ) p (Y ) Y yi where si is i' s market share, Y 1 p (Y ) and is the elasticity of demand. p(Y ) Y 07.07.2010 11 G.B. Asheim, ECON4230-35, #18 Characterization of Cournot competition marginal revenue Each firm has market power (P(Y) P(Y) P(Y) yi) Outcome lies between monopoly and perfect comp. Difference between price and marginal cost is reduced when the demand becomes more elastic. Each firm’s difference between price and marginal cost is proportional to its market share. A firm’s market share depends of its efficiency. Even less efficient firms ”survive” with positive market share. 07.07.2010 G.B. Asheim, ECON4230-35, #18 12 4 Cournot competition with many firms Assume ci ( yi ) c for all firms and quantities. p (Y ) c 1 perfect competitio n when n . p (Y ) n p u (Y ) W lf analysis Welfare l i off Cournot C t comp. p Firms act as if they maximize 1 n p(Y )Y cY nn1 u (Y ) cY where u (Y ) n 1 : Monopol y, maximize profit. n " large" : Almost maximize welfare. 07.07.2010 G.B. Asheim, ECON4230-35, #18 Y 0 ~ p (Y ) ~ Y Y ~ ~ p (Y ) dY 13 Condition for decreasing best response fn. Profit function : i ( yi , y j ) i ( f i ( y j ), y j ) Best response fn : f i ( y j ) defined by 0 yi 2 i 2 i Differenti ate totally : dyi dy j 0 yi y j yi2 2 SOC for i -max. 2 y y dy i 2 i f i( y j ) i 2i j 0 if 0& 0 2 dy j i 0 yi y j i yi yi yi2 f i( y j ) 0 : Strat. substitutes f i( y j ) 0 : Strat. complem. 07.07.2010 G.B. Asheim, ECON4230-35, #18 14 Simultaneous price setting: Bertrand comp. Inverse demandfn.: p (Y ) a bY No costs. The firm with the lowest price gets all the demand. (If both set the same price, then each gets half the demand.) Are there prices such that no firm will regret its own price when told of the price of the other firm? p1 p2 MC 0 ? Each firm will regret that it did not set a lower price. p1 p2 MC 0 eller p2 p1 MC 0 ? The lower price firm will regret not having set a higher price. Hence: p1b p2b MC 0 07.07.2010 y1b y2b a / 2b G.B. Asheim, ECON4230-35, #18 1b 2b 0 15 5 Observation Firms in oligopoly markets set prices, but the competition does not seem to be as hard as under perfect competition. Why not? 1. There are capacity constraints. The Cournot model can be interpreted as competition in capacity (Example: Competition between tour operators) 2. Long-term relation. If one firm sets a lower price now, then competitors will set lower prices in future periods. (Example: Meet-the-competition-clause) 3. The products are differentiated. Types of differentiation. (Example: Advantage programs for loyal customers) 07.07.2010 G.B. Asheim, ECON4230-35, #18 16 6