General equilibrium analysis: Equilibrium in pure exchange Agents and goods

advertisement

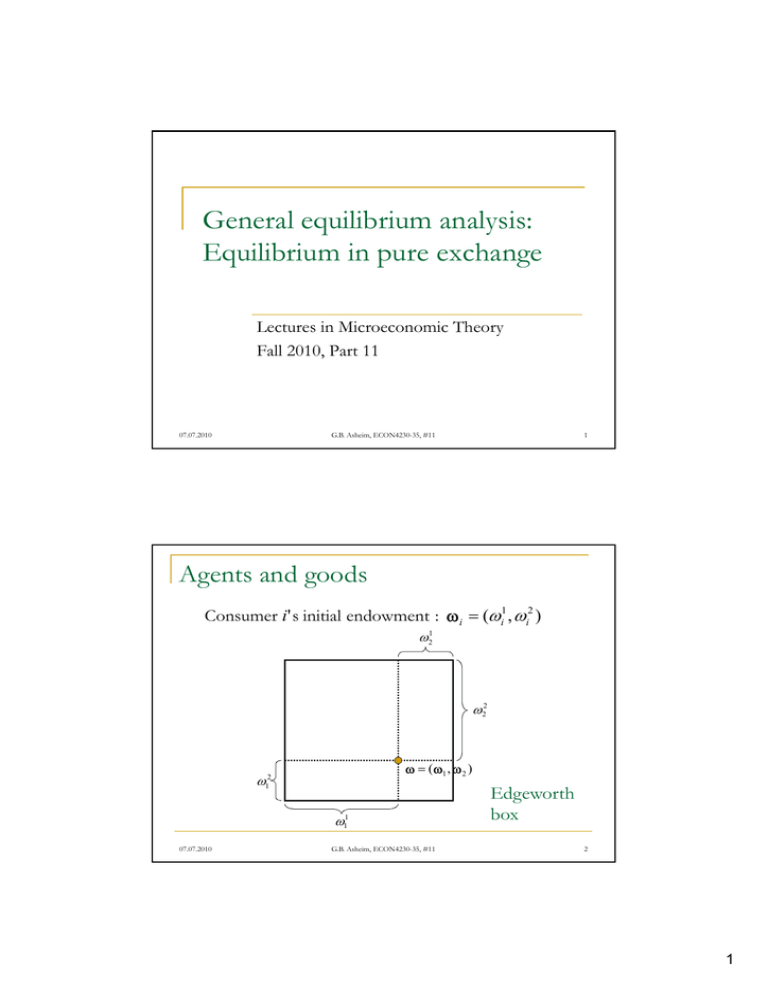

General equilibrium analysis: Equilibrium in pure exchange Lectures in Microeconomic Theory Fall 2010, Part 11 07.07.2010 G.B. Asheim, ECON4230-35, #11 1 Agents and goods Consumer i' s initial endowment : i (i1 , i2 ) 2 All illustrations and analysis y will be made with two consumers and two goods, but can be generalized to n consumers and k goods. 22 1 (1 , 2 ) 12 11 07.07.2010 G.B. Asheim, ECON4230-35, #11 Edgeworth box 2 1 Feasible allocation Consumer i' s consumptio n bundle : x i ( xi1 , xi2 ) x12 Allocation : x22 x2 x ( x1 , x 2 ) An allocation is feasible if x1 x12 (1 , 2 ) x11 x12 1 and x12 x22 2 1 1 x 07.07.2010 3 G.B. Asheim, ECON4230-35, #11 Budget sets If consumers take market prices, p ( p1 , p2 ), as given, their budget sets will be as follows : x2 p ( p1 , p2 ) x1 07.07.2010 G.B. Asheim, ECON4230-35, #11 Even if consumers choose consumption bundles in their g sets, the budget resulting allocation need not be feasible. 4 2 Walrasian equilibrium Definition : A pair of an allocation , x ( x 1 , x 2 ) , and a price vector, p ( p1 , p 2 ) , satisfying (1) The allocation , x ( x 1 , x 2 ) , is feasible. (2) It holds for each consumer i that px i p i , and u i ( x i ) u i ( x i ) implies px i p i ( x i maximizes i i utility ili s.t. the h budget b d constraint i ). ) Does a Walrasian equilibrium exist? 07.07.2010 5 G.B. Asheim, ECON4230-35, #11 Price vectors leading to excess demand Low price of good 1 … High price of good 1 … … leads to excess demand. … leads to excess supply. Is there an equilibrium price? 07.07.2010 G.B. Asheim, ECON4230-35, #11 6 3 Assumption on the utility functions x2 Assumption : For each i , u i is (1) continuous , x1 (2) strictly quasi - concave, and (3) monotone (i.e., x i x i implies u i ( x i ) u i ( x i) ). Assume that x i maximizes u i ( x i ) s.t. px i m . Part (3) implies px i m . Parts (2) and (3) implies that p 0 . Parts (1) - (3) imply x i x i ( p , m ) , where x i is point valued and continuous in positive prices and income. 07.07.2010 7 G.B. Asheim, ECON4230-35, #11 Existence of a Walrasian equilibrium Suppose the Assumption on the utility functions holds. Define the aggregate excess demand function: z ( p ) x 1 ( p , p 1 1 x 2 ( p , p 2 ) 2 p is an equilibr. price vector if z (p ) 0 . Why? Walras' law. For all p 0 , it holds that pz ( p ) 0 . Proof. Follows since px i p i holds for each i . Implications given that both prices are positive: (1) If one market clears, then so does the other. (2) In a Walrasian equilibrium it holds that z ( p ) 0 . 07.07.2010 G.B. Asheim, ECON4230-35, #11 8 4 Existence of a Walrasian equilibrium (cont.) Result. There exists p such that z ( p ) 0 . Proof. Normalize prices so that p1 p 2 1 . Define p i max(( 0 , z i ( p1 , p 2 )) g i ( p1 , p 2 ) 1 max( 0 , z1 ( p1 , p 2p)) 2 max( 0 , z 2 ( p1 , p 2 )) Note that g 1 ( p1 , p 2 ) g 2 ( p1 , p 2 ) 1 . 1 For p1 near 0 , we have that p1 g 1 ( p1 ,1 p1 ) 0 . For p1 near 1, we have that p1 g 1 ( p1 ,1 p1 ) 0 . Since p1 g 1 ( p1 ,1 p1 ) is continuous , it follows that there exists p such that p1 g 1 ( p1 ,1 p1 )p 0 . 1 By Walras' law, this implies z1 ( p ) z 2 ( p ) 0 . 07.07.2010 G.B. Asheim, ECON4230-35, #11 1 9 5