General equilibrium analysis: More welfare results Does welfare increase?

advertisement

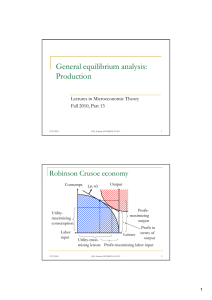

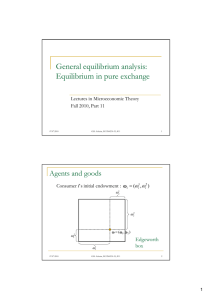

General equilibrium analysis: More welfare results Lectures in Microeconomic Theory Fall 2010, Part 15 07.07.2010 G.B. Asheim, ECON4230-35, #15 1 Does welfare increase? Suppose we are in a competitive equilibr. ( x 1 , x 2 , p ) that maximizes u2 (u1 (x 1 ), u 2 (x 2 )) W ( u1 ( x 1 ), u 2 ( x 2 )) 1 1 U 2 a u ( x1 ) a u 2 ( x 2 ) 1 1 so that a i v i ( p , px i ) i m i ( a1 , a2 ) u1 If we consider moving to a new allocation ( x 1 , x 2 , p ) , how to decide whether welfare will be improved? 07.07.2010 2 G.B. Asheim, ECON4230-35, #15 W ( u1 ( x 1 ), u 2 ( x 2 )) W ( u1 ( x 1 ), u 2 ( x 2 )) a1 D u1 ( x 1 )( x 1 x 1 ) a 2 D u 2 ( x 2 )( x 2 x 2 ) a1 1p ( x 1 x 1 ) a 2 2 p ( x 2 x 2 ) where D u i ( x i ) p ( x 1 x 1 ) p ( x 2 x 2 ) u i ( x i ) u i ( x i ) , 1 2 1 since xaii λ x i i Because distribution is already optimal, we are left with a simple criterion: A small project increases welfare if national income (at original prices) increases. 07.07.2010 G.B. Asheim, ECON4230-35, #15 3 1 Optimal taxation Untaxed good Tax Tax burd den Without possibilities for lump-sum taxation or taxation of all goods, the tax burden exceeds the tax. Problem: Substitution effect: Untaxed good Taxed good Taxed good 07.07.2010 G.B. Asheim, ECON4230-35, #15 4 Why not lump-sum taxation? A lump-sum tax that does not vary between the individuals is unfair. A fair lump-sum tax must vary between the individuals according to criteria that the individuals cannot influence through their actions. Such criteria are not observable. Why not tax all goods? Leisure cannot be taxed. Optimal tax rates on the taxed goods? 07.07.2010 G.B. Asheim, ECON4230-35, #15 5 Consider two taxed goods, 1 and 2, and one untaxed good, 0. Direct u-fn: Assume that production prices are fixed. u ( x 0 , x1 , x 2 ) Assume one representative consumer. Problem Indirect u-fn with 0 as numeraire: v ( p1 t1 , p 2 t 2 , m ) Government revenue: R ( t ) t x ( p t , m ) Maximize the consumer’s utility w.r.t. the tax rates, s.t. the contraint that the tax system raises R. max v ( p t , m ) s.t. t x ( p t , m ) R t L v ( p t , m ) t x ( p t , m ) R 07.07.2010 G.B. Asheim, ECON4230-35, #15 6 2 First-order conditions v x x x1 t1 1 t 2 2 p1 p1 p1 R t1 0 v x x x 2 t1 1 t 2 2 0 p 2 p p2 2 R t 2 1 v 1 v R x1 0 p1 m t1 1 v 1 v R x2 0 p 2 m t 2 07.07.2010 By Roy’s Identity. 7 G.B. Asheim, ECON4230-35, #15 2 2 h j x j 1 v xi xi t j xi t j 0 By the m p m j 1 j 1 i Symmetry h tj 1 pj j 1 Slutsky equation Does not depend on i. 2 x1 2 2 x j 1 v 1 t j m m j 1 t j 1 j h2 p j x2 Relative Increased Increased tax burden reduction in tax Conclusion: It is comcompensated pensated quantities (not prices) that demand for 1. should be changed as little as possible. 07.07.2010 G.B. Asheim, ECON4230-35, #15 8 3