General equilibrium analysis: More welfare results Does welfare increase?

advertisement

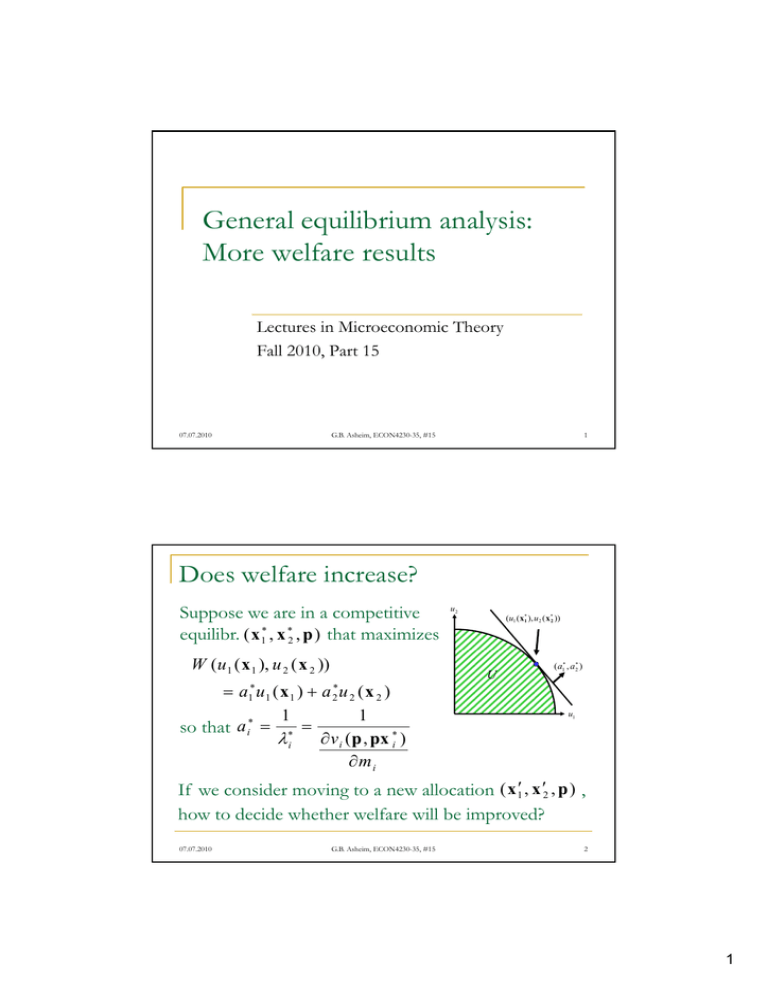

General equilibrium analysis: More welfare results Lectures in Microeconomic Theory Fall 2010, Part 15 07.07.2010 G.B. Asheim, ECON4230-35, #15 1 Does welfare increase? Suppose we are in a competitive equilibr. ( x 1 , x 2 , p ) that maximizes W ( u1 ( x 1 ), u 2 ( x 2 )) a1 u1 ( x 1 ) a 2 u 2 ( x 2 ) 1 1 so that a i v i ( p , px i ) i mi u2 (u1 ( x1 ), u 2 ( x 2 )) U ( a1 , a2 ) u1 If we consider moving to a new allocation ( x 1 , x 2 , p ) , how to decide whether welfare will be improved? 07.07.2010 G.B. Asheim, ECON4230-35, #15 2 1 W ( u1 ( x 1 ), u 2 ( x 2 )) W ( u1 ( x 1 ), u 2 ( x 2 )) a1 D u1 ( x 1 )( x 1 x 1 ) a 2 D u 2 ( x 2 )( x 2 x 2 ) a1 1p ( x 1 x 1 ) a 2 2 p ( x 2 x 2 ) where D u i ( x i ) u i ( x i ) u i ( x i ) , 1 2 1 since xaii λ x i i p ( x 1 x ) p ( x 2 x ) 1 2 Because distribution is already optimal, we are left with a simple criterion: A small project increases welfare if national income (at original prices) increases. 07.07.2010 G.B. Asheim, ECON4230-35, #15 Optimal taxation Untaxed good Tax Tax burden 3 Without possibilities for lump-sum taxation or taxation of all goods, the tax burden exceeds the tax. Problem: Substitution effect: Untaxed good Taxed good Taxed good 07.07.2010 G.B. Asheim, ECON4230-35, #15 4 2 Why not lump-sum taxation? A lump-sum tax that does not vary between the individuals is unfair. A fair lump lump-sum sum tax must vary between the individuals according to criteria that the individuals cannot influence through their actions. Such criteria are not observable. Whyy not tax all goods? g Leisure cannot be taxed. Optimal tax rates on the taxed goods? 07.07.2010 G.B. Asheim, ECON4230-35, #15 5 Consider two taxed goods, 1 and 2, and one untaxed good, 0. Direct u-fn: Assume that production prices are fixed. u ( x 0 , x1 , x 2 ) Assume one representative consumer. Problem Indirect u-fn with 0 as numeraire: v ( p1 t1 , p 2 t 2 , m ) Government revenue: R ( t ) t x ( p t , m ) Maximize the consumer’s utility w.r.t. the tax rates, s.t. the contraint that the tax system raises R. max v ( p t , m ) s.t. t x ( p t , m ) R t L v ( p t , m ) t x ( p t , m ) R 07.07.2010 G.B. Asheim, ECON4230-35, #15 6 3 First-order conditions v x x x1 t1 1 t 2 2 p1 p1 p1 R t1 0 v x x x 2 t1 1 t 2 2 p 2 p 2 p 2 R t 2 1 v 1 v R x1 0 t1 p1 m R 1 v 1 v x2 0 p 2 m t 2 07.07.2010 0 By Roy’s Identity. 7 G.B. Asheim, ECON4230-35, #15 2 2 h j x j 1 v xi t j 0 By the xi xi t j pi m m j 1 j 1 Symmetry 2 tj j 1 h1 p j x1 Slutsky equation Does not depend on i.i 2 2 x j 1 v 1 t j m m j 1 t j 1 j h2 p j x2 Relative Increased Increased tax burden reduction in tax Conclusion: It is comcompensated pensated quantities (not prices) that demand for 1. should be changed as little as possible. 07.07.2010 G.B. Asheim, ECON4230-35, #15 8 4