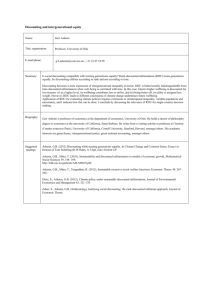

Partial equilibrium analysis: Monopoly Price- making

advertisement

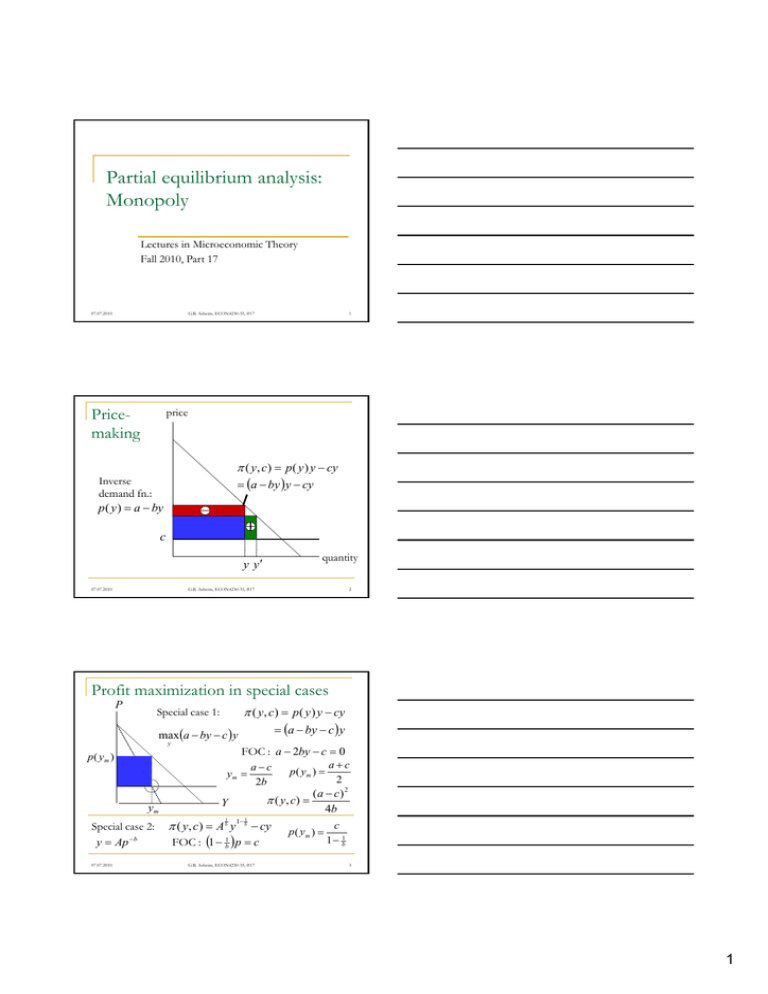

Partial equilibrium analysis: Monopoly Lectures in Microeconomic Theory Fall 2010, Part 17 07.07.2010 G.B. Asheim, ECON4230-35, #17 Pricemaking 1 price ( y, c) p ( y ) y cy a by y cy Inverse demand fn.: p ( y ) a by c quantity y y 07.07.2010 2 G.B. Asheim, ECON4230-35, #17 Profit maximization in special cases P ( y, c) p ( y ) y cy Special case 1: a by c y max a by c y y FOC : a 2by c 0 p( ym ) ym ym Special case 2: y Ap 07.07.2010 b ac 2b ( y, c) Y ( y, c) A y 1 b p( ym ) 1 1b cy FOC : 1 p c 1 b G.B. Asheim, ECON4230-35, #17 ac 2 (a c) 2 4b p( ym ) c 1 1b 3 1 General analysis ( y ) p( y ) y c( y ) FOC : y p ( y ) p( y ) y c( y ) 0 p ( y ) c( y ) y 1 p( y ) p( y) p( y) where SOC : 1 p( y) is the elasticity of demand. p( y ) y 2 2 p( y ) p( y ) y c( y ) 0 y 2 07.07.2010 4 G.B. Asheim, ECON4230-35, #17 Comparative statics c ( y ) cy SOC p( y ) 0 2 p( y ) p( y ) y 0 ( y , c) Special case 1: ( y, c) p ( y ) y cy 0 ac y p( ym ) 2 ( y, c) ( y, c) dc 0 dy dp p b y d y dc 0 dc 2b dy 1 0 Special case 2: c dcy y dc 2 p( y ) p( y ) y p( ym ) 1 1b dp dp dy p( y ) dp 1 0 1 dc dy dc 2 p( y ) p( y ) y dc 1 1b 2 2 2 2 2 2 07.07.2010 5 G.B. Asheim, ECON4230-35, #17 Welfare and output Welfare as a function of output: p W ( x) u ( x) c ( x) Welfare maximization: u ( x0 ) p ( x0 ) c( x0 ) c(x) p ( xm ) Monopoly output satisfies: p( x0 ) p( x) p ( xm ) p( xm ) xm c( xm ) W ( xm ) u ( xm ) c( xm ) p( xm ) xm u ( xm ) xm 0 Monopolist’s gain is smaller than consumers’ loss. 07.07.2010 G.B. Asheim, ECON4230-35, #17 u( x) xm x0 x Deadweight loss 6 2 Price discrimination Monopolist’s dilemma: A higher quantity leads to a lower price. price p( y) p ( y ) The monopolist can get out of this dilemma by • sorting consumers • charging different prices to different consumers c y y This requires that the monopolist can sort, and that consumers cannot resale. 07.07.2010 G.B. Asheim, ECON4230-35, #17 quantity How can the monopolist sort? 7 Types of price discrimination First-degree price discrimination (Also called perfect discrimination) “Special price for you” Price = maximal willingness-to-pay for each unit. Second-degree Second degree price discrimination Price differs according to consumed quantity (or quality), but not across consumers. Ex: Full price/disc. tickets for transportation Third-degree price discrimination Price differs across consumers, but does not depend on consumed quantity. Ex: Different Ticket price depends on age, etc. price dom. and abroad 07.07.2010 G.B. Asheim, ECON4230-35, #17 8 1st-degr. price discr. p Maximization of total surplus c( x) u ( x0 ) c( x0 ) No surplus to consumers: p ( x0 ) p( x) x0 u ( x0 ) u (0) p ( x)dx 0 u( x) 0 x Whole surplus to x0 monopolist. Why is first-degree price discrimination difficult to implement for the monopolist? 07.07.2010 G.B. Asheim, ECON4230-35, #17 9 3 Model with two consumers p Low demand consumer (L) High demand consumer (H) Assumptions: H has higher total willingness-to-pay u H ( x) u H (0) u L ( x) u L (0) 0 uH (x) H has higher marginal willingness-to-pay uL (x) u H ( x) u L ( x ) 0 x 07.07.2010 10 G.B. Asheim, ECON4230-35, #17 2nd-degr. price discr. (self-selection) Each consumer is offered a pair of total payment and quantity: (ri , xi ) p xH xL rH rL u H ( x)dx 0 xL rL uL ( x) dx uH (x) Assume no costs. Ensures participation and self-selection uL (x) How to determine xL and xH ? No distortion at the top: u( xH ) 0 MC xL xH xL 07.07.2010 x L’s quantity is distorted: u( xL ) 0 MC Why? 11 G.B. Asheim, ECON4230-35, #17 3rd degr. price discr. (segmentation) The monopolist is able to treat the two consumers as separate markets. p uH (x) uL ((xx) p pH Monopoly price and quantity in each market. Higher elasticity leads to lower price. What are the welfare effects of requiring the same price in both markets? 3rd degr. price distr. is welfare improving only if it leads to a higher quantity. pL xL x H 07.07.2010 Assume no costs. x x G.B. Asheim, ECON4230-35, #17 x 12 4